Summary:

- The COVID-19 pandemic made Pfizer the most recognizable pharmaceutical company on the planet. But, COVID policies are dialing back and the future demand for COVID products is not clear.

- The Street expects Pfizer’s revenues to revert in the coming years as COVID vaccination rates slow and government contracts run out. The company expects 2023 to be a transition year.

- Recent COVID headlines have drawn attention to the impending downturn in COVID revenue and have already had a negative impact on the share price.

- I believe the market is going to get hung up on the atrophy of COVID-related revenue and will overlook Pfizer’s long-term outlook.

- It is time to adjust my strategy for managing my PFE position as we navigate the COVID washout.

Justin Sullivan

The COVID-19 pandemic solidified Pfizer (NYSE:PFE) as one of the premier pharmaceutical companies on the planet. Nevertheless, the company’s clinical and commercial accomplishments have left investors waiting for an equivalent performance, or reprise. I am sorry to inform investors that the past few years are going to be tough to follow considering the company’s COVID vaccine, Comirnaty, nearly doubled their revenue in the first year. Then, the addition of Pfizer’s COVID antiviral pill, Paxlovid, is now making their COVID revenue more than half of the company’s projected $100B in revenue for 2022. But, the world’s governments and health agencies are dialing back their COVID policies and the future demand for COVID products is not clear. The Street expects Pfizer’s revenues to revert in the coming years as COVID vaccination rates slow and government contracts run out. Into the bargain, Pfizer is dealing with a few COVID headlines regarding Paxlovoid’s manufacturing and pricing in China. These COVID headlines have drawn attention to the impending downturn in COVID revenue and appear to have had a negative impact on the share price. Consequently, I believe it is time to update my Pfizer game plan in order to take advantage of the market getting hung up on the atrophy of COVID-related revenue and be prepared for a possible opportunity to manage my position.

I intend to provide a background on Pfizer’s recent COVID-related headlines and will discuss how the COVID landscape will impact Pfizer’s revenue. In addition, I review the company’s growth opportunities and provide my view on Pfizer’s valuation. Finally, I lay out my strategy for managing my PFE position as we navigate the COVID washout.

COVID Headlines Attract Attention

Pfizer has been the subject of several COVID-related headlines over the past couple of weeks. A recent article from Reuters reported that the Chinese government was in discussions with Pfizer to acquire a license that will allow Chinese pharmaceutical companies to manufacture and distribute a generic form of Pfizer’s COVID-19 antiviral drug Paxlovid in China.

Pfizer’s CEO, Albert Bourla, addressed this issue at JPMorgan’s (JPM) healthcare conference and revealed that they are not in talks with Chinese authorities to license a generic version of Paxlovid. Pfizer already has an agreement with the Chinese drug manufacturer, Zhejiang Huahai, for domestic manufacturing of Paxlovid in China, but Pfizer is still going to handle the selling of the branded drug in the Chinese market. Bourla also mentioned that Pfizer shipped thousands of courses of Paxlovid to China in 2022, but COVID-19 infections have surged since the country removed their ZERO-COVID policy in December, so the company has increased their shipments to “millions”.

It is important to note that Paxlovid is presently covered by China’s broad healthcare insurance scheme thanks to temporary measures, but that will stop at the end of March. This is a growing concern as a single course of treatment of Paxlovid is being sold by scalpers for as much as 50,000 yuan, which is roughly $7,300 USD. Unfortunately, Bourla said that negotiations with China on prospective pricing had ceased after China had requested Pfizer drop the price below what lower-middle-income countries are paying for Paxlovid. Bourla commented, “They are the second highest economy in the world and I don’t think that they should pay less than El Salvador.”

Clearly, there is some jousting going on between the Chinese government and Pfizer over Paxlovid pricing and supply in China. To make matters worse, there is a public health crisis occurring in the country that is seeing millions of COVID cases each day.

Of course, the same concern can be applied to the global response to the COVID-19 pandemic as western countries start to remove it as a public health emergency, as well as the WHO. If these government agencies and institutions decide to remove the public health emergency status, we should see funding and support begin to dial down, which would most likely have a significant impact on public funding for COVID tests, drugs, and therapeutics.

As a result, Pfizer is expecting 2023 to be a transition year for their business as COVID revenue will fade as they switch from government contracts to the commercial market. What is more, they will have to work through the stocks that the U.S. government has already purchased.

I believe these recent headlines have drawn attention to these circumstances that could have a dramatic impact on the company’s COVID efforts.

Overreaction?

These COVID-related headlines have not helped PFE in recent days as the share price has dropped from around $55 to roughly $47.50 per share in just a few days of trading. Personally, I believe the market’s reaction to these headlines is really due to a broader concern that Pfizer might revert to its lackluster growth as the COVID revenue fades. Prior to the pandemic, Pfizer was on a hunt to find its next big drug, after going a few years without launching a new blockbuster. The pressing concern is that the company has several of its backbone products moving closer to patent expiration and will soon have to deal with competition from generics.

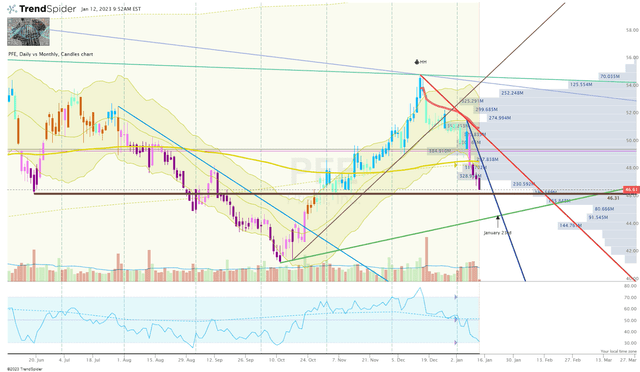

Pfizer Products Patent Expiration (Pfizer)

It is projected that Pfizer will lose between $16B and $18B in revenue from 2025 through 2030 as some of their bestselling drugs become generic.

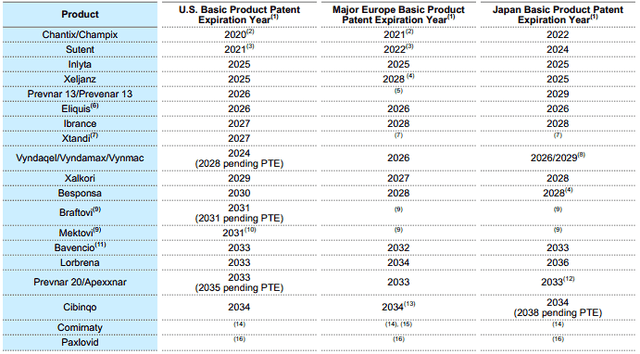

Pfizer Products Approaching LOE (Pfizer)

Indeed, the COVID revenue is not disappearing and Pfizer has some new products coming online soon, but it is unlikely the company will be able to fill the gap in a short period of time.

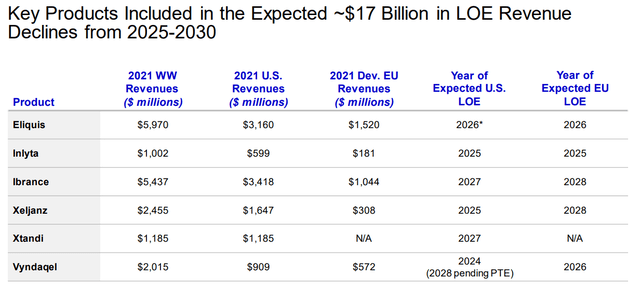

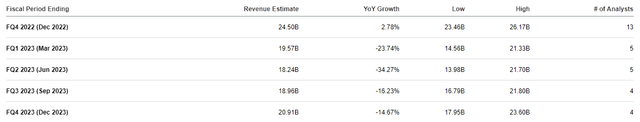

In fact, the Street expects Pfizer to report a year-over-year decrease in revenue for the next 4 years with revenues being cut by over 30% compared to the estimated ~$100B for 2022.

Pfizer Annual Revenue Estimates (Pfizer)

So, I have to say the market’s reaction to these headlines is justified.

Is COVID Really Over Though?

Certainly, the projected decrease in COVID revenue should concern investors. However, I think the market is discounting the persistence of COVID and that it will ultimately become endemic in the human population, much like influenza. Additionally, it is becoming more and more evident that both natural and vaccinated immunity is only strong enough to thwart the virus for a very limited amount of time. So, it is likely that the COVID indication will remain in play and so will Pfizer’s COVID products.

Clearly, the vaccination rate is an issue considering it went from 80% for the first dose and is now around 30% for the fourth. It is logical that as immunization rates fade, infection rates will most likely rise and could lead to more severe disease states and possibly hospitalization. As a result, we can expect demand for therapeutics to remain.

Another aspect to consider is that Pfizer expects their commercial price per dose for the Comirnaty to be between $110 and $130, which is around 4x the average price the U.S. paid for Pfizer’s bivalent doses. Therefore, if 2024’s utilization rates will be like 2023’s, we could see a solid bump in COVID revenue. Let’s assume U.S. utilization bottoms around 25%, which would be around 65M doses and the commercial price of the Comirnaty will be $115 per dose. If we see Pfizer takes 50% of those doses, Comirnaty should pull in around $3.7B in revenue. If Pfizer was to continue to pay the Federal rate of roughly $29 for the bivalent dose at 25% utilization and 50% of the market, Comirnaty would pull in $950M in revenue. Regardless, I think it is safe to say that Comirnaty will still be a blockbuster drug for Pfizer for the foreseeable future.

So, I suspect 2023 to be the bottom due to a potential drop in Comirnaty utilization and a transition from government contracts to the commercial market. However, the expected persistence of COVID and changes in pricing should bring some recovery in 2024. Looking beyond 2024, the company is looking to bring a flu-COVID combination vaccine, which could be a source of steady revenue as COVID becomes endemic. As a result, I think it is fair to say that Pfizer’s COVID-related revenue still has the potential to be a major contributor in the coming years.

Growth Opportunities

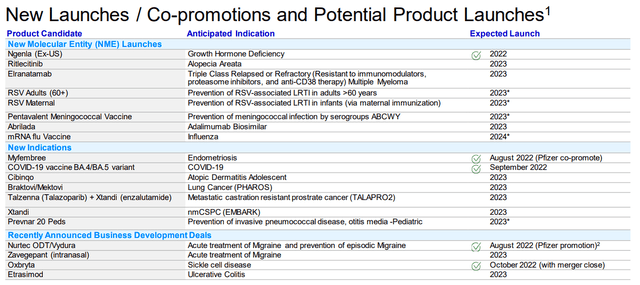

It is important to note that Pfizer is more than a COVID-play, I know that is obvious but perhaps investors need to be reminded that Pfizer was one of the world’s leading pharmaceutical companies and has the capacity to extract growth from their core business. The company has 19 new products heading to the market in the next 18 months, which could contribute $20B in 2030.

Pfizer New Products Hitting The Market (Pfizer)

In fact, Bourla was forecasting 6% annual revenue growth for their core business through 2025… this is excluding COVID products. Indeed, 6% is below the sector’s median, however, that level of annual growth is in-line with most of Pfizer’s big pharma peers.

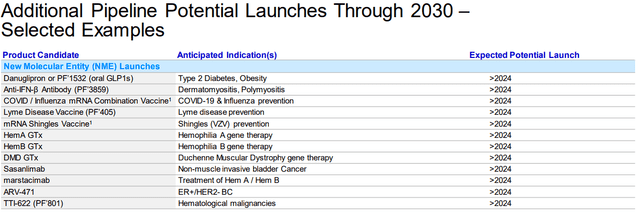

In addition, the company has invested in their R&D capacity to return to being a drug developer rather than just a drug acquirer. Notably, Pfizer has made significant financial commitments to developing mRNA therapies with the goal of getting “multiple mRNA products to market within five years.” In addition to mRNA candidates, Pfizer is working on other potential blockbusters including gene therapies, along with autoimmune therapies, a therapy for obesity and diabetes, and oncology agents.

Pfizer Potential Launches Through 2030 (Pfizer)

Collectively, these internal growth opportunities should not only replace the LOEs but drive growth past 2030.

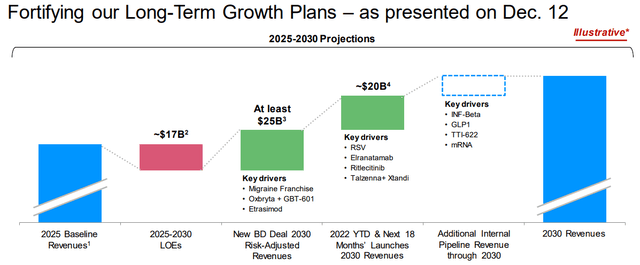

Pfizer Long-Term Growth Plans (Pfizer )

That being said, Pfizer does have a strong history of making deals to fuel growth. Pfizer is flush with cash ($36B) that they could spend on the types of acquisitions that could help the company grow for decades. Actually, Pfizer executives have publicized that they’re expecting to do enough deals to add some $25B in sales by 2030.

The take-home here is that Pfizer has plenty of growth opportunities in the coming years, that should replace the lost COVID revenue in due time. One could say Pfizer’s best years have yet to come.

Finding An Appropriate Valuation

In terms of valuation, the standard models have PFE’s valuations all over the place. The DCF growth valuation models have PFE’s value around $54.50 per share, which is roughly a 14% upside from the ticker’s current price.

Value Investing Valuation Models (Value Investing)

If we use the DCF EBITDA models, we get PFE’s valuation of $28-$33.50, which is a ~30%-40% cut in the share price. Meanwhile, the P/E Multiples model generates a value of ~$91 per share, which is roughly a 92% upside. When considering the dividends, the Stable Dividend Discount Model has PFE at ~$108 per share and the Multi-Stage at ~$47. EV/EBITDA Multiples point to $59.35 and the Earnings Power Value is around $44 per share.

Which One Do We Pick?

If I had to pick one, I would select the DCF Five Year Growth Exit model for this current situation because the company’s revenue growth is the main concern. I decided to go with conventional inputs of a WACC/Discount Rate of 7.5% and a Long-Term Growth Rate of 3% which equates to a $54.35 share price. Certainly, shareholders probably don’t want to hear PFE will be worth $54 per share, but we must concede the market is going to focus on growth and it’s probably going to take several years before the company starts reporting strong growth again.

Managing PFE Through The Trough

Indeed, determining whether to buy, sell, or hold PFE shares might be difficult over the next few years thanks to the lack of clarity on the company’s COVID-related revenue and the uncertainty that their new products will achieve blockbuster status in the projected timeframes.

This year is supposed to be a transition year, which tells me that I am going to have to be flexible with my strategy and be prepared for surprises. On one hand, I have to expect there will be a solid ceiling for PFE shares over the course of 2022 as earnings reports start to reveal the year-over-year decreases in revenue and EPS.

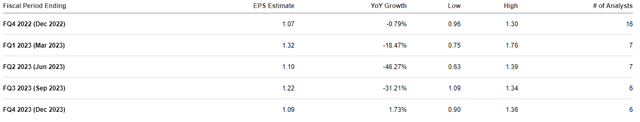

Pfizer Quarterly Revenue Estimates (Seeking Alpha) Pfizer Quarterly EPS Estimates (Seeking Alpha)

Historically, it is hard for tickers to break to new highs as their earnings are fading, so I shouldn’t expect to be booking profits around my Sell Target 1 of $62 per share.

On the other hand, I might have a hard time determining where I am looking to buy because I am apprehensive about locking up my capital in ticker with limited upside in the near term… especially if I see better opportunities.

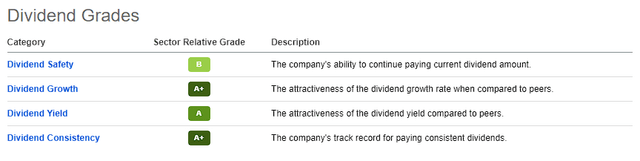

So should I hold? Well, PFE does have a healthy dividend with a forward dividend of 3.46% and a forward annual payout of $1.64.

PFE Dividend Grades (Seeking Alpha)

Moreover, PFE’s dividend has a 24.39% and a 12-year dividend growth record. So, I believe there are some benefits to holding onto my PFE shares through the trough.

Seeing that I don’t have a strong conviction on what to do with my PFE shares, I am going to stick to my Buy and Sell Targets to manage my position at this time. I have my Buy Threshold set to $46 per share, so PFE is not far off from a potential buy at the moment.

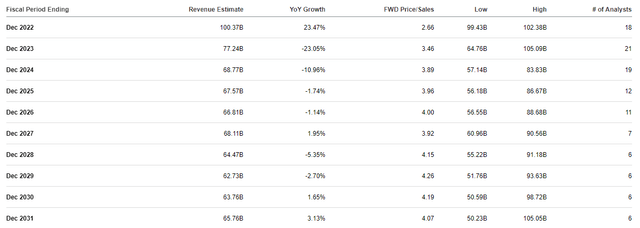

PFE Daily Chart Enhanced View (TrendSpider)

Looking at the daily chart, we can see PFE’s angle of attack is steep to the downside, so I am not willing to set a buy order without seeing a potential reversal setup. We might see a bounce of support right around $46 per share, but I am looking for the ticker to continue its descent toward the uptrend ray established back from the October low. At this rate, we could see a buying opportunity around January 23rd at $44.75, which is just above my Buy Target 1 at $43.75 per share. Typically, I would increase my share sizing as we hit lower buy targets, but I am going to stick to minuscule additions until earnings improve.

Conversely, selling some PFE appears to be a long way out, considering my Sell Target 1 is currently $62, which is above the 52-week high and above the ticker’s fair value. What is more, we can see the share price is trading below 200-day EMA and under a mountainous volume shelf spreading from $47 to $53 per share. Contrary to my buy share sizing, I would look to unload an ample amount of shares if PFE gets close to a 52-week high over the course of 2023.

Long term, PFE is going to continue to be a mainstay in my Compounding Healthcare “Healthy Dividend” Portfolio indefinitely. These past few years have certified that Pfizer is the paragon of the healthcare sector with the ability to capitalize on nearly every opportunity.

Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thank you for reading my research on Seeking Alpha. If you want to learn even more about my method and how I discover these investment opportunities, please check out my subscription marketplace service, Compounding Healthcare, and sign up for a free trial.