Summary:

- Sterling Infrastructure’s high-growth prospects are driven by the ongoing infrastructure boom, particularly in data centers and e-commerce distribution centers through META and AMZN.

- Despite the robust financial performance and raised FY2024 guidance, its FWD P/E of 26.20x and FWD PEG non-GAAP ratio of 1.75x are significantly higher than historical averages and sector median.

- The elevated short interest offers interested investors with a minimal margin of safety as well, worsened by STRL’s relatively small float.

- With the upward momentum unlikely to last forever, we believe that its eventual correction may be very painful, implying a downside of high-double digits to our fair value estimates.

xxwp

STRL’s High-Growth Investment Thesis Remains Overly Expensive At Current Levels

We previously covered Sterling Infrastructure, Inc. (NASDAQ:STRL) in July 2024, discussing its robust prospects attributed to the infrastructure boom observed in data centers and aviation end markets, with it explaining why the stock had outperformed the wider market thus far.

Despite the growing backlogs, expanding profit margins, and increasing multi-year domestic opportunities, we had believed that there was a minimal margin of safety then, worsened by the potential volatility arising from its small float and growing short interest.

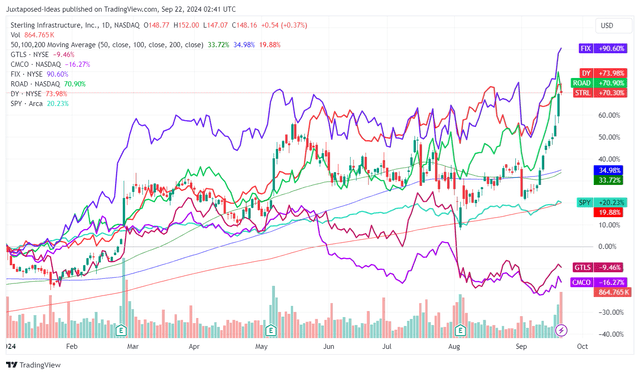

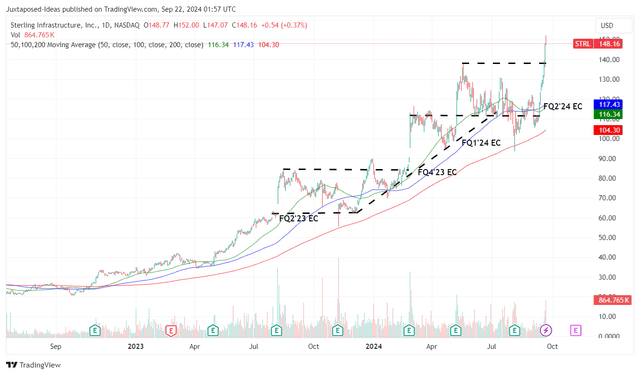

STRL YTD Stock Price

Since then, STRL has charted another near vertical rally after the double beat FQ2’24 earnings call, with the robust bullish support materializing as predicted in our previous article, as the stock consistently charts higher highs and higher lows after each earnings call.

Part of the tailwinds may be attributed to the generative AI boom, which has triggered intensified data center/ AI chips related capital expenditures, as reported by numerous hyperscalers, including Amazon’s AWS (AMZN), Google Cloud (GOOG), Microsoft Azure (MSFT), and Meta (META) in their latest earning calls.

This development is critical indeed, given that AMZN and META are two key customers across STRL’s growing exposure to data centers and e-Commerce distribution centers – with Statista already expecting data center market to grow from $239.7B in 2024 to $624.1B in 2029 at a robust CAGR of +8.4%.

This is on top of the upcoming megaprojects for EV, batteries, solar, semiconductors and the reshoring of manufacturing capacity in the second half of the decade.

STRL’s Robust E-Infrastructure Solutions & Transportation Solutions Performance

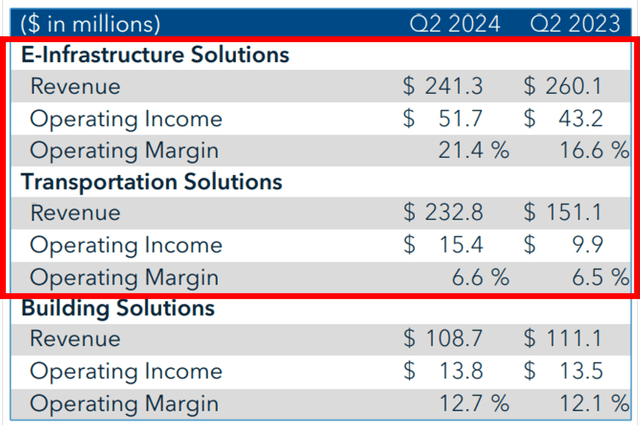

We can already see the promising early results in STRL’s FQ2’24 earnings call, with growing multi-year remaining performance obligations of $2.09B (-11% QoQ/ +20.8% YoY) with “data center-related revenue increased more than 100% in the quarter and now represents over 40% of segment backlog.”

This also explains its robust overall revenues of $528.8M (+20% QoQ/ +11.5% YoY), adj EBITDA margins of 14.9% (+2.3 points QoQ/ +0.9 YoY), and adj EPS of $1.67 (+67% QoQ/ +31.4% YoY).

Readers must note that STRL’s robust bottom-line growth mostly attributed to the E-Infrastructure Solutions segment’s “shift toward large mission-critical projects, including data center and manufacturing, and away from small commercial and warehouse work” – which has resulted in exemplary operating margin growth by +4.8 points YoY.

STRL’s prospects are significantly aided by the excellent growth observed in the Transportation Solutions segment as well, thanks to the IRA funding to improve existing infrastructure including roads, highways, and railroads.

With the segment already recording over 2 years’ worth of backlog and new contract bidding still underway, it is unsurprising that the management already expects the segment to “deliver strong growth and margin expansion in 2024 and 2025,” building upon the +54% YoY increase observed in FQ2’24.

Therefore, despite the lower projects underway at ~220 (-4.3% from FQ3’23 levels), STRL’s pivot to higher value/ margin businesses, the growing backlog, along with the lower headcount at ~3,000 (-6.2%) has naturally triggered the raised FY2024 guidance.

This is with revenues of $2.18B at the midpoint (+10.6% YoY), adj EBITDA margins of 13.9% (+0.8 points YoY), and adj EPS of $5.67 (+26.8% YoY), compared to the original numbers of $2.17B (+10.1% YoY), 13.4% (+0.3 points YoY), and $5 (+11.8% YoY) offered in the FQ4’23 earnings call, respectively.

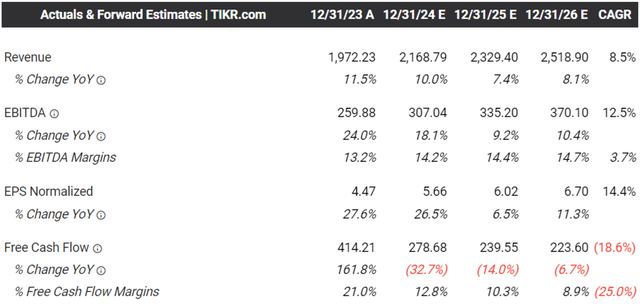

The Consensus Forward Estimates

As a result of these promising developments, it is unsurprising that the consensus have further raised their forward estimates, with STRL expected to generate an accelerated bottom-line growth prospects at a CAGR of +14.4% through FY2026.

This is compared to the original estimates of +7.9%, while building upon the robust historical growth at +45.9% between FY2017 and FY2023.

The other silver lining to STRL’s investment thesis (aside from the robust growth prospects) will be its increasingly healthier balance sheet with $211.11M of net cash (+45.3% QoQ/ +344.8% YoY), along with the ongoing share repurchases to offset the elevated stock-based compensations.

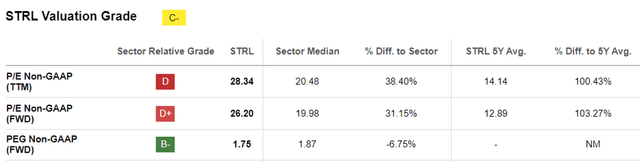

STRL Valuations

On the other hand, it is undeniable that STRL’s FWD P/E non-GAAP valuations of 26.20x is overly expensive, compared to its 5Y mean of 12.89x and the sector median of 19.98x.

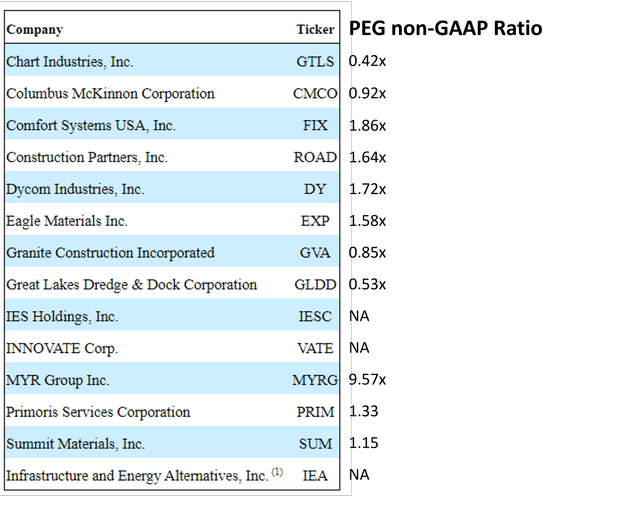

STRL Peer Group

While the bulls may argue that STRL may deserve a higher FWD P/E premium, attributed to its high-growth prospects, we are not so certain indeed.

This is especially after comparing its FWD PEG non-GAAP ratio of 1.75x to its pre-pandemic mean of 0.35x and its direct peer group mean of 1.2x (aside from MYRG at 9.57x), as listed in the chart above, with its expensive valuations offering interested investors with a minimal margin of safety.

So, Is STRL Stock A Buy, Sell, or Hold?

STRL 2Y Stock Price

For now, the bullish support surrounding STRL has been well observed in its consistent upward momentum since mid-2023, with it currently charting new peaks while running away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $60.20 in our last article, based on its 5Y P/E mean of 12.48x (nearer to its peers) and the LTM adj EPS of $4.83 (+37.6% sequentially) ending FQ1’24.

Based on the management’s FY2024 adj EPS guidance of $5.67 (+26.8% YoY) and the same 5Y P/E mean, it goes without saying that STRL has (yet again) ran away from our updated fair value estimate of $70.70.

Based on the consensus FY2026 adj EPS estimates of $6.70, the stock is also trading well beyond our updated long-term price target of $83.60.

We believe that part of the baked in premium may also be attributed to the Fed’s recent pivot by 50 basis points, which has already contributed to the exuberant market sentiments and the increasingly greedy stock market index.

At the same time, short interest remains elevated at 4.5%, up from 3.6% from the start of the year and 1.2% a year ago, with it implying that the stock’s recent rally is likely to be moderated as observed in its typical trading pattern since the FQ2’23 earnings call.

As a result of the overly premium investment thesis and the potential volatility, we prefer to prudently reiterate our Hold (Neutral) rating for the STRL stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.