Summary:

- Sterling Infrastructure is benefitting from long-term AI tailwinds, with double-digit revenue growth and margin expansion.

- The company is involved in e-infrastructure, transportation, and building solutions, with a focus on custom solutions for customers.

- Strong financial performance, growth opportunities in e-infrastructure, and a solid capital allocation framework make Sterling Infrastructure a buy.

- Despite shares having doubled in the last 12 months, the valuation is still compelling enough because of the growth ahead.

shaunl

Introduction

Sterling Infrastructure (NASDAQ:STRL) is an infrastructure company in North America that’s benefitting from long-term tailwinds in AI. Over the last few years, the company has grown its top-line double digits while experiencing some margin expansion over time, as the business mix shifts to more e-infrastructure. Despite the company’s shares having more than doubled over the past year, I still see good value here.

Company Overview

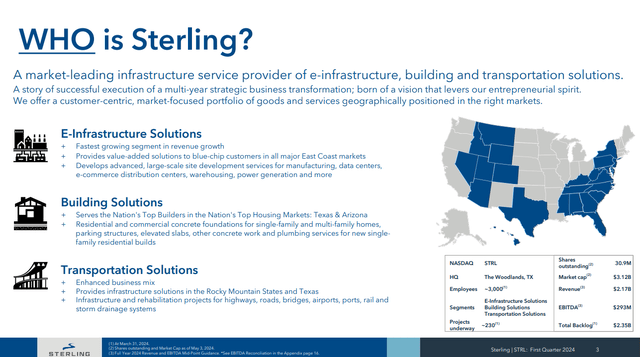

Sterling Infrastructure is a specialized construction and engineering company that’s involved in three verticals: e-infrastructure, transportation, and building solutions.

In e-infrastructure, Sterling Infrastructure is involved in building out large-scale projects for data centers, e-commerce distribution centers, warehouses, and energy companies. This might sound simple at first glance, but many of its customers often need specific requirements that necessitate custom solutions tailored to their operational needs. Essentially, what this means is that considerations like high-capacity data storage, robust network connectivity, scalable computing power, and energy-efficient solutions to minimize operational costs and environmental impact, need to be taken into account from beginning to end. As such, the company is involved with help its customers, many of which are large, blue-chip customers, from site selection all the way through completion. As the company’s largest and fastest growing segment, the e-infrastructure business generates 48% of the company’s total sales.

In the transportation segment, Sterling Infrastructure is involved in the construction of projects like roads, bridges, highways, airports, and ports — all things that are needing in helping people get from one place to the other. This is generally a lower margin segment that does 6.6% operating margins (compared to 15% for the e-infrastructure business) and represents 32% of total sales.

Finally, in the building solutions segment, the company serves North America’s top builders in Texas and Arizona, which are high growth markets for construction for single-family and multi-family homes. While the building solutions is the company’s smallest segment at 20% of revenues, it’s still growing at has good operating margins of 11.4%.

Background

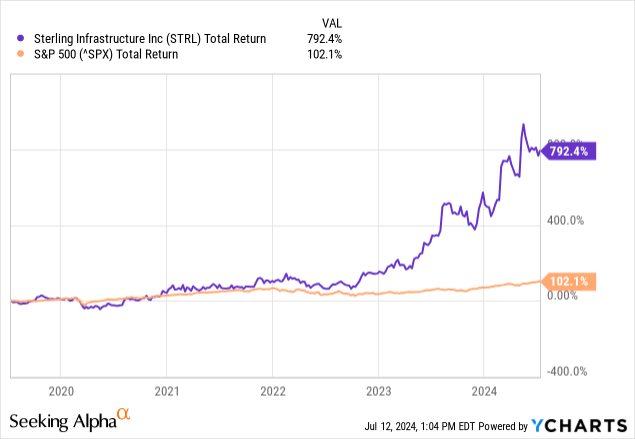

Shares of Sterling Infrastructure have been on a tear as of late, with the company’s shares more than doubling over the past twelve months. We can see the divergence in total return compared to the S&P500, where Sterling’s shares started ripping in early 2023. Over the last five years, the company’s shares have delivered a total return of 792%, compared to the S&P 500’s return of 102%.

While a valuation re-rating certainly played a large role in this, as e-infrastructure for data centers (with the emergence of AI) have become increasingly in the spotlight for investors. However, Sterling Infrastructure has continued to deliver impressive returns for shareholders, growing both the top and bottom line.

Improving Profitability

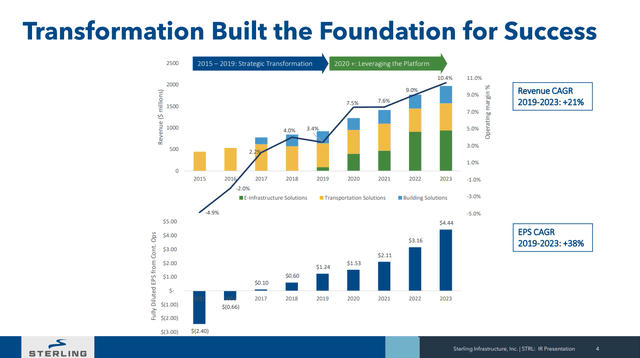

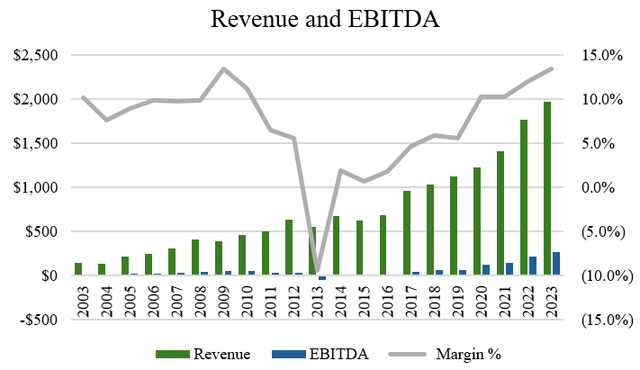

Over the last twenty years, the company has delivered CAGRs in revenue and EBITDA of 13.8% and 15.4%. More recently, in the last five years, the company has compounding revenues and EBITDA at 13.7% and 33.9%, respectively (source: S&P Capital IQ). Clearly, Sterling Infrastructure is a company whose growth rates are not slowing down, as evidenced by double-digit top line growth which translates to the bottom line with some margin expansion.

Author, based on data from S&P Capital IQ

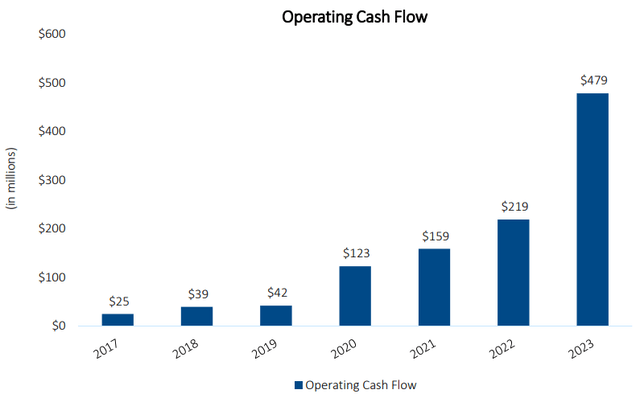

Sterling Infrastructure’s financial performance (revenue and EBITDA growth) has a huge impact on free cash flow conversion as well. As illustrated by the chart below, the company’s operating cash flow has been nearly doubling every 2 years, providing flexibility as well as capital for growth investments.

Growth Opportunities

So what’s been driving this growth? One of the biggest reasons is the company’s e-infrastructure growth. While this makes up nearly half of the company’s revenues today, this wasn’t always the case. As illustrated below, the e-infrastructure business really only got started in 2019, and since then, it’s seen massive success post-pandemic.

When we look at the smart infrastructure market, the runway for growth is massive. As a $187 billion market, the market globally is poised to grow at a 23.1% CAGR to just under $1 trillion by 2032. Most of this growth was triggered out of the pandemic, where global lockdowns caused disruption to production and networks, highlighting the need for e-infrastructure to be robust. Within the AI vertical alone, a technology that has seen huge advancement in growth at an 18.5% CAGR.

In my view, the spending from blue-chip companies is going to be massive Just a few months ago in May, Microsoft (MSFT) signed a deal with Brookfield (BN:CA), one of the world’s largest infrastructure investors, to supply 10.5 gigawatts of renewable power capacity between 2026 and 2030. This was an important deal for Microsoft because the deal will help it meet AI demand as well as meet its emission commitments on ESG.

As the largest deal of its kind (almost 8x larger than the largest single corporate PPA ever signed), I’d expect more investments like this one. While Microsoft and other blue chips companies lead the way for now, I’d also expect mid-sized companies to start investing in e-infrastructure as well.

Companies like Sterling Infrastructure are almost certainly going to benefit from this trend. Particularly given their strong reputation in the industry working with other blue-chip companies and the fact that current capacity in data centers only represents a small fraction of what is needed to support artificial intelligence and other emerging technologies.

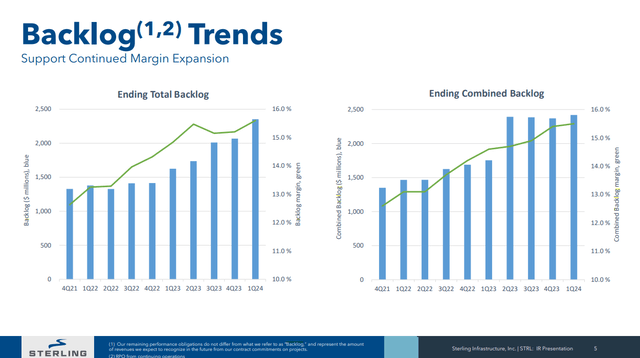

When we look at the company’s backlog of projects, management believes that the growing backlog should support the company’s future plans as well as margin expansion over time. At the end of the most recent quarter, in spite of a small 10% revenue decline in the quarter, the company’s infrastructure awards totaled $332 million, for a backlog of 961 million, a 32% increase compared to Q1’23.

As for the mix of the backlog growth, management commented that data centers were again the largest contributor to awards growth as customers are feeling more comfortable building out their AI and technology infrastructure advancements. To date, data centers are now about 40% of the e-infrastructure backlog, highlighting just how important this growth is.

In terms of the outlook, management is guiding for revenue of $2.125 to $2.215 billion with EBITDA of $285 to $300 million for FY’24. On EPS, management is guiding for earnings per share of between $5.00 and $5.15 for 2024, indicating that they see margins continuing to expand from here along with more awarded contracts. Given the backlog, these targets should be achievable for the year, in my view.

Strong Capital Allocation Framework

Another reason to like Sterling Infrastructure is for its strong capital allocation framework. While the company doesn’t pay a dividend, the company invests heavily into organic growth initiatives, M&A, as well as buybacks. Of the company’s capex, most of its investments are tilted towards the e-infrastructure business, an area the company has been investing in so that it can better meet the demand from AI in the years to come.

In addition to M&A, Sterling Infrastructure targets tuck-in and bolt-on acquisitions, particularly small and mid-sized deals where an acquired company would add new customers or complement the existing service offerings. With respect to M&A, on the earnings call, management commented on the types of deals they’re looking for:

Yeah. We are. We’ve seen several, we’re looking at several. One of the core things for us is we’re very picky. We want really good businesses with really good people that we think we can double over a five-year or six-year period. So it’s getting that right match and that right opportunity put together. But they’re out there, yes. And they’re of various sizes.

Clearly, management is very focused on finding deals with the right fit and not just doing deals for the sake of growth. In other investor materials, the company has also signaled that they have a preference for doing margin-accretive deals with end-markets that are attractive. Paying a fair price and finding the right fit means a high hurdle rate for the company, but this is what you want to see in M&A, given that it reduces the risk of integration of a deal being dilutive with inadequate synergy potential.

When it comes to share repurchases, management is taking an opportunistic approach to buying back shares. In 2023, the company repurchased $9.6 million and the year before it purchased $9.4 million worth of shares (source: S&P Capital IQ). Given that shares have run up a lot lately, I don’t expect management to be aggressive in buying back shares as the company’s shares aren’t exactly cheap nor is it likely a great place to allocate capital. As such, even with a $200 million authorization under the share repurchase program, I don’t foresee significant buybacks being a major part of the company’s capital allocation framework.

From a balance sheet perspective, the company has a bit of debt, which includes $337 million in term loan borrowings. It also has a $75 million revolving credit facility, which is currently undrawn. With cash of $480 million at quarter end, cash exceeds total debt. Scheduled term loan debt repayments are for $26.3 million in 2024, $26.3 million in 2025, and $6.6 million in 2026. With an EBITDA Debt Coverage Ratio of 1.1x, the company has minimal leverage, but is comfortable taking that to 2.5x, should opportunities present themselves.

Valuation and Wrap Up

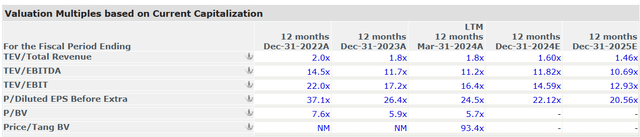

Currently, there’s only one sellside analyst who covers Sterling Infrastructure. He has a price target of $130.00, which implies about 6.4% upside from the current price. Given the hold rating and limited upside potential, shares of Sterling are likely fairly valued.

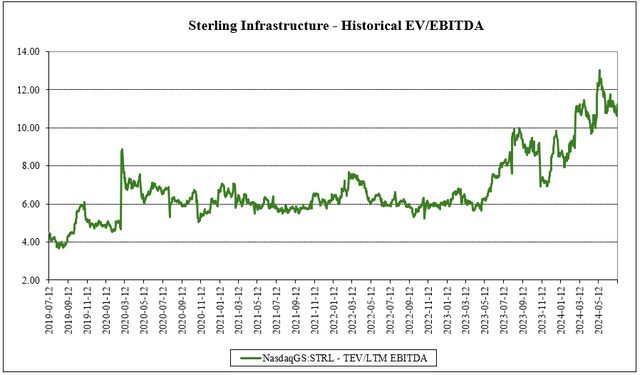

I would disagree with the analyst here. When we look at the historical EV/EBITDA multiple, it’s clear that the company might look expensive at 11.2x EV/EBITDA, a near doubling of where it was trading before 2023 at around 6.0x EV/EBITDA (source: S&P Capital IQ).

Author, based on data from S&P Capital IQ

In my view, what I think most have valued to realize about Sterling Infrastructure is that the company’s business mix has changed tremendously in just the last three years. Compared to 2021, when the e-infrastructure business made up only 32% of revenues, Sterling’s margins were vastly inferior at around 10% EBITDA margins (source: S&P Capital IQ). Given the transition to better growth markets, the shift in business mix to higher margin businesses, and the fact that the company can likely continue growing in the mid-teens for the foreseeable future (in line with the industry growth rate), I don’t see why paying 11.2x EV/EBITDA would be expensive. When looking at the forward multiples of the company, Sterling Infrastructure looks even cheaper.

When it comes to the risks to the investment thesis, the main ones would be a slowdown in AI spending. Macroeconomic pressures like higher interests rates are generally poor for infrastructure spending, as the cost of borrowing/ financing makes funding projects more expensive. For e-infrastructure in particular, I’m not too worried given that there is a huge runway for growth with AI having long-term secular tailwinds, that may prove to be several decades, rather than just a few years. Another risk would be competition. More market entrants into the market would mean that Sterling Infrastructure would need to sacrifice price in order to win business, potentially providing a headwind to margins. With respect to the company’s competitive advantage, CEO Joseph Cutillo had this to say on the company’s Q4’23 earnings call:

Our competitive advantage is really, again at the end of the day, I look at us as an insurance policy, and the bigger the project, the better the policy, and our ability to get very large complicated site development done in a very short period of time for our customers. As you can imagine, if our project, which was a big project, would be $100 million, let’s say that’s part of a $2.5 billion to $3.5 billion project.

And if we say, we’ll get it done in six months and we’re two weeks late, that project will be six months to eight months late on the back end with the domino effect or snowball effect of the trades. And the cost of capital on the rest of that, and the loss of revenue and profitability associated with incremental six months is a very, very small price to pay a slight premium to us over the rest to ensure that they get it.

Given the company’s size and scale, I think this isn’t a risk to be too concerned with. My estimation is that given the high demands of customers (particularly complex blue chip projects), customers would rather pay more for a trusted company like Sterling to work on their projects for them, end to end.

So to summarize, Sterling Infrastructure really is a picks and shovels company to the AI industry, piggybacking off of the long-term tailwinds of e-infrastructure buildout, particularly in data centers. Over the years, the company has grown at a decent clip with margin expansion over time, that should continue as the business mix shifts to more e-infrastructure. Because of the higher margin and faster growing end-markets that the company is positioned in, I think the recent re-rating in the company’s valuation is warranted. So in spite of 100%+ rise in the company’s shares over the last year, I think this is a company that has only now starting to get discovered and getting the valuation it deserves. As such, I rate the company’s shares as a ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.