Summary:

- Super Micro Computer stock plunged nearly 20% on November 6 as its business update was a massive disappointment.

- Supermicro didn’t provide sufficient clarity over its delayed 10K, new auditor engagement, spurring increasing fears of a potential delisting.

- Investors are likely pricing in a further reduction in guidance, as there is little clarity about whether SMCI could regain timely compliance with Nasdaq’s listing requirements.

- Despite a relatively solid financial profile, Supermicro could face intense competitive pressures from competitors keen on grabbing its market share.

- I argue why investors shouldn’t catch this falling knife now as the plunge and round trip in SMCI is justified.

JHVEPhoto

Supermicro: No Respite As Business Update Disappoints Massively

Super Micro Computer, Inc. (NASDAQ:SMCI) (“Supermicro”) investors have endured another massive plunge in the stock, as SMCI fell almost 20% on November 6. The de-rating has continued to haunt holders in the stock, as the selling intensity has threatened to complete a round trip for bottom fishers in late 2023. Hence, these dip-buyers have not only seen their gains vaporize since the stock peaked in early 2024 but have likely taken losses. It likely prompted a mass exodus as the market started to price in the increasing likelihood of Supermicro’s delisting risks.

In my previous SMCI article, I downgraded the stock, cautioning that the resignation of its auditor is expected to trigger an intense session with analysts when the company reports earnings. Therefore, management needs to provide more clarity and help regain credibility with investors at a crucial time.

However, I’ve not assessed the ingredients in SMCI’s recent business update on November 5, which corroborates the market’s fears. Accordingly, in Supermicro’s Q1FY2025 business update (preliminary), its revenue is expected to underperform Wall Street’s estimates, although its adjusted EPS is anticipated to exceed the previous forecast.

Furthermore, Supermicro’s FQ2 guidance disappointed massively. Accordingly, SMCI’s midpoint revenue outlook of $5.8B for the fiscal second quarter is markedly below previous estimates of $6.79B. In addition, it’s also expected to miss its adjusted EPS by a mile, as SMCI anticipates a midpoint metric of $0.605 against previous estimates of $0.80. Management’s caution is justified, as Nvidia (NVDA) has reportedly reallocated orders in the supply chain, given the uncertainties surrounding Supermicro. However, I assess that the market has already somewhat priced in the possibility of a lowered guidance, as analysts have already commented on possibly losing market share to Hewlett Packard Enterprise (HPE) and Dell (DELL).

SMCI Stock: Delisting Possibility Increasingly Likely

Notwithstanding the market’s caution, given the recent reallocation reports, investors are likely not convinced by Supermicro management’s clarification that its partnership with Nvidia has remained robust. Moreover, the suggestion that the delays in Blackwell orders could have worsened the outlook shouldn’t lead to another steep plunge, as these challenges aren’t new. Therefore, I assess that the market remains unconvinced with the clarifications provided by SMCI concerning its compliance with Nasdaq’s listing rules and the narrowing window of opportunity in finding a new auditor to replace EY.

Accordingly, SMCI highlighted that its special committee had found no indications of fraud or misconduct. While it should have assured investors and mitigated the stock’s bearish sentiments, the battering today underscores the lack of conviction in management’s commentary. Why?

Because the company has not provided a timeline for resolving the engagement of a new auditor. It also seems increasingly likely that SMCI will not file its delayed 10K by November 16, although it expects to file a plan with Nasdaq to regain compliance before the deadline. However, the plan is also subject to Nasdaq’s approval, which could put SMCI’s listing at risk if not approved (and failing a subsequent appeal to a Nasdaq hearings panel).

Moreover, Supermicro has not provided sufficient reasons to convince the market why it couldn’t file the delayed 10K by November 16 if it doesn’t expect to restate its financials (which were not concurred/signed off by EY). Hence, I believe the market had expected much more clarity over these uncertainties amid the lingering concerns. However, the company’s response suggests investors are not likely to have a resolution by November 16, which could drag out the issue with Nasdaq for some time.

What’s expected to worsen the bearish sentiments on Supermicro is the fast-evolving AI CapEx growth and the anticipated shipments of Blackwell servers through 2025. Given the intensely competitive market against Dell and HPE, Supermicro could face potentially daunting market share losses at a time it could ill afford to lose.

Supermicro maintains a relatively solid financial profile of $2.1B in cash and equivalents (against total debt of $2.3B). Hence, it doesn’t seem that SMCI could face near-term liquidity issues. However, the uncertainties due to the impact of its loan covenants requiring filing its 10K and listing requirements could affect investor sentiments. These uncertainties are expected to hover over the company even as Blackwell is anticipated to go into volume production in Q4 and possibly start shipping in the first quarter of CY2025. Therefore, the market likely expects SMCI’s FY2025 guidance to be lowered further while the company contends with potential delisting risks.

SMCI Stock: Panic Selling Unfolded This Week

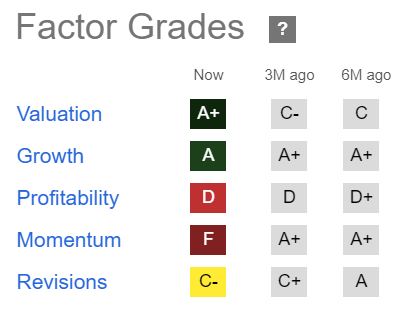

SMCI Quant Grades (Seeking Alpha)

The market also isn’t dumb. As seen above, SMCI’s “A+” valuation has improved markedly relative to its technology sector peers (XLK) over the past three months. However, its weak “D” profitability grade underscores the vulnerabilities in its business model, even as it stepped down its production capacity. The recent challenges could hinder its efforts to maintain its growth cadence, although a valuation bifurcation could be assessed, given its “A” growth grade.

However, SMCI’s “F” momentum grade underscores the significant pessimism that has engulfed the Charles Liang-led company, highlighting caution for dip-buyers.

Is SMCI Stock A Buy, Sell, Or Hold?

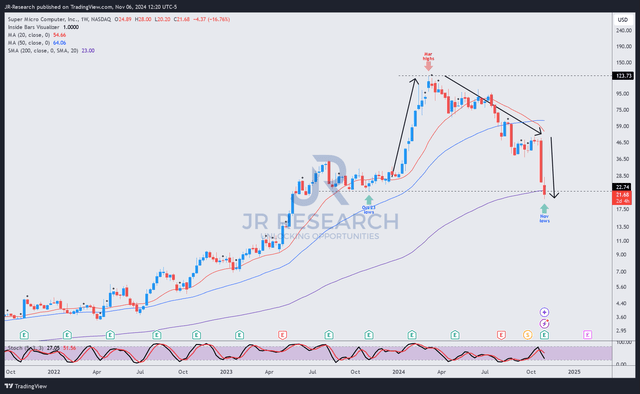

SMCI price chart (weekly, medium-term) (TradingView)

In my previous article, I cautioned that SMCI investors must anticipate a possible fall toward the $22 support zone before a potential consolidation. The price action has played out this week, as SMCI fell and re-tested that level after its business update.

Hence, it has completed an incredible round trip and more for investors who accumulated in late 2023 before the surge toward its March 2024 peak. The steep decline in SMCI occurred over the past two weeks compared to the distribution phase between March and October 2024. Hence, it’s clear that panic selling in SMCI unfolded, indicating investors fled for the exit doors, potentially pricing in a possible delisting.

With SMCI’s critical support zone being tested, SMCI’s 200-week moving average (purple line) has come into play. Therefore, it should allow investors more time to reassess their thesis on the stock while also affording dip-buyers the opportunity to consider adding exposure. Short sellers could capitalize on SMCI’s critical support level to cover their positions, potentially bolstering its anticipated consolidation phase.

As a result, I assess that the market has priced in significant near-term risks on the stock. While the stock seems to have buoyant and robust secular AI growth drivers underpinning its bullish thesis, its competitive positioning has likely weakened considerably. Therefore, I have not determined an opportunity to upgrade the stock, even though the risk/reward has improved markedly. Given the mounting uncertainties and potential delisting challenges surrounding the company, investors should consider steering clear of stock until we have more clarity moving ahead.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!