Summary:

- Super Micro Computer is expected to submit a plan to Nasdaq by November 16th to avoid delisting, with a potential filing deadline extended until February 2025.

- The company’s 1Q FY2025 earnings result was still resilient, but the 2Q guidance indicates a sharp growth slowdown as management signaled an inventory buildup due to delays in Blackwell chips.

- Despite strong AI-driven revenue growth, investor confidence has been shaken by delayed filings and the resignation of the E&Y auditor, affecting stock sentiment and potential market share.

- Following its previous accounting scandal in 2017, the stock dropped 50% and was delisted from Nasdaq, taking years to rebuild investors’ confidence.

- Valuation matters only when the risk is manageable.

Valerii Evlakhov/iStock via Getty Images

What Happened

Super Micro Computer (NASDAQ:SMCI) has continued its decline, falling over 50% following its 1Q FY2025 earnings update from the Independent Special Committee. The stock has now dropped more than 75% since the company delayed its FY2024 annual report filing and faced potential allegations of accounting fraud from Hindenburg Research. At this point, rather than focusing on earnings numbers and forward guidance, investors are primarily concerned with the timing of the annual report filing to avoid a potential delisting and the recruitment of a new auditor after E&Y resigned due to concerns regarding transparency and internal controls. The deadline to submit a compliance plan to Nasdaq is November 16th.

In my recent analysis, I downgraded the stock to hold from buy, citing multiple unquantified risk factors that could lead to further significant declines. Since then, SMCI has fallen another 46% over two months. While management has denied any evidence of fraud or misconduct, I believe it is still too premature to be bullish on the stock without more clarity regarding a new auditor and the annual report submission. Therefore, I reiterate my hold rating on SMCI, as valuation currently remains secondary to these risks.

Scenario 1: Manageable Impact; Growth Affected by Blackwell Chips Delay

The company model

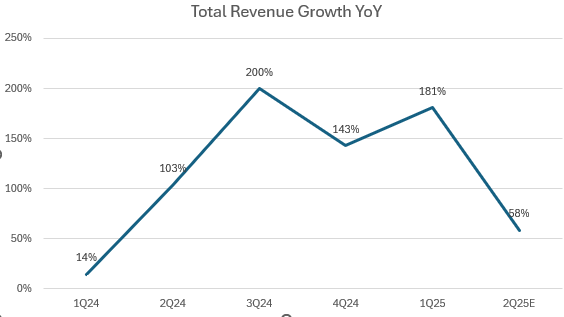

SMCI slightly missed the lower end of its previous revenue guidance by $50 million in 1Q FY2025, achieving 181% YoY growth. Although this number was below market consensus, it showed a sequential growth rebound from 143% YoY in 4Q FY2024. Non-GAAP EPS came in at approximately $0.76, above the estimate of $0.74, driven by sequential margin improvements. However, SMCI forecasts a significant slowdown in revenue growth for 2Q FY2025, with an expected growth of 58% YoY. The revenue guidance range of $5.5 billion to $6.1 billion falls well below the market estimate of $6.8 billion, suggesting a potential miss on its non-GAAP EPS consensus. Despite this disappointing 2Q guidance, I believe the negative post-earnings reaction reflects investor concerns over SMCI’s credibility amid recent issues. Given the substantial uncertainty, let’s conduct a scenario analysis.

If the outlook accurately reflects SMCI’s fundamental performance, it’s encouraging that top-line growth remains resilient, with AI contributing 70% of revenue, underscoring strong demand for its Direct Liquid Cooled (DLC) solutions. Management anticipates that 15% to 30% of new datacenters will adopt liquid-cooled infrastructure over the next 12 months, with DLC volume expected to grow 10x from the current year.

The significantly lower 2Q revenue and EPS outlook may indicate potential market share losses, as customers could turn to competitors due to delayed annual filings and accounting concerns, which have damaged the company’s reputation. However, these impacts may prove temporary if SMCI can secure a new auditor to avoid delisting and clarify the reason for the filing delay. Still, rebuilding investor trust will take time, affecting stock sentiment in the near to mid term.

During the 1Q FY2025 earnings call, management explained that the weaker revenue outlook reflects customers waiting for the NVIDIA’s (NVDA) Blackwell chip, though their Blackwell-based liquid cooling solution, GP200, is ready to ship. Management remains confident that revenue growth can rebound once the new chips become available. SMCI’s Inventories balance climbed by 103% to $5 billion compared to 2Q FY2024. Investors should monitor the inventory levels in upcoming quarters to confirm management’s comments.

Scenario 1: Valuation Does Matter; Potential Contrarian Buying Opportunity

The company model

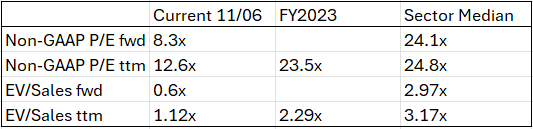

After a 75% pullback over the past 3 months, SMCI is trading at a substantial discount. As shown in the table, its non-GAAP P/E fwd is currently at 8.3x, 47% below its 5-year average and 65% below the sector median. Let’s take a step back, we can assume, hypothetically, a 0% YoY growth on the company’s FY2024 revenue and non-GAAP EPS due to inflated financial numbers, which would place the stock at its FY2023 level. Its non-GAAP P/E FY2023 is 23.5x and EV/sales FY2023 is 2.29x, both below sector averages according to Seeking Alpha. If SMCI fails to capture the secular growth tailwinds from GenAI, its valuation multiple would likely trade below that of its peers. Particularly, SMCI’s FY2023 multiples remain below the current sector median averages, indicating that the stock is extremely undervalued if the recent issues prove to be manageable.

Scenario 2: Accounting Fraud and Weak Internal Control

SMCI has a history of accounting scandals. As mentioned in my previous analysis, in August 2017, the company prematurely recognized revenue, which led to delays in financial filings. This caused the stock to drop by 50% over the next 12 months, and SMCI was subsequently delisted by Nasdaq. In 2019, the company restated several years of financial statements and underwent an internal management restructuring, which ultimately led to a sharp rebound in the stock.

While not all accounting scandals are comparable, the current 75% decline seems to have priced in most negative outcomes, including the risk of delisting. Typically, investors tend to sell first and ask questions later. However, the company’s solvency risk remains low, with a healthy balance sheet showing net debt of only $90 million as of 1Q FY2025. Additionally, the company generated positive FCF of $465 million in 1Q, marking its first positive gain since 1Q FY2024.

It’s impressive that SMCI’s inventory balance increased further by $600 million in 1Q FY2025, up 13.6% QoQ, and its operating cash flow also grew by $1 billion QoQ. This inventory buildup typically reduces operating cash flow, but management explained that the increase in operating cash flow was primarily due to earnings growth outpacing the rise in inventory. However, SMCI is currently trading at near-term sentiment rather than fundamental, meaning that the stock can go down further if SMCI is delisted from Nasdaq.

Scenario 2: Fair Valued Will Be Greatly Discounted

If SMCI fails to secure an auditor and file its annual statement in time, the stock may be delisted as in 2018, potentially trading on the OTC market. Due to investment mandates, SMCI would lose a large percentage of institutional investors. Additionally, the company’s reputation would suffer once again, likely requiring even more time to recover. Therefore, at this point, valuation doesn’t matter, even at attractive levels. Fair value would be structurally discounted to reflect the reputational damage among both investors and customers. Consequently, SMCI’s stock may remain a value trap, trading below the current price for an extended period.

Bottom Line

Investors should closely monitor whether SMCI can meet its November 16th filing deadline to avoid potential delisting from Nasdaq. Management has stated that it is actively working to replace the auditor and file a plan with Nasdaq, potentially with an extension. However, the reason for E&Y’s disassociation remains unclear, and its full impact is uncertain. While the company’s reputation has been damaged, justifying a lower valuation multiple, the sharp 75% stock decline may have already priced in many negative outcomes. Given the ongoing uncertainty, I will refrain from downgrading the stock to “sell” but will stay on the sidelines for now, as a strong rally driven by cheap valuation or a short squeeze would be speculative.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.