Summary:

- Meta stock has sold off after earnings guidance indicated higher CapEx ahead in 2025, though this reaction may have been unwarranted given the incredible ROI from AI investments so far.

- Investors may be overlooking how the company’s genius open-source strategy is already paying off in the background with valuable third-party developer contributions conceivably buoying its social commerce and advertising potency.

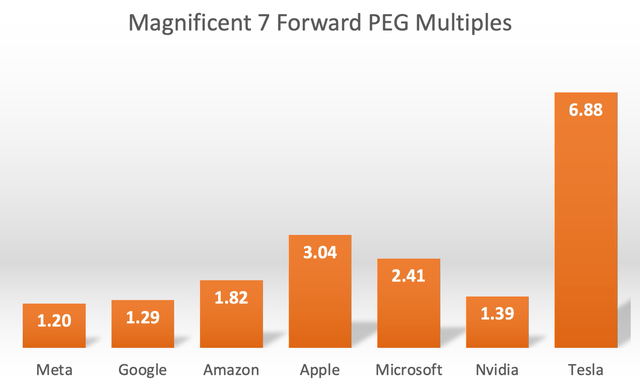

- Looking beyond the Forward PE multiple, another more comprehensive valuation metric uncovers just how cheap Meta shares are relative to the other Magnificent 7 stocks.

Buda Mendes

Meta Platforms (NASDAQ:META) stock plummeted following the release of its Q3 2024 earnings report, as investors become increasingly wary of the growing AI-related capital expenditures weighing on the company’s profitability. Nevertheless, Meta continues to prove to the market that its AI-related investments are already paying off in the form of greater user engagement and improving ad performance, conducive to higher revenue growth. Considering the remarkable progress that the social media giant is making on the AI front, the stock is actually beautifully cheap, sustaining the ‘buy’ rating on the stock.

In the previous article, we delved deeply into the advantages of Meta’s open-source Llama strategy, and how it could pay off over the long term. We covered how the rapid proliferation in Llama usage across the tech industry is already yielding advantages for Meta. We also discussed how Meta’s open-source approach is paving the way to consorted AI progress with the current king of AI, Nvidia (NVDA).

Over the last quarter, Meta has continued making progress in reaping the benefits of AI to drive advertising revenue growth.

Meta’s progress on the AI front

Meta delivered revenue growth of 19% last quarter, underpinned by continued advertising revenue growth.

Q3 Total Family of Apps revenue was $40.3 billion, up 19% year -over -year. Q3 Family of Apps ad revenue was $39.9 billion, up 19% or 20% on a constant currency basis. Within ad revenue, the online commerce vertical was the largest contributor to year -over -year growth, followed by healthcare and entertainment and media.

– Meta CFO Susan Li, Q3 2024 Meta Platforms earnings call.

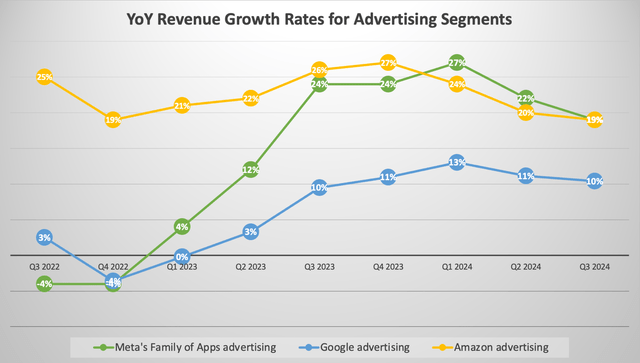

While 19% ad revenue growth marks a slowdown from previous quarters for Meta Platforms, consider the fact that it is much faster than chief rival Google’s (GOOG) (GOOGL) ad revenue growth rate of 10% last quarter. For context, Meta’s ad revenue in Q3 was $39.9 billion, while Google’s total advertising revenue over the same period was almost $66 billion. While Meta is obviously growing off of a relatively smaller ad revenue base, the difference in ad revenue growth rates is still remarkable, with Meta’s growth rate almost double that of Google’s ad revenue growth rate.

Nexus Research, data compiled from company filings

Furthermore, despite Amazon (AMZN) having a much smaller ad revenue base of $14.3 billion, it failed to grow faster than Meta’s advertising revenue last quarter, instead growing at the same rate at 19%.

Ever since the AI revolution began, the market has been keenly observing whether the major ad platforms will be able to successfully deploy generative AI technology to boost advertising revenue. And so far, out of the three largest advertising giants, Meta seems to be offering the most promising Return-on-Investment (ROI) potential.

Moreover, the social media giant is already delivering quantitative improvements in ad performance among early users of its generative AI-powered advertising tools.

Mark Zuckerberg

More than a million advertisers used our GenAI tools to create more than 15 million ads in the last month, and we estimate that businesses using Image Generation are seeing a 7% increase in conversions — and we believe that there is a lot more upside here.

…

Susan Li

There is continued momentum with our Advantage+ solutions, including our ad creative tools. We’re seeing strong retention with advertisers using our generative AI-powered image expansion, background generation and text generation tools, and they’re already driving improved performance for advertisers even at this early stage.

Improving ad performance is indeed conducive to advertisers becoming more willing to spend higher ad dollars on Meta’s social media apps, translating to higher advertising revenue for shareholders.

Average price per ad increased 11%… Pricing growth was driven by increased advertiser demand, in part due to improved ad performance.

– Meta CFO Susan Li, Q3 2024 Meta Platforms earnings call.

Meta’s key differentiating attribute in this AI race is that it has open-sourced its flagship Llama models, whereas the AI models powering Google and Amazon’s GenAI services and advertising tools remain closed-source. As discussed in the previous article, Meta’s open-source approach enables contributions from the third-party developer community, allowing for faster model improvements and advancements that the social media giant can subsequently use to enrich its own product/ service offerings.

Over the years, Meta’s endeavors to continuously advance the advertising potency of its platforms has centered around facilitating increasingly more commerce activities through its apps. This includes enabling businesses to set up Facebook/ Instagram Shops, as well as running its own Facebook Marketplace for second-hand goods.

Now by open-sourcing Llama, Meta could already be benefitting from the deployment of its model by commerce-software companies and developers, the contributions from which could further buoy its social commerce efforts.

Shopify is continuing to experiment with best-in-class open source models, including LLaVA, which is built on the foundations of Llama. They use finetunes of LLaVA for multiple specialized tasks and are currently doing 40M – 60M Llava inferences per day supporting the company’s work on product metadata and enrichment.

– Meta Platforms (emphasis added).

For context, LLaVA stands for ‘Large Language and Vision Assistant’, which is a distilled version of Llama that combines text and visual image processing.

Shopify’s developers working on and potentially contributing to Llava could be conducive to expanding the open-source model’s capabilities in the context of e-commerce/ social commerce. Shopify’s deployment of a derivative model could also encourage more third-party developers to build e-commerce functionalities around Llama. Such free contributions from the open-source community would certainly expedite Meta’s own social commerce endeavors, enabling it to more easily innovate and build new product experiences that ultimately lead to more ad revenue for shareholders.

So while market participants fret over the slowdown in ad spending from “online commerce” vendors like Temu and Shein, which is a rather temporary revenue story, investors may be overlooking the progress Meta is making on the social commerce side in the background thanks to its savvy open-source strategy.

AI driving user-engagement advancements

Aside from generative AI fueling ad-performance improvements, Meta has also been successfully leveraging the power of AI to drive increased user engagement for some time now.

Improvements to our AI-driven feed and video recommendations have led to an 8% increase in time spent on Facebook and a 6% increase on Instagram this year alone.

– CEO Mark Zuckerberg, Q3 2024 Meta Platforms earnings call.

Investors are now well-aware of the concept that more time spent on the social media apps leads to more opportunities to show ads, underpinning revenue growth for shareholders.

Now, Meta is going a step further in capitalizing on this engagement by better collecting and processing data on user behavior before and after seeing an advertisement and feeding it into their systems to deliver higher conversions for advertisers, with signs of early success.

we recently deployed new learning and modeling techniques that enable our ads systems to consider the sequence of actions a person takes before and after seeing an ad. Previously, our ads systems could only aggregate those actions together, without mapping the sequence. This new approach allows our systems to better anticipate how audiences will respond to specific ads. Since we adopted the new models in the first half of this year we’ve already seen a 2% to 4% increase in conversions based on testing within selected segments. – CFO Susan Li, Q3 2024 Meta Platforms earnings call (emphasis added).

Moreover, these complementary technology advancements relating to “the sequence of actions a person takes before and after seeing an ad” should further augment Meta’s generative AI-powered ad products in the form of increasingly better targeting potential, conducive to stronger ad pricing power and revenue growth.

Downside risks

Meta is making notable progress in improving the performance of its ad products using AI technologies, with its open-source strategy offering promising potential to enhance Meta’s innovations around new social media features and experiences.

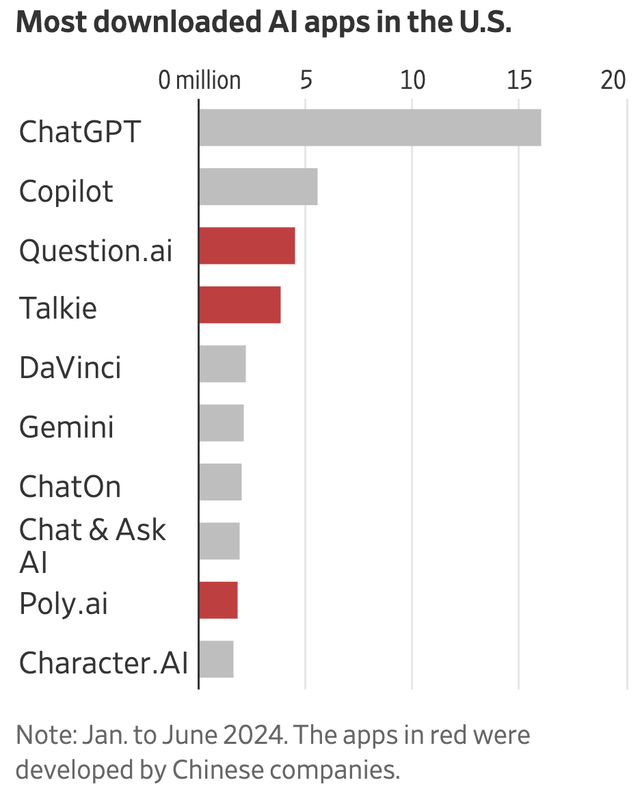

However, the company also faces intensifying competition from other platforms like TikTok or the new, rising Chinese-owned app ‘Talkie’, that will also be fighting for users’ time and engagement.

Sensor Tower, The Wall Street Journal

Furthermore, Meta’s open-source strategy means that the company is not making any immediate revenue from the wide-scale deployment of its Llama models, while innovations of new social media features and subsequent new monetization opportunities are expected to arise at future points in time. Meanwhile, Meta is spending heavily on training new iterations of the Llama series and building out the necessary infrastructure to support future AI workloads.

We anticipate our full year 2024 capital expenditures will be in the range of $38-40 billion, updated from our prior range of $37-40 billion. We continue to expect significant capital expenditures growth in 2025. Given this, along with the back-end weighted nature of our 2024 capex, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet.

Now, this guidance of growing capital expenditures is what spooked investors post-earnings. Rising expenses means profit margin compression.

However, Meta stock did not deserve to sell-off based on this guidance, given the company’s track-record of delivering remarkable returns on its AI investments over the past few years, manifesting in the form of higher user engagement and ad-conversion advancements.

“Unlike the hyperscalers, who are renting out picks and shovels to customers who have yet to find much AI gold, Meta is finding its own gold in the form of 19% advertising growth on a 23% comp,” said D.A. Davidson’s Gil Luria and Alex Patt, in an investor note on Monday. “It is clear that AI can and will make for more, better ads, that create more value for customers and will therefore be sold at higher prices.”

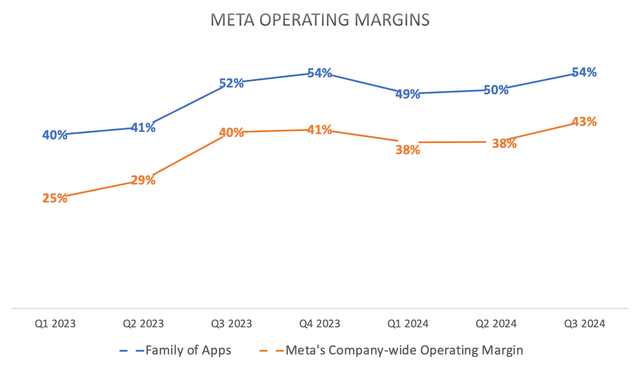

In fact, Meta’s impressive ROI on its AI investments has also been cultivating in the form of operating margin expansion over the past several quarters, reaching 43% in Q3 2024.

Nexus Research, data compiled from company filings

Therefore, investors shouldn’t be overly concerned about rising CapEx going into 2025, given that the management team evidently knows how to extract lucrative returns on those investments for long-term shareholders.

The investment case for Meta

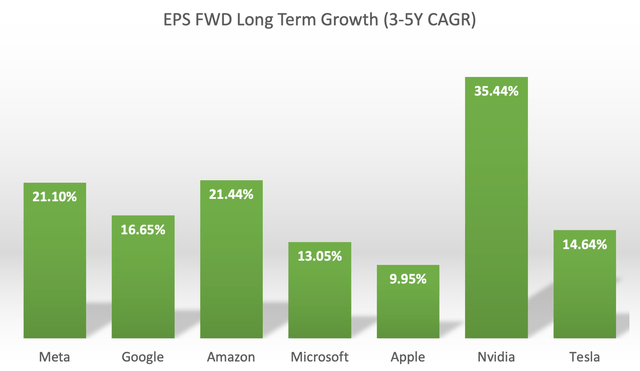

META currently trades at just over 25x forward earnings (non-GAAP), which is higher than its 5yr average Forward PE multiple of 23x. However, it is important to assess stock valuations in the context of future earnings growth rate expectations. This is where the Forward Price-Earnings-Growth (Forward PEG) ratio comes in, which adjusts the Forward PE multiple by the projected EPS growth rates.

Nexus Research, data compiled from Seeking Alpha

Barring Nvidia, which has been crowned the king of AI, Meta and Amazon have the highest projected EPS growth rates of 21%+ out of all the Magnificent 7 stocks.

Now, adjusting each stock’s Forward PE multiple by these anticipated earnings growth rates gives us the following Forward PEG multiples.

Nexus Research, data compiled from Seeking Alpha

At 1.20x Forward PEG, META is the cheapest Magnificent 7 stock.

Meta’s incredible track-record of delivering returns on AI investments so far supports the bull case that the company will be able to continue reaping lucrative returns from its generative AI innovations going forward, while also benefitting from third-party developers’ contributions to its open-source Llama model series that underpin future social media products and services.

Meta stock remains a ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.