Summary:

- Keytruda, Merck’s flagship oncology drug, drives significant revenue growth, with a solid market position and patent protection ensuring continued growth.

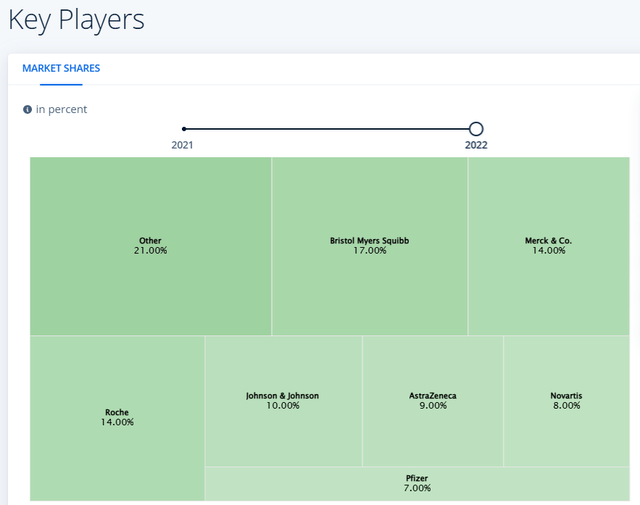

- Merck is the second largest player in the oncology drugs industry, which is expected to observe a 6.7% CAGR over the next five years.

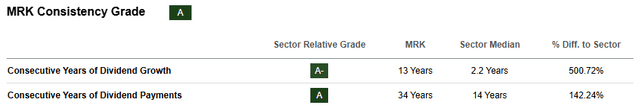

- Merck’s consistent dividend payments over 34 years, healthy balance sheet, and attractive valuation highlight its investment appeal.

- Despite foreign exchange and geopolitical risks, Merck’s diversified portfolio and innovative pipeline support a bullish outlook.

hapabapa

Introduction

Merck & Co., Inc. (NYSE:MRK) is one of the world’s largest pharmaceutical companies, and its stock is conservatively valued. The company recently delivered a solid Q3 performance, consistent with its overall long-term trend of strong performance. Its exceptional capital allocation allows it to balance innovation, growth, and consistently paying growing dividends. The company is strategically positioned and actively expands its reach through R&D and M&A. The stock certainly deserves a ‘strong buy’ rating.

Fundamental analysis

Merck is a global healthcare company that develops and sells prescription medicines, vaccines, biologic therapies, and animal health products. With its $255 billion market cap Merck is the seventh-largest public healthcare company in the world.

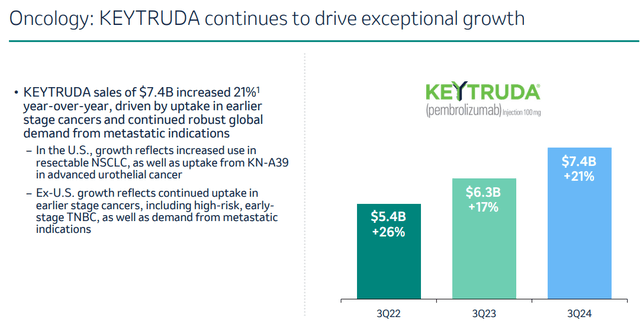

The company operates in two primary segments: Human Health (around 90% of sales) and Animal Health. Merck has a diverse portfolio of offerings, but some of the most well-known are Keytruda and Gardasil. Keytruda is an oncology drug that represents the lion’s portion of the company’s revenue. According to the Q3 10-Q report, Keytruda generated $7.4 billion in sales out of the total $16.4 billion revenue. This represents around 45% of the total.

According to Statista, Merck and Roche share the second spot among the largest players in the oncology market by market share. This suggests Merck’s strong strategic positioning in the growing market. The same source indicates that the global oncology market is expected to demonstrate a solid 6.7% CAGR between 2024 and 2029. The below chart suggests that Keytruda sales are growing at an impressive pace. The drug loses its exclusivity in the U.S. in 2028, meaning there are still several years to enjoy solid growth.

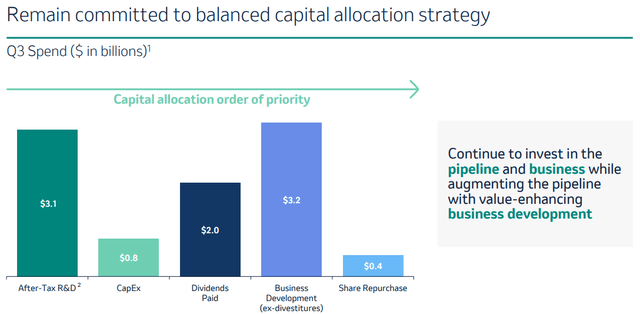

The company is heavily focused on innovation, which I see from its $10.7 billion TTM R&D spending. Merck boasts over twenty Phase 3 assets in its pipeline, which underscores the company’s commitment to innovation and driving sustainable growth for shareholders. Apart from the R&D, Merck also seeks to grow through M&A. The recent acquisitions like EyeBio and Curon are aimed at enhancing the company’s capabilities in ophthalmology and immunology, which will help in improving Merck’s therapeutic reach.

Overall, Merck’s capital allocation strategy looks well-balanced as the company allocates capital between R&D, M&A, CapEx, dividends, and buybacks. At the same time, Merck’s balance sheet looks healthy with relatively low leverage. Another positive sign for investors is that Merck is a true dividend champion with 34 years of consistent dividend payments. The forward dividend yield is decent and above inflation at 3.06%.

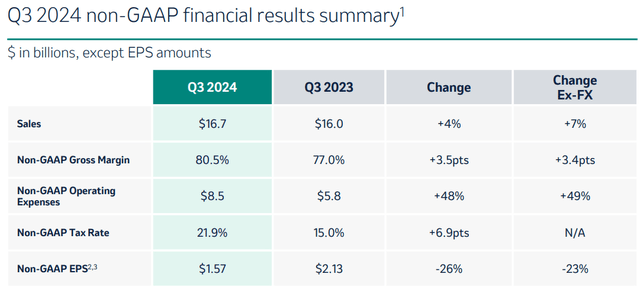

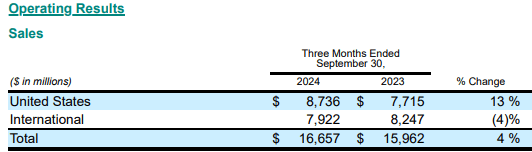

The dividend is highly likely rock-solid based on Merck’s ‘A+’ credit rating from Fitch and historically strong profitability. Moreover, the recent Q3 earnings release was positive as well. MRK delivered positive revenue surprise and in-line non-GAAP EPS. Total quarterly revenue reached $16.7 billion, marking a 7% year-over-year growth on a constant currency basis. The EPS decline from $2.13 to $1.57 should not mislead because the increase in operating expenses were caused by the boost in R&D spending and impacted by acquisition-related charges. The important part is that the non-GAAP gross margin improved year-over-year by 3.4 percentage points on a constant currency basis.

So, what do we have at the end of the day? An innovative pharmaceutical company with strong positioning in a thriving oncology drugs market. Its flagship product demonstrates robust growth, and its U.S. patent is not expiring soon. There is a strong commitment to growth through R&D and M&A, backed by a healthy balance sheet and historically strong, improving profitability. I believe these factors are sufficient to support a bullish stance.

Valuation analysis

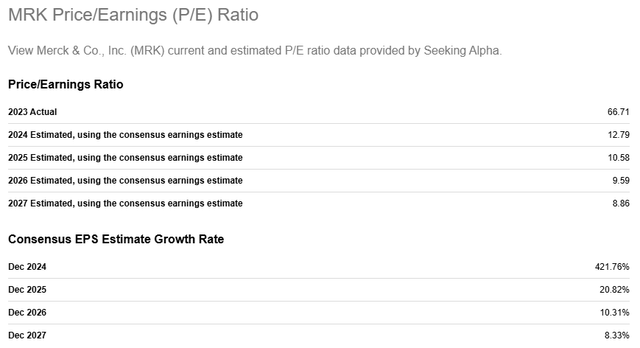

Merck appears very attractively valued when considering the dynamics of the forward P/E ratio through FY2027. The forward 12.8 FY2024 P/E ratio seems quite low, even for the defensive healthcare industry. Despite these low FY2024 levels, the P/E ratio is projected to shrink notably further through FY2027.

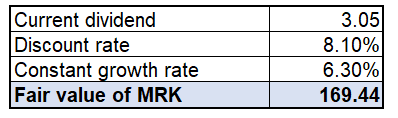

Merck’s dividend consistency is exceptional, making the DDM approach suitable for my valuation analysis. Merck’s cost of equity is 8.1%. The past decade’s dividend CAGR is 6.3%, and this is my first scenario. The current dividend is $3.05.

Calculated by the author

With a 6.3% constant growth rate MRK’s fair value is $169.44, around 69% higher than the current share price. Maintaining a 6.3% constant dividend growth rate might be a very challenging task, and it appears that I have to simulate a more conservative scenario. On the other hand, MRK’s share price was around $130 just a couple of months ago, meaning that a $169.44 fair value estimation is not that unrealistic.

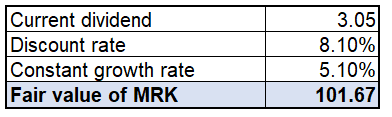

Nevertheless, in the below table I am simulating the second scenario to find out which dividend growth rate the market expects from the stock based on the company’s current valuation. With the same 8.1% discount rate it appears that the market prices in a 5.1% dividend growth rate. This is significantly lower compared to the past decade’s CAGR, meaning that MRK is very conservatively valued.

Calculated by the author

Mitigating factors

In my analysis, I highlighted that Merck’s Q3 revenue grew by 7% on a constant currency basis. However, when factoring in foreign exchange headwinds, revenue grew by a more modest 4%. This indicates a significant adverse effect from foreign exchange fluctuations. This is due to Merck’s extensive international presence, with around 48% of sales generated outside the U.S. As a company that generates almost half of its sales internationally, Merck faces not only foreign exchange risks but also international trade and geopolitical risks. The situation might become adverse for Merck following Donald Trump becoming the 47th U.S. president, given his aggressive approach to resolving international trade disputes.

Merck’s 10-Q

Keytruda is a major growth driver for Merck, and I bet any pharmaceutical company would want such a stellar product in its portfolio. However, having such an apparent star also means high reliance and dependence on the success of a single product. This could be adverse for Merck, especially considering the tough competition in the global oncology drugs market.

Conclusion

I think Merck is an attractive investment opportunity. The valuation is quite conservative, and the stock offers a solid dividend yield backed by historical consistency and solid growth. The company is well-positioned in a thriving oncology industry, demonstrates historically strong financial performance, and has delivered a strong quarter recently. The stock certainly deserves a ‘strong buy’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.