Summary:

- Nvidia has become the world’s most-valuable company – a title that it might find difficult to retain.

- Although business momentum for Nvidia is unlikely to falter anytime soon, the stock price is reaching its limits.

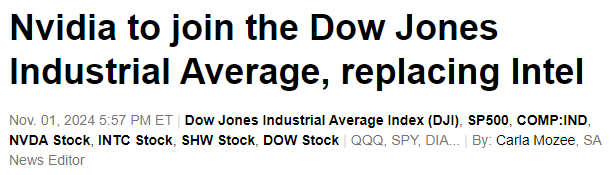

- If history is any guide, the recent inclusion into the Dow Jones index could have serious repercussions for shareholder returns from here on.

luza studios

The narrative around semiconductors is still running high and for a very good reason.

Chips are seen as “the new oil” with almost every single industry within the economy being heavily reliant on semiconductors. On top of that, for more than a year now the generative-AI revolution narrative has been grabbing investors’ imagination and with that we have seen fresh new all-time highs for many of the world’s largest semiconductors companies.

Undoubtedly, the biggest winner from this trend has been Nvidia (NASDAQ:NVDA), which just very recently became the world’s most valuable company.

Seeking Alpha

Although it is almost impossible to conceive the thought of NVDA’s stock underperforming the market at the moment, this is the exact environment that creates such conditions.

Moreover, when looking at the top 10 most valuable public trading companies, we see businesses with much stronger competitive advantages than a semiconductors business could ever have.

Companies like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) and Amazon (AMZN), all operate in much more attractive areas of the market from a long-term perspective. Although the current demand growth in semiconductors is unprecedented, competitive advantages in the sector are far more fluid over longer periods of time.

A very good example of the not so distant past is AMD (AMD) and the state that the company was in back in 2015/16 period, prior to the introduction of Zen (microarchitecture). On the contrary, we had Intel (INTC) and its hegemony that lasted decades.

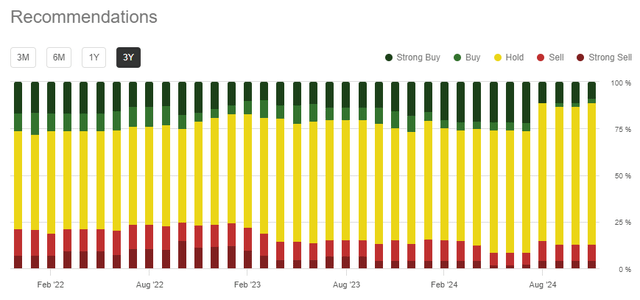

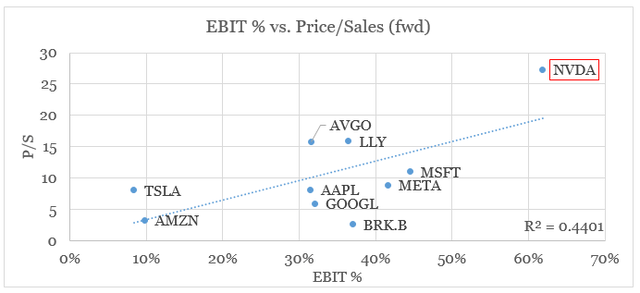

On top of all that, the most valuable company is also trading at much higher forward sales multiple than all other stocks within the top 10 holdings of the S&P 500.

prepared by the author, using data from Seeking Alpha

Differences in profitability are usually enough to explain differences in forward price/sales ratios, but in that regard NVDA is priced at a level that suggests significantly higher operating margin that the company’s current one of 62%.

prepared by the author, using data from Seeking Alpha

This leaves the current abnormal revenue growth rate of the company to support the valuation, but the forward P/S ratio already incorporates that for the following year. What that shows is that the market is pricing-in a scenario where current growth rate is sustained beyond the near-term. A low probability scenario in my view.

In spite of all that, NVDA is not a sell. It is foolish to go against the heard at this point, especially when we have such loose financial conditions. That does not make it a buy either as the risk at current levels is simply too high to justify a buy rating.

What I see as the most likely scenario from here on is NVDA stock underperforming as the business remains on a strong footing. Just very recently we got yet another important sign that upside for NVDA stock is likely limited from here.

The Curse Of Dow Additions

About four years ago, the prospects in front of the oil & gas industry appeared bleak and Exxon Mobil (XOM) was expected to be one of the biggest losers as the narrative of the world not needing much oil was gaining momentum.

On the other hand we had software stocks that were seen as invincible just as pandemic lockdowns accelerated the trend of digitalization.

As a result of these developments XOM was excluded from the Dow Jones Industrial Average index and Salesforce (CRM) took its place.

Seeking Alpha

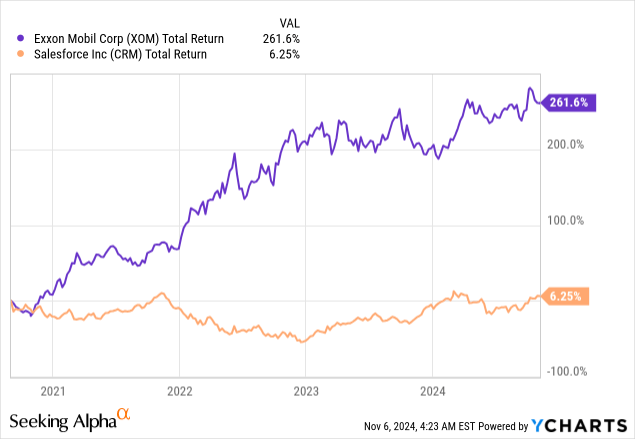

Just a week later, I wrote a very controversial thought piece where I outlined my reasoning why this event has likely marked a shift in share price performance between these two stocks. The thesis was based the extreme narratives around these two stocks and the academic research that index exclusions quite often end-up outperforming the new additions.

Needless to say that at the time the thesis of XOM outperforming CRM seemed laughable. And yet, this is how things unfolded after early September of 2020.

In the thought piece I focused more on the chances of Exxon outperforming the market as the exclusion from the index marked a peak in the negative investor sentiment.

If history is any indication, the fall of Exxon Mobil which culminated in its exclusion from the Dow Jones Index should reverse over the coming year. (…)

Source: Seeking Alpha

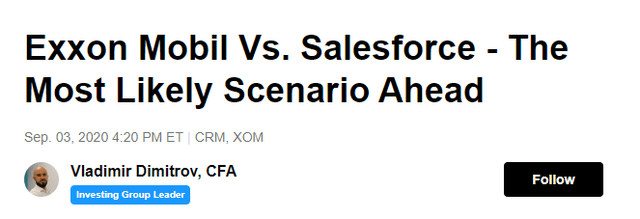

In the following months I went against the predominant narrative around Salesforce and rated the stock as a sell at a time when almost everyone was extremely bullish on its future prospects.

There are two reasons why I reiterate all these points:

- Firstly, it is because there is solid academic evidence that index inclusions tend to underperform exclusions in traditional cap-weighted indices.

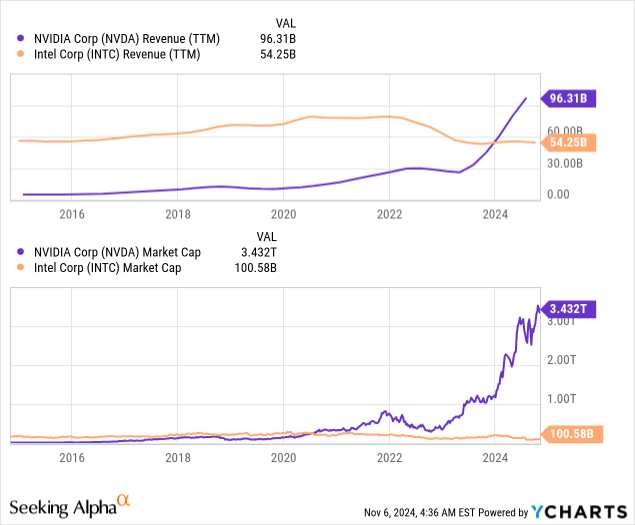

- Secondly because just recently I got a déjà vu from the announcement that the widely popular Nvidia (NVDA) stock would replace the beaten-down Intel (INTC) stock in the Dow Jones Industrial Average index.

Seeking Alpha

When Narratives Go To The Extreme

When comparing the XOM vs. CRM case with the NVDA vs. INTC one we have to keep a number of key points in mind.

Firstly, NVDA and INTC operate in the same industry. This makes the case of INTC outperforming NVDA less likely than it was in the XOM vs. NVDA as both stocks would be severely impacted by any negative development within the semiconductors segment.

Secondly, although XOM was facing significant challenges back in 2020, the company was still the dominant player in its industry and was also in a good position to cut costs and capital expenditures temporarily, until oil prices recovered.

Intel, unfortunately, cannot afford that. Instead, INTC is faced with the hard task for continuing to invest heavily in R&D and capital expenditures in order to catch-up with its peers and develop its capital intensive foundry business.

For these two reasons, I see a much lower probability of the INTC vs. NVDA case developing in a similar fashion to the one of XOM vs. CRM from a couple of years ago. Nonetheless, the extreme sentiment around these two stocks is a strong indication that the odds are now stacked in favour of the loser and against the winner.

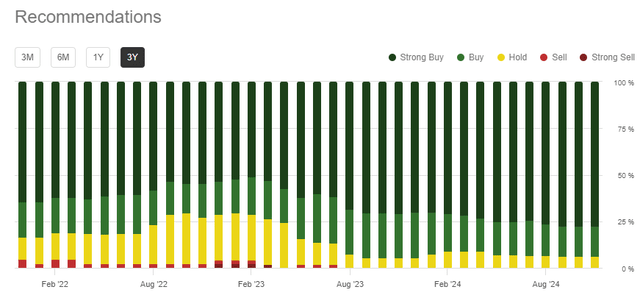

The recent rally in NVDA has made the trade extremely one-sided and has removed any pessimistic views altogether. As of today, even hold ratings are on the brink of extinction, not to mention any contrary views with a sell rating.

While Intel is facing significant difficulties and the stock continued falling over the past year, it now seems that nobody on Wall Street believes that the stock’s market cap of $100bn is justified. Thus, buy ratings on INTC are also on the brink of extinction.

Yes, things are going very well for Nvidia as a company and Intel is definitely on a back foot, but the question here is whether or not the share prices of these two companies have gone to the extreme on both sides. For how long can these extremely one-sided trades continue, until the market realizes that building castles in the air is not a viable investment strategy and that even troubled businesses could hold value for long-term shareholders?

When we consider INTC and NVDA current size in terms or revenue, we could justify the enormous difference in market cap by assuming that the former would remain loss-making for years to come and would continue shrinking in size. On the other hand, the latter would need to retain its current margins and continue growing at similar rates to the one experienced over the past year. Two scenarios with probabilities that are likely much lower than the market currently anticipates.

While the future of INTC is far less certain than the future of XOM was back in 2020, the strong interest in the company is a clear indication that there is enormous value that could be unlocked, provided that INTC delivers on its current strategy.

In a very short-period of time a number of peers have come forward and expressed interest in acquiring Intel or at least some parts of it. From Arm Holdings plc (ARM) to QUALCOMM (QCOM) and Broadcom (AVGO).

Seeking Alpha Seeking Alpha Seeking Alpha

Although AVGO is not currently considering a takeover, the company was previously assessing a potential bid. The change is likely as a result of AVGO’s previous attempts to acquire QCOM – a deal that was blocked by the U.S. government due to national security concerns. Even tough regulatory concerns might dissuade other potential bidders for Intel, the fact that all these major competitors have come forward so quickly to consider a potential bid is a strong signal that Intel holds enormous value.

All of these companies are also evaluating Intel’s potential on a medium to long-term basis and are unlikely to be influenced by short-term volatility to the same extent that sell-side analysts and other market participants are. That is why, this is a major sign that INTC could offer a significant upside potential for long-term investors, provided that current capital needs are addressed.

Conclusion

NVDA has just become the world’s most valuable publicly traded company and the stock is about to replace Intel in the Dow Jones Industrial Average index. Although the company’s leading role in the GPU space is unlikely to be rivalled anytime soon and data centers demand would most likely remain strong, NVDA stock is not in a good spot to continue to outperform the market. Moreover, if history is any guide, NVDA would most likely underperform INTC going forward. Not due to poor business performance of the former, but rather because of investors’ sentiment reaching extreme levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.