Summary:

- Palantir’s U.S. commercial segment posted 54% YoY growth, and U.S. government growth was strong at 40% YoY, lifting overall company growth.

- CEO Karp emphasizes Palantir’s unique position to leverage AI advancements, focusing on integrating proprietary data with LLMs to drive customer results.

- Adjusted gross margin was 82%, with an adjusted operating margin of 38%, despite high stock-based compensation and increased expenses for AI and tech talent.

- PLTR raised Q4 revenue guidance, and is expecting strong U.S. commercial growth of at least 50% for the full year, indicating confidence in continued growth.

Sundry Photography

Palantir (NYSE:PLTR) just held its earnings call. Results were very good. In the medium term I view sales growth as the key driver of the stock price. Last quarter there was a shift where government growth started overtaking the U.S. commercial growth rate. This quarter the U.S. commercial segment did extremely well and posted 54% year-over-year growth. U.S. government was also very strong at 40% year-over-year growth. Palantir’s non-U.S. business is what’s dragging the company growth rate down to a 30% average. However, the U.S. growth rates are quickly lifting the company growth rate as U.S. revenue is now ~69% of the pie. Two quarters ago it was at ~61% only.

CEO Karp believes, and they are ascribing the growth rate to it, that Palantir is very well positioned to capitalize on the advancements that are being driven by AI large language models or LLMs (emphasis mine):

What will differentiate the AI haves from the have nots is the ability to maximally leverage these models in production by capitalizing upon the rich context within the enterprise. That’s why our focus on delivering proof, not proof of concepts continues to pay-off. Years of foundational investments in our infrastructure and in on ontology have positioned us uniquely to harness and deliver on AI demand. This is Palantir’s focus.

The market has been focused on AI supply the models. We see this clearly in the progress, but also in the capital sunk into these models. Indeed, the models continue to improve, but more importantly, the models across both open and closed source are becoming more similar. They are converging, all while pricing for inference is dropping like a rock. This only strengthens our conviction that the value is in the application and workflow layer, which is where we excel. Tapping into this rapidly expanding pool of leverage from AI labor means more than just saving money. It means a massive acceleration of results for our customers.

Karp is arguing that building the software in between vast amounts of (proprietary) data and LLMs is where the money is at. In his view, the LLMs are largely interchangeable or will be soon enough. There are various open-source models, for example. They actually deploy these LLMs within an enterprise and hook up propriety data-sets there are privacy, security and all kinds of legal issues that need solutions. Palantir has been building these solutions for years.

As the price of querying LLMs drops (inference) it opens up all kinds of possibilities to set AI loose on datasets. Driving the need for software that solves other obstructions.

Turning to margin and expense, adjusted gross margin, which excludes stock-based compensation expense was 82% for the quarter. Adjusted income from operations, which excludes stock-based compensation expense and related employer payroll taxes was $276 million, representing adjusted operating margin of 38% and marking the eighth consecutive quarter of expanding adjusted operating margins.

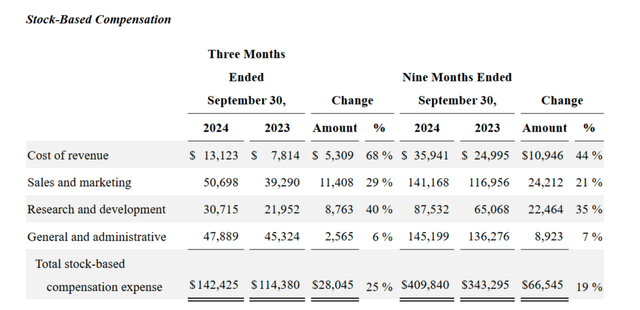

Gross margins look good and are trending in the right direction. It is a bit trite but stock-based compensation is very high. I’m not going to mention it in every article I write about the company, but it’s a significant negative. Sure, it is likely to decrease over time, but for now, it’s high (see table below).

stock based compensation (seekingalpha.com)

Q3 adjusted expense was $450 million, up 6% sequentially and 14% year-over-year, primarily driven by our continued investment in AIP and technical talent. We continue to expect expenses to ramp through the fourth quarter as we invest in the product pipeline and accelerate the journey from AI prototype to production.

I don’t really mind the increased expenses expected for Q4 based on AIP and tech talent expenses. The interest in AIP makes a lot of sense and I buy into the idea that investments now will translate into profitable long-term contracts in the future.

Finally, Palantir also raised its guidance for Q4. The company now expects revenue of between $767 million and $771 million. Here’s what the company said about its U.S. commercial revenue for the full year:

We are raising our U.S. Commercial revenue guidance to an excess of $687 million, representing a growth rate of at least 50%.

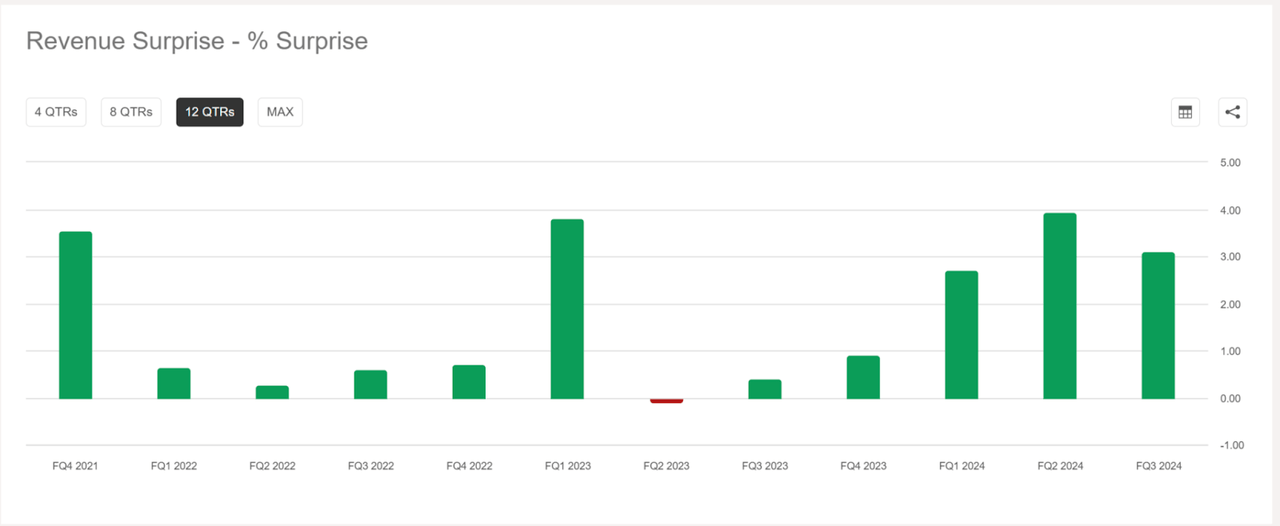

Interestingly, it expects a (U.S. Commercial) growth rate of at least 50%. I was surprised by the “at least”. Although, the fourth quarter tends to be a good quarter for Palantir, its revenue is also somewhat lumpy and the company often depends on the end of a quarter to book contracts. In the last three years it rarely missed revenue:

revenue surprises PLTR (seekingalpha.com)

It missed only once by a tiny amount. Given Q4 is generally strong, the confident guidance with an “at least” qualifier, the investments in technical talent to try and meet the demand for AI-related software and the general propensity to sandbag guidance, I’m strongly inclined to believe the next quarter is likely to be another very good quarter.

There’s always something I don’t love or that worries me on a call. This time Karp said (emphasis mine):

We want a smaller number of the world’s best partners that, quite frankly are dominating with our product. And the way you do that is by having by not blowing up your margin and getting 10,000 sales people, it’s actually by going deeper on the product. And in fact, what we see is the deeper and the better the product, the more we drive sales, the more we have our cultural singular advantage as Palantir, not as a commodity product. It’s like we are not a commodity. We do not want our customers to be commodities, we want them to be individual Titans that are dominating their industry or the battlefield.

Karp said this to try and explain why Palantir could sustain both high margins and high growth rates. His argument is basically they’re going to sell very expensive (but worth its weight) software that integrates deeply into a “limited” set of major customers. This deep integration is highly valuable and delivers results which then leads to increasing demand from existing customers. As customers expand their reliance on Palantir, this can further increase the value of the software to that enterprise, but it also increases Palantir’s margins because less customization is required. Karp is contrasting this model to some fast-growth SaaS businesses that charge $8 (or something) per month per seat for software that’s basically a very good version of a chatroom. In the long run I don’t believe in fast growth and expanding margins, but at the stage Palantir is at, it’s possible. He may also be trying to explain some of the stronger relationships Palantir has with Airbus (OTCPK:EADSF) and BP (BP) that involve a level of exclusivity.

Obviously, they’re not entering these partnerships with small companies but if it turns out this keeps Palantir from working with Exxon (XOM) or Boeing (BA) in the future it could be a problem. Deciding not to sell to China, Iran and Russia is one thing.

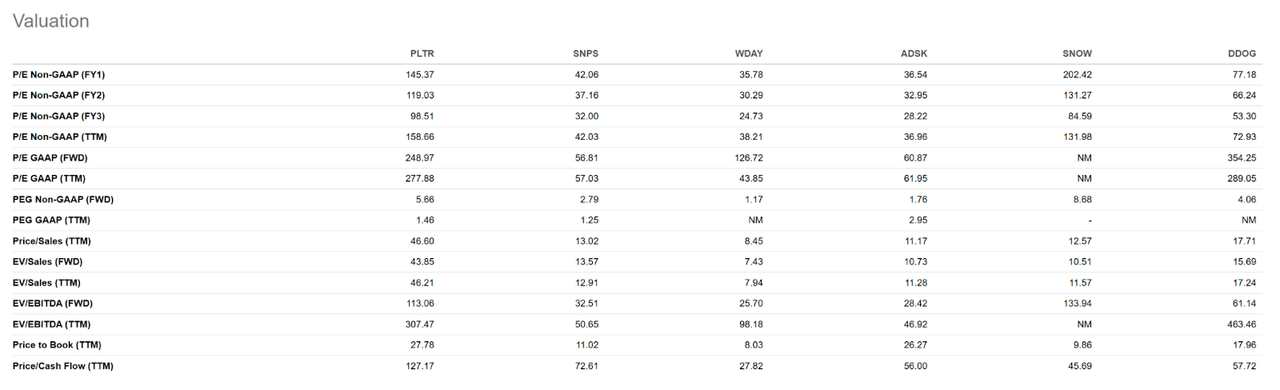

PLTR valuation (Seekingalpha.com)

The market is pricing in a lot of good fortune, though. I pulled up valuation multiples for Palantir and its Seeking Alpha peers, substituting two out for Snowflake (SNOW) and Datadog (DDOG) and it’s not pretty. Palantir trades at much higher sales multiples (most relevant) and most other multiples. In terms of margins, it is not clear to me why PLTR would have much more room to expand. In terms of recent growth rates, it is ahead of the competition. Looking back a bit further, its growth is at the higher end of the range, but not on a different level. I think Palantir is a hold/buy here because there seems to be a lot of momentum behind its current sales, there’s likely a great quarter ahead of it and U.S. commercial (which I was worried about last quarter) is doing fantastic. The reason hold remains an option is the valuation. In the short term, it doesn’t have to be a problem, but in the longer term it could weigh on the company and limit returns even if the business is very successful (the multiples implying amazing success).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.