Summary:

- Rocket Lab USA, Inc. is a promising long-term investment due to its market leadership in small satellite launches and expansion into space systems and human spaceflight.

- The company’s Electron rocket dominates the small satellite market, and the upcoming Neutron rocket will further boost capabilities and revenue streams.

- Despite short-term financial challenges, Rocket Lab’s robust backlog, government contracts, and vertical integration strategy position it for significant growth in a high-barrier market.

- I expect RKLB’s Q3 numbers to be stronger than consensus, with positive management comments. So, RKLB stock is likely to react positively, but the main growth awaits long-term holders.

- I rate RKLB a “Buy” today, a few days before its Q3 earnings release.

imaginima

Intro & Thesis

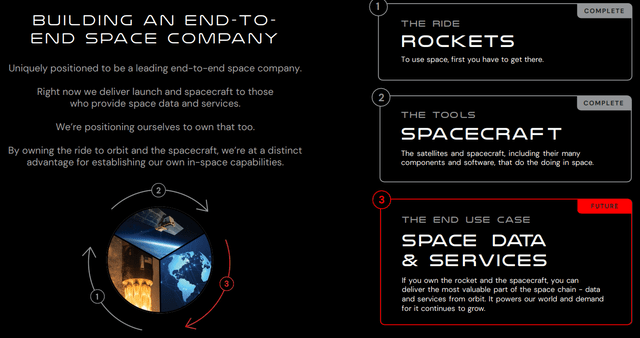

Rocket Lab USA, Inc. (NASDAQ:RKLB) with its headquarters in Long Beach, California, is an end-to-end space company providing reliable launch services and spacecraft solutions. According to its latest 10-Q, the firm also owns one of the few private orbital launch sites in the world – in Mahia in New Zealand – which offers enormous operational flexibility. Rocket Lab’s flagship launch vehicle, Electron, has launched more than 190 vehicles into orbit over the course of 46 missions since its debut in 2017. The company also plans to develop the Neutron launch vehicle, a medium-capacity rocket that will be able to accommodate larger payloads and human spaceflight. Alongside the launch, Rocket Lab provides spacecraft design, manufacturing, and on-orbit operations, and seeks to expand its space systems solutions and optimize operations.

This is my first article on RKLB, and based on what I can see from the company’s history and recent financial and operational data, Rocket Lab seems to me to be a pretty promising investment for those who are willing to wait and not touch their long position for at least 3-5 years.

Why Do I Think So?

Rocket Lab was founded by Peter Beck in New Zealand in 2006 with the goal of democratizing space with innovative, affordable launch solutions. It started off by making small-class launchers to address the increased need for small satellites. When Rocket Lab flung its first suborbital rocket, tea-1, into orbit in 2009, it set a major milestone in its proto-development. This triumph was the impetus for the Electron rocket, a miniaturized orbital launcher that allows frequent and stable passage into space for miniature payloads.

Since its first test in 2017, Rocket Lab’s Electron rocket has become a market leader in small satellite launches. In recent years, Rocket Lab has gone beyond launch services into spacecraft design, manufacturing, and on-orbit operations. Acquisitions such as Sinclair Interplanetary expanded that growth, expanding the company’s capabilities in satellite parts and systems. The company also is developing the Neutron rocket, a medium-vehicle lift-off platform for heavier payloads and human launches. Rocket Lab’s growth plan will be to increase production, expand its space systems offerings, and capitalize on space economy investments to maintain expansion and profitability.

From what I can see, RKLB’s growth strategy seems to be working well. In Q2 FY2024, the company posted a quarterly record-breaking $106 million in sales, up 71% YoY and 15% QoQ, driven by the strong performance of their launch services and space systems businesses. Launch services, driven mostly by the Electron rocket, delivered ~$29.4 million, slightly more than predicted. The space systems segment, meanwhile, generated ~$77 million, representing a 28% sequential increase, primarily driven by agreements with the Space Development Agency (SDA) and MDA.

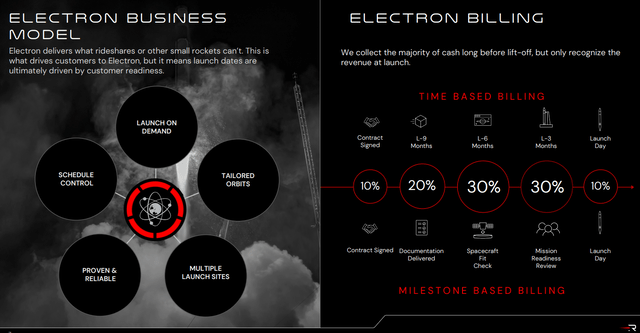

Their Electron rocket now dominates the small satellite launch market as the third most frequently launched rocket in the world (“Electron accounts for 64% of all non-SpaceX orbital U.S. launches in 2024 so far”, based on RKLB’s IR materials). This success is based on Rocket Lab’s ability to provide a one-on-one launch service for each customer with the flexibility to change launch times and locations. With 17 new Electron launch contracts signed so far this year for a total contract value of $141 million, demand for the company’s services is high.

According to Market Research Future’s data, the small satellite market was valued at $3.5 billion in 2022 and is expected to expand from $4.1 billion in 2024 to $12.25 billion by 2030, with a CAGR of about 19.60% during the forecast period (2024-2030) – this is a great TAM for RKLB and its dominant position, in my view, especially given that RKLB’s market cap today is only $6.5 billion.

But it’s impossible to discuss RKLB’s prospects with the Neutron rocket – it is an important part of Rocket Lab’s future expansion plans. Neutron’s goal is to disrupt the small launch market, which is currently dominated by just a handful of players. The company has already made significant progress in the Neutron program, passing the design stage and transitioning to production and qualification of flight hardware, according to the latest earnings call commentary. And Rocket Lab’s hot fire test of the Archimedes engine, another important accomplishment, looks like a testament to Rocket Lab’s ability to build complex systems quickly. Neutron is due for mid-2025’s first launch and will greatly boost Rocket Lab’s capabilities for launching massive constellations and assisting with manned missions.

The business verticalization at Rocket Lab’s core makes it able to manage costs and timelines by manufacturing most of its components in house, keeping costs and timelines low. This plan has allowed for complex spacecraft to be built at an incredibly rapid pace, like the two identical probes for NASA’s Mars mission built in only three years. The company’s ability to manufacture quality spacecraft on short notice has made it a preferred vendor for both government and commercial clients.

Rocket Lab USA has been selected by NASA to complete a study for retrieving rock samples from the Martian surface and bringing them to Earth for the first time. Rocket Lab’s study will explore “a simplified, end-to-end mission concept that would be delivered for a fraction of the current projected program cost and completed several years earlier than the current expected sample return date in 2040,” the company said.

Source: Seeking Alpha News

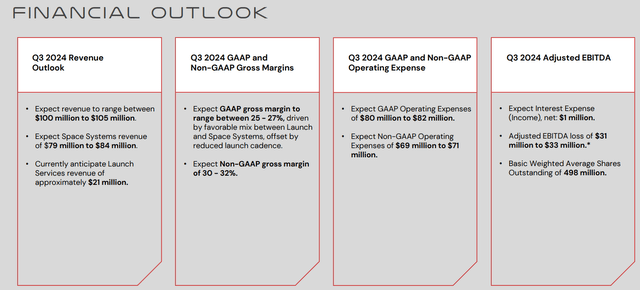

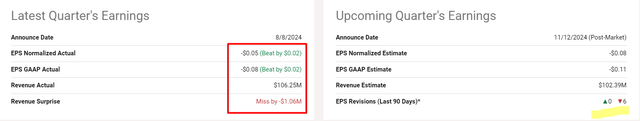

The company is well-capitalized and holds $546.8 million in cash, cash equivalents, and marketable securities, which provide the company with solid funding sources for the future. Rocket Lab also completed the quarter with a $1.07 billion backlog, indicating a robust future demand. Its operating costs (OPEX) rose with continued investments in the Neutron development program and “the scaling up of space systems capabilities”. In spite of these costs, Rocket Lab’s adjusted EBITDA loss improved to $21.2 million, reflecting a “cost-controlled increase in an environment of rapid growth.” As a result, RKLB managed to massively beat the EPS projections for the quarter, although the analysts decided to lower their expectations for the third quarter (set to be released in 3 days):

Seeking Alpha, RKLB, the author’s notes added

To be honest, I see no reason for these downgrades, which came against the backdrop of a very strong Q2 report – so I think that while maintaining very careful cost management in Q3, the company most likely managed to report lower net loss per share than the market is forecasting today. This is just my guess – on November 11, 2024, when Rocket Lab presents the Q3 report, we will find out to what extent they were justified.

Anyway, despite the estimates’ downward revisions, Rocket Lab’s management expects the launch services and space systems segments to continue to expand, forecasting $100-105 million in revenue in Q3 2024 (primarily from space systems and launch services). The firm is now geared towards expanding its operations to serve rising demands, especially in the space systems industry, where it has already been awarded key contracts with the SDA and MDA. By the way, the space tech market in general was valued at $443.20 billion in 2023 – according to Precedence Research data – and it is anticipated to reach ~$916.85 billion by 2033, growing at a CAGR of 7.54% for the next decade. This is essentially an immensely large TAM in which RKLB’s presence is likely to grow, as the innovations it offers are very important and the barrier to entry into this market is very high.

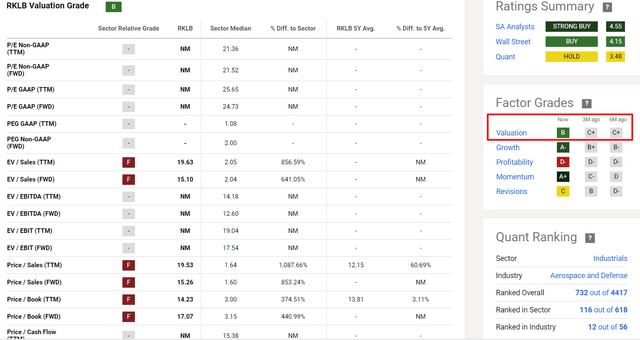

As far as the valuation of the company is concerned, it’s important to note that we don’t really have enough valuation metrics to assess it due to the negative EPS forecast for the coming years. However, according to Seeking Alpha’s Quant rating, RKLB stock became “cheaper” than 3 and 6 months ago, although the stock price has risen by 193% and 239% respectively since then.

Seeking Alpha, RKLB’s Valuation

As you can see above, a closer look at RKLB’s valuation metrics does not show an undervaluation – but that is normal for a high-growth company. Most likely, continued EPS beats could easily change the current picture – the most important thing is that Rocket Lab continues to grow its business as fast as management sees it and communicates to the market. I think they should succeed – the recent government contracts clearly show that the services and products offered by RKLB are of high quality. At the same time, this is a market with very high barriers, where it is unlikely under current conditions that a new entrant will emerge to thwart RKLB’s plans. For all these reasons, I think RKLB is a promising investment for those who are willing to wait at least 3-5 years to potentially double (if not more) their capital.

Where Can I Be Wrong?

I think Rocket Lab may have some hiccups, especially when it comes to scheduling launches. The agility the customers are provided, while competitive, creates variation in release times that can affect revenue. The startup receives the bulk of its funds from launch customers before launch day, but revenue only occurs at launch, so you may experience some incongruities between cash flow and revenue.

RKLB’s actual revenue and EPS for Q3 might have been affected somehow given this peculiarity – hence the lowered expectations for the quarter. Rocket Lab may miss on the bottom line or give a negative projection for FY2024 and beyond – in this case the stock is very likely to fall off a cliff, and I’ll have to re-asses my thesis.

The Bottom Line

I believe Rocket Lab’s ability to run large-scale projects, and its dedication to growing its addressable market through vertical integration and acquisitions, are the key drivers. In particular, the Neutron rocket will help create new revenue streams and further differentiate Rocket Lab from its competitors in the space sector – this is a major bullish catalyst that, I suppose, should keep the stock rally going.

I expect the Q3 numbers to be stronger than the revised figures expected by consensus. I also expect positive comments from management. If both of these expectations of mine are met, RKLB stock is likely to react positively. But again, I think the main growth awaits those who are willing to wait at least 3–5 years, as the company’s project activities imply a long-dated break-even (in terms of EPS).

Based on the above, I rate RKLB a “Buy” today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RKLB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!