Summary:

- I reiterate a ‘Strong Buy’ rating on Airbnb with a one-year target price of $200 per share, driven by strong travel market recovery.

- Airbnb reported 10% constant revenue growth and 10% gross booking value growth in Q3, supported by investments in customer service and the Co-Host network.

- Global travel market growth, driven by increased discretionary cash flow and international travel demand, is expected to benefit Airbnb’s near-term growth.

- Key risks include a 25% increase in stock-based compensation and strong comparables in Q1 FY25 due to favorable timing factors in FY24.

Klaus Vedfelt

I reiterated a ‘Strong Buy’ rating on Airbnb (NASDAQ:ABNB) in April 2024, highlighting the potential for a global travel market recovery. Airbnb delivered 10% constant revenue growth and 10% gross booking value growth in Q3 FY24. I believe a strong travel market will continue to benefit Airbnb’s near-term growth. I reiterate a ‘Strong Buy’ rating with a one-year target price of $200 per share.

Anticipating A Strong Travel Market Ahead

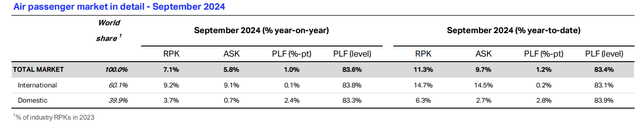

IATA released its air passenger market analysis in September 2024, reporting a 7.1% year-over-year increase in total Revenue Passenger Kilometers (RPK), reaching an all-time high for the month. Notably, the international passenger traffic increased by 9.2% YoY in September, indicating strong international travel demand.

As the Fed has begun the interest rate cut cycle, I anticipate a strong growth in the global travel market, as consumers are likely to have more discretionary cash flow for travel. IATA forecasts the number of global airline passengers will increase by 10.4% in 2024, which is quite remarkable.

Q3 and Outlook

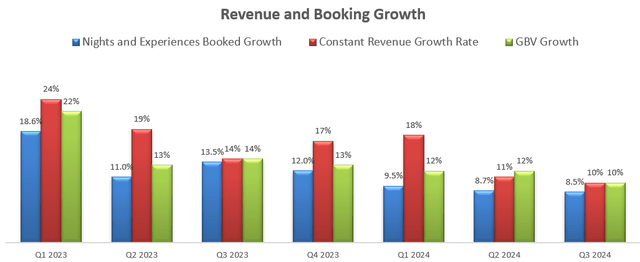

Airbnb released its Q3 result on November 7th after the market close, delivering 10% constant revenue growth and 10% gross booking value growth, as depicted in the chart below:

In Q3, Airbnb’s take rate remained flat year-over-year, as the additional revenue from cross-currency bookings was offset by their investment in customer service. In October 2024, Airbnb introduced Co-Host network, a marketplace to find and hire the local co-hosts to manage properties. There are currently 10,000 co-hosts across 10 countries, and Airbnb uses a personalized ranking algorithm to recommend co-hosts based on over 80 factors, according to their release.

I think Airbnb is making the right investments to attract more hosts to their platform.

Airbnb is guiding for $2.39 billion to $2.44 billion in revenue for Q4 FY24, with a slight year-over-year decline in take rate due to one-time benefits recognized from unused gift cards in Q4 FY23.

For Airbnb’s near-term growth, I am considering the following factors:

- Airports Council International (ACI) predicts that global passenger traffic will grow at a CAGR of 4.3% from 2023 to 2042. The structural growth in global passenger traffic could pave the foundation for Airbnb’s business growth.

- As discussed in my previous article, Airbnb has been taking market shares from the traditional hotel booking business, as alternative accommodation meet a broad range of customer needs. I forecast Airbnb will continue capturing shares in the accommodation market.

- Airbnb plans to expand its core hotel booking business into other experience-related markets, including private tours, co-host networks and in-home experience services, which could contribute additional revenue growth to Airbnb.

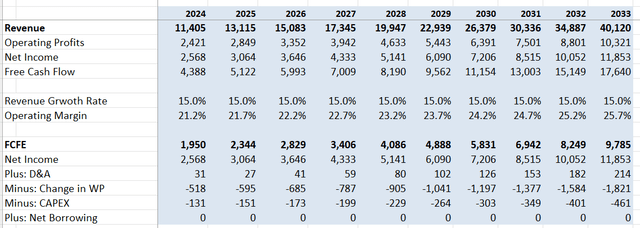

I project Airbnb will deliver 15% annual revenue growth in the near-term, assuming 4.3% global traffic growth, 5% share gains from traditional accommodation market, 2% take rate improvement and 3.7% from new services. I project 50bps annual margin expansion, driven by 10bps from gross profits, 10bps from take rate improvement, 20bps from reduction in SG&A and 10bps from R&D operating leverage. I calculate the total operating expenses will grow by 14% year-over-year, leading to operating leverage for Airbnb. I maintain the cost of equity to be 16.3% assuming: risk-free rate 4.22%; beta 1.72; equity risk premium 7%.

With these assumptions, I calculate the free cash flow from equity (FCFE) as follows:

I discount all the future FCFE to the end of FY25 to estimate Airbnb’s one-year target price. Assuming a 4% terminal growth rate, the one-year target price is calculated to be $200 per share, according to my model.

Key Risks

For FY24, Airbnb anticipates the stock-based compensation (SBC) to increase by 25% over FY23, caused by the accounting change for their restricted stock unit awards. The SBC growth rate will exceed their headcount growth rate in FY24. Going forward, Airbnb expects the SBC growth will be largely in-line with headcount growth.

In addition, Airbnb delivered 18% constant revenue growth in Q1 FY24, benefiting from both the timing of Easter and inclusion of Leap Day. As such, Airbnb is going to face a strong comparable in Q1 FY25.

Conclusion

A healthy global travel market continues to support Airbnb’s business growth. I believe Airbnb has huge growth potential to expand its co-host network and adjacent experience markets. I reiterate a ‘Strong Buy’ rating with a one-year target price of $200 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.