Summary:

- Amazon’s AWS segment is driving substantial operating profit growth, significantly contributing to the company’s overall financial performance and future potential.

- Amazon exceeded Wall Street’s Q3 estimates, highlighting consistent underestimation of its profit potential and suggesting a strong Q4 ahead.

- Despite a high profit multiple, Amazon’s robust growth in cloud and eCommerce justifies a higher valuation, with an intrinsic value target of $240.

- Receding inflation and strong holiday sales forecasts bolster Amazon’s outlook, positioning it for continued operating income growth into 2025.

4kodiak/iStock Unreleased via Getty Images

Amazon Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA) profits from robust growth in AWS which is enjoying a substantial uplift in its operating profits. Moreover, Amazon sailed past Wall Street’s estimates for the third quarter which suggests that expectations for the eCommerce company are still rather low.

In my view, Amazon is poised to profit like no other company from growth in cloud and the fact that inflation is receding could point to a strong fourth quarter as well.

Amazon’s stock might appear that it is expensive based on its leading profit multiple, the company is poised for strong growth moving forward and I think that Amazon will inevitably grow into a higher valuation.

My Rating History

My last stock classification on Amazon was Strong Buy because the eCommerce company managed to grow its sales at double digits and because the cloud business in particular impressed.

In the third quarter, Amazon enjoyed substantial growth in its operating profits from its cloud segment which remains the main reason why investors should own stock in the company.

In my view, Amazon is one of the best tech stocks that investors can buy right now, and I have doubled my position in Amazon right after earnings.

Amazon’s 3Q24 Profits, AWS And Operating Profit Uplift

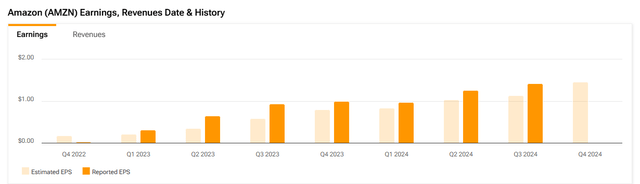

Amazon earned $1.43 per share in profits in the third quarter which beat Wall Street’s estimate of $1.14 per share in profits by a comfortable margin.

It was also the seventh straight quarterly earnings beat for Amazon, highlighting that investors have consistently been too bearish about the company’s profit potential.

Earnings And Revenues (Yahoo Finance)

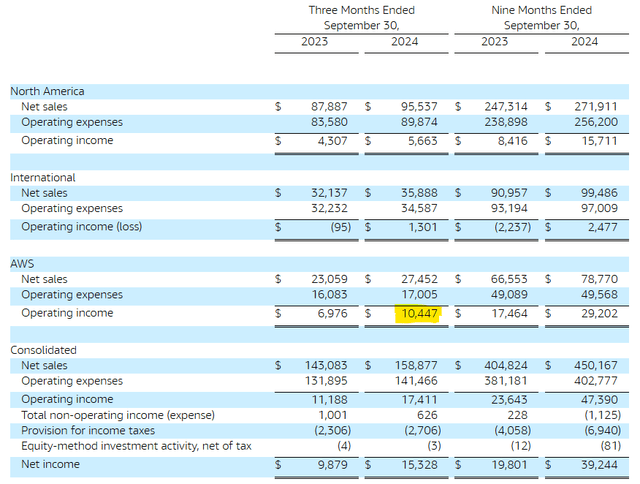

AWS is absolutely firing on all cylinders right now which created a big surprise in terms of the segment’s operating profit growth. Operating income is a key performance metric for companies that I analyze, and I think in AWS’s case it paints a very bullish picture for Amazon.

In the third quarter, Amazon produced $17.4 billion in operating profits and a solid 60% of this amount, $10.4 billion, came just from Amazon’s cloud segment. AWS had a couple of contract wins in the last quarter as well, with the cloud platform signing on new clients such as T-Mobile, Toyota, Datadog, Epic Games or Booking.com.

In the year-ago period, AWS produced $7.0 billion in operating income, and total operating profit performance was dragged down by Amazon’s International eCommerce. This segment, Commerce, performed quite decently as of late, with both North American and International eCommerce growing their operating profits. Amazon’s eCommerce segment produced a combined $7.0 billion in operating profits, up 65% YoY.

Operating Income (Amazon Inc.)

The forecast for Amazon is also quite positive, in my view. The primary reason for this is that inflation is receding quickly, potentially benefiting consumer spending which is something that would be particularly helpful for Amazon’s eCommerce segment in the fourth quarter.

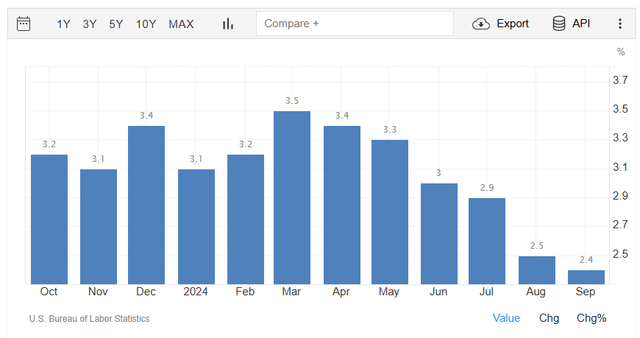

With inflation falling to 2.4% in October, down from 3.5% in March, and all segments growing their operating profits in 3Q24, I think that Amazon is in a great position to grow its operating income in the fourth quarter.

According to Amazon’s earnings release, the company anticipates to produce between 7% and 11% YoY growth in its sales in the fourth quarter. If its operating profits grow at the same pace as in 3Q24, Amazon could be on track to achieve $20 billion in quarterly operating income by 1Q25.

Inflation (U.S. Bureau Of Labor Statistics)

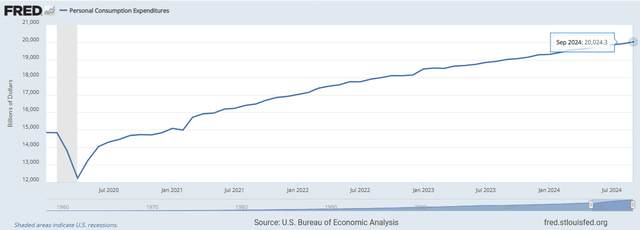

Inflation decreased for six consecutive quarters, creating upside in personal consumption. Despite inflation, personal consumption expenditures have consistently trend up since the end of the Covid pandemic and the associated recession in 2020. Since the economy opened up again in 2021, however, personal consumption has consistently grown, reaching $20 trillion in September 2024. I anticipate this trend, particularly in the context of receding inflation to continue, and to benefit Amazon.

Personal Consumption Expenditures (U.S. Bureau Of Economic Analysis)

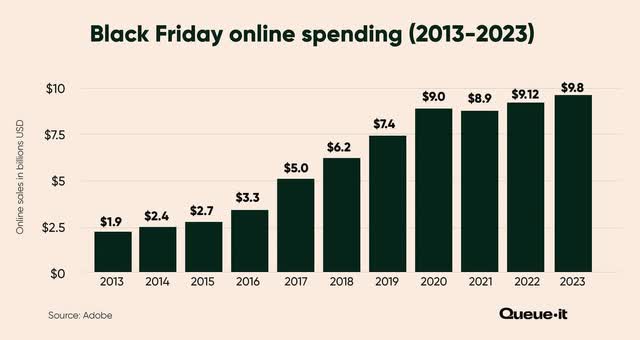

The optimistic outlook is supported by fourth quarter sales holidays that have historically boosted eCommerce sales. Black Friday is happening again this month which tends to lead to billions in dollars in additional sales.

Total Black Friday spending, based on estimates from Adobe Analytics, went up to $9.8 billion last year, reflecting an increase of 7.5% YoY. For the present year, I think that consumers are going to spend at least $10 billion on online shopping, a big portion of it will go Amazon.

Black Friday Online Spending (Adobe Analytics)

With inflation falling, consumer spending growing and major shopping sales events just around the corner, Amazon is poised to see an operating income boost in its eCommerce segment in 4Q24 which could fuel the company’s profit growth in the short-term. In the long term, growing adoption of AWS obviously is a factor that could support operating profit growth.

With Amazon being close to $20 billion in quarterly operating profits just from AWS, the company is still only in the early innings of a multi decade growth opportunity and could achieve much higher operating profits in the future.

Amazon holds a market share of 31% in the cloud market, according to Statista, which makes AWS the main destination for large corporate customers that seek to migrate their workloads to the cloud. Thus, AWS should be able to continue to win over new corporate clients and enjoy sustained operating profit growth as a consequence.

Obviously, with Amazon having both a compelling short- and long-term business outlook, I think the stock has a place in every investor’s portfolio.

Amazon Is A Steal

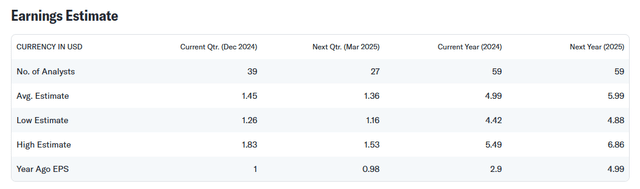

The market models $5.99 per share in profits next year for Amazon, with the consensus Wall Street estimate implying a YoY profit jump of 20%. This year, Amazon is anticipated to grow its profits 72% in large measure because of a supportive U.S. economy, receding inflation and substantial operating profit momentum for AWS.

Presently, Amazon is selling for $195 which reflects back to us a leading profit multiple of 32.6x. Though this is not a low multiple, I think that Amazon’s robust position in cloud with AWS as well as in eCommerce makes the company one of the best stocks available in the tech market.

Taking into account how quickly Amazon is growing is operating profits, I would be totally fine with paying a 40x profit multiple for Amazon. Moreover, Amazon owns the number one cloud platform in the world, AWS, whose profits are soaring.

Taking into account that all segments are growing their operating profits, a 40x profit multiple is entirely sensible, in my view, and it reflects back to us an intrinsic value of $240 for Amazon’s stock.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Could Go Wrong

The U.S. economy is growing and inflation is receding, which is a setup that should benefit online retailers. The cloud part of Amazon business profits from an accelerating shift of artificial intelligence workloads to the cloud and Amazon is leading the market here with a market share of 30%. The state of U.S. eCommerce is also bullish, with the segment seeing robust operating profit growth.

With that said, slowing growth in the U.S. economy may weigh on consumer spending just at a time when inflation is moderating. This could create challenges for companies like Amazon, which depend on consumer spending.

My Conclusion

Amazon did not disappoint in the third quarter. The company is doing well in both its main businesses, but AWS particularly is firing on all cylinders.

Because I found Amazon’s third quarter earnings so convincing, particularly with respect to operating profit growth in AWS, I doubled my position in Amazon after I read through the 3Q24 earnings release.

The trajectory in operating profit growth is extremely compelling, as far as I am concerned, and Amazon seems to be on track for $20 billion of quarterly operating profits in a very short time.

Though the stock might appear expensive based on leading profits, I don’t really think it is given Amazon’s success in growing operating profits, particularly in AWS.

If Amazon can keep up its present rate of growth, I think it will be only a question of time until we reach my intrinsic value target of $240.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.