Summary:

- Exxon Mobil will report earnings for its Q4’22 in two weeks.

- The energy producer is likely to report strong earnings and free cash flow, but is unlikely to match record results from Q3’22.

- Energy prices and Exxon Mobil’s margins are likely to decline in 2023.

Dean Mouhtaropoulos

Exxon Mobil (NYSE:XOM) is going to submit its fourth-quarter earnings sheet in two weeks and investors can look forward to seeing robust earnings and free cash flow results from the producer. Exxon Mobil recently announced a $50B stock buyback — which I believe is a mistake — due to a soaring free cash flow in FY 2022. However, with energy prices more likely to decline than rise in 2023, in my opinion, I believe Exxon Mobil faces valuation headwinds and investors should be careful to avoid what is likely a bull trap ahead of earnings. While fourth-quarter results can be expected to be solid, I don’t expect them to beat Exxon Mobil’s Q3’22 earnings which likely marked the peak for Exxon Mobil!

Petroleum prices remain high, support Exxon Mobil’s stock price for now

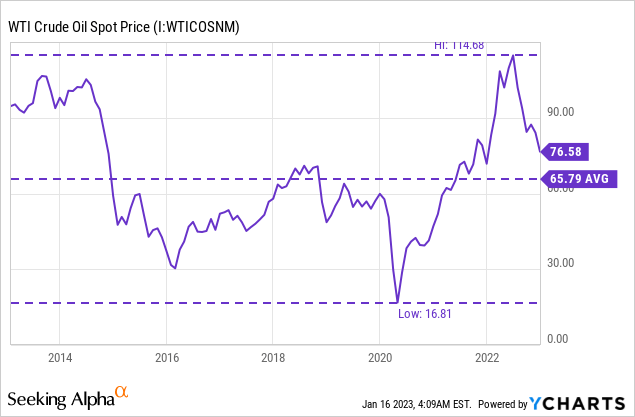

Although WTI prices have declined by nearly half since reaching a peak above $130 a barrel about a year ago, petroleum and natural gas pricing remains strong due to supply uncertainty related to war in Ukraine. Currently, a barrel of WTI costs buyers $77 which is 16% above the longer term average. While pricing currently still supports Exxon Mobil’s free cash flow and earnings, I believe the market is going to see weakening petroleum demand and potentially much lower energy prices in 2023 compared to 2022. The reason is that a consensus has formed about a recession in the US which would weigh heavily on demand and pricing strength for Exxon Mobil’s core energy products.

Q4’22 expectations

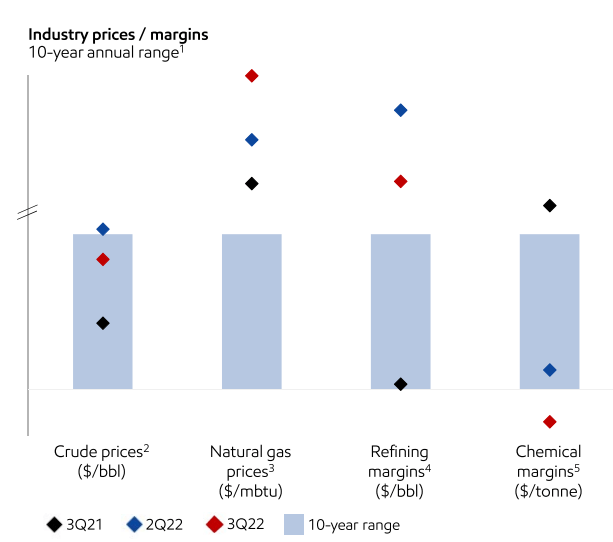

I expect $17-19B in free cash flow for Exxon Mobil’s fourth-quarter which would be below the $22B in free cash flow the company achieved in Q3’22. Exxon Mobil’s free cash flow soared in the third-quarter due to record petroleum and natural gas prices that fell way outside the 10-year price range.

Source: Exxon Mobil

With prices so far outside the normal range in FY 2022, investors should expect a normalization of the pricing environment in FY 2023… even if Exxon Mobil is all but set to report solid Q4’22 earnings and free cash flow numbers in two weeks. In FY 2023, I expect Exxon Mobil to return to a more normalized earnings and free cash flow profile and I believe prices for crude oil and natural gas are going to reset lower as the market starts to price in a recession.

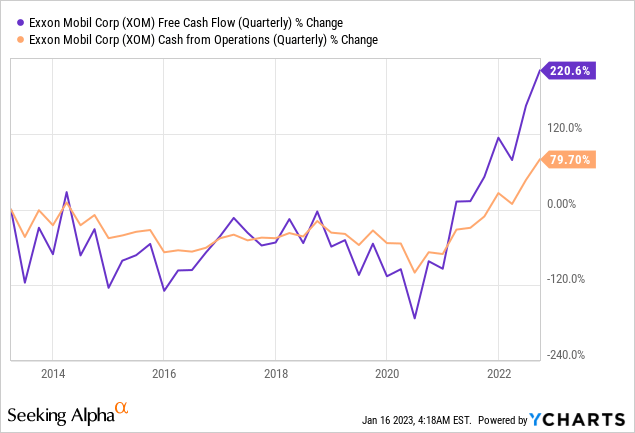

In Q3’22, Exxon Mobil generated a record $22B in free cash flow, much of it will be distributed to shareholders through stock buybacks. However, in Q3’19, Exxon Mobil reported a free cash flow of just $2.9B which is possibly much closer to Exxon Mobil’s longer term average FCF potential than the inflated $22B the company reported in Q3’22. Both operating and free cash flow have fallen way outside of the 10-year range for Exxon Mobil in 2022.

Exxon Mobil’s valuation

The fourth-quarter will be a strong quarter regarding free cash flow, but I believe Exxon Mobil will not be able to achieve the record FCF levels of Q3’22 due to drops in product pricing in Q4’22. With $17-19B in free cash flow in Q4’22, Exxon Mobil could be looking at total annual free cash flow of $66.7B to $68.7B. Considering a market cap of $466B, Exxon Mobil’s shares are valued at a P/FCF ratio of 6.9 X. While this ratio does not necessarily indicate that Exxon Mobil is expensive, investors should keep in mind that Exxon Mobil’s free cash flow is more than double now what it used to be in Q3’21 ($9B), before the recent price spike in petroleum and natural gas markets. With lower free cash flow expectations in a weaker price environment, Exxon Mobil’s FCF multiplier factor can be expected to soar.

Risks with Exxon Mobil

Despite Exxon Mobil making investments in low-carbon energy sources, the firm’s core operating focus is the production and refining of petroleum products which places the firm at the heart of the fossil fuel industry. The regulatory landscape, now and likely in the near future, is not going to be supportive for fossil fuel companies as many countries seek to transition their energy systems to more sustainable ones that rely more heavily on green energy sources. From a regulatory point of view, I believe Exxon Mobil’s growth prospects could be stifled going forward if fossil fuel investments in energy infrastructure are disincentivized.

Final thoughts

Exxon Mobil is most likely going to submit a robust earnings sheet for Q4’22, but I believe investors may step into a bull trap here. Exxon Mobil’s free cash flow likely already peaked in Q3’22 and a beginning recession could throw cold water on petroleum and natural gas prices. I also continue to believe that Exxon Mobil’s $50B stock buyback is a mistake since the company is buying stock at the peak of the cycle.

While Exxon Mobil’s results are undoubtedly going to be solid in two weeks, investors need to remember that energy product prices are currently high inflated and that Exxon Mobil’s free cash flow falls way outside of its longer term average. A recession in FY 2023 could drastically lower Exxon Mobil’s free cash flow prospects and result in a down-side revaluation of the firm’s shares. For those reasons, I believe Exxon Mobil is a bull trap before Q4’22 earnings and the risk profile remains skewed to the down-side!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.