Summary:

- On 06/11/24, I published an article on Affimed focused on my belief the company’s upcoming acimtamig update would be positive. It was, and Affimed’s stock popped the next day.

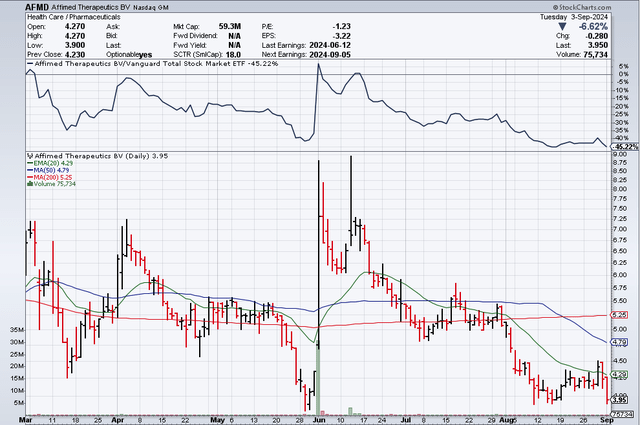

- The stock has since dropped to below $4/s based, in my opinion, on investor’s perceptions that a dilutive capital raise is coming soon.

- AFMD’s 2Q ’24 Earnings Call is scheduled for tomorrow, 09/05/24. And we are due for an acimtamig and AFM24 3Q ’24 update before the end of the month.

- Abstracts for ESMO’24 are posted on 09/06/24 and the WCLC starts 09/07/24…will we get the AFM24 update before acimtamig’s?

- While AFMD’s assets have shown promise, a potential investment carries high risk and may not be suitable for most investors.

selvanegra

Introduction

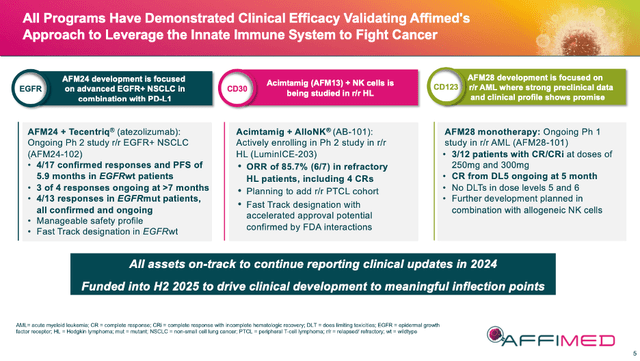

I am going to touch on key highlights from my article on Affimed NV (NASDAQ:AFMD) on 06/11/24 and additional updates from the company given a day later in their 1Q ’24 Financial Results & Business Update. Therefore, I highly recommend readers review my first article, Affimed: AFM24’s Update Was Good, Acimtamig’s Should Be Better if they have not already. The focus of this article will be on the 3 key assets AFMD has in the clinic (AFM24, acimtamig and AFM28). I will also briefly touch on AFM32 (recently reacquired from Roivant (ROIV) and another asset that Roche/Genentech (OTCQX:RHHBY) partnered with AFMD on and may be advancing very soon.

AFMD 6 month stock chart as of 09/03/24 (stockcharts.com)

2Q ’24 Financial Results & Corporate Update are scheduled for 09/05/24. My gut originally said that we would get the promised update on acimtamig on that call, but that was if AFMD conducted the call in August, and now it is September (AFMD stated that they would share an update on the 12 patients in Cohorts 1 & 2 of the LuminICE-203 trial by the end of this quarter). While I am expecting a positive acimtamig update, I would not expect too much more to be revealed on this asset until the ASH (American Society of Hematology) meeting in December.

Instead, I am now thinking we might get the update on the AFM24mut (EGFR mutation) cohort on Thursday because ESMO (European Society of Medical Oncology) abstracts are out on Friday; the WCLC (World Conference on Lung Cancer) starts on Saturday, 09/07/24; and then ESMO starts on Friday, 09/13/24. Even if the company is not officially presenting at either conference, now would be the perfect time to release the AFM24 update, in my opinion. Further, should AFMD go this route, they then could release the acimtamig update in a couple of weeks and still make the 3Q ’24 self-imposed deadline.

Either way, both of these assets have the potential to gain in value with each positive update. Then why is AFMD trading close to $4.00/s at the time of this writing with a valuation ~$60M? It is due, in my opinion, to the company’s cash level (last reported as ~$52.4M) and its potential need to raise capital within the next 6-12 months. I’ll discuss why I am less concerned with the fact the company needs to raise cash and mostly focused on when, how much, and what the initial raise will look like because of a potential Roche/Genentech collaboration milestone.

In fact, it remains my opinion that if the acimtamig update by year-end is positive, AFMD’s value should quickly approach at least $500M, despite a capital raise of $50-$100M squeezed in between. However, while I may see a clear path to a 4-5x gain over the next 4-6 months if clinical data readouts remain positive, this type of higher-risk investment is not appropriate for most investors.

Pipeline Review

The timing of my last article on AFMD was a bit fortuitous. The company provided an update during their earnings call the next day on both acimtamig and AFM28, after providing updates on AFM24 earlier. The slide below briefly summarizes each accomplishment, and so I will not dwell as much on the clinical details (again, please review my last article for that), but rather what I think the results mean for each asset moving forward.

AFMD 07/24 Corporate Presentation

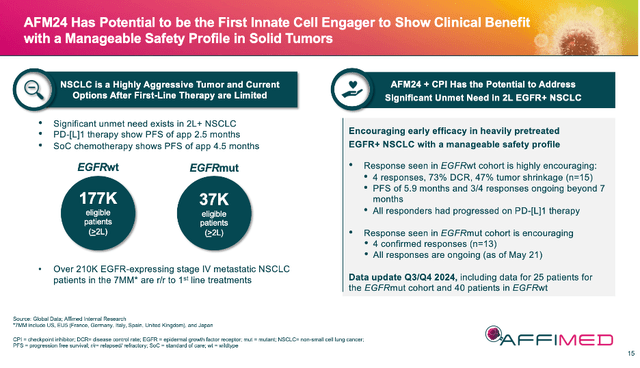

AFM24

The results to date for AFM24 + atezo (atezomab) in 2L+ (second line or greater) NSCLC are early, but good. EGFRwt (wildtype) patient data was fine: 4 of 17 confirmed responses with 3 of 4 responses ongoing at > 7 months. This is a positive start, and it will be interesting to see this cohort’s data mature further in AFMD’s future 4Q ’24 update. However, the 4 of 13 confirmed responses in EGFRmut (mutant) patients was noteworthy. This group is harder to treat, having worse outcomes and fewer options. This quarter’s coming update on 25 patients in the mutation cohort could be a game changer for the asset, especially if safety and tolerability are manageable.

AFMD 07/24 Corporate Presentation

AFMD moved AFM24 to be listed above acimtamig over the past couple of months in corporate presentations, even though acimtamig is further along the pipeline and has great data of its own. One could cynically suggest this is because AFMD is not as confident in acimtamig moving forward. I would argue the move was made because the NSCLC market is so large and AFM24 is wholly owned. We shall see.

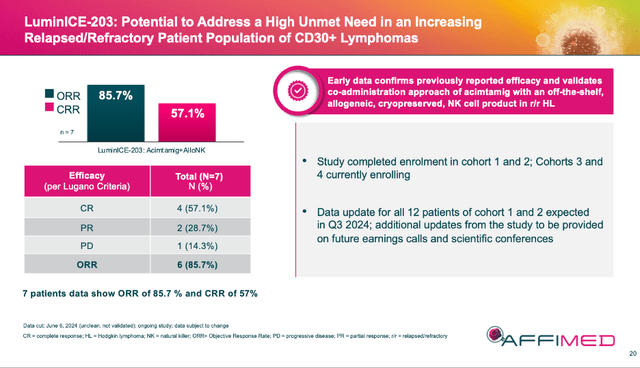

Acimtamig

The LuminICE-203 update on 06/12/24 of acimtamig and AlloNK (AB-101) in r/r Hodgkin Lymphoma [HL] was pretty exciting. The combo drug had an ORR (overall response rate) of 85.7% (6 of 7) and a CR (complete response) of 57.1% (5 of 7) which tracks well to the earlier AFM13-104 results.

AFMD 07/24 Corporate Presentation

Some skeptics complained that the 7 patients were across cohort 1 & 2 (4/3 patients respectively) but that cohort 1 was not complete yet. The company explained in the accompanying conference call that the reason for the movement was due to the complicated recruiting protocol that had to be followed. Basically, if a patient from one of the first two cohorts dropped out (even before they were dosed), they had to be replaced. Which means you could have enrolled and progressed to the later cohort before the first was finished. Regardless, the company will be updating all 12 patients from the 2 cohorts in this update.

What I shared in my comments on 06/14/24 after listening to the call a second time, is that cohorts 1 & 2 were low and then high doses of acimtamig with the dose of NK cells remaining the same. And yet initial CR results were very strong. Cohorts 3 & 4 will receive double the NK cells of the first 2 cohorts. This is important because in the prior clinical trial (AFM13-104), more NK cells meant a better clinical response. Further, we saw patients’ responses deepen over time. Hence, my optimism we may see even better results in this upcoming update for cohorts 1 & 2.

Additionally, we may learn that cohorts 3 & 4 have completed dosing (or will shortly), which would mean we could get their topline results in 4Q ’24 most likely at ASH ’24. Again, if LuminICE-203 tracks like AFM13-104 did (97% ORR and 78% CR), the CR rates would be significantly higher than the current SOC’s (standard of care). That could make this combo worth at least $500M-$1B in the second line plus (2L+) setting alone.

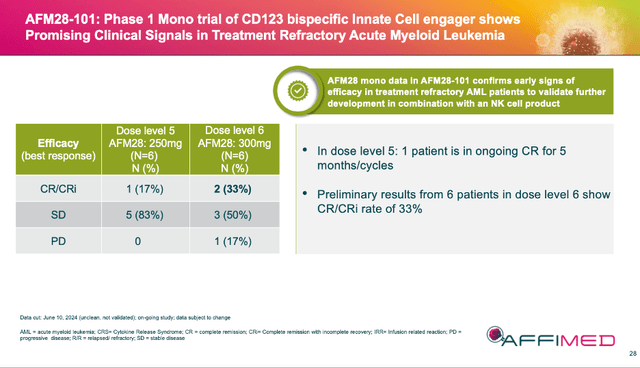

AFM28

I called the AFM28 results “a huge bonus” in my comments on 06/14/24 because the asset’s initial results in r/r AML of a 33% ORR (2 of 6 patients) were good and, frankly, unexpected. Yes, the n is small, but these patients were extremely sick, and they didn’t have many options or a lot of time. Further, their endogenous NK cells were most likely exhausted, meaning that AFM28’s addition of exogenous cells worked.

AFMD 07/24 Corporate Presentation

Again, the data is very early, and I think we will get an update at ASH ’24. But this additional early success validates AFMD’s technology for a third time, and more importantly for AFM28, a future partnership with a manufacturer of NK cells for repeat dosing. The obvious choice for this partner would be Artiva (ARTV) who is partnered on acimtamig. However, until a partner is announced and terms of the deal are revealed, this asset will most likely remain undervalued.

Additional Pipeline Assets

AFM32: This asset uses the company’s ICE (innate cell engager) technology to target FRa in Solid tumors. ROIV licensed the asset on 11/09/20 for $60M up front ($40M cash and $40M in ROIV shares) and up to $2B in milestones. ROIV elected to return the asset which closed on 04/30/24. AFM32 is still in the pre-clinical phase and we don’t know much more about it. Theoretically, the asset could be licensed again, or their could have been an issue with it.

Novel ICE – Genentech: This asset is listed as in the Pre-Clinical stage, targeting undisclosed multiple indications. Not much about this asset is known in the public space.

Discussion on Financials

From the 1Q ’24 Earnings Call on 06/12/24, AFMD Cash was listed ~$53.6M and Burn Rate ~$21.58M. (I converted Euros into $s) The company stated that it would have enough cash to get through 1H’25, but as I shared in both my last article and the comments that followed, the only way that math works is if there is a deal and/or milestones already in play.

A shout out of thanks to the commenters from my last article and my current thoughts:

First, AFMD lists a collaboration with Roche/Genentech for an undisclosed target on its pipeline page, and it was suggested by one commenter that ROG’s R07617991 targeting Mage-A4 is the one. I think he is spot on. That study, NCT06372574, was submitted on 04/15/24 and is estimated to begin on 09/30/24. If so, there should be a clinical milestone payable to AFMD (and I am assuming there will be one for the start of that trial). Unfortunately, the original agreement from 08/24/18 was full of [*****]’s, and so we will most likely have to wait for the public announcement to determine if we are right and what the actual dollar amount would be. (Could it be $15-$20M per indication or higher?)

What we do know though is the original agreement had an upfront payment to AFMD of $96M with up to ~$5.0 billion in total milestone payments upon successful development and commercialization of all product candidates. Approximately $250 million relate to development activities; $1.1 billion relate to receipt of regulatory approvals; and $3.6 billion are related to worldwide net sales and tiered royalties. A cash milestone would be timely, but the movement into the clinic would put the value of this asset’s milestones back into play. And there is no value being attributed to them currently.

Second, AFMD could announce a collaboration and/or asset sale. At this point, I hope it is not for acimtamig, but that is the asset furthest along and part of the rights to the drug are already owned by ARTV. AFM24 is wholly owned and has potentially the most significant upside long-term for AFMD. Therefore, I do not see this asset as on the table. AFM28 should get an NK partner shortly and if that deal is with ARTV as expected, depending on the terms of that deal, there could be interest from a third party as well. And finally, the resale of the rights to AFM32 are available, but I would think that getting a significant value for a recently returned asset is unlikely without additional work in the clinic.

Third, AFMD needs additional cash and therefore, it is assumed a follow-on offering is coming soon. The company can sell up to 15.227M shares if and when they are ready. I think that number scares many investors because it would be ~100% of outstanding shares. So, if they have the Roche/Genentech milestone above in-hand, why rush? If acimtamig’s 3Q update is positive, the value of AFMD should increase (again). Same for AFM24’s update, which could take place any day. In December at ASH ’24, acimtamig should present another update and potentially one for AFM28 as well.

There is significant value in the above-mentioned assets already, and literally none of it is being counted for in the stock’s current valuation of ~$60M. With all of the possible outcomes mentioned above, it is too difficult to handicap an accurate valuation for AFMD right now. So, I will keep it simple: as long as AFMD has a milestone payment coming over the next couple of months, it does not need to raise cash right now at such a poor valuation. But if it absolutely needed to, AFMD could still use the $97M or so of its ATM it hasn’t tapped yet.

The Short-Term Play

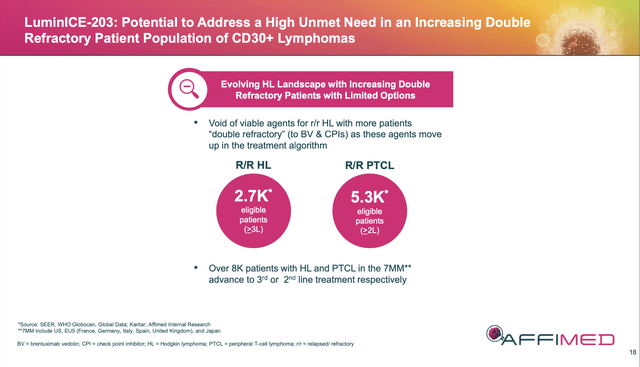

As shared above, if acimtamig puts up efficacy numbers over the next 3-4 months that are similar to what it put up in the prior phase 2s, and safety/tolerability remain constant (which they should), this asset should be projected to do at least $500M to $1B peak sales in the right hands [see slide below and my previous article for market info on Pfizer’s (PFE) SOC for HL ADCETRIS/brentuximab vedotin].

AFMD 09/24 Corporate Presentation Slide 18

That means this asset alone could be worth $3-$7B at peak (applying a 6-7x multiple, which is the going rate for a top hematology and/or oncology asset) to an acquirer depending on when and/or what they purchase. (For the naysayers, I ask, what if an acquirer moves the treatment to first line?) But this also means that an early sale or collaboration, say prelaunch, could be for significantly less (a couple hundred million up front plus tiered royalties?). I could equally see AFMD selling acimtamig’s rights for cash and future milestones to fund AFM24 and AFM18. There are just too many ways to value this right now, and the fact that AFMD owns the rights to 67% of this upside makes the calculation even more complex.

Yet, for the low-end example, even 67% of a $500M peak asset is ~$335M. At that 6-7x multiple, that puts a potential takeout of just this asset closer to ~$1.5 – $2B. (For those thinking about a DCF model, feel free to apply your own discount rate and play around with peak sales, etc. But for longer-term calculations, I think this asset and even the company will get taken out prior to a potential launch in 24+ months, so a DCF model is not of much use to me right now).

If AFM24 continues to progress to become a viable, non-chemotherapy option for 2L+ NSCLC, that potential market of over 214K patients equals a multi-billion-dollar revenue opportunity. Even an approval for only EGFRmut is ~37K patients. Plus, AFMD owns the asset out-right.

Which makes AFM28 truly a “freebie” at this point. If this drug can get severely r/r AML patients to transplant without chemotherapy, it becomes another billion-dollar opportunity. It too has a long way to go in the clinic, but my point is, these assets have demonstrated positive outcomes in the clinic and have value today. However, that value is not being reflected in AFMD’s current valuation, which at the time of this writing, is currently trading ~$60M.

Based on the above 3 assets, I can see a clear path to ~$500M valuation (4-5x) over the next 3-4 months for just acimtamig. A lot still needs to go right, but longer term, out to 12-24 months, if either acimtamig or AFM24 demonstrate they are commercially viable in potentially multi-billion-dollar markets, the stock should get over at least a $1B valuation or more. This is why AFMD would make a nice acquisition for a larger biopharma looking for $2-$5B bolt-on deals in hematology and oncology (hi, Genentech).

Full disclosure: I shared in my original article that I had trimmed some of my original 8% portfolio position when the stock went up after the AFM24 update to rebalance the portfolio. I did the same after the acimtamig/AFM28 update caused a similar spike. Since the stock has dropped more recently, I have added back shares once again and been able to get my average cost below $4.25/s. As a result, the percentage of AFMD in my portfolio has increased to over 10% (with options included), but I am playing now with some of the house’s money. That is a little higher percentage than I usually like to take for this type of earlier clinical company, but I like the data to date and remain optimistic more positive data is coming. And barring negative updates, I am willing to hold the bulk of my position for the longer-term.

Risks

In my opinion, the 3 greatest risks to AFMD now are in the clinical assets that have been increasingly de-risked (acimtamig more significantly than others) and not the finances and/or Sr. Leadership.

Acimtamig update does not build on its prior success. I think this is unlikely due to the prior data release and previous clinical studies. In fact, what we have seen with this asset is that efficacy improves over time. The next two cohorts use more NK cells; therefore, I would expect an even better ORR and improvements in CRs as well.

AFM24 update does not build on its prior success. Again, the prior data release sets the stage for improved efficacy over time. However, whereas acimtamig has robust historical data supporting its potential pivotal trial, AFM24 is still in the early stages and has only been tested in a small patient population. That being said, the data from the mutation cohort is extremely impressive to date. As stated above, we just haven’t seen such positive data in these types of patients.

AFM18 update does not build on its prior success/A deal for an NK cell partner is poor. Similar to AFM24, it is early and the # of patients treated to date is low. Tolerability and toxicity are always a risk with these types of cell therapies. However, the lack of toxicity forcing any patients out of the current study through cohort 6 is very positive. The addition of exogenous NK cells moving forward should be positive as well.

As for a potential future NK cell partner, keep in mind that AFMD had to make the deal they did with ARTV on acimtamig because AFMD was running out of money AND didn’t have a path to commercialization without an NK cell partner. This time around, AFMD has clinical results and, frankly, could try a different vendor if they had to. A deal between the two is logical, though, and the pairing of a second asset between the two raises some interesting questions on potential acquisitions down the road. ARTV recently completed their IPO in July which helped them get the cash they needed to pursue other projects internally. Therefore, I agree with one of the commenters from my last article that this relationship will be important to watch moving forward.

Cash needed soon: As shared above, there should be a milestone achieved shortly that should buy AFMD more time to share clinical updates on the above 3 assets. If not, then it would appear that a deal of some sort (equity or debt) would need to be struck over the next couple of months. And that would certainly be dilutive. I like that the company has not tried to raise capital at these levels, but it does put significant short-term pressure and risk on the company if the upcoming clinical updates are not positive.

Sr. Leadership: The company just announced on Tuesday, September 3, 2024, they have hired a new CEO. I have not had the chance to conduct a thorough review of him yet, but I do believe that some investors will view this as either a “not good enough” hire and/or a sign the company is not for sale. That is all speculation and conjecture at this point in time. AFMD’s current crew has stopped the ship from sinking and is in the process of achieving an amazing potential turnaround. The ship needed a captain, so the interim could go back to the clinical side full-time. Good.

Conclusion

This week’s announcement of a new CEO, and 2Q ’24 earnings over the next couple of days accompanied by potential clinical updates will most likely create a lot of volatility for the stock. I am cautiously optimistic that the coming data updates will help the company achieve the financial stability it needs, and I look forward to seeing how the next 3-4 months play out.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.