Summary:

- Affimed’s 06/01/24 update on AFM24 means the company has a second viable commercial asset. This is why the stock popped after ASCO.

- Acimtamig’s update is due before the end of this month. If it is positive, the stock should run again for a possible 3-5x.

- Although the company will likely raise capital after the announcement, I am comfortable owning shares into the action and I am a fan now for the longer term.

- The stock is currently trading below a $100M valuation, which makes it more of a high risk/high reward play. And as such, is not suitable for all investors.

selvanegra

Introduction

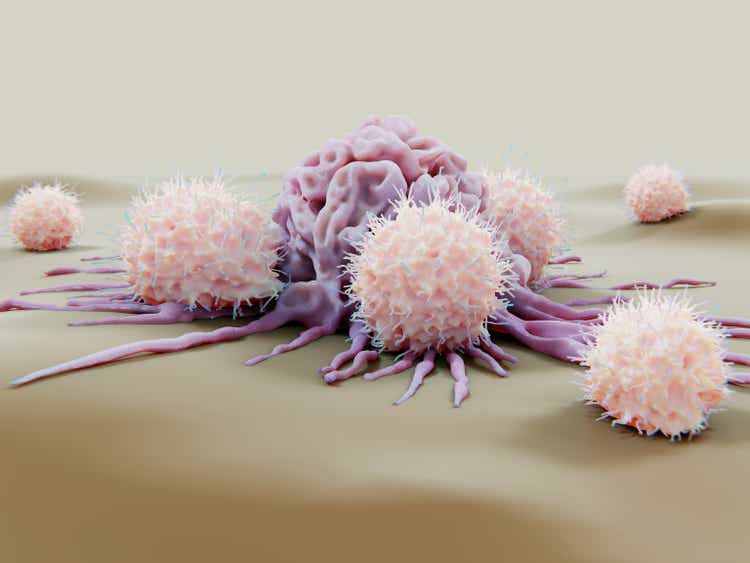

Affimed N.V. (NASDAQ:AFMD) recently reported a clinical update for AFM24 on 05/23/24 in its ASCO abstract release. The results were positive and then reinforced with an additional update on 06/01/24 (see below). These updates keep the doors open for the company to pursue this second, wholly owned, commercial asset targeting a large oncology market. The stock popped ~70% early last week on the news, breaking $8/s briefly before tracking back to Monday’s close of $6.12/s or ~$92M valuation.

AFMD 06-10-24 12m stock chart (Stockcharts.com) (AFMD 06-10-24 12m stock chart (Stockcharts.com))

A legitimate question of whether the company would conduct a necessary follow-on offering (or PIPE these days) on this data is out there. The fact that AFMD has not done so yet is a good sign in my opinion. Not because they don’t need the money, rather, I think they have better news coming soon for their lead asset, acimtamig (AFM13). If I am right, I think the value of the company could increase 3-5x or more in the short term, which would enable the subsequent raise to take place at a higher valuation. For those of us anxiously waiting, the acimtamig update could be as soon as this week and no later than the end of this month.

Full disclosure: I started to accumulate shares in AFMD ~$0.45/s prior to the recent 1-for-10 reverse stock split (now ~$4.5/s post-reverse) and eventually built an 8% position in my portfolio when the company’s valuation was closer to $70M. After the stock popped a bit last week, I trimmed shares in the mid-$7 range to rebalance my portfolio and take the position back to 8%. This does include some shorter-term calls and puts to help hedge my bet. Typically, I would have trimmed my holding back to 4-5% of the portfolio or lower in anticipation of a capital raise. However, the clinical results of acimtamig to date and recent update on AFM24 have made me a believer in the company’s long-term prospects.

AFMD announced it will share its 1Q’24 results on Wednesday, 06/12/24 and the European Hematology Association (EHA) meeting starts the next day on 06/13/24. Therefore, an acimtamig update over the next few days would make sense. So my main focus of this article will be on acimtamig and I will only briefly touch on AFM24 and another early-stage candidate, AFM28.

Corporate Background

Several years ago, AFMD pivoted to using NK cells with its bispecific Innate Cell Engager technology (ICE). Each bispecific antibody has been designed for one arm of the antibody to engage CD16A receptors found on NK cells as the other arm targets the receptor on specific proteins such as EGFR, CD30 or CD123 that are found on different tumor types.

The goal was to see if the patient’s own NK cells and/or macrophages (part of our innate immune system) could overpower the tumors that they had been directed to. Each drug created first attempts at monotherapy to see if its bispecific antibody can generate an efficacy signal and be safe or safer than the existing standard of care (SOC).

AFMD’s journey has not been smooth and currently, the company just let its CEO go and cut 50% of its staff in an effort to conserve cash and focus on its best assets, in addition to the reverse stock split. These moves were critical to regaining investors’ trust as we waited for additional clinical updates.

Pipeline

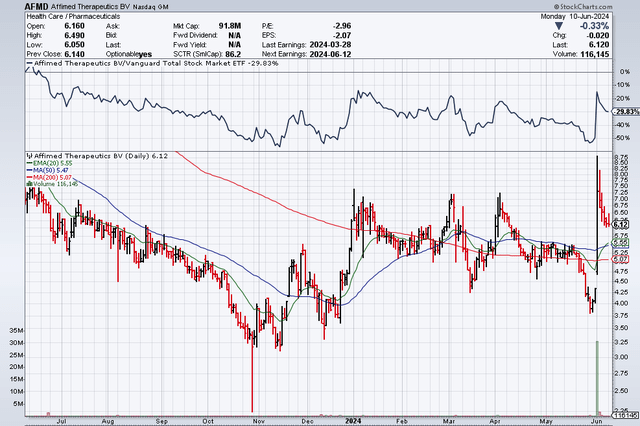

Acimtamig/AFM13-NK

This bispecific ICE antibody has the one arm to engage CD16A receptors on NK cells and the other for CD30 receptors (found on lymphoma cells). When used as monotherapy in heavily pretreated relapsed/refractory (r/r) Hodgkin Lymphoma (HL) patients, acimtamig’s results were “ok.” When used with an anti-PD-1 checkpoint inhibitor (CKI), ORR went up to 88% at the highest dose and achieved a CR of 46%. Good, but not good enough to compete or replace the SOC.

AFMD originally caught my eye in April of 2021 when it had a 100% Overall Response Rate (ORR) in 4 heavily treated patients with HL using acimtamig with preloaded NK cells. The key differentiator of this specific phase 1 trial, 13-104 NK, was that investigators at MD Anderson Cancer Center (MDACC) used their own off-the-shelf NK cells derived from cord blood that they infused into the CD16 arm of the AFM13 bispecific antibody. Two points that were so remarkable about the initial result were first, 2 of the 4 patients had complete responses (CRs), meaning their tumors were gone even though prior to treatment they were told by their physician to prepare for hospice. And second, the responses were coming after the first and/or second doses, which were still very low doses. Because of the tolerability, investigators could still titrate up if they needed to…and they could repeat dosing.

In short, it looked like the trial was producing CAR-T-like results without the harsh pre-conditioning regimen or complicated engineering/manufacturing of CAR-T’s. However, questions about durability would need to be answered, in addition to how would AFMD replicate the results at a national scale once a pivotal trial was initiated and MDACC wasn’t producing small batches for each patient.

Because of these questions and more, I was not ready to invest yet. Like many others, I needed to see if the results were durable and repeatable as many more patients were treated. And we found out soon enough they were. On 12/10/22, the MDACC team announced topline results for the 13-104 NK trial: ORR was 100% at the recommended phase 2 dose (RP2D) with a CR of 70.8% (17/24) in patients up to 23 months. Better still, on 12/11/23 the phase 2 update of 13-104 demonstrated that the acimtamig/cbNK cell combination had achieved an ORR of 97%, with a CR of 78% in r/rHL. These results are outstanding, because these patients had failed on prior SOC chemotherapy as well as 2L SOC therapies Adcetris (brentuximab vedotin) and CKIs, yet 84% of them were still alive at 12 months.

AFMD April ’24 Corporate Presentation (AFMD April ’24 Corporate Presentation) (AFMD April ’24 Corporate Presentation (AFMD April ’24 Corporate Presentation))

A basic explanation for the success of the combo trials is that the original AFM13 linked the body’s own NK cells to the lymphoma cell’s CD30 receptor. Unfortunately, the body’s reservoir of NK cells were most likely depleted or too low to continue to be efficient tumor killers. Therefore, the addition of exogenous, “fresh” NK cells meant that patients now had a second army to combat weakened lymphoma cells.

Further, patients were not exhibiting adverse events of concern, validating that this therapy could be easier on patients than chemo-based, targeted or CKI therapies and that additional dosing could be used if necessary. The path forward was clear, pair acimtamig with NK cells for a potential registrational trial. But whom to partner with for NK cells and how to partner took months to determine. This is one set of reasons why investors fled the stock.

Eventually, AFMD partnered with Artiva Biotherapeutics on 11/03/22 to use Artiva’s AlloNK cell line (AB-101) in acimtamig’s phase 2 LuminICE-203 trial. AB-101 NK cells are allogeneic cord blood-derived NK cells that are cryopreserved, non-genetically modified, off-the shelf and can be produced in large quantities. They are exactly what AFMD needed to move acimtamig forward and came at the cost of 33% of the combination therapy’s future revenues (the companies will split the costs of a confirmatory study as well)

Investors should keep in mind that this upcoming initial readout of LuminICE-203 will most likely be focused on the safety and efficacy of the 24-patient run-in portion of the study that was required by the FDA due to the use of a new source of NK cells. This consisted of 4 cohorts of 6 patients, each testing out 2 doses of acimtamig and 2 doses of NK cells. After that, a RP2D will be selected for a Simon-2 stage study of ~70-110 patients across 2 cohorts, all depending on the data produced along the way.

While this may seem like a lot, consider that the first patient in the run-in portion was dosed last October, and we are getting an update ~9 months later. Should these early LuminICE-203 patients show anything close to the 13-104 NK trial results, you can bet that there will be an acceleration of patients into the study as well as significant support from the FDA and lymphoma community. Therefore, I am trying to set reasonable expectations for the upcoming results, but it is difficult to imagine them completely crashing down from MDACC’s.

AFM24

AFM24 is a tetravalent bispecific ICE that binds CD16A on NK cells with epidermal growth factor receptors (EGFR) found on many solid tumors. For the Phase 1/2a trial of AFM24-102, Roche’s (OTCQX:RHHBY) PD-L1 atezomab (atezo) was selected. The premise behind this strategy being that once AFM24 binds to the tumor, both the NK cells recruited to the site and the addition of atezo would enable the patients’ innate immune system to better fight back.

Phase 1/2a of AFM24-102 w/atezo has two arms, one for heavily pretreated NSCLC patients with EGFR-wildtype and the other, for EGFR mutant patients. On 06/01/24, AFMD held a press conference to review the results in the EGFR-wildtype cohort presented earlier in the week, as well as positive data on the mutant cohort. Both cohorts showed early signs of efficacy and manageable safety.

In the EGFRwt cohort, 15 of 17 patients dosed were response-evaluable. Of those 15, there were 1 CR and 3 Partial Responses (PRS) for an ORR of ~27% (4/15). While this ORR was down slightly from the earlier cutoff point, this update does support investigating the drug further in these patients. For the EGFRmut cohort, which is more difficult to treat, the early results were even better. Out of the 13 patients in this cohort who were response-evaluable, the ORR was 31% with 1 CR and 3 PRs (4/13).

Adverse Events were low in both arms, and as acting CEO Harstrick shared, “we believe the durability of the responses in the EGFRwt tumors is remarkable and is unlikely driven by PD-1/PD-L1 blockade alone, as all patients with responses had documented progression on their previous PD-1/PD-L1 therapy.” While still early, the updates appear to demonstrate that AFMD might have a second, viable asset for at least r/r NSCLC, a very large potential market.

AFM28

This Bispecific ICE is designed to target CD16A and CD123-positive cancer cells in acute myeloid leukemia (AML) patients. It ran into some hiccups in early development, which led to the company advancing it in the early clinic in Europe. The company announced on 05/14/24 that it would be presenting an abstract on AFM28 in animal models at EHA. I do not anticipate the news to impact the stock.

Discussion on Financials

AFMD announced 2023 Financial Results and Operational Progress on 03/28/24.

Cash: Cash at the end of 2023 was 72M euros (under $80M) which the company claims will get them into 2H’25 now that the restructuring is complete. This means a follow-on raise is more than likely going to take place after a positive clinical update. Since AFMD has not raised following the AFM24 update over a week ago, my gut says they are waiting for an acimtamig update first. I would expect the raise to be in the $200-$300M range if the company can get that much, which usually isn’t possible when a stock is trading under a $100M valuation like AFMD currently is.

Burn Rate: R&D in ’23 averaged around $25M/quarter and G&A averaged ~$5-$6M/quarter. Both should be lower in ’24 following the restructuring.

Weighted # of common shares: As a result of the recent reverse stock split, AFMD has shrunk its share-count down to 14.94M shares. I liked the reverse split move and bought more shares when they dropped post-announcement. Savvy investors knew the split was coming and were able to pick up shares at a significant discount. More importantly, larger, institutional-type investors will be able to invest in the company now that it is trading over $5/share…another reason to expect a capital raise of some sort to take place soon.

To sum it up, the company’s cash was low, but its burn rate had been reduced. Its CEO was now gone and the CMO had been appointed active CEO. Multiple data readouts were coming before the end of June, and a reverse split would put AFMD shares into a range that institutional investors could now consider again. The next 6 months would be key.

Current SOC for Hodgkin Lymphoma

HL can be treated with chemotherapy, radiation therapy, targeted therapies, immunotherapies and chemo with stem-cell transplantation. Treatment is determined by multiple factors, and when HL is detected early, the patient has a better chance of success, including potential cure. Unfortunately, the flipside of the first two treatment options above in particular is that they can increase the chance of other cancers, as well as heart and lung diseases years later.

Chemotherapy is the main treatment for HL and the most common 1L SOC in the US is called ABVD, a regimen consisting of 4 powerful, but highly toxic drugs. Adcetris (brentuximab vedotin) can be used in 1L as well in place of bleomycin, the “B” in ABVD. In Adcetris’ PI, it lists the CR of the drug + AVD at 73% vs. 70% on the ABVD arm. For r/rHL, Adcetris is SOC with an ORR of 73% and CR of 32%. For more rare lymphomas, Adcetris’ efficacy #s are lower.

Adcetris is an antibody-drug conjugate (ADC) that selectively targets CD30 expressed on the tumor cell and then delivers a toxic payload into the tumor. The drug was created by SGEN and is now owned by Pfizer (PFE) after the company’s acquisition of SGEN on 12/14/23. 1Q’24 sales of Adcetris were $257M putting the drug well on its way to over $1B in sales in 2024. The drug works well but has some very toxic potential adverse events, including a black box warning for progressive multifocal leukoencephalopathy (PML).

PD-1 CKI’s like Merck’s (MRK) pembrolizumab or Bristol’s (BMY) nivolumab are used 2L or later, but they do not have strong efficacy data and tolerability is poor for many.

The Acimtamig Opportunity

If LuminICE-203 puts up ORR and CR #s similar to MDACC’s trial numbers, acimtamig could do well over $1B/year in sales just in r/r HL if it makes it through approval. A lot still has to go right here, not just with the upcoming data reveal, but then with the continuing study over the next year or two.

With ~$1B peak sales #, a 6-7x multiple for this kind of hematology asset comes into play. Yes, Artiva is entitled to ~33% of revenue, but a potential take-out of AFMD for just that ~$667M revenue potential alone could value the company well over $3-4B longer-term. That is a 30-40x long-term upside potential, for just this one asset which we have seen some very solid data on. With the current valuation of AFMD less than $100M, that is the kind of upside I like to play for.

I think the worst is behind AFMD. Hence, why I have continued to increase its position in my portfolio. And I am not alone in this belief, according to the company’s latest Form 13’s. Ridgeback Capital Investments has become the #1 holder of stock, with 683 Capital Management #2 and NEA #3. I don’t like seeing Point72 at #4, because they will most likely sell the stock on any sudden moves, but the top 3 are very strong, and I am guessing will be part of any follow-on raises.

Risks

All preclinical biotech companies have significant risks and AFMD is no different. However, it is my opinion that acimtamig has been reasonably de-risked to this point and that much of the criticism and fear is designed to keep the price of the stock down until the results of LuminICE-203 are public. Therefore, here are a couple of the most pressing risks that I think the company is facing in the short-term and how I believe AFMD will address them/they will be resolved moving forward.

“The company is running out of money.” As acknowledged above, AFMD is going to have to raise capital before mid’25 and will most likely do so in the near future after a positive data update. Similar raises for successful hematology assets have been in the hundreds of millions of dollars, so that is why I selected the $200-$300M range for AFMD this time around. I don’t mind the dilution if I get to experience a significant run-up first.

“The acimtamig update could fail.” Of course, it could; however, is that likely? LuminICE-203 doesn’t have to have the near 100% ORR and near 80% CRs seen in 13-104 NK to be better than Adcetris in 2L HL. Remember Adcetris’ ORR of 73% and CR of 32% above? That is the target that AFMD has to beat! Which would mean they would have to lose ~50% of their CRs due to the manufacturing of NK cells. I expect a drop-off, but nothing close to that type of loss.

“Management is the problem.” It certainly was part of the company’s problems. However, with the recent change in CEO clinical priority refocus and fiscal moves, it appears that top investors are now more involved in the company. Either the acting CEO will get to keep the job, or a new one will be brought in. I will continue to watch this carefully.

“The Artiva economics were a give-away/reduced acimtamig’s value.” My initial responses are, “Not really” and “yes, but necessary.” AFMD made the best deal it could from a position of weakness. They had to have a top partner for NK cell production, and I am sure that Artiva wanted more. No one liked how long it took to lock this agreement down. Investors still angry over the delay need to get over it. Focus instead on the upcoming readout. Yes, if the ORR and CRs drop significantly, I too will be angry. However, I do not think that is likely.

Conclusion

This could be a very busy, but positive week or two for AFMD. If the LuminICE-203 data is positive, the stock should pop again and a capital raise of some sort will be conducted by the company. I have positioned my investment to try and take advantage of the market’s current pricing of AFMD’s value and will most likely trim to rebalance my portfolio once the dust settles.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.