Summary:

- Affimed recently reported their Q1 earnings that revealed a solid beat on EPS and revenue. However, the company also announced that Genentech has stopped one of their partnered programs.

- Following the Genentech announcement, the share price has been under pressure. I believe the market is overreacting, which could provide an opportunity to buy.

- I discuss the impact of the discontinuation and will defend my bullish outlook.

- Finally, I take a look at the charts to find a few opportunities to add to my “house money” position.

Affimed N.V. (NASDAQ:AFMD) recently reported their Q1 earnings with a strong beat on revenue and EPS from milestone payments from their Genentech and Roivant partnerships. Despite the solid beat, the market has punished the stock, which has dropped more than 10% over the past week. It appears as the market is reacting to the news that Roche’s (OTCQX:RHHBY) Genentech has stopped their Phase I trial of RO7297089 (AFM26). Although I am concerned about this development, I believe the market will take this news too far and will provide investors an opportunity to buy AFMD at a discount.

I intend to review the company’s earnings and pipeline programs. In addition, I will discuss my views on the RO7297089 update and how it impacts my long-term thesis. Finally, I reveal my plan for taking advantage of this sell-off and how it has altered my strategy for managing my AFMD position.

Q1 Earnings

Affimed recently reported their Q1 earnings where they revealed they pulled in €11.7M in total revenue, which is up from €5.1M in Q1 of 2020. The revenue came from the company’s Genentech and Roivant partnerships, which allowed the company to report a net income of €1.4M.

In terms of cash, Affimed ended the first quarter with €240.7M in cash and cash equivalents, which is up from €146.9M at the end of 2020 due to public offering and €10M from their Silicon Valley Bank loan. Affimed anticipates that the company’s finances “will support operations into the second half of 2023.”

Pipeline Updates

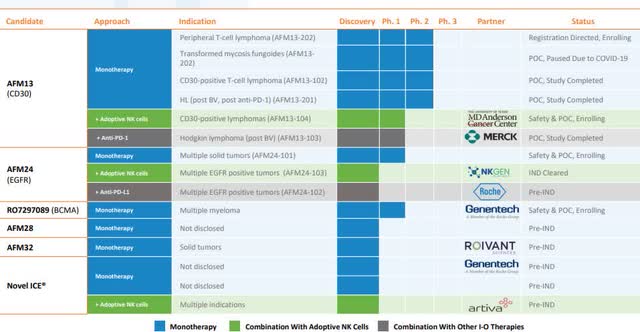

Affimed is maintaining the company momentum by continuing to execute well across all of the company’s wholly-owned programs – the company development strategy, their ICE candidates as monotherapies, and in combinations with NK cells and in combination with PD-1 or PD-L1 products.

Figure 1: AFMD Pipeline (Source: AFMD)

AFM13’s registration-directed study in relapsed/refractory peripheral T-cell lymphoma is on track with Affimed expecting to complete enrollment in the first half of next year. In addition, AFM13’s Phase I study at MD Anderson Cancer Center for cord blood-derived natural killer cells pre-complexed with AFM13 is enrolled and Affimed expects MD Anderson to inform of their progress in the second half of this year.

AFM24 for advanced EGFR-positive solid malignancies is in a dose-escalation phase to determine the maximum tolerated dose in order to establish their Phase II dose. Once the company has their recommended Phase II dose, Affimed projects to begin their expansion cohorts in the second half of this year. Affimed is also looking to start two additional combination clinical studies for AFM24 in combination with Roche’s anti-PD-L1 antibody TECENTRIQ. Affimed believes they can display a synergistic effect with TECENTRIQ, which could deliver impressive clinical outcomes. Affimed plans to dose their first patient in a Phase I/IIa study in the second half of this year. In addition, Affimed expects to start a Phase I/IIa study for AFM24 in combination with NK Gen bios autologous NK cell product in the second half of this year.

As for AFM28, Affimed continues to advance the IND enabling studies and plans to submit the IND application in the first half of next year, and start a clinical study in the second half.

RO7297089 Decision

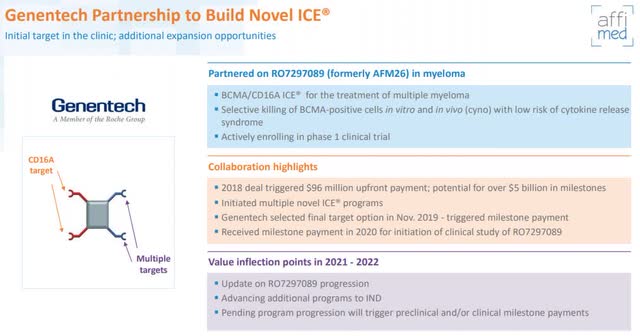

In the company’s Q1 earnings, Affimed also announced that RO7297089‘s development partner, Genentech, finished the dose-escalation portion and decided to stop the Phase I study. Affimed explained that the decision was due to a “broader portfolio consideration” and not due to any concerns about dose toxicities.

Figure 2: RO7297089 Overview (Source: AFMD)

Affimed has not seen the full dataset, so we don’t know the exact reason why Genentech stopped the study. It is possible there is a lack of efficacy or loss of efficacy, which is an issue for immune-based therapies targeting multiple myeloma. In fact, some lymphoid-based cancers have been able to stump several immune-based therapies, including NK cell tactics and PD-L1 agents. Therefore, the potential lack of efficacy might not be an ICE-related problem and is a general issue with immune-based therapies. Hopefully, we will get to see the dose-escalation results at some point in order to better understand Genentech’s decision.

The Impact

Indeed, Genentech’s decision to stop the trial is a significant setback for Affimed and has maimed the bull thesis. Yes, Affimed and Roche do have plans for additional programs, but all of those potential programs are now in question considering Roche was willing to push it to the side this early in its development. In addition, RO7297089 was a source of revenue from development milestones, so the trial stoppage will have a meaningful impact on the company’s earnings.

Still Bullish

It is important to note, RO7297089 is not the only program that will go under development with Genentech and was only the first of multiple targets. According to Affimed, Genentech’s decision to stop RO7297089 won’t impact the development of additional targets. Unfortunately, Affimed is barred from revealing the timing and the targets with Genentech, so we will have to wait to see what Genentech takes into the clinic. Until then, investors need to remain patient and should not jump to the conclusion that Genentech is starting to look for the door when they have barely stepped through it.

It is also important for investors to look beyond the Genentech partnership and realize Affimed is still in a prominent position in the innate immune cell therapy arena. The ROCK platform continues to generate impressive innate cell engager molecules that are allowing NK cells and macrophages to find the tumor and eradicate it. So far, we have not seen any data that discredits that hypothesis. In fact, there are several upcoming pipeline catalysts for their wholly-owned and partnered programs that can keep the bull thesis afloat. What is more, Affimed’s financials are healthy with a cash runway expected to last into the second half of 2023. As a result, I still have a bullish outlook for AFMD.

My Plan

In my previous AFMD article, I revealed that I was considering using some put options or perhaps drop a few lots if I saw some topping action in AFMD. I pointed out how the market has punished some tickers once their momentum has weakened and I didn’t want to risk losing my chance to bank some profits. Luckily, I kept an eye on AFMD and pulled the trigger at the right time, which was when the Daily RSI was rising into the overbought area while the Weekly RSI was weakening (Figure 3).

Figure 3: AFMD Daily (Source: Trendspider)

As a result, I am sitting in a “house money” position and I am patiently waiting for a sign to reapply those profits. At the moment, the share price is hovering just above 200-Day EMA, and will probably make a brief bounce up toward the $7.50 resistance before making another move lower where I am looking to make some additions. I got my eye on the $6.50 area, where there is a significant volume shelf and signs of support. Below that, we have the $5.00 area that has another volume shelf and support. I will use these two areas to re-accrue a hefty position and hold onto the majority of this AFMD position for at least five more years in the belief we will see an enormous return or potential acquisition. However, I will downsize or completely bail on AFMD if Genentech decides to terminate the partnership and consider a reentry once the market has digested the news.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.