Summary:

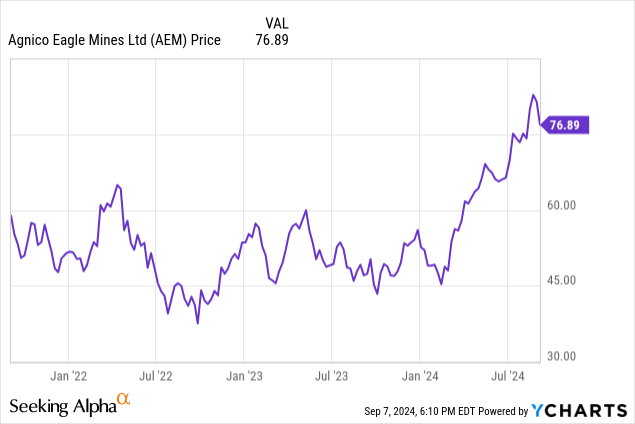

- Agnico Eagle Mines has benefited from rising gold prices, with shares up over 40% this year.

- Q2 results showed strong performance with near-record production, robust cost control, and significant free cash flow, enabling strong shareholder returns and a solid balance sheet.

- Despite a favorable outlook for gold, AEM’s high valuation compared to peers and lower forecasted earnings growth leads me to assign a “Hold” rating.

- Key risks include gold price volatility and operational risks, though AEM operates in traditionally safer mining jurisdictions, mitigating some political/regulatory risks.

Oat_Phawat

Introduction

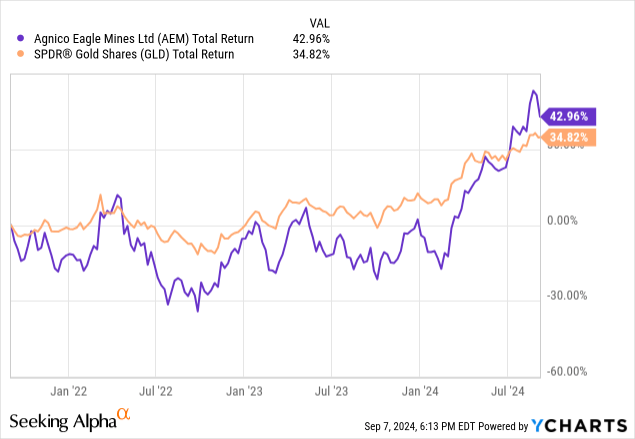

Agnico Eagle Mines (NYSE:AEM) investors have been rewarded this year as the gold price has risen and reached record highs. As geopolitical tensions have risen, alongside increased central bank buying and the prospect of interest rate cuts, gold has seen a significant price rise, surpassing $2,500 per ounce. As a leading gold mining company, Agnico Eagle Mines, with its mines in what are traditionally viewed as safer mining jurisdictions, has been a beneficiary of the rising gold price. Investors have been rewarded; so far this year the shares have followed gold’s rise and are now up over 40%.

With the gold price looking set to continue its upward trend, the question remains: is Agnico Eagle Mines a buy at today’s price? In this article, I want to explore the latest results for the company and discuss why I believe gold has further to climb. Let’s dive in.

Q2 Results

Agnico Eagle Mines reported its Q2 results at the end of July and had another solid quarter of results. Production came in at 896,000 ounces of gold, up almost 4% from a year earlier and close to a record high. Combined with a realized gold price up 15% from a year earlier at $2,342 per ounce, revenues reached $2.08 billion, beating expectations by $50 million and up 21% compared to a year earlier.

This translated into an adjusted net income of $472 million, which corresponds to $1.07 per share, beating consensus expectations of $0.91 per share.

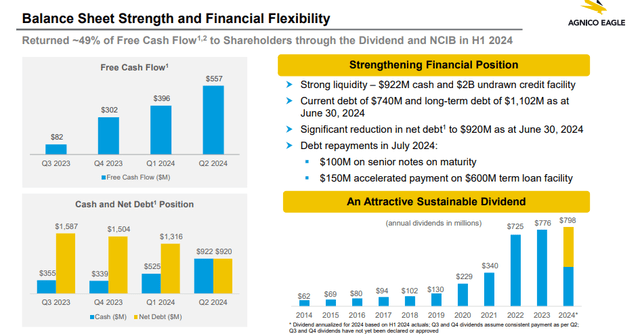

Agnico Eagle Mines Q2 2024 Results Presentation

Free cash flow generation for the quarter came in at $557 million, enabling the company to increase its cash levels and reduce net-debt. This gives the company a strong balance sheet with under $1 billion of net-debt, despite generating over a billion dollars of EBITDA in the quarter alone. This enables the company to engage in strong shareholder returns, with 49% of free cash flows during the first half of 2024 returned in the form of dividends and buybacks.

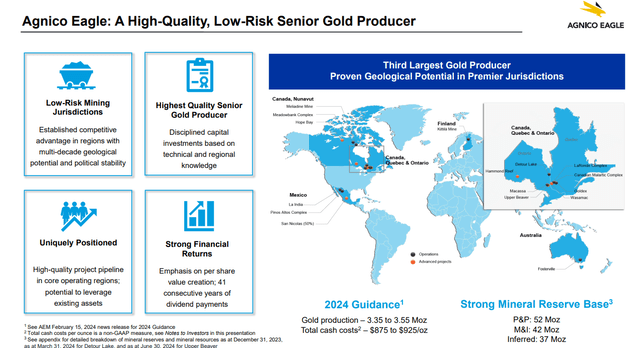

Agnico Eagle Mines Corporate Update September 2024

Gold production was led by strong performances at the Fosterville, LaRonde, and Canadian Malartic mines. Expansion projects remained on track as the company seeks low-risk organic growth, operating in safe, stable jurisdictions.

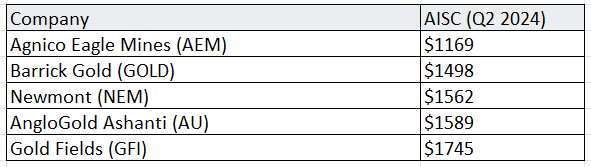

On the cost front, all In Sustaining Cost (AISC), a measure of the total cost to produce an ounce of gold including operating expenses, sustaining capital, and administrative costs came in at $1169, up only 2% compared to last year. This robust cost control combined with a rising gold price resulted in a record AISC margin of 50%.

Comparison of AISC of gold miners. Made by the author using data from Q2 2024 earnings reports for each respective company

Compared to other miners, AEM has amongst the lowest AISC, meaning even at lower gold prices, the company can maintain healthy profit margins. This low-cost structure does reduce operational gearing, meaning profits grow at a lower rate as gold prices rise compared to higher AISC competitors. This lower AISC does however mean the company has a competitive edge as it can continue to produce profitably at low gold prices and still generate cash flows and reinvest in the business.

Overall, this was a positive set of results that highlight the strongly positive impact the rising gold price is having on the AEM’s earnings. With mines operating in multiple jurisdictions, AEM offers diversification, growth projects, and a commitment to shareholder returns. The Q2 2024 results highlight this with record AISC margins, near-record production, and strong free cash flow, putting the company on a solid future path.

A Rising Gold Price

As a gold miner Agnico Eagle Mines is heavily exposed to the price of gold that drives both its revenues and profits. Its share price therefore closely follows that of the gold price as we can see below. Since the start of the year, the price of gold has risen over 21% reaching a record high of over $2500, with AEMs shares up over 40%.

So, what are the key drivers of the increasing gold price? I covered these in more detail in my previous article on the VanEck Gold Miners ETF (GDX) but I will summarize them here.

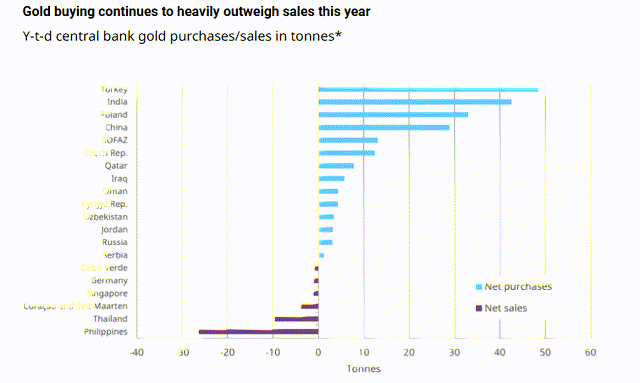

Central banks, especially those in emerging markets have seen significantly increased gold purchases to diversify their reserves and reduce their reliance on the US dollar. This can be partly attributed to the rise in geopolitical tensions. Following the sanctions placed on Russia freezing their foreign reserves due to their part in the conflict in Ukraine, foreign dollar holders have been reducing exposure to the dollar by buying more gold. This is to ensure their reserves cannot be frozen, which they potentially face with their US dollar assets, and reduce their reliance on the Western financial system. Over the first half of the year, central banks bought 483 tonnes of gold, a record amount. This amount looks only set to increase.

World Gold Council Central Bank Gold Statistics July 2024

Another factor is the rise of geopolitical tensions across the world driving investors to purchase more gold, traditionally seen as a safe-haven asset and store of value. With interest rates also set to fall, this boosts the attraction of gold as well which I discussed in my article on GDX:

Another key factor at play is the outlook for interest rates. Gold is a non-yielding asset. It does not produce any cash flow or pay out dividends. In a higher interest rate environment such as that of the past few years, this results in a higher carrying cost for gold. With some central banks already cutting interest rates and the Fed looking set to begin cutting soon, this boosts the appeal of gold by reducing the carrying cost, acting as a greater incentive to hold it. Falling interest rates could also weaken the US dollar, and gold, as a dollar-priced commodity, would be cheaper to foreign buyers helping drive demand.

I believe these factors combined have driven the price of gold higher over the past few years. None of these factors appear to be stopping any time soon, with interest rates set to only begin being cut soon in the US. As such I believe gold has the potential to go even higher.

So why invest in Agnico Eagle Mines rather than the underlying commodity? The answer is operational leverage. This is best described as when the price of gold increases, a miner’s profitability should increase by a higher percentage. For example, if a miner’s all in sustaining cost is $1,000 per ounce of gold and gold is priced at $2,000 per ounce, the miner earns $1,000 per ounce in profit. If the gold price rises 25% to $2,500 and costs remain the same, the miner’s profits rise to $1500 per ounce, a 50% increase. This makes miners like Agnico Eagle Mines especially attractive in a rising gold market, as their profits can increase disproportionately compared to the commodity itself. This is why I generally prefer miners over the underlying commodity in a rising market.

Valuation

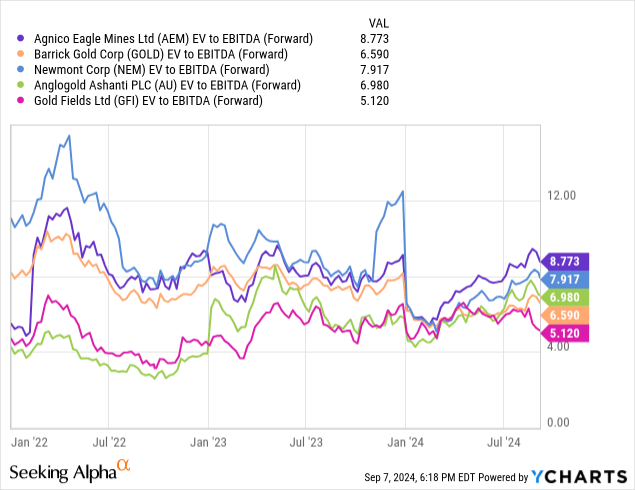

Placing a valuation on a gold miner is hard given their earnings reliance on the price of gold. In a rising gold market, all miners stand to benefit from a higher gold price, but miners have different valuations which could impact potential future returns. As such, I believe the fairest way to value the company is in comparison to other large gold miners such as Barrick Gold (GOLD), Newmont (NEM), Anglo Gold Ashanti (AU), and Gold Fields (GFI). Given the large difference in cash and debt levels, a direct comparison of earnings multiples will not suffice, and I instead use an enterprise value to EBITDA multiple.

When compared to its peers, we see Agnico Eagle mines trades at a significant premium with a forward EV/EBITDA multiple of 8.98, the highest amongst its peers. Although AEM has a history of trading at a higher multiple than its peers due to various factors such as the jurisdictions it mines in and AISC of production which of course garners a higher valuation, at the current price it looks expensive compared to peers. This raises questions surrounding whether peers would perform better with the rising gold price.

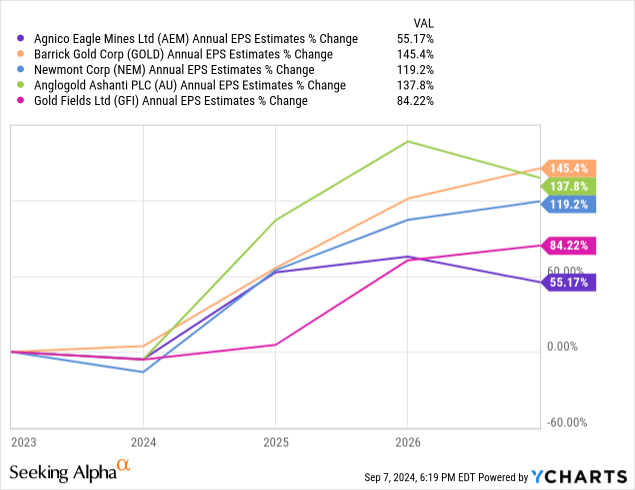

Looking at the estimated growth in earnings per share over the coming years, we see that Agnico Eagle Mines is forecast to experience the lowest growth compared to its peer group. This is amongst the highest starting valuation of this group.

As such, although I am bullish on the gold price in the long term and believe Agnico Eagle Mines has a bright future ahead, the valuation is too high compared to peers for me to consider an investment presently. As such I assign a “Hold” rating to the shares.

Risks

When considering an investment in Agnico Eagle Mines, there are two main risks I believe it is important to consider: gold price volatility and operational risks.

Agnico Eagle Mines’ financials are deeply dependent on the price of gold, its primary source of revenue. As such, changes in the gold price will deeply impact the revenue and profits of the company. Although I am bullish on gold in the long term and with gold having recently reached a record price, the underlying drivers: central bank gold buying, rising geopolitical tensions, interest rates reduction, and a weaker dollar could be reversed. While I do not believe this will be the case, it is something investors should be aware of.

The other key risk I believe is important is operational risk. This applies to any miner and includes rising operational costs increasing AISC, exploration risk, and also political/regulatory risk. Although Agnico Eagle Mines operates in what are traditionally viewed as safe mining jurisdictions, this does not protect it fully from political/regulatory risk. There may not be the risk of nationalizations, but increased environmental regulation and permitting issues makes opening and operating mines much harder and more expensive. Operational risk is part and parcel of the mining industry and something investors should monitor.

Conclusion

Based on what I’ve covered above, Agnico Eagle Mines is likely to continue to benefit as the price of gold reaches record highs and potentially goes even higher. However, despite the favorable outlook for gold, I believe investors are better off looking at alternative gold miners. AEM’s elevated starting valuation compared to peers, though partly justified by its mines being located in safer jurisdictions, combined with lower predicted earnings per share growth, makes me believe AEM may underperform others in the sector. As such, I give the shares a hold rating as I believe alternative miners offer better value potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.