Summary:

- Agnico Eagle Mines Limited reported solid Q2 production just shy of record levels at ~896,000 ounces (ca. 34 t) with AISC margins soaring to ~50%.

- The company’s distribution of production stands out, with over 90% of gold production coming from Canada and Australia, justifying its premium multiple.

- In this update, we’ll dig into the Q2-24 results, recent developments, and why Agnico Eagle continues to be one of the best ways to get exposure to the gold price.

Falcor

We’re one-third of the way through the Q2 Earnings Season for the precious metals sector, and one of the first companies to report its results was Agnico Eagle Mines Limited (NYSE:AEM). The company put together another solid quarter overall in Q2 with production just shy of record levels at ~896,000 ounces (ca. 34 t) while all-in sustaining cost [AISC] margins soared to ~50%. In this update, we’ll dig into the Q2-24 results, recent developments, and why Agnico Eagle continues to be one of the best ways to get exposure to the gold price.

Kittila Gold Pour – Company Website

All figures are in United States Dollars unless otherwise stated. G/T refers to grams per tonne of gold. AISC refers to all-in sustaining costs. GEOs refer to gold-equivalent ounces.

Agnico Eagle Q2 Production

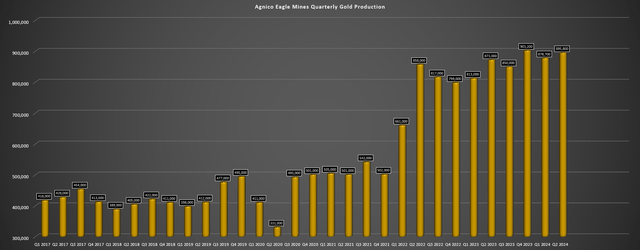

Agnico Eagle (“Agnico”) released its Q2 24 results last week, reporting quarterly production of ~895,800 ounces (ca. 34 t) of gold. This translated to a nearly 3% increase from the year-ago period, and benefited from:

- another massive quarter from Canadian Malartic (~180,900 ounces (ca. 7 t)) and Meadowbank (~126,400 ounces (ca. 5 t))

- higher production from LaRonde (~82,300 ounces (ca. 3 t)), Kittila (~55,700 ounces (2.11 t)), Meliadine (~88,700 ounces (3.35 t)) and Macassa (~64,100 ounces (2.42 t))

- record ore tonnes mined at Fosterville which softened the year-over-year production decline as high-grade Swan Zone reserves continue to be depleted

The year-over-year increases at some of its top mines discussed above were offset by lower production at Fosterville (~66,000 ounces (2.49 t)), Detour Lake (~168,200 ounces (6.36 t)), Goldex (~33,800 ounces (1.28 t)), and La India (~6,100 ounces (0.23 t)), with the latter seeing much lower production residual leaching underway after mining ended in Q4-23.

Agnico Eagle Quarterly Gold Production – Company Filings, Author’s Chart

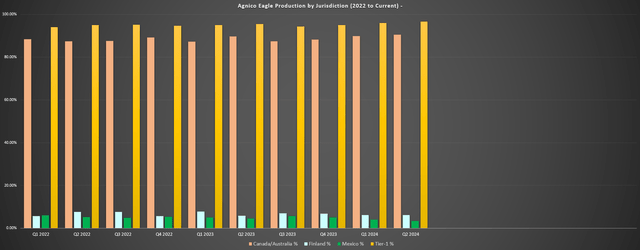

Looking at Agnico’s distribution of its production, it clearly stands out relative to its peer group, with over 810,000 ounces (ca. 31 t), or ~90% of its Q2-24 gold production coming from Canada and Australia. The rest comes from Finland (Kittila) and Mexico (La India, Pinos Altos) with the former regarded as a highly attractive jurisdiction, resulting in less than 5% of Agnico’s production coming from Tier-2 ranked jurisdictions and explaining its premium multiple. This compares favorably to Newmont (NEM) with ~58% from Tier-1 ranked jurisdictions in Q2-24.

Agnico Eagle Production by Jurisdiction (2020 – Current) / Tier-1 Defined as Canada, Australia, Finland – Company Filings, Author’s Chart

It’s also worth noting that nearly all of Agnico’s planned future growth is coming from Canada to boost its already industry-leading jurisdictional profile, with an incremental 300,000 ounces (ca. 11 t) from the Detour Lake UG Expansion, an incremental 300,000 ounces (ca. 11 t) if Agnico’s Fill The Mill strategy can turn Canadian Malartic into a ~1.0 million ounce operation longer-term which seems achievable, and 400,000 incremental ounces from Hope Bay that should fully offset any decline in production from Tier-1 ranked jurisdictions (Meadowbank).

This is one unique attribute that separates Agnico Eagle from the pack among its larger producers, especially with a few producers pursuing growth in Tier-2/Tier-3 ranked jurisdictions and set to see their percentage of production from Tier-1 ranked jurisdictions decline over the next decade.

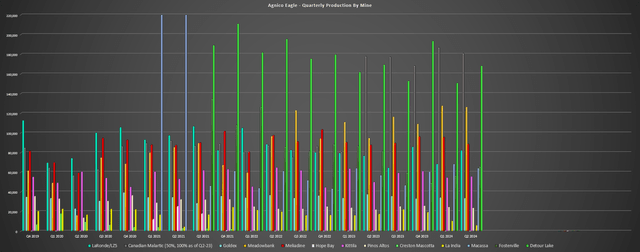

Quarterly Production by Mine

Canadian Malartic

Digging into production results by mine, Canadian Malartic had another solid quarter with production of ~180,900 ounces (ca. 7 t) at cash costs of $871/oz. Higher production on a year-over-year basis was related to increased throughput (5.18 million tonnes processed) which more than offset lower grades. Notably, Agnico reported record quarterly production of ~22,300 ounces (0.84 t) from Odyssey and record quarterly mining rates (3,750 tonnes per day) and that ramp development continues to exceed internal targets, reaching the third production level at East Gouldie as of the end of Q2. As for operations, it continues to be encouraging to see positive stope reconciliation at Odyssey South primarily from the Odyssey internal zones, with 13% more gold produced vs. anticipated in Q2-24.

Agnico Eagle Quarterly Production by Mine – Company Filings, Author’s Chart

Given the impressive Q2 operating performance from Canadian Malartic, production is well on its way to meet its guidance midpoint of 630,000 ounces (ca. 24 t) with ~367,800 or ~58.3% of production delivered with two quarters left to go. Progress on the Odyssey Project continues with shaft sinking advancing at 2.5 meters per day (680 meters depth as of end of Q2-24) and that surface constructed is on budget and moving along as planned. During Q2-24, $43.2 million development capital spent, or ~21% of the company’s development capital spent in the quarter across its portfolio.

Detour Lake

Detour Lake saw production dip 1% year-over-year to ~168,200 ounces (6.36 t) of gold at cash costs of $791/oz in Q2-24. The marginally lower production was related to lower recovery rates offset by slightly higher grades, with ~6.79 million tonnes processed at 0.86 G/T of gold during the quarter (Q2-23: ~6.80 million tonnes at 0.85 G/T of gold). Unfortunately, metallurgical recoveries were below plan in Q2-24 once again after Agnico shared that abnormal chipping of grinding media in the SAG mill was affecting grinding efficiency.

While lower recoveries have left Detour Lake tracking behind guidance a little at ~319,000 ounces (ca. 12 t) produced year-to-date (690,000 ounce (ca. 26 t) midpoint), Detour Lake certainly ended Q2 on a high note. In fact, Agnico reported monthly mill throughput of ~81,300 tonnes per day or ~29.7 million tonnes annualized — tracking well above its longer-term ~29.0 million tonne per annum goal (2028). Meanwhile, the company has unveiled its plan to take Detour Lake to 1.0 million ounces per annum by next decade with extremely favorable economics, especially on a risk-adjusted basis.

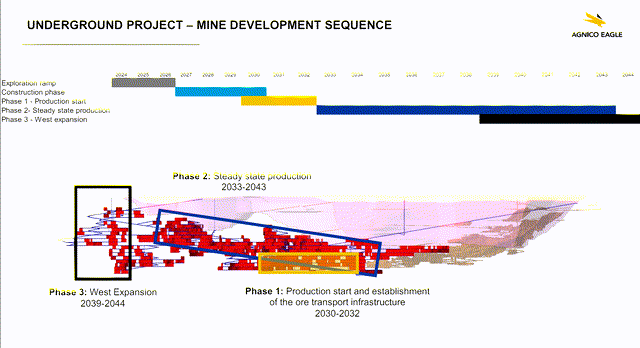

Detour Lake Underground Expansion Plans & Development Sequence – Company Presentation

As for Detour’s exploration upside, it’s important to remember that Agnico used an October 2023 cut-off for new drill results and as we can see, high-grade mineralization continues over 2 kilometers west of the pit, with highlight intercepts of 3.2 meters at 13.7 G/T of gold, 4.8 meters at 32.3 G/T of gold, and 35.3 meters at 2.6 G/T of gold. Hence, there looks to be an upside to further expanding the underground reserve base longer-term. Second, the recent cut-off for the 2024 PEA did not include impressive intercepts like 36.1 meters at 2.6 G/T of gold near-surface, nor did it include an extremely high-grade intercept of 2.6 meters at 524.9 G/T of gold. Meanwhile, other recent drilling just outside of resources included 12.2 meters at 2.8 G/T of gold and 6.1 meters at 4.7 G/T of gold, both well above its current underground resource grade.

So, for investors focused on the bigger picture, the future has never been brighter at Detour Lake.

Detour Lake Drilling Highlights – Company Website

Meadowbank

Meadowbank produced ~126,400 ounces (ca. 5 t) of gold at $922/oz cash costs in Q2-24, a 33% increase year-over-year. The significantly higher production from the company’s Meadowbank Complex was related to easy comps year-over-year (unplanned downtime at SAG mill and unplanned mill shuts from caribou migration in year-ago period) and Agnico noted that Q2-24 production was higher than expected due to strong operational performance. Just as importantly, Meadowbank reported underground quarterly performance records for hauling, production drilling and cemented rockfill, while its open-pit operations set records in June as well.

Whale Tail UG Ramp (Meadowbank) – Company Website

During Q2-24, ~990,000 tonnes were processed at 4.36 G/T of gold at the Meadowbank Complex, and it’s tracking well against guidance with ~51.9% of its annual guidance (YTD: ~254,200 ounces (ca. 10 t) vs. 490,000 ounces (ca. 19 t) guidance midpoint).

Meliadine

Meliadine produced ~88,700 ounces (3.35 t) of gold in Q2-24 at $892/oz cash costs, a 1% increase in production year-over-year. Higher production can be attributed to higher grades (6.79 G/T of gold vs. 6.14 G/T of gold), offset by lower throughput of ~421,000 tonnes. Agnico noted that production was partially impacted by the earlier than planned caribou migration period, but that its Caribou Readiness Plan being adopted and should ultimately help to reduce the impact of early caribou migration on its operation in future years. As it stands, Meliadine’s year-to-date production sits at ~49.8% of its guidance midpoint at ~184,400 ounces (ca. 7 t) vs. 370,000 ounces (ca. 14 t).

LaRonde

LaRonde produced 82,300 ounces (ca. 3 t) of gold at $816/oz cash costs, a 7% increase in production vs. the year-ago period. Higher production was related to increased throughput (~680,000 tonnes) at higher grades (4.05 G/T of gold) and production is sitting at 51.1% of its guidance midpoint at ~150,700 ounces (5.7 t) year-to-date. Agnico noted that it continues to exceed its automation targets at LaRonde and that a 4.1 magnitude seismic event occurred in late June, but that the mine was evacuated with no injuries and its “dynamic ground support performing as designed.” As for normal operations, Agnico noted that it is working to improve recoveries with optimized blending of ore from LaRonde, 11-3 Zone, LZ5, Goldex, and Akasaba West.

Macassa

Macassa produced ~64,100 ounces (2.42 t) in Q2-24 at $833/oz cash costs, a ~13% increase in production from the year-ago period. Higher production was related to increased throughput (~152,000 tonnes) offset by lower grades (13.44 G/T of gold vs. 16.16 G/T of gold) and production is sitting just shy of its 2024 guidance midpoint currently (~132,300 ounces (ca. 5 t) of 275,000 ounces (ca. 10 t)). Overall, it’s encouraging to see productivity gains continuing from the new ventilation infrastructure with record quarterly volumes skipped and record quarterly mill throughput, with throughput benefiting from Macassa Near Surface ore. As for ongoing projects, the construction of the new paste plant is expected to be commissioned in H1-25 and is 50% complete currently.

Fosterville

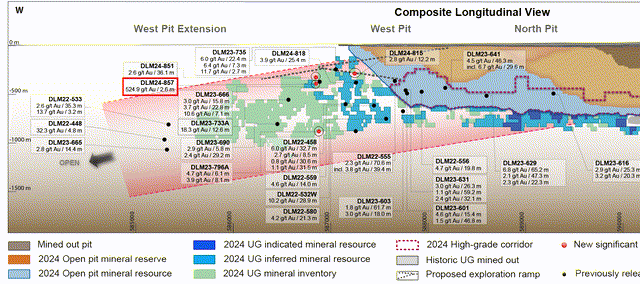

Fosterville reported Q2-24 gold production of ~66,000 ounces (2.49 t), a 19% decline year-over-year. The sharp decline in production was largely expected with much of the high-grade Swan Zone reserves depleted, but Q2-24 was actually a solid quarter overall even if production fell year-over-year. This is because Fosterville saw significantly higher throughput of 234,000 tonnes processed, a record ore mined of ~241,000 tonnes in Q2-24, and delivered a monthly record for mill throughput at ~101,000 tonnes in June.

The result was very respectable cash costs of $608/oz and production is tracking well relative to guidance thus far with ~122,500 ounces (4.63 t) produced of a planned 230,000 ounces (ca. 9 t) at the guidance midpoint. So, while the production cliff in the below chart may appear alarming, it’s important to point out that production appears to be stabilizing near the 50,000 ounces per quarter mark and the idea seems to be to keep churning ounces at ~$1,200/oz plus AISC margins while it works to hopefully uncover another mid-grade (10+ G/T of gold) to ultra-high-grade (20+ G/T of gold) gold discovery.

Fosterville Quarterly Production – Company Filings, Author’s Chart

While there’s no question that grades have dropped off materially at Fosterville, it certainly helps that in the period that head grades have slid over 70% from their peak, gold prices are up 50%. Plus, this is still a very profitable operation even assuming ~$200/tonne mine site operating costs vs. ~$500/tonne rock values at 7.0 G/T of gold ($2,250/oz gold price assumption) once Swan is fully mined out at the end of this year (Agnico: 2024 forecasted grades: 9.15 G/T of gold).

Agnico noted in its year-end update that work is ongoing to optimize Fosterville in hopes of maintaining it as a 175,000 to 200,000 ounce (7.56 t) production profile, with preliminary results of this evaluation expected later this year.

Kittila

Kittila produced ~55,700 ounces (2.11 t) of gold in Q2-24, an 11% increase from the year-ago period. Higher production was related to increased throughput (~524,000 tonnes) offset by lower grades (4.07 G/T of gold) and lower than planned recoveries due to high carbon and sulfur content in the ore. Unfortunately, test trials with carbon depressants showed inconsistent results according to Agnico, but further work will be conducted this quarter. Like Fosterville, Kittila is also seeing a continuous improvement program with Agnico working to leverage off results of recently completed Meadowbank and Meliadine, where work has clearly paid off as these Nunavut mines continue to rack up monthly and quarterly records.

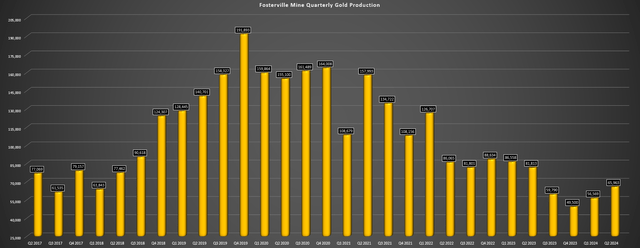

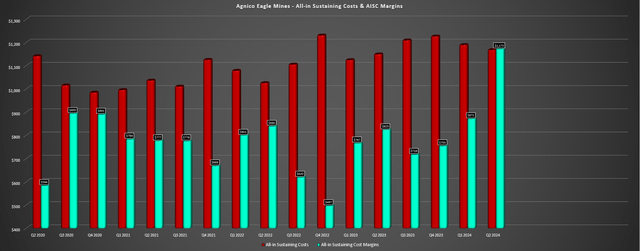

Costs & Margins

Looking at Agnico’s Q2-24 all-in sustaining costs, AISC came in at $1,169/oz, a merely 2% increase year-over-year (Q2-23: $1,150/oz) that significantly outperformed the cost increases we’ve seen from many of its peers. The solid cost control combined with a record gold price [$2,342/oz] resulted in an AISC margin of $1,173/oz [50%] vs. $825/oz in Q2-23 [41.8%], benefiting from lower sustaining capital spend [$199.5 million] and higher ounces sold [~874,200 vs. ~858,800]. This consistently strong production has placed Agnico in great shape relative to guidance, sitting at ~1.77 million ounces produced YTD or 51.3% of its guidance midpoint with AISC looking like they could come in below $1,210/oz for the year and beat its cost guidance midpoint (2024 guidance midpoint: $1,225/oz).

Agnico Eagle Quarterly All-in Sustaining Costs – Company Filings, Author’s Chart Agnico Eagle AISC & AISC Margins – Company Filings, Author’s Chart

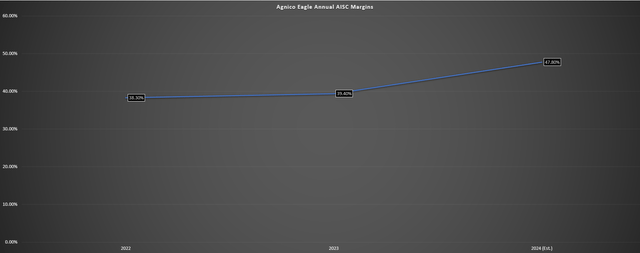

As for Agnico’s full-year margin outlook, Agnico could see its AISC margins jump over 800 basis points year-over-year to ~48% vs. ~39% reported in 2023. This based on the assumption of a $2,330/oz average realized gold price, $1,210/oz AISC and $1,120/oz AISC margins. Ultimately, I don’t think any of these projections are unreasonable, especially given where Agnico’s YTD AISC and average realized gold price sit today and would result in a 40%+ increase in unit margins year-over-year ($1,120/oz vs. $767/oz in 2023).

Agnico Eagle AISC Margins – Company Filings, Author’s Chart & Estimates

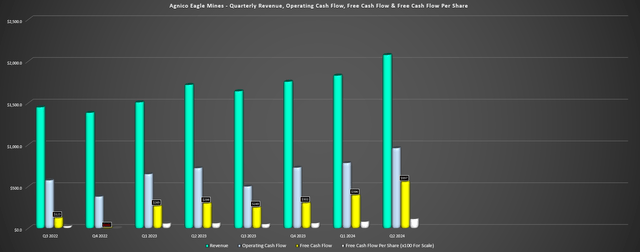

Agnico Eagle Quarterly Financial Metrics – Company Filings, Author’s Chart

Given the strong operational performance combined with record gold prices, it’s little surprise that Agnico’s Q2-24 results were marked by records. Quarterly revenue increased ~21% year-over-year to ~$2.08 billion, operating cash flow surged 33% year-over-year to ~$961 million and free cash flow soared to ~$557 million (+87% year-over-year) despite similar capital expenditures year-over-year (-4%). This resulted in the company ending the quarter with ~$1.84 billion in debt and ~$920 million in net debt after its cash and cash equivalents position of ~$922 million. (*)

(*) Agnico noted that it paid an additional $150 million paid after quarter-end on its term loan and $100 million on its 5.02% Series B Senior notes. (*)

However, while this is a company that can generate ~$2.0 billion in annual free cash flow at $2,400/oz gold given the quality of its current portfolio, it’s important to highlight what’s not producing today but could be by the end of the decade, which is 1.0+ million incremental mid-grade to high-grade ounces in Agnico’s backyard (Canada).

Recent Developments

Hope Bay

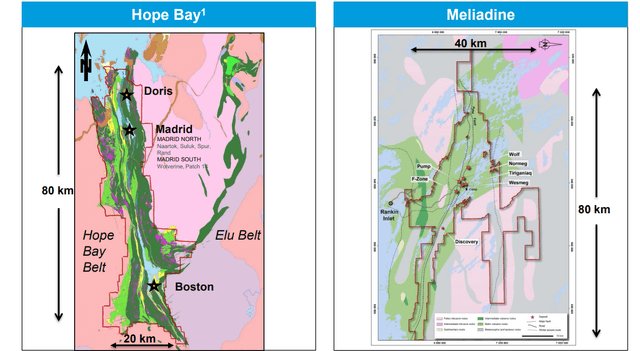

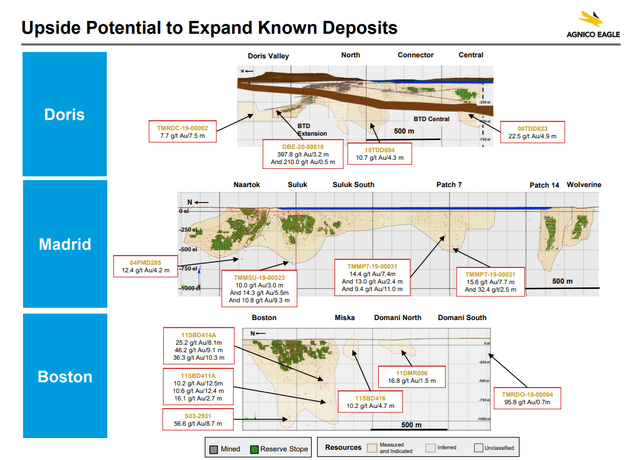

Starting with Hope Bay, the acquisition of TMac by Agnico already looked like a steal at just over $300 million given that it was buying high-grade ounces at ~$50/oz (~7.3 million ounces of measured, indicated, and inferred), but the purchase price is looking better each quarter that we get an exploration update. This is because while the results from Doris which was drilled first post-acquisition were solid with extensions to high-grade mineralization uncovered outside existing resources/reserves, the results from Madrid have been jaw-dropping, and Agnico confirmed this potential in its Q1-24 Conference Call:

“We got what I would qualify as some very spectacular exploration results in the gap between Suluk and Patch 7 at the Madrid deposit that could move the needle because of the high-grade nature of those intercepts that could significantly improved the scenario for future project development. If we have an area in that gap with a million ounces at 10 to 20 grams per tonne or obviously if we bring that in sooner but that was not known. So now we’re looking potentially, we should in the most likely scenario try to go there first. Obviously from a return perspective, if we could access that higher grade ore earlier that’s going to help.”

– Agnico Eagle Q1-24 Conference Call.

Hope Bay Belt vs. Meliadine – Agnico Eagle Presentation

Not only is this news a testament to what the right properties geologically can yield in the hands of Agnico which is one of the sector’s most aggressive drillers, but it also is a great example of Agnico’s conservatism, a trait that many other producers in the sector lack. This is because not only has Hope Bay delivered on Agnico’s initial expectations for exploration upside outlined in its 2021 acquisition with room to significantly grow its resource at higher grades at Madrid, but Hope Bay has gone from having “250,000 to 300,000 ounce (ca. 11 t)” per annum potential to “350,000 to 400,000 ounce (ca. 15 t)” per annum potential, and what I ultimately believe could be closer to 400,000 ounces (ca. 15 t) with peak production near 500,000 ounces (ca. 19 t) per year if Patch 7 can keep delivering thick 15+ G/T gold intercepts.

TMAC Acquisition Presentation – Upside at Doris, Madrid, Boston – Company Presentation

“We believe the project could ultimately produce 250,000 to 300,000 ounces. But we still have to do the study. We still have to do the work. We’re confident that there is a solid plan to move forward as we put our Nunavut expertise to work there.”

Agnico Eagle, Q4 2020 Conference Call (emphasis added).

“Drilling in 2022 confirmed the potential to upgrade and expand mineral resources at Doris. Exploration in 2023 will primarily shift to the Madrid deposit to further expand the mineral resources with a focus on defining areas of higher-grade mineralization. Work continues on evaluating larger production scenarios (targeting 350,000 to 400,000 ounces of gold per year).”

Agnico Eagle Year-End 2022 Update (emphasis added).

As Agnico Eagle mentioned in its Q4-23 Conference Call that Hope Bay could look something like Meliadine with 5,000 to 6,000 tonnes per day at 6-7 G/T of gold. This obviously remains to be seen, but at even 5,500 tonnes per day and factoring in a spike to overall grades in higher grade years (weighted average grade could be pulled up materially by new Patch 7 Discovery), there looks to be the potential for closer to 500,000 ounces (ca. 19 t) per annum from Hope Bay in its best years, but it’s obviously still early days. Agnico’s most recent comments were as follows, and aren’t surprising given the most recent batch of new high-grade intercepts from this area.

“This emerging new mineralized area continues to show excellent continuity as well as grades and thicknesses greater than average for the Madrid deposit. It is anticipated that the drilling program in this area in 2024 will have positive impacts on the mineral resource estimate at year-end 2024 and on mining scenarios for potential project redevelopment.”

Agnico Eagle Q2- 2024 Update.

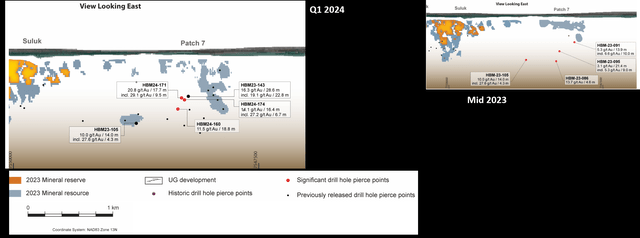

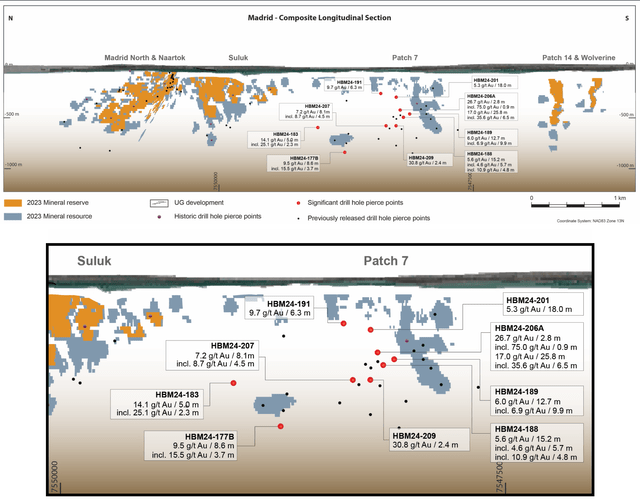

As the images below highlight, there was limited drilling (right image) in the gap between Patch 7 and Suluk in 2023 previously, but we’ve since seen material growth in resources at Patch 7 and a clear high-grade area emerging just north of Patch 7 resources. The most recent drilling update is shown further below (zoomed-in image on bottom) and we’ve thus far seen multiple thick high-grade intercepts here, with the most recent being one of the best to date (25.8 meters of 17.0 G/T of gold at 419 meters depth):

- 28.6 meters at 16.3 G/T of gold

- 17.7 meters at 20.8 G/T of gold

- 25.8 meters at 17.0 G/T of gold

- 16.4 meters at 14.1 G/T of gold.

Hope Bay Drilling Highlights & Progression – Company Website

Hope Bay Drilling Highlights – Company Website

The other encouraging takeaway was Agnico stating the following about mineralization closer to surface after it reported highlights of 6.3 meters at 9.7 G/T of gold (242 meters depth) and 18.0 meters at 5.3 G/T of gold (278 meters depth):

“Drilling in this shallower area is confirming the presence of the same structures and favorable host rocks encountered in the main Patch 7 mineral resources located several hundred meters to the south.”

Finally, while a little deeper and further south of the new Patch 7 high-grade discovery, drilling closer to Suluk near the lone resource block continues to yield solid results. Recent intercepts include 5.0 meters at 14.1 G/T of gold and 8.6 meters at 9.5 G/T of gold that complement previous high-grade hits like 14.0 meters at 10.0 G/T of gold. Putting it all together, Hope Bay continues to exceed my expectations and has turned out to be an intelligent purchase, as a developer with a project of this quality in the market today could easily have a $1.2+ billion valuation (~4x what AEM paid for Hope Bay) if not already acquired.

Upper Beaver

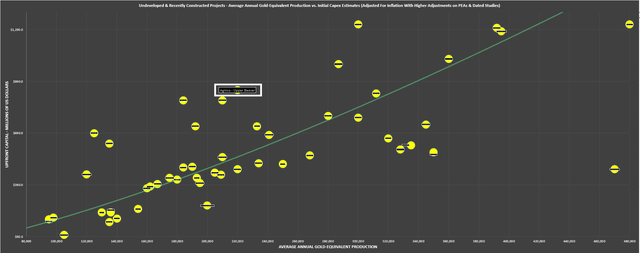

While the results out of Hope Bay were quite exciting and suggest 400,000 ounces (ca. 15 t) per annum potential looks achievable, investors also got much-awaited results from early work on its Upper Beaver Project in the Kirkland Lake Camp of Ontario, Canada. As discussed in the Q2-24 update, Agnico envisions an underground gold-copper operation at Upper Beaver (*) with a 13-year mine life with average annual production of ~210,000 ounces (ca. 8 t) of gold and ~3,500 tonnes of copper per year or just over 220,000 GEOs. And while this is on the lower end of the scale, margins are expected to be phenomenal with sub $740/oz AISC on a by-product basis (even being more conservative at $875/oz would translate to margins 25% below AEM’s margins today and ~40% below the industry average of $1,450/oz).

(*) Upper Beaver is a mid-grade underground gold-copper project with a resource base of ~33.8 million tonnes (94% indicated) at 3.53 G/T gold and 0.24% copper for ~3.44 million ounces of gold and ~71,000 tonnes of copper (*).

In terms of how the project stacks up to other undeveloped or recently constructed gold projects globally, we can see that upfront capex is on the higher end at ~$0.90 billion relative to Upper Beaver’s production profile, given that this requires the construction of shaft and ramp access. However, the project easily makes up for this with its industry-leading expected margins (sub $900/oz AISC), potential synergies given the vast resource base and its other operating mine in the Kirkland Lake Camp. Based on this early work, Agnico has approved a $200 million investment over three years, which will include developing an exploration ramp and shaft to depths of 160 and 760 meters to collect bulk samples. According to the company, shaft sinking could begin in H2-2025.

Undeveloped & Recently Constructed Gold Projects – Average Annual Gold-Equivalent Ounce Production vs. Initial Capex Estimates – Company Filings, Author’s Chart & Estimates

In addition, Agnico has openly discussed that it could look at foregoing building a plant and trucking east across the border to process at its LaRonde operation in Quebec, reducing upfront capital as it discussed below. As it stands, it’s still early days for this operation that could boost Kirkland Lake Camp production to ~500,000 ounces (ca. 19 t) per annum. However, early results are encouraging and this looks like another robust asset to add to an already enviable pipeline for investors that looking for organic growth in top-ranked operating jurisdictions.

“There is absolutely an opportunity to continue to consider leveraging existing infrastructure. We are still looking at the transport option to LaRonde, which would obviously materially reduce the capital that we would have to spend. So given as you would know that the longest driving factor is the shaft and given that the shaft is independent of where you have the plant, what we’ve decided to do is basically we said, look, worst-case scenario, we build the mill, it still makes a lot of money for our shareholders. So let’s get started on that shaft because it’s a great investment. But to your point, absolutely, we are still looking at transportation to LaRonde. And if we were to do that, obviously, it would be because it improves the economics.”

Agnico Eagle Q2-24 Conference Call.

Recent Investments & Share Repurchases & Other Developments

Agnico repurchased ~1.14 million shares year-to-date at an average price of ~US$61.40, including ~763,000 shares purchased in Q2-24. Agnico also continued to make small investments in other companies, including gaining exposure to the Oijarvi Project, which is 350 kilometers south of Kittila and 85 kilometers east of Kemi in Finland, through its stake in First Nordic Metals. For those unfamiliar, the Oijarvi Project is home to a small resource of ~2.7 million tonnes at 3.3 G/T of gold and 23 G/T of silver for ~285,000 ounces (ca. 11 t) of gold and ~2.02 million ounces of silver.

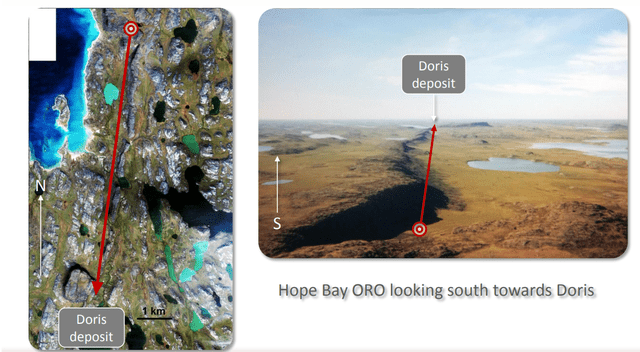

HB Oro Property & Doris Mine – North Arrow Minerals

After quarter-end, Agnico also added to its Nunavut land holdings, purchasing the Oro Gold Property for ~$1.8 million. This property sits just 3 kilometers north of Doris and gives it another set of targets along its massive 80+ kilometer gold belt, with drilling in 2011 returning a few decent hits of 4.2 meters at 8.0 G/T of gold, 2.0 meters at 20.22 G/T of gold and 4.0 meters of 7.0 G/T of gold in holes HB-04, HB-10 and HB-08, respectively. There’s no guarantee that the HB Oro Gold Property turns up anything like what past operators have uncovered at Doris, Madrid or Boston, but given all the drilling success in Nunavut, it makes sense to lock up this additional property at fire-sales prices from a motivated seller.

As for other developments, Agnico shared that it would be increasing its exploration budget, which is never a bad sign, with a supplemental $50 million to be spent in H2-24 (45% to be spent at Hope Bay). As for its dividend, I would be surprised to see a raise in its base dividend this year even with record gold prices, given that Agnico has consistently stated that it wants a safe and conservative dividend that it never has to cut. In addition, capex will be higher over the coming decade with a very busy pipeline competing for capital. That said, I could look at AEM looking at special dividends and/or opportunistic share buybacks to supplement shareholder returns.

Summary

Agnico Eagle has trounced the performance of its major producer peers over the past year, justified by solid operational performance, consistent exploration success at key assets and an upgrade to its pipeline following its recently announced Detour Underground Expansion plans. And while AEM may screen expensively compared to some of its million-ounce producer peers, this is a company that has always traded at a premium valuation because it executes near flawlessly and has some of the best mining assets in the safest jurisdictions globally.

Some investors might argue that this premium has become overcooked in the share price, but Agnico Eagle carves out a near unrivaled niche that contributes to its premium multiple. This is because it offers the ideal mix of diversification (4 countries, 10 mines), scale (~3.5 million ounces with room to grow), and a robust pipeline coupled with a management that’s laser focused on per share metrics. And in a sector that that is extremely unforgiving for those that invest in the wrong names, it’s tough to put a price on the ability to get one’s exposure to gold with a good night’s sleep, which AEM offers with:

- safe mining jurisdictions

- constantly prioritizing per share growth over growth for growth’s sake and showing extreme capital discipline

- “boringly” consistent operational results, with regular delivery against guidance and more upside vs. downside surprises.

Besides, it’s worth noting that while cash flow metrics may make AEM look more expensive than NEM, AEM’s relatively low-risk and lower capex projects like Hope Bay Restart, Detour UG Expansion, Malartic Fill The Mill, and Upper Beaver have the potential to add 1.2+ million ounces per annum if all approved/commissioned or ~20% growth from current levels even factoring in lower/no production at shorter life assets.

Hence, valuing AEM on this year’s or next year’s cash flow doesn’t do it justice when you could build another ~1.5 million ounce gold producer out of its current pipeline of projects. Still,

Agnico Eagle Mines Limited continues to fire on all cylinders and has an extremely bright future. I continue to see AEM as the premier way for an investor to get exposure to the gold price, and I would view sharp pullbacks in the stock as buying opportunities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AEM, AEM:CA, VOXR, VOXR:CA, NEM, NGT:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Alluvial Gold Research offers in-depth research on my favorite miners ranked in order to aid in positioning in the most undervalued miners with upcoming catalysts to drive portfolio outperformance. Subscribers also get access to my current portfolios and buy/sell alerts as well as the following:

- A Proprietary Sentiment Indicator for gold/silver miners updated weekly not available anywhere else

- Exclusive Research on Top Ideas

- Top Takeover Targets

- Buy/Sell Signals for GDX, SIL & Individual Miners

I have been able to outperform GDX consistently since its peak (170% return since August 2020 peak) with the help of timing models I’ve built & rigid stock selection.