Summary:

- Palantir’s software has proven its value through high-profile deals and exceptional growth, but its current valuation is too high, suggesting a potential pullback.

- Despite strong financial performance and profitability, including significant free cash flow and net income growth, Palantir’s stock price doesn’t justify its stretched valuation.

- Risks include increased competition and a high valuation multiple compared to peers, making it less attractive for new investments at current levels.

- While bullish on Palantir’s long-term prospects, I am neutral on adding shares now and will wait for a more attractive entry point.

hapabapa

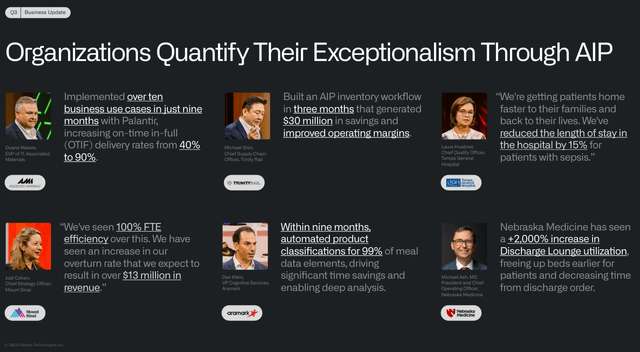

Palantir (NYSE:PLTR) is adjacent to Nvidia Corporation (NVDA) in the AI revolution as it’s one of the hottest pure-play software companies. For a long time, PLTR bulls have been trying to educate the investment community on why PLTR’s software was unlike anything else in the market. The inflection point came after the first AIP Con, where PLTR showcased how clients could leverage their AI capabilities to make actionable decisions in real-time. Impact studies have been published showcasing how some of the world’s largest companies benefit from utilizing PLTR’s software, including Airbus, Cleveland Clinic, Ferrari, Fujitsu, Kinder Morgan (KMI), and Tampa General Hospital. It’s one thing to read research reports or listen to analysts, but watching the live stream from AIP Con and seeing how the largest companies are solving complex problems in days, not years, validates PLTR’s legitimacy. Since the direct listing, I have been a long-term bull on PLTR and a shareholder, but I am changing my investment thesis. The PLTR community rivals Tesla’s (TSLA) community as one of the most passionate groups of investors there is. I think a lot of people will disagree with me, and some will be annoyed that I am going from a PLTR super bull to being neutral about the company. I continue to believe that PLTR will end up being the second most important software company behind Microsoft (MSFT) over the next decade, but stocks don’t just go up, and too much forward growth is priced in for the valuation to make sense. I don’t believe we are anywhere near an attractive entry point, and I think shares will retrace for a while after the massive surge before we see the next leg up.

Seeking Alpha

Following up on my previous article about Palantir

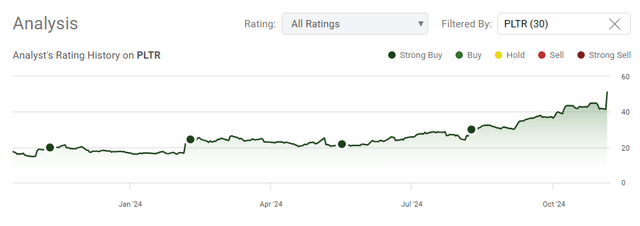

I wrote my last article about PLTR on August 9 after Q2 earnings were released (can be read here). Since then, the shares of PLTR have appreciated by 89.62% as shares traded for $29.28 less than four months ago. I didn’t think we would break $45 by now, and I certainly didn’t think shares of PLTR would be trading for more than $50 in 2024. I discussed PLTR’s explosive growth and the importance of its high-profile deals. Since PLTR went public, I have been a shareholder, discussing how and why they would become a premier software company that will be critical to every industry. I am following up with a new article to discuss why I believe shares of PLTR have gotten too expensive despite the future growth I believe they will achieve. I think the PLTR community will be split in their opinions, but at some point, numbers matter, and the current business metrics from a profitability standpoint do not support the current valuation. I am not selling my shares, as I have always said, and this is a company I want to hold until at least 2030, but I also don’t think an attractive entry point is anywhere near this level.

Seeking Alpha

Risks to investing in Palantir

PLTR has taken the market and the software industry by storm. The largest companies are showcasing how they utilize Foundry and AIP at PLTR’s conferences, which are livestreamed for the world to see. PLTR’s relevance isn’t based on opinions but on companies such as Cisco Systems (CSCO) and Panasonic signing large contracts and presenting how PLTR has helped them achieve things no other company could deliver. While I am bullish on PLTR’s future and its ability to grow its book of business, there are still several risk factors to consider. Other software companies are trying to figure out how to disrupt PLTR’s business model. While many bulls I have talked to don’t believe this is possible there are several larger companies than PLTR that can spend any amount of money to develop enterprise software. New or old competitors can enter the space in which PLTR does business and compete. Over the next several years, there is a risk that PLTR’s moat will shrink due to increased competition. The other risk to investing in PLTR here is the valuation. At some point, numbers matter, and stocks don’t just go up indefinitely. While I believe that, in the long term, shares of PLTR will be higher than they are today, in the short term, I think that the valuation has become extremely stretched, and there isn’t an attractive entry point that makes sense.

Palantir

Palantir does it again and proves why Alex Karp and his team were correct and the bears were wrong

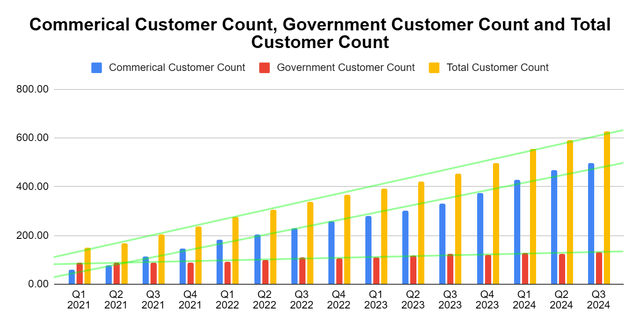

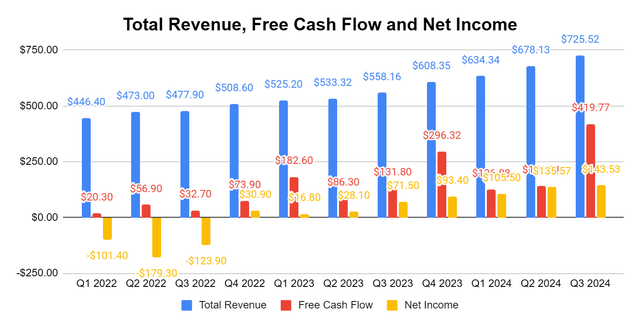

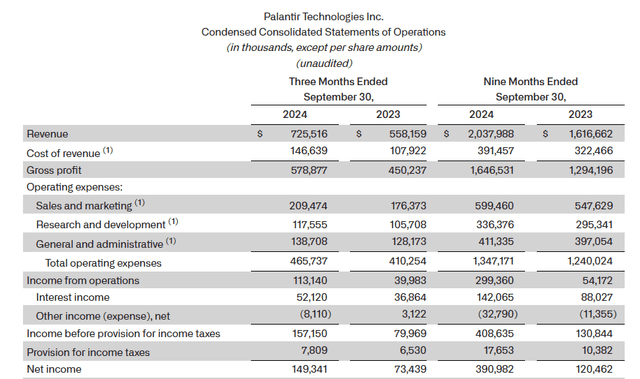

PLTR delivered a strong quarter, as its Q3 results ended with a 30% YoY growth rate, and it generated $725.52 million in revenue. PLTR also beat on the bottom line as they produced $0.10 in Non-GAAP EPS when the street was looking for $0.09. From a business operating perspective PLTR is firing on all cylinders, and Q3 was a continuation of exceptional business metrics. I track many different data points, and every bear case about PLTR’s operating ability has been shattered. The biggest bear case used to be PLTR’s ability to convert commercial enterprises because they were seen as a black box government software provider. Going back to Q1 2021, PLTR’s government customer count was 89, while commercial customers accounted for 60 corporations. I have gone through every quarterly report and compiled PLTR’s customer count on a quarterly basis. The growth in their commercial business has answered every question the bear case has formulated. Over the past 14 quarters, PLTR’s commercial clients have expanded by 730% (438 clients), and they now have 498 commercial accounts. Their government business has expanded by 47.19% (42 clients) to 131. Commercial now represents 79.17% of PLTR’s client base. On a YoY basis, PLTR’s commercial clients grew by 50.91% as they added 168 accounts.

Steven Fiorillo, Palantir

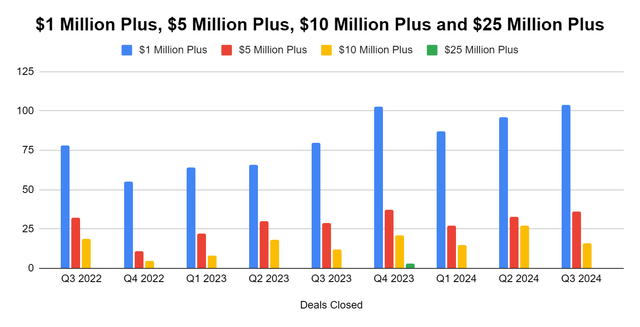

The number of customers is very impressive, but it’s not as important as the type of deals they represent. PLTR has been able to facilitate its top and bottom-line growth by delivering large-scale deals quarter after quarter. PLTR started disclosing the deal sizes that were inked in Q3 2022, and since then, they have closed 733 deals worth over $1 million. In Q3, PLTR delivered 104 deals that were worth at least $1 million. Within these deals, 36 exceeded $5 million, and 16 exceeded $10 million. This was the second time that PLTR exceeded 100+ deals in a quarter of over $1 million, and it was their largest quarter for closing large deals to date. This has very important future implications, especially when all of the data is reviewed. PLTR didn’t put the following metric in the 10-Q, but it was in the earnings presentation. PLTR has a net dollar retention of 118%, which is calculated from all deals without original terms of 12 months or less. This means that PLTR is upselling customers by 18% on average on their previous contracted bills. As PLTR adds large-scale customers, they are compounding their forward growth rate by being able to expand their business from the current portfolio. This is an important factor as to why PLTR has been able to achieve $2.65 billion in revenue over the TTM with 629 total customers.

Steven Fiorillo, Palantir

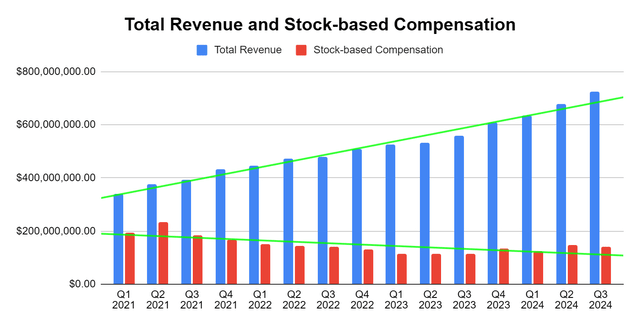

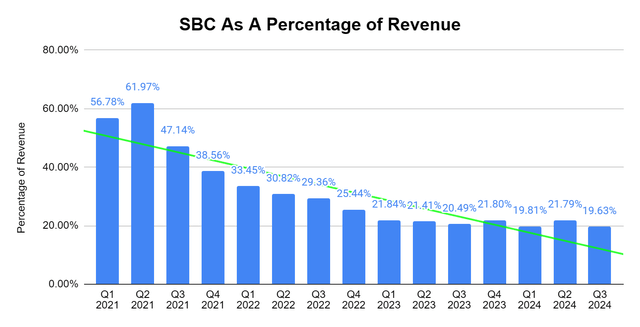

Some of the negativity that was highlighted in the past was the amount of stock-based compensation (SBC) that PLTR delivered to employees. In the beginning, this was a valid concern, considering SBC represented 56.78% and 61.97% of their revenue in Q1 and Q2 of 2021. Since then, PLTR has dropped the SBC as a percentage of revenue to 19.63%, which is the lowest it has been since PLTR went public. PLTR is a company with $4.56 billion in cash and marketable securities on hand and $0 in long-term debt. I am perfectly fine with dilution as a vehicle for the team to expand the company as long as profitability increases, and over the past four years, PLTR went from an unprofitable company to being included in the S&P 500. As long as SBC stays at a low percentage of revenue, I don’t see this as being the red flag it once was.

Steven Fiorillo, Palantir

Steven Fiorillo, Palantir

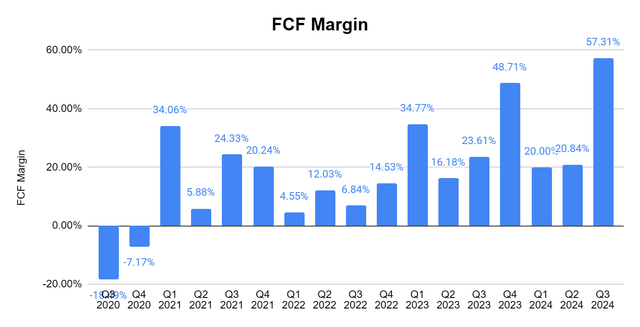

From a profitability standpoint, PLTR delivers for shareholders. Over the TTM, PLTR has generated $2.65 billion in revenue and produced $984.28 million in free cash flow and $478 million in net income. PLTR’s revenue has increased by $167.36 million (30%) YoY, while its FCF increased by $287.97 million (218.49%) YoY. This has allowed PLTR to generate eight consecutive quarters of net income, and they have produced $478 million of net income in the TTM. In Q3, PLTR was able to generate its largest quarter of net income with $143.52 million, which was a 100.74% increase ($72.03 million) YoY. While net income and FCF are both important measures of profitability, I care about FCF slightly more as this is a harder number to manipulate or distort because it is cash in vs cash out. In Q3, PLTR operated at a 57.31% FCF margin; over the TTM, they have produced a FCF margin of 37.19%. As PLTR’s customer base grows and their net dollar retention remains above 110%, they should be able to expand margins and profitability going forward. This is becoming a highly profitable business, and FCF of over 35% is difficult to achieve.

Steven Fiorillo, Seeking Alpha

Steven Fiorillo, Seeking Alpha

Despite how bullish I am on Palantir, I think the company is overvalued at these levels

I am not turning bearish on PLTR, but at some point, numbers matter. I don’t believe the underlying profitability metrics justify the current valuation. We have lived through a high-interest environment with the Fed taking rates past 5%. PLTR has increased the amount of cash allocated toward marketable securities by $952.82 million (33.51%) YoY. The Fed started cutting rates in September, and the Fed Dot plot indicates that the Fed will take rates to around 3.5% in 2025 and 3% in 2026. This isn’t great for PLTR’s profitability as PLTR has generated $142.07 million in interest income during the first nine months of operations in 2024. This represents 36.34% of their bottom-line profitability. As the Fed takes rates lower, it will be harder for PLTR to utilize its cash to boost earnings, and its ability to beat analyst estimates on the bottom line may become more difficult.

Palntir

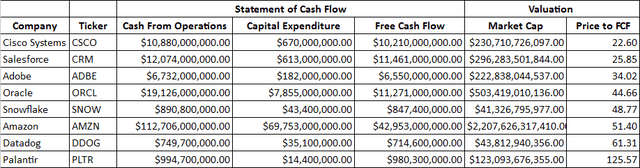

At some point, numbers matter, and the pool of buyers will dry up. PLTR is trading at a valuation that doesn’t make sense, and I believe we will experience a pullback after the incredible appreciation shares have experienced. I compared PLTR to several different companies to show how the market is valuing them. The companies I will compare PLTR to are Cisco Systems, Salesforce (CRM), Adobe (ADBE), Oracle (ORCL), Snowflake (SNOW), Amazon (AMZN), and Datadog (DDOG). When you invest in a company, you’re paying the present value for all of the future cash flow they will generate. Regardless of industry, a company operates in $1 of revenue and $1 in FCF, which still amounts to $1 of revenue and FCF.

In the TTM PLTR, $980.3 million in FCF has been generated, and its market cap is $123.09 billion. PLTR is trading at 123.06 times the amount of FCF it generates. Its competitors of DDOG and SNOW, trade at 61.31 times and 48.77 times their FCF. Companies such as CRM and CSCO which both generate more than $10 billion in FCF, trade at multiples of 25.85 and 22.60 times their FCF. The amount of FCF that PLTR generates doesn’t justify the valuation, and profitability does matter. We have seen this happen with TSLA and other companies in the past. This doesn’t mean that PLTR can’t continue to go up or grow into the current valuation, but at these levels, making the case for investing in PLTR becomes much more difficult.

Steven Fiorillo, Seeking Alpha

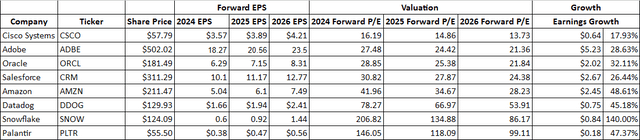

When I look at the forward estimates for EPS growth, PLTR looks even more expensive than an FCF model. PLTR is expected to generate $0.38 in EPS for 2024, then generate $0.47 in 2025, and $0.56 in EPS in 2026. PLTR is trading at 146.05 times its 2024 earnings and 99.11 times its 2026 earnings. This valuation is extremely high when I look at other software and tech companies. DDOG trades at 53.91 times 2026 earnings, while AMZN trades at 28.23 times 2026 earnings. Over the next two years, PLTR is expected to increase their EPS by 47.37%. The most common statement that I hear to defend highly valued companies is that you’re paying for growth. We saw how that worked out in 2021. PLTR is expected to grow its EPS at 47.37%, while AMZN is expected to see its earnings expand by 48.61% over the same period, and it trades for 28.23 times its 2026 earnings. You can pay a 28.33 multiple on AMZN compared to a 99.11 multiple for PLTR’s earnings for 1.24% more expected growth in EPS. If the defense is paying for growth, SNOW is expected to grow its EPS by 140% over the next two years to $1.44 compared to PLTR generating $0.56, and SNOW’s 2026 multiple on its 2026 EPS is 86.17. The numbers don’t justify the valuation, and I think that PLTR will retrace rather than continue appreciating for a while.

Steven Fiorillo, Seeking Alpha

Conclusion

As a long-term shareholder of PLTR, it doesn’t benefit my accounts to reduce my stance from very bullish to neutral on the company. From a business perspective, PLTR is achieving staggering growth as its customer count continues to grow. They are operating a high-margin business with FCF margins of 37.19%. As PLTR continues to close hundreds of deals in excess of $1 million and maintains a net dollar retention ratio of over 110%, it should be able to continue compounding its underlying profitability metrics. The inclusion into the S&P 500 was a strong vote of confidence and could potentially be the final thing that ends the bear case on PLTR being an AI imposter. Looking out 5-10 years, I am still bullish on PLTR, and that is why I am not ringing the register with shares above $50. Today’s valuation makes me less inclined to add to my position and is making me turn my investment perspective to neutral. Anyone who is looking to add shares at these levels should read through all of the financial metrics because a top may have been established for the foreseeable future. If we see a retracement, I will likely add to my position, but for now, I am holding onto my position and waiting for a better opportunity to purchase more shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, NVDA, TSLA, CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.