Summary:

- Starbucks’ new CEO is seemingly on the right track, implementing customer-focused changes that should resonate well with consumers.

- Some of these include removing extra charges for milk customization, adding comfortable seating and amenities, as well as leaning out the company by reducing new store openings and renovations.

- These changes will take time, and I expect these changes to positively impact the company in the next 2–4 quarters.

- If SBUX’s new CEO is successful, this should drive price appreciation over the long term.

- The recent dividend increase shows their new CEO is confident in his ability to re-establish Starbucks as the preferred community coffee house.

bensib/iStock Editorial via Getty Images

Introduction

Starbucks (NASDAQ:SBUX) has faced their fair share of headwinds over the past year or so, partly due to higher for longer interest rates. Consumers financials have become negatively impacted as inflation has been persistent despite the FED’s 50 basis point rate cut this past September.

And due to its own headwinds that the coffee giant had been facing, the retailer snagged Chipotle Mexican Grill’s (CMG) CEO, Brian Niccol to lead the charge in turning the company around.

While I expect Starbucks to continue to face headwinds for the near to medium-term, I suspect their new CEO will be successful in transforming the coffee behemoth into the neighborhood powerhouse they were once known to be.

In this article, I discuss the company’s latest earnings, fundamentals, and why I think Starbucks is likely to see a successful turnaround over the long-term.

Previous Thesis

I covered Starbucks this past August with a buy rating shortly after the company hired their now CEO Brian Niccol. As a result, their share price rallied as investors shared the same optimism in the company’s chances of a successful turnaround.

Since then, the stock is up over 6%, even beating the S&P who is up 2.25% over the same period. During the third quarter the company saw some improvements, but still faced challenges, particularly in their international segments.

Seeking Alpha

During his tenure at Chipotle, Brian Niccol was able to grow the company’s revenue by 116.7% from $4.555 billion to $9.872 billion. He was also able to improve the company’s gross and operating margins to 26.20% and 15.78% respectively.

I also touched on SBUX’s dividend, which saw the coffee giant raise this by 7.5% the prior year. Investors, as well as myself, remained skeptical of the upcoming increase due to prominent headwinds they were facing. I predicted an increase between $0.02 – $0.04, which I’ll discuss more in depth later.

The Turnaround Will Take Time

With Niccol’s first quarter as CEO in motion, it’s obvious the turnaround will take some time. I’m expecting to see a difference in the company’s financials over the next 2 – 4 quarters.

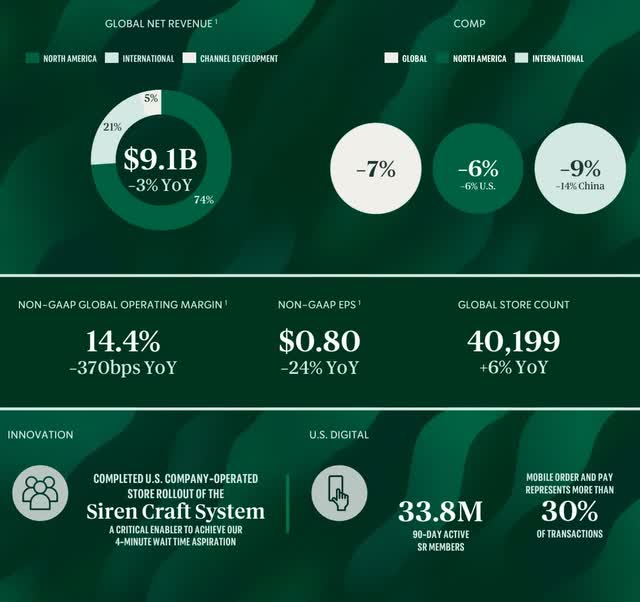

During Q4 earnings, SBUX’s headwinds were still persistent as the coffee retailer saw their revenue down 3% from the previous year at $9.1 billion and earnings per share of $0.80 down nearly 25% from $1.06. This was driven by foot traffic challenges in stores. SBUX saw a 7% decline in comparable store sales and an 8% decline in transactions in the U.S.

In China, their second largest market, these were more prominent as comparable store sales saw a steeper decline of 14% and an 8% decline in average ticket. This resulted in margins to contract 370 basis points to 14.4%. For the full-year, operating margins were 15%, down from 16.1% the year prior.

SBUX earnings snapshot

Although interest rates are anticipated to continue trending downward over the next several months/years, this will likely have a lagging effect, similarly to rate hikes. In turn, consumer discretionary businesses like Starbucks will continue to see headwinds as a result.

But, even with the disappointing earnings, the coffee giant’s share price was in the green, a testament to long-term investors’ confidence in the new CEO’s plan to turn the business around in the foreseeable future.

They also saw some positives during the quarter. Rewards members grew 4% year-over-year to 33.8 million despite being flat from the previous quarter.

When A Little Goes A Long Way

It’s easy to hire a new CEO, especially one that was successful in CMG’s transition, and I’m confident he can do it again. If you were thoughtful of comments made during earnings, it’s apparent Niccol has been paying close attention to customer concerns.

During earnings, he mentioned how he planned to get Starbucks back to the neighborhood coffee house vibe. How he plans to do this is by implementing customer service-focused changes.

Aside from fixing known staffing issues, the CEO plans to bring back coffee condiment bars in all cafes by early next year and lean the company out by reducing new stores & large-scale renovations in the upcoming fiscal year.

Niccol also plans to bring back more comfortable seating and amenities. Additionally, SBUX intends to roll out new coffee brewers sometime next fiscal year in all stores to deliver coffee more swiftly to their customers.

But what may be one of the most valuable changes to customers is removing the extra charge for non-dairy milk orders starting this month. Allowing customers to customize milk without any extra charge will likely resonate well and could lead to an increase in foot traffic.

This is what I mean when I say a little goes a long way. With consumer financials being negatively impacted by rising credit card and household debt, things like comfortability and removing additional charges will make a bigger impact and resonate with consumers over the long term, particularly non-rewards members.

Dividend Safety

The biggest surprise regarding Starbucks for some could be the recent 7% dividend increase to $0.61 this past October. Not only is he focused on the customer in the store, he’s focused on shareholders as well. And this is a further testament their new CEO believing he can successfully turn the company around in the foreseeable future.

The increase brings the dividend estimate for 2025 to $2.44. And although earnings declined 6% for the full-year to $3.31, the dividend remains more than covered by earnings with an annualized payout of $2.32. The company suspended their FY25 guidance, but I suspect by the end of the year things will start to look up for the coffee giant.

If so, I expect earnings will see some solid growth going forward. Currently, analysts expect earnings to decline to $3.18 by the end of the fiscal year and grow double-digits to $3.89 by FY26.

And despite headwinds, SBUX’s dividend was well-covered by cash flows as well. Cash from operations grew slightly from the prior year to $6.096 billion from $6.009 billion.

Subtracting their CAPEX of $2.778 billion, free cash flow of $3.318 billion was more than enough to cover dividend payments of $2.585 billion, giving the company a 77.9% payout ratio.

The company also repurchased shares, which should drive earnings and cash flow growth going forward. I would like to see a lower payout ratio, and as the quarters go on; free cash flow growth and buybacks are metrics I plan to pay close attention to moving forward.

Below, Starbucks’ cash from operations and free cash flow are expected to see solid growth over the next 3 years. Cash from operations is expected to grow to $8.722 billion while free cash flow is expected to grow to $4.925 billion over the same period, growth rates of 43% and 48% respectively from this year.

Author chart

Valuation

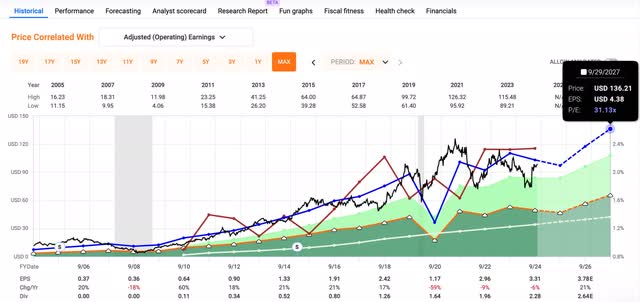

With a multiple over 31x earnings, I think the valuation is a bit rich for my liking. For a margin of safety, I like the stock in the $70 – $80 range where it traded before the news of their new CEO broke. And despite the company usually trading at a premium, the high likelihood of Niccol successfully turning the company around seems to be priced in already.

Over the long-term, however, I do expect their share price to trade much higher than the current valuation. But this is over the next couple of years. Moreover, as previously mentioned, it will take some time for the company to see any positive impact from the new CEO’s turnaround strategy.

And this, along with the strong price appreciation in recent months what leads me to downgrade the stock to a hold until I see obvious signs of the current strategy’s success.

Starbucks has a long-term price target of roughly $136 using their normal P/E of 31x. Moreover, if they are able to transition successfully in the coming months/years, I expect the company’s share price to see solid upside. However, this remains to be seen.

Fastgraphs

Downside Risks & Conclusion

Starbucks’ current risks are well-known by most investors. China, their second-largest market, still continues to be a huge risk for the company as well as the U.S. Their new CEO is implementing a strategy to transition the coffee retailer back into the friendly, community coffee house they were known for previously.

Starbucks also faces headwinds from competitors within the coffee segment. Recently, Luckin Coffee (OTCPK:LKNCY) announced they were planning to enter into the U.S. with much cheaper coffee ranging between $2 – $3.

Although this is expected to be on a small scale, this could resonate well with consumers, leading to increased expansion / competition for the coffee giant in the coming years.

But the company could also see some huge downside should the new CEO not be successful during his tenure. As seen by the suspended guidance and earnings miss recently, the share price held up well as the likelihood of a successful turnaround are seemingly priced in here.

But over the next one or two quarters, if headwinds persist, or become worse, I suspect the share price could fall to the low $80 range as investors grow tired and lose confidence in Niccol’s ability.

As mentioned previously, it will take some time, and I’m personally giving the new CEO a year minimum, which, I think, is sufficient time to see changes within the company.

Niccol seems to be on the right track implementing important, customer-focused changes which I expect to have a large impact and could drive increased foot traffic in the near to medium term. But these are likely priced in, and due to this along with time for changes to take effect, I am downgrading Starbucks to a hold at the moment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.