Summary:

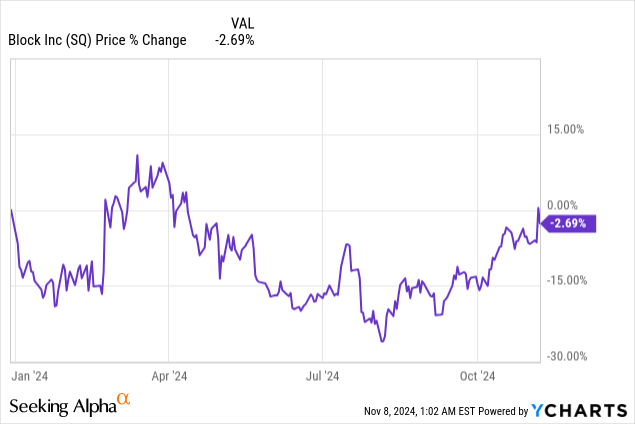

- Block reported decent Q3 ’24 results, driven by Cash App’s strength.

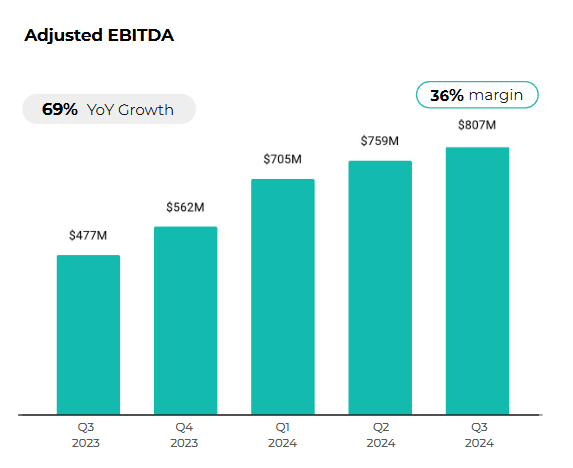

- Block’s EBITDA grew 69% year-over-year, with margins expanding to 36%, supported by Cash App’s momentum and an improved cost structure.

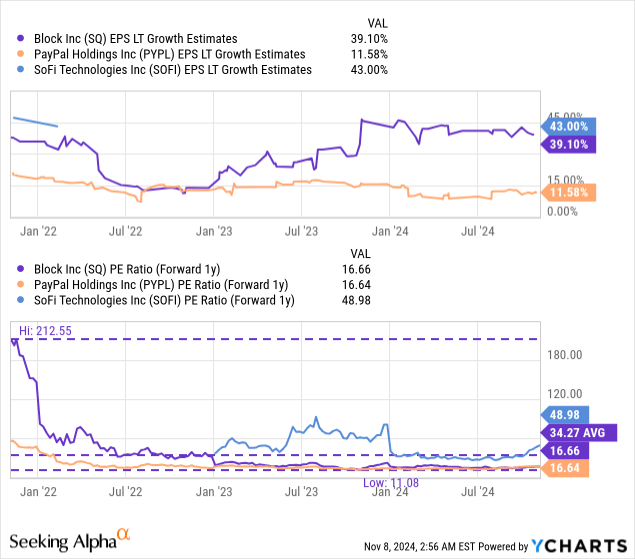

- Shares are attractively valued at 16.7X FY 2025 earnings, making Block a strong buy due to its rapid growth and profitability.

- Block is also expected to grow its EPS significantly faster than PayPal, but the Fintech is trading at the same FY 2025 P/E ratio.

- Risks include potential margin contraction or slowing adoption of Cash App Card, but current trends support a favorable long-term growth outlook.

BlackJack3D

Block (NYSE:SQ) reported results for its third fiscal quarter that met on earnings, but missed on revenues. Generally, however, Block saw decent Cash App strength and double-digit growth year-over-year in Cash App Card users. The Fintech benefited from continual gross profit momentum in both of its core businesses, and Cash App is now responsible for the majority of Block’s earnings on a gross profit basis. Shares of Block are also very attractively valued, with investors currently paying only 16X FY 2025 earnings for one of the fastest-growing, publicly listed Fintechs. I believe the long-term growth outlook is very favorable, and I continue to rate Block’s shares a strong buy.

Previous rating

I rated Block a strong buy in my August work on the Fintech because of the company’s growth, especially in terms of Cash App-related gross profits: The More It Drops, The More I’ll Buy. In the September quarter, Block continued to improve its profitability profile, due chiefly to Cash App, which resulted in the company reporting drastically higher EBITDA and margins as well. In my opinion, Block has massive potential to grow its gross profits, in both Cash App and Square, and the valuation is very attractive.

Block beats estimates

The Fintech met bottom-line expectations for the third fiscal quarter: Block reported adjusted earnings of $0.88 per-share and had a top line that came in at $5.98B, falling short of the consensus estimate by $280M.

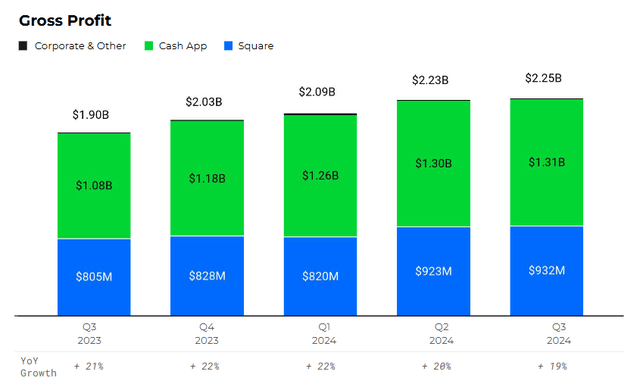

Although Block missed revenue estimates, the Fintech had a solid third quarter that showed 6% top-line growth year-over-year, and the Fintech made considerable progress in terms of growing its gross profits as well. Total consolidated gross profits reached $2.25B, showing 19% year-over-year growth. What stood out from Block’s earnings scorecard yet again was the solid momentum that the Fintech experiences in the Cash App segment. In this business, Block generated 21% year-over-year growth in gross profits, compared to 16% growth in the Square segment. Cash App represented 58% of the company’s total gross profits, and it is here that the company has the momentum. The Cash App segment focuses on instant, digital payments, while Square is a retail-focused point-of-sale system that is chiefly focused on merchants.

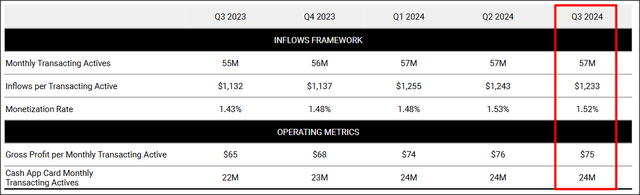

Block’s Cash App has considerable momentum and one key driver here in the year has been growing adoption of the company’s Cash App Card, a debit card that can be used to pay for goods and services. It allows users to tap into the Cash App ecosystem, and the Fintech has seen some inspiring growth here in the last year: total Cash App Card users reached 24M in the September quarter, showing 11% year-over-year growth. Growing product up-take of the Cash App Card is a key catalyst here.

Improving profitability profile

Block generated $807M in adjusted EBITDA in the third-quarter, showing massive 69% year-over-year growth. This growth comes from strong momentum in the Cash App ecosystem, higher scale (a larger number of users) compared to the year-earlier period and a better cost structure. Block laid off staff earlier this year in order to improve its profitability profile which is a trend we have seen in the technology industry in general. Block’s operating expenses grew 1% year-over-year in Q3’24 compared to 6% growth in revenues and 19% growth in gross profits, leading to positive operating leverage for the Fintech.

Importantly, Block managed to improve its EBITDA margins by a significant amount in the last year: as of the end of the September quarter, Block expanded its EBITDA margin to 36%, showing an 11 PP year-over-year expansion.

Block

Block’s valuation is offensive

Since Block is solidly profitable, we can use a price-to-earnings approach to valuing the Fintech and its main rivals in the market for instant, digital payments. Block is currently valued at a forward price-to-earnings ratio of 16.7X which puts the Fintech’s valuation multiplier about on the same level as PayPal (PYPL)’s. However, Block is expected to grow its EPS about 3.4X faster than PayPal in the long term, suggesting that the Fintech’s valuation is almost offensively cheap.

In the chart below, I am comparing Block’s, PayPal’s and SoFi Technologies (SOFI)’s forward P/E ratios and long term EPS potential. From a growth perspective, I believe SoFi is by far the most promising investment in the industry group with an estimated long term EPS growth rate of 43%, but this growth is also reflected in a much higher P/E ratio of 49X. I explained recently why I see a long-term fair value of $30 for SoFi’s shares. PayPal is chiefly a capital return play due to its large moat and high, recurring free cash flow.

Block, on the other hand, has the right combination, at least for me, of above-average EPS growth and a moderate price-to-earnings ratio. Trading at just 16.7X forward earnings, the Fintech’s shares are also priced at a 51% discount to the historical average P/E ratio. In my previous coverage I stated that I saw a fair value of $108 per-share for Square due to its strength in both core businesses, but especially in Cash App.

This fair value estimate was based off of a consensus estimate of ~$4.50 and a fair value P/E ratio of 25X, and I believe that Block’s improving EBITDA profile justifies a significant revaluation to the upside. Applying a 25X P/E ratio to the current consensus estimate of $4.49 per-share calculates to a new fair value of $112 per-share, implying 49% upside revaluation potential. Given its strong prospects for EPS growth, especially in the long term, I believe the market underprices Block’s potential for both growth as well as multiplier expansion.

Risks with Block

The biggest risk for Block, as I see it, relates to the Fintech’s gross profit growth in the Cash App segment. It is here that the company has considerable momentum, which in turn backs up Block’s valuation. What would therefore change my mind about Block is if the Fintech were to see slowing product up-take of the Cash App Card or weakening segment top-line growth.

Final thoughts

Block is benefiting from strong EPS and gross profit growth that is driven mainly by Cash App, the Fintech’s crown jewel business that is seeing higher product adoption rates. Cash App Card, which allows customers to tap into the Cash App ecosystem through the use of a debit card, is seeing excellent growth as well. I believe the market is wrong about pricing Block’s shares at about the same P/E ratio as PayPal, as the former is expected to see 3.4X stronger long term EPS growth than PayPal. Shares of Block have considerable long-term revaluation potential… if the Fintech can continue to grow its core business at double-digits, increase Cash App Card usage and enhance its EBITDA margin profile further.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ, PYPL, SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.