Summary:

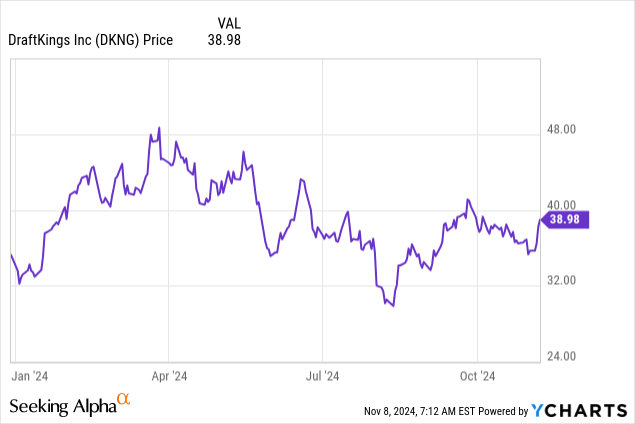

- Shares of DraftKings slid after reporting Q3 results, primarily because the company lowered its full-year revenue and adjusted EBITDA targets.

- The company blamed unfavorable NFL outcomes so far QTD in Q4 as the reason for the drop. In Q2, the company made a similar statement about MLB outcomes.

- The company is still retaining its expectations of $0.9-$1.0 billion in adjusted EBITDA in FY25, which represents nearly quadrupling profits – an unreasonable expectation.

- Even if we assume DraftKings can hit these targets, the stock already trades at a rich ~19x next year’s adjusted EBITDA outlook.

Joe Hendrickson

It has been an optimistic earnings season so far, buoyed by lower interest rates and the hopeful prospects of Donald Trump’s re-election, but for those few companies that have adjusted their outlooks downward, investors have been rather unforgiving.

DraftKings (NASDAQ:DKNG) is one of those companies. The fantasy sports and online sports betting company is continuing to ace expectations on the top line, adding new active players at a rapid pace: but at the same time, its profitability is turning an unfavorable corner. To me, investors’ focus on the bottom line is a signal that the market is turning substantially more conservative amid all-time index highs. After accounting for the company’s post-earnings losses, DraftKings’ gains this year have been sliced down to under 10%, substantially underperforming the S&P 500. In my view, a more cautious market and the fact that DraftKings is already expensive despite lowered guidance could signal further losses ahead for DraftKings.

I last wrote a neutral note on DraftKings in October, downgrading the stock from a prior buy rating. Now, after parsing through the company’s latest Q3 results and looking into its expectations for next year, I’ve become far more bearish on the company’s prospects (especially given its price!) and am downgrading the stock further to a sell rating.

To me, here are the core risks that the company is facing:

- Multiple quarters of unfavorable sports outcomes. For several quarters now, the company has blamed adjusted EBITDA misses on “unfavorable sports outcomes,” particularly in the NFL. While sportsbook hold figures will vary from time to time, it’s a bad signal when DraftKings keeps blaming unfavorable outcomes on its weaker profitability: shouldn’t the house always be winning in the long run?

- The company relies heavily on fickle government decisions that are out of its control, and yet dominate its future. A lot of the company’s present valuation is based on the hopes of expansion to other states and territories beyond the U.S. In addition to this, Illinois’ recent decision to substantially increase the taxes on gambling activity also shows the company’s susceptibility to political whims.

- Macro risks may put consumers in a more wary state to be gambling their budgets away. We continue to hear rumblings of an incoming recession in the U.S. Businesses like retail and restaurants are reporting that customers are delaying purchases and trading down to cheaper alternatives; B2B businesses are also slowing down their own purchases in response. Against this backdrop, few people may be willing to gamble.

Steer clear here and sell this stock if you own it.

FY24 guidance lowered

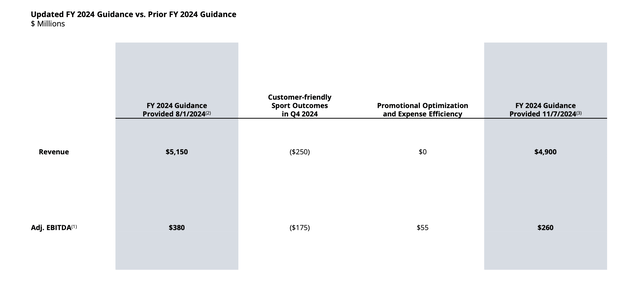

Let’s now address the primary elephant in the room that is weighing on the stock today: the cut to FY24 guidance expectations.

DraftKings guidance cut (DraftKings Q3 earnings deck)

The company sliced its full-year revenue outlook by $250 million (5% on a full-year basis, but over 20% in the context of the one quarter (Q4) that remains in the year. This is meanwhile flowing through as a $120 million reduction (32%) in adjusted EBITDA, of which -$175 million is flowed forward from the revenue reduction with a $55 million positive offset from lower promotional expense versus prior expectations.

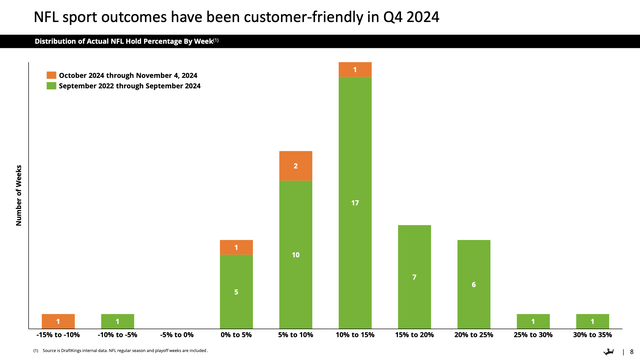

The big culprit here, apparently, has been the NFL. The chart below showcases how structural hold percentages (with higher hold translating to higher revenue and thus, more favorable for DraftKings) has trended in Q4 quarter-to-date (in orange in the chart below) versus the preceding two years. The vertical y-axis on the chart below indicates the number of weeks that DraftKings’ average hold actualized in the percentage range on the horizontal axis.

DraftKings NFL outcomes (DraftKings Q3 earnings deck)

Needless to say, the orange bars (Q4 QTD through the week ending on November 4) has seen much lower hold. And yet we do have to call out the fact that DraftKings has used this excuse before. In Q2, the company called out weaker MLB results as a reason for weaker-than-expected profitability, with the company calling out that the most-bet MLB teams that customers favored ended up winning a higher percentage of games.

How often can we expect this to happen? And when will investors start to wonder if DraftKings has effective risk management or operating controls in place to ensure its margins are protected?

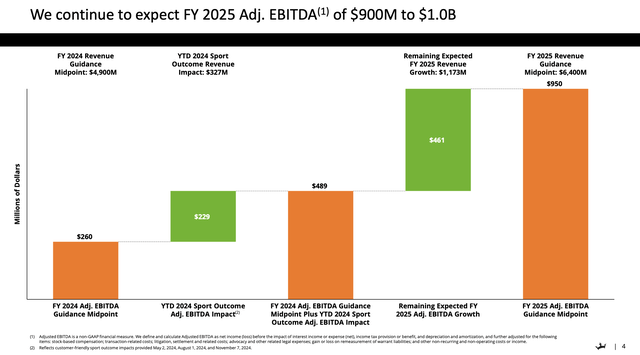

FY25 download calls for adjusted EBITDA to now nearly quadruple

The bigger reason that I am bearish now, however, is that I believe DraftKings may be setting itself up for further guidance disappointments in FY25. Despite the fact that the company substantially cut its profitability expectations in FY24, it has reaffirmed its outlook for FY25, reiterating its expectations of $0.9-$1.0 billion in adjusted EBITDA – the midpoint of which represents 3.6x expansion over this year’s latest outlook. It’s also initiating a revenue outlook of $6.2-$6.6 billion, which represents a growth range of 25-33% y/y growth

We have to take a step back and ask ourselves: does nearly ~4x EBITDA make sense when profitability is trending the wrong direction this year? The chart below shows a bridge of how DraftKings intends to get from this year’s $260 million in adjusted EBITDA to next year’s outcome.

DraftKings FY25 guidance retained (DraftKings Q3 earnings deck)

There are three primary reasons why I think this outlook is unreasonable to attain, and why I called it a “fantasy” in the headline.

Number one: the company is citing that unfavorable sports outcomes were basically a one-off in FY24 and not a sustained part of the company’s operations going forward. It has added $229 million in adjusted EBITDA back to next year’s profit expectations for this, or nearly the amount of FY24’s adjusted EBITDA in total. When the company has cited unfavorable outcomes in each of the past two quarters, I’m far less inclined to write these situations off as one-timers, and not exactly willing to bet on this normalizing next year.

Number two: recall that last quarter, DraftKings made a big deal out of the state of Illinois raising its taxes on gambling to above 20%, which enters into DraftKings’ definition of a “high tax state.” There are now four such states – on top of Illinois, the markets of New York, Pennsylvania, and Vermont also tax gambling at higher than a 20% rate.

Previously, DraftKings had a plan to offset these higher taxes by implementing a customer surcharge (which it cited as potentially driving upside to the company’s $0.9-$1.0 billion EBITDA target for FY25). However, the company has walked that plan back. These higher tax rates, as well as the possibility that other states might follow suit without any offsetting revenue increase from the company, is another unknown headwind to DraftKings’ net revenue and profitability next year.

Lastly, DraftKings is banking on $461 million of positive adjusted EBITDA growth (relative to this year’s guidance) to flow through from the revenue growth expectations of 22% y/y, or $1.173 billion as shown in the chart after adjusting for the impacts of unfavorable sports outcomes. The implied adjusted EBITDA flow-through margin on this revenue growth is 39%. This compares to DraftKings’ FY24 adjusted EBITDA margin of just 5%, and the most recent quarter even saw an adjusted EBITDA loss. Note as well that “sports outcome normalization” is already separately factored in. Yes, it’s true that DraftKings will have some opex leverage if it grows headcount at a slower pace than the ~20% expected revenue growth, and that the company has been lowering the rate of promotional incentives to bring new customers on board. But can we really bank on such a huge jump in adjusted EBITDA margins for this incremental revenue?

Unlike many other tech companies, DraftKings evidently doesn’t take a conservative approach to guidance, with its outlook reflecting management’s best view of the business at the time – in an industry that has proven itself to be quite volatile. To me, DraftKings is set up for further disappointment in FY25.

Valuation and key takeaways

Even if we take DraftKings’ guidance at face value and assume it won’t need to cut further, the stock is already quite expensive against these expectations. At current post-earnings share prices near $36, DraftKings trades at a market cap of $17.80 billion. After we net off the $877.8 million of cash and $1.26 billion of debt on DraftKings’ latest balance sheet, the company’s resulting enterprise value is $18.18 billion.

This already sits at a 19.1x EV/FY25 adjusted EBITDA multiple, against the $950 million midpoint of the company’s existing $0.9-$1.0 billion guidance range. Even if DraftKings does remain faithful to this outlook (which I think is unlikely), the stock is already priced for success.

All in all: results are trending the wrong way for DraftKings, and to add insult to injury, the stock is still very expensive and at risk of a multiple re-rating downward. Sell here and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.