Summary:

- Super Micro Computer, Inc. experienced extreme volatility in 2024, with a dramatic 66.03% decline followed by a further 45.63% drop, defying mean reversion strategies.

- Despite recent declines, SMCI’s forward P/E ratio of 6.785x and forward P/S ratio of 0.478x make it highly attractive compared to industry peers.

- The stock’s current trading levels suggest potential for limited downside, with key support at $15.83 and RSI indicating oversold conditions.

- Given the low relative valuations and potential for upside reversal, SMCI remains a “buy” for contrarian investors, with protective stop losses recommended.

da-kuk

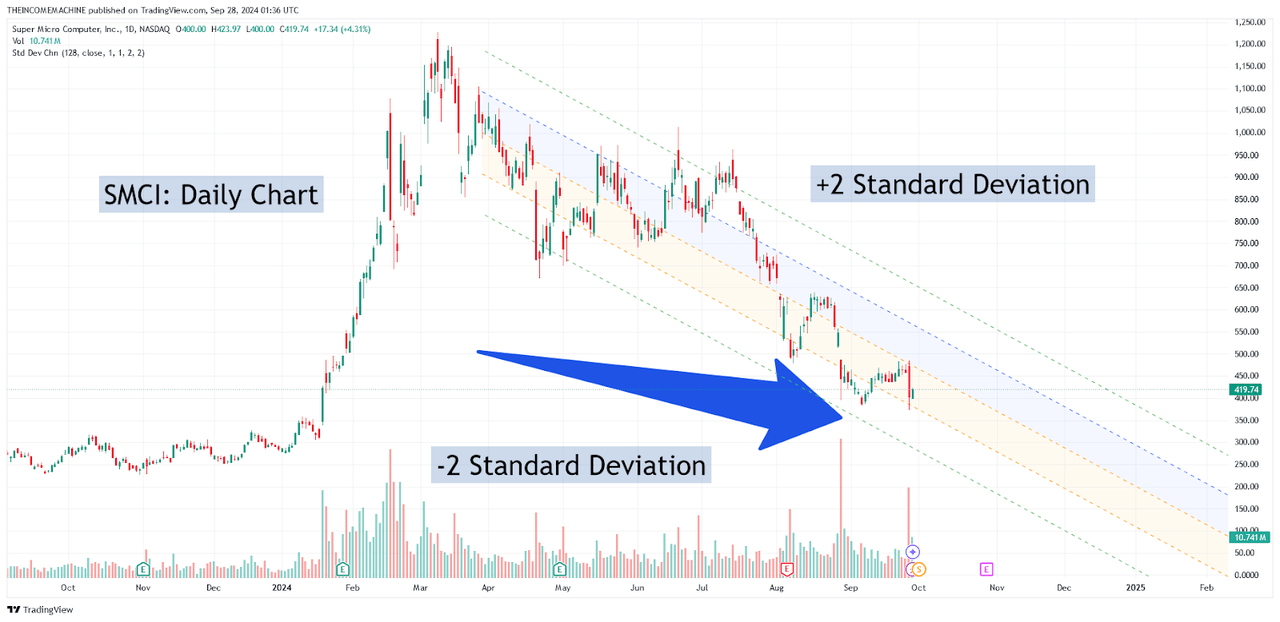

One of the wildest and, perhaps, least likely financial markets news stories of 2024 has been the extreme series of enormous trend reversals experienced by Super Micro Computer, Inc. (NASDAQ:SMCI) investors over the last year. When I last covered the stock on September 30th, 2024 with my article “Super Micro Computer: Buy The Crash“, the stock had fallen by nearly -66.03% in less than seven months. In the article, I discussed the severity of Super Micro Computer’s decline and the potential for an upside reversal given the test of the bottom of the -2 standard deviation price channels that occurred near the end of August:

SMCI: Yearly Stock Declines Test Important Standard Deviation Levels (Income Generator via TradingView)

To summarize the contrarian thesis of the main bullish aspect of the article, I explained:

Share prices are unlikely to extend much further in the bearish direction because downward price movements that pierce through the -2 standard deviation channels are only expected to be seen for about 2.5% of the time (before reverting back to the mean). In other words, share prices are expected to remain within the +/-2 standard deviation price channel 95% of the time – and we are already threatening to breach these areas on a daily timeframe. So while this advantage still does not give us 100% certainty that share prices will be able to move back toward the longer-term averages (the 0 standard deviation line), this does suggest that mathematical probabilities clearly favor long positions rather than short positions at current levels.

However, since the article was written, we have received bombshell news that auditing firm Ernst & Young announced its resignation and the market reaction has been quite dramatic in nature. Additionally, Super Micro Computer recently reported preliminary earnings results for the fiscal first quarter, calling for revenues of $5.9-6 billion and $0.75-0.76 in EPS (adjusted). In both cases, these figures represented downward revisions relative to Super Micro Computer’s prior expectations, and the midpoint of this new revenue guidance falls below prior consensus estimates ($6.44 billion). On the positive side, this EPS guidance was actually a small improvement relative to the consensus estimates seen previously ($0.74). In the periods that followed my last article coverage for Super Micro Computer, the stock has fallen by another -45.63% and this massive decline has done significant damage to my prior projection models. As a result, I cannot characterize the stock as a “strong buy” because there are simply too many unknowns at the moment and SMCI price action has demonstrated that conventional mean reversion strategies have already shown weaknesses in terms of reliability and accuracy.

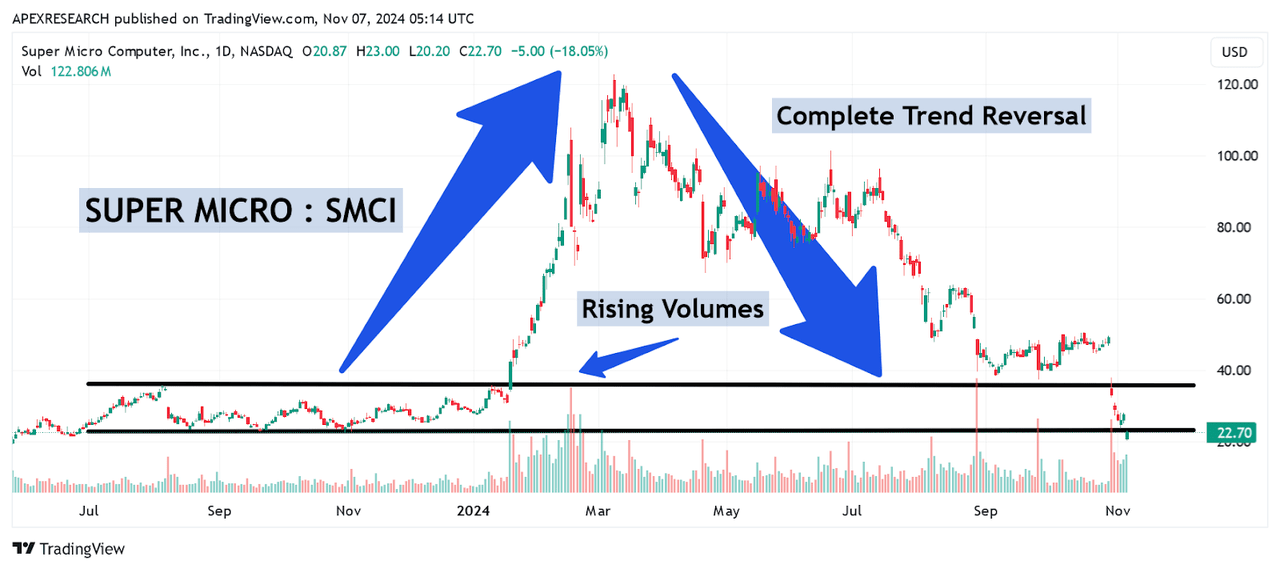

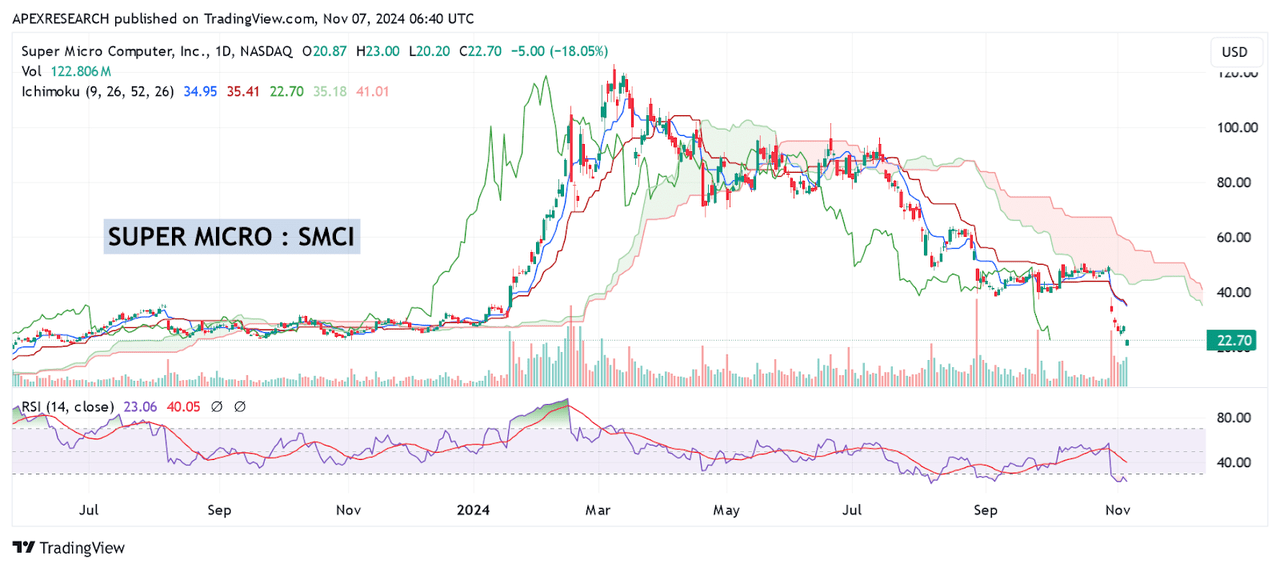

SMCI: Major Trend Reversal Points in 2024 (Income Generator via TradingView)

To get a better sense of what has actually occurred with SMCI share prices on a YTD basis, we must first pull out to very broad time frames so that we can reassess this recent chart history with a revised outlook. Initially, share prices started the year at $28 per share and quickly exploded to $122.90 in just 61 days. Of course, these gains of nearly 338.93% caught the market’s attention as a newer high-flyer in the artificial intelligence space. But the eventual reversal from these highs was even more surprising because that entire January-March rally would be fully retraced before the end of October (when prices fell to $27.22 per share) in a complete trend reversal that led to enormous destruction in share price values for investors. As we can see, rising trading volumes initially supported the upward strength in momentum and the validity of the bullish trend waves that developed toward the beginning of the March trading period. However, this major downside reversal from the stock’s all-time highs was so substantial that investors have really been left with no choice but to question long-term sustainability of SMCI share price valuation anywhere near those prior elevated levels.

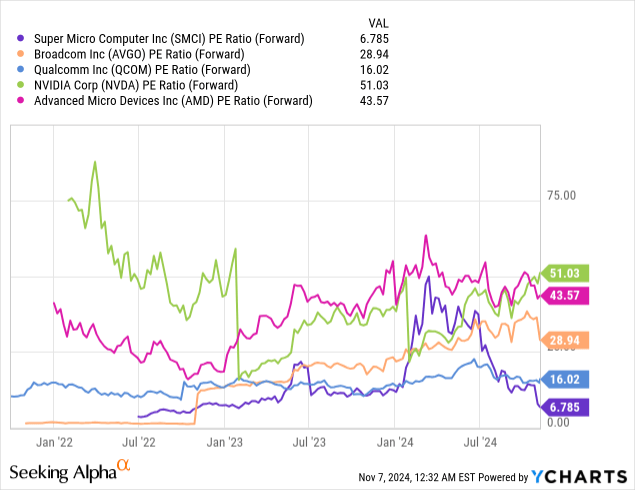

Super Micro Computer: Comparative Forward Price to Earnings Ratios (YCharts)

Data by YCharts

On the other side of the debate, there is still a strong argument to be made that recent declines in SMCI share prices have actually presented investors with a highly attractive opportunity to capitalize on the stock’s comparative forward valuation prospects. Specifically, Super Micro Computer currently trades with a forward price-earnings ratio of just 6.785x. To get a sense of where this depressed metric stands in relation to industry competitors within the same peer group, we can look at the forward price-earnings valuations for companies like Qualcomm, Inc. (QCOM) at 16.02x and Broadcom, Inc. (AVGO) at 28.94x. However, if these stocks seem expensive on a comparative basis, we can also compare Super Micro Computer to companies like Advanced Micro Devices, Inc. (AMD) at 43.57x and Nvidia Corp. (NVDA), which is much more expensive (at 51.03x).

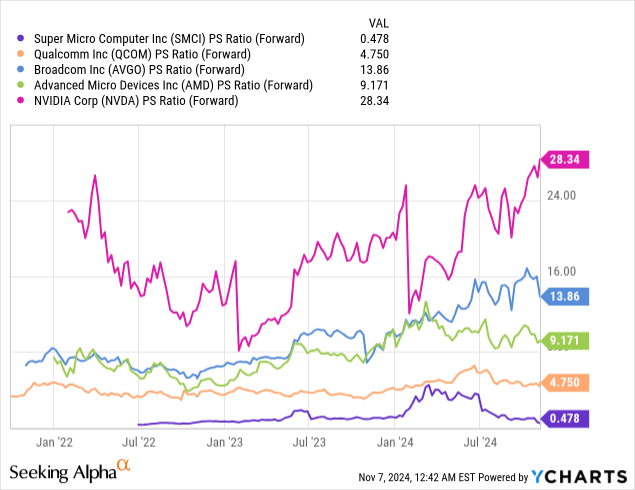

Super Micro Computer: Comparative Forward Price to Sales Ratios (YCharts)

Data by YCharts

For an alternative viewpoint, we can also look at Super Micro Computer’s forward price-sales ratio, which currently stands at just 0.478x. Again, this ratio is far below Qualcomm at 4.75x and AMD at 9.171x, but these are still the cheaper options in this group. In contrast, Broadcom is currently trading with a forward price-sales ratio of 13.86x and Nvidia is again trading at much higher valuations of 28.34x. As we can see, Super Micro Computer is still trading at incredibly low relative valuations, so I will not be reducing my outlook below a “buy” rating at the moment.

SMCI: Identifying Important Price Support Zones (Income Generator via TradingView)

Ultimately, it’s clear that these types of volatile trading conditions can be quite dangerous for investors with conservative portfolio strategies. Stocks that rally by more than 330% in just two months can attract a lot of attention in the financial news media, as many investors might wind up taking long positions at elevated levels. In my prior article, I argued that improved reversal probabilities favored taking long positions after the stock had fallen to extreme lows. However, this stock managed to defy those mathematical probabilities and my stop losses were hit in the process.

For these reasons, I think the best way to approach this type of erratic price action is to identify important support and resistance levels that are most likely to influence share prices near-term. Now that the stock is trading back into the regions that were visible during the beginning of the year, we can see that the recent downside break of prior range-bottom support zones at $22.30 suggests that the next major historical support level can be found at the May 2023 lows of $15.83. Fortunately, November 2024 price lows currently rest near $20.20 and relative strength index indicator readings on the daily time frames have fallen into oversold territory (near 23.4). When taken into combination with one another, these chart signals suggest potential for limited downside going forward.

Now that comparative forward valuation metrics have reached extreme depths relative to key competitors within Super Micro Computer’s industry peer group, it seems clear to me that the potential for an upside bullish reversal remains viable. For all of these reasons, I think SMCI is a stock that should still be considered for potential buy positions for contrarian investors looking for undervalued stocks within the technology sector. However, given the extreme downside price volatility that has already been experienced this year, protective stop losses are vital and the aforementioned support zone found near $15.83 can be utilized as a potential stop loss placement level for positions taken in the lower $20s.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.