Summary:

- DraftKings faces significant litigation risks, including uncertainty about the legal status of Reignmakers NFTs.

- The company generated 9 figures in gross sales from the endeavor but is now the target of a class action lawsuit.

- A separate NFLPA lawsuit alleges DraftKings owes an estimated $65 million due to contract cancellation conditions having not been met.

- The changing of the guard in Washington could be a life raft for the company’s digital asset problems, but the path forward remains very unclear.

bluecinema/E+ via Getty Images

As another US election narrowly brings the state of Missouri into the addressable market for online sports betting, DraftKings (NASDAQ:DKNG) has released earnings for Q3 2024. This is my first time covering DraftKings for Seeking Alpha but it’s a company that I’ve been interested in as a possible investment in the past. In my initial coverage of the stock, we’ll have a look at ongoing litigation issues from the company’s discontinued NFT product and assess whether DKNG stock is worth a speculative investment given what many expect to be a quickly changing regulatory environment.

Lawsuits & NFTs

There is no shortage of litigation risk pertaining to DraftKings. The company has roughly a dozen ongoing lawsuits by my count. Those suits involve various claims pertaining to patent infringement, unpaid prize money, the legality of daily fantasy sports offerings in certain jurisdictions, and the sales of Non-Fungible Tokens (or NFTs). Regarding the latter, there are two distinctly different battlefronts; the first being whether or not the tokens themselves are unregistered securities offerings and the other being an alleged breach of a licensing agreement with the National Football League Players Association (referenced from here as the NFLPA).

Before going much further, I want to make it abundantly clear that I’m not in any way a legal scholar or law expert. But I have a viewpoint on the unregistered securities offering angle that I hope will provide insight to current shareholders and prospective investors. First, the company’s Reignmakers NFT project was arguably one of the most successful examples of real-world utility in the digital asset space before the company ended it in late-July due to legality concerns. This was a disappointing end to what had actually been a very interesting complimentary business line.

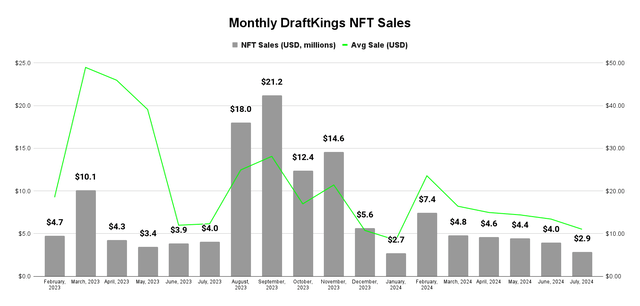

Through its licensing contract with the NFLPA, DraftKings allowed users to enter certain contests in the platform provided they had Reignmaker NFTs. Since NFTs were essentially player-based digital trading cards, there was a strong synergy with the company’s daily fantasy sports offering. While DraftKings hasn’t broken out revenue from NFT sales in its earnings report, the company utilized the Polygon (MATIC-USD)/(POL-USD) blockchain to facilitate the transactions. As a transparent public chain, we can see exactly how much DraftKings generated from NFT sales by month through its NFT product offerings:

DraftKings NFT Sales (CryptoSlam, Author’s Chart)

Despite the broader NFT market having peaked well over a year prior, DraftKing’s NFT sales were bucking the market and performing quite well during the beginning of the 2023 NFL season. According to data from CryptoSlam, DraftKings made $39.2 million in NFT sales between August and September of last year alone and generated well over 9-figures in sales during the life of the project. To date, DraftKings is still ranked as the 21st highest grossing project in all-time NFT sales and remains the highest grossing project on the Polygon blockchain. And yet, it ends with not one, but two ongoing lawsuits.

The primary issue from the perspective of the NFLPA seems to be that DraftKings doesn’t believe it should have to honor the remainder of the contract because it can no longer monetize the player licensing rights. The LA Times recently published a breakdown of what the NFLPA says would justify contract termination:

It says the agreement would allow DraftKings to bail out only if it or the NFLPA is declared bankrupt, if any provision of the agreement is found to violate the law, or if the Securities and Exchange Commission or state regulators declare NFTs to be securities. (Another termination provision is redacted in the lawsuit and the copy of the license agreement attached as an exhibit.) The NFLPA says none of those conditions has been met.

The bold in the quote above is my emphasis as this is where the NFT battlefronts converge. The NFLPA may have a valid argument. Which puts DraftKings in a very difficult position because it is defendant in a class action lawsuit due to an allegation that Reignmakers cards were unregistered securities – which DraftKings denies. Yet, the conditions necessary to void an estimated $65 million obligation with the NFLPA don’t appear to have actually been met because the SEC has not directly deemed Reignmakers NFTs to be unregistered securities.

Are NFTs Unregistered Securities?

With respect to the NFLPA lawsuit, I suspect the bigger concern for DraftKings – and by extension DKNG shareholders – is a class action lawsuit that was recently denied dismissal. From DraftKing’s latest 10-Q, the complaint against the company is as follows:

the NFTs that are sold and traded on the DK Marketplace allegedly constitute securities that were not registered with the SEC in accordance with federal and Massachusetts law, and that the DK Marketplace is a securities exchange that is not registered in accordance with federal and Massachusetts law.

As mentioned above, DraftKings denied these allegations. So are Non-fungible tokens unregistered securities? It’s an important question and I’m going to give the best answer that I believe the market has, as unsatisfying as that answer may be; it depends.

The problem with the blanket statement that NFTs are unregistered securities is that not all NFTs possess the same qualities or utility. Some are no different from membership passes to a club or group. Others aren’t much different from URLs that just point to web-based images or other files. That said, there have certainly been instances where a strong argument could be made that a non-fungible token project is likely an unregistered securities offering.

For instance, there’s a fairly high likelihood that a court would find tokenized royalties from entities like Royal to be unregistered securities, in my estimation. Blockchain-based ‘investment contracts’ would likely need to hit all four requirements of the Howey Test to be considered securities. Under Howey, an asset is a security if it involves;

- an investment of money

- into a common enterprise

- with the expectation of profit

- to be derived from the efforts of others

Given this, I would argue Reignmakers NFTs fail to meet all 4 requirements of Howey as there can be no reasonable expectation of profit from buying what amounts to a digital trading card. Even though a select few of these NFTs may be profitably flipped after an initial sale, history has shown that most NFTs do not return a capital gain. Furthermore, to make the claim that a Reignmaker card is an unregistered security just because there is a small possibility that it may be sold at a profit after it is purchased, one would have to also deduce that a physical Pokemon card is also an unregistered security. This is an actual argument made by US Representative Ritchie Torres when questioning SEC Chair Gary Gensler during a House Financial Services Oversight Committee last year. What is uncertain is where DraftKings goes from here with these dual lawsuits given the changing of the regime in Washington.

Future Regulatory Possibilities

I’d wager there will be very little push back from those who have followed the digital asset space on this assertion: the Biden administration was highly combative to the industry in the United States. The prevailing wisdom shared by many in the space was that the SEC regulated by enforcement, repeatedly punted on providing the market with requested clarity, and attacked under-capitalized entities under the guise of consumer protection. That is likely changing. The re-election of President Trump is expected to result in a positive regulatory impact on domestic companies that have previously come under fire for digital asset sales. John Reed Stark, formerly the head of internet enforcement at the SEC, has publicly stated he believes the SEC’s ‘war on crypto’ is effectively over.

And that’s a reason for optimism if one views blockchain innovation as a good thing. Trump himself has a history of using the very network used by DraftKings to launch his own NFT products. Thus, it is widely expected that his administration will be far friendlier to the digital asset industry in the United States than the Biden administration was. The expectation from many who have covered public blockchains the last several years is that most NFTs do not meet the criteria needed to be defined as securities via the Howey Test. And there are certainly high ranking individuals in the US Securities and Exchange Commission who share that belief. Such as Hester Peirce; who figures to garner consideration for Gensler’s position when Trump is sworn in.

Closing Thoughts

Of course, this is all speculative. The reality is regulations will always be an ongoing concern for a company like DraftKings because sports betting legalization is still somewhat fresh and there are several states where sports betting is not legal. States like California and Texas are among the largest potential markets that companies like DraftKings are not legally permitted to serve. But in my view, the bigger question is whether or not DraftKings can find a way out of the NFT lawsuit pickle.

Elsewhere, I see DraftKings’ purchase of Jackpocket is an odd fit for a company that was born out of Daily Fantasy Sports. Lotto ticket services seem to lack strong enough synergy with current sports-focused revenue streams from gaming that requires more analytical skill than picking Powerball numbers. Reignmakers was actually a really terrific synergy with DFS. Yet, DraftKings discontinued the product because of a class action lawsuit alleging the NFTs were unregistered securities even though the SEC has yet to come out and say the same.

What DraftKings is left with is an estimated $65 million expense that it won’t currently monetize. This is all happening as an administration that has been combative to digital assets has been shown the door by voters in the United States. It’s quite the mess for DraftKings to navigate and I’m not really seeing a clear path to a happy resolution. Reignmakers seems like an example of a good idea that was simply executed at the worst time. Until there is more clarity regarding these lawsuits, I’m initiating DKNG as a ‘hold.’

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of POL-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.