Summary:

- JPMorgan remains highly profitable, with strong net interest income and a robust CET1 ratio of 15.3%, despite increased loan loss provisions.

- Preferred shares offer a steady income stream, with a 6% fixed dividend yield, making them attractive for income-focused investors.

- The Series EE preferred shares are appealing, but currently slightly above my buying range; I would consider buying at $25/share.

- I hold a small position in JPMorgan common shares but haven’t increased it due to the stock’s rise beyond my limit price (and I haven’t chased it).

ridham supriyanto

Introduction

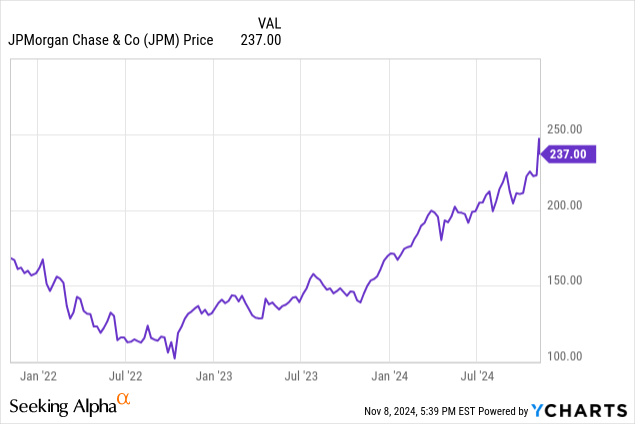

JPMorgan (NYSE:JPM) is a US-based financial conglomerate with a worldwide name and brand recognition. The bank’s share price has done very well in the past few years. But as interest rates on the financial years started to move down, I became increasingly interested in the preferred shares issued by JPMorgan. While the preferred shares don’t really offer any exposure to capital gains, they can be a useful security to focus on a steady and reliable stream of income. You can read all my older articles on JPMorgan here.

JPMorgan remains very profitable

Before going into more detail on a specific series of the preferred shares, I wanted to establish how well the preferred dividends are covered. As JPMorgan recently published its Q3 results, we have access to a fresh set of financial details.

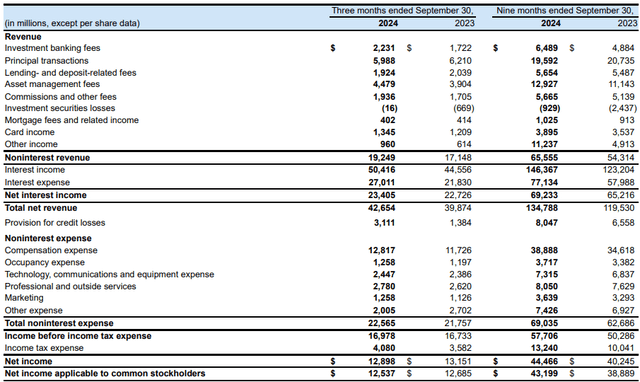

As the income statement of JPM below shows, it reported total net interest income of $23.4B, which is an increase of almost 3% compared to the third quarter of last year. On top of that, the total non-interest revenue increased from $17.15B to $19.25B, and that $2.1B increase only had an increase of the non-interest expenses to the tune of just around $800M associated with it.

JPM Investor Relations

It goes without saying the combination of a higher net interest income as well as a lower net non-interest expense had a very positive impact on the underlying profitability of the bank. The pre-tax income before loan loss provisions jumped to $20.1B. And despite a sharp increase in the loan loss provisions, which jumped from less than $1.4B in Q3 2023 to just over $3.1B in the third quarter of this year, the pre-tax income increased by a few hundred million dollars.

That ultimately resulted in a net income of $12.9B of which $12.54B was attributable to the common shareholders of JPMorgan, translating into an EPS of $4.38. While that was slightly lower than in the third quarter of last year, mainly due to a higher tax expense, the EPS increased by approximately 1% thanks to the reduced share count.

And although the total amount of loan loss provisions increased to $3.1B, the bank is still doing fine. After all, the cost of risk will fluctuate throughout the cycle and will be lower in good economic years and higher in weaker years. I think it’s fair to say 2024 is a weaker year, but as the income statement shows, the bank can still easily handle the higher loan loss provisions.

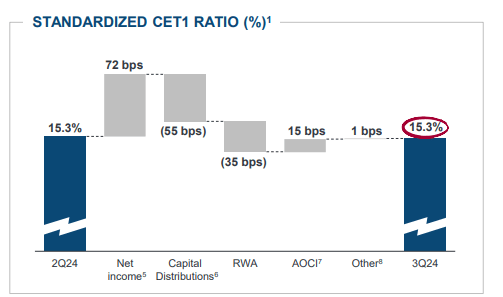

In fact, based on the Q3 financial results, JPMorgan can handle $20B per year in loan loss provisions before reporting a loss. Some authors have been focusing hard on the safety of the banks and were warning for higher loan loss provisions. And while that was a fair thing to warn for (and no one can say higher loan loss provisions are a surprising element to see), the larger US banks can still easily deal with these higher provisions. In fact, JPMorgan’s CET1 ratio of 15.3% is a ratio quite a few other banks would be jealous about.

JPM Investor Relations

With $273B in Common Equity Tier 1 capital and the current earnings profile of generating $80B per year on a pre-tax and pre loan loss provision basis, JPMorgan appears to be in a good position to immediately deal with any potential fall-out from a deteriorating loan book or higher risk market positions.

And to state the obvious: The bank needed less than 5% of its after-tax profit to cover the preferred dividends, so I’m satisfied from a preferred dividend coverage perspective.

The Series EE preferred shares: attractive on a small pullback

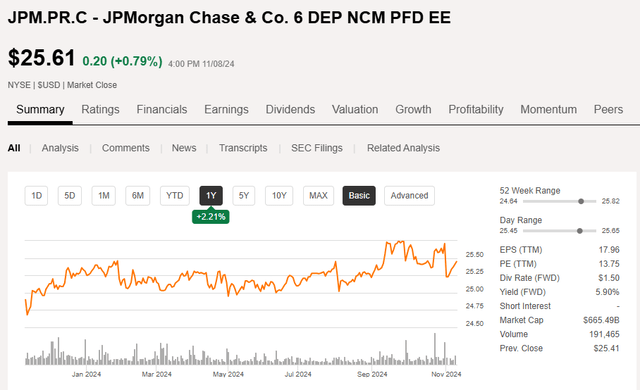

As explained in a previous article, there are 185,000 shares of $10,000/share outstanding, but the depository shares, trading as (NYSE:JPM.PR.C) represent 1/400 th as the principal amount of the depository share is $25. This means the total size of this issue is $1.85B. These preferred shares pay a 6% fixed preferred dividend yield and the annual preferred dividend of $1.50 is payable in four equal quarterly tranches of $0.375.

While writing this article, the share price moved up to $25.60, likely as the increasing interest rates on the financial markets are reducing the call risk.

Seeking Alpha

After all, in the past few months the five-year US Treasury rate increased from 3.5% to approximately 4.2% and this 70 bps increase obviously also has an impact on the interest-dependent securities. REITs have been suffering and preferred shares for sure have been impacted as well. This means that the cost of the preferred equity of 6% is just 180 bps above the perceived five-year risk-free interest rate and less than 170 bps above the 10-year Treasury yield, which currently stands at 4.31%.

Investment thesis

I would only be willing to pay the $25 principal plus one quarterly dividend payment per preferred share so the Series EE preferred shares are just outside of my buying range, but should it drop back toward $25/share, I could potentially be a buyer again as this security would be a useful diversification for my fixed income portion of the portfolio.

I have a small long position in the common shares of JPMorgan as well, and the sole reason why I don’t have a larger position is because the stock started to run away from my limit price and I haven’t chased it yet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!