Summary:

- Innovative Industrial Properties is rated as a Buy due to its modest valuation, stable rental income, strong financial position, and growth potential in the cannabis market.

- The stock fell due to Florida’s Amendment 3 not passing and a slight earnings miss, but I believe these are short-term issues.

- IIPR has done just fine in the past without Florida legalizing recreational cannabis, and it can continue doing just fine now.

- Despite preferring NewLake Capital Partners stock for its lower valuation and higher yield, IIPR remains attractive with a well-covered 7.14% dividend yield and growth potential.

David Trood/DigitalVision via Getty Images

Innovative Industrial Properties (NYSE:IIPR), a cannabis REIT, has fallen in the past few trading sessions, finishing the week trading at $106.37, even though it was in the $130s early on Wednesday. This was likely caused by a surprise result of Florida not passing an amendment (Amendment 3) to legalize recreational cannabis. According to usnews.com, “While 55.9% of Florida voters backed the proposed amendment, it did not reach the 60% threshold needed to make the initiative part of the state’s constitution.”

That caused other cannabis stocks to fall hard. For example, Trulieve Cannabis (OTCQX:TCNNF), one of IIPR’s tenants that has lots of exposure to the Florida market, fell by 38% on Wednesday. Other tenants, such as Curaleaf (OTCPK:CURLF)(CURA:CA), Green Thumb Industries (OTCQX:GTBIF), and Cresco Labs (OTCQX:CRLBF), fell by 30.45%, 16.42%, and 25%, respectively.

Compounding IIPR’s fall was an earnings report that slightly missed expectations due to tenant-related issues. However, the problems mentioned above don’t mean that IIPR is in trouble and that you should run for the hills. They’re short-term issues.

IIPR is still a very high-quality business, in my view, as it generates stable rental income through triple-net leases, meaning that all property expenses are paid by tenants, including repairs, property taxes, and property insurance. Plus, it has growth ahead as the cannabis industry grows, and it should benefit from falling interest rates. I also don’t view the SAFER Banking Act as much of a risk because it comes with some pros and cons.

Overall, I rate the stock as a Buy, as its dividend yield is now attractive at 7.14%. Nevertheless, I do think NewLake Capital Partners (OTCQX:NLCP), another cannabis REIT, is more attractive due to its lower valuation and higher dividend yield. I recently wrote about NLCP, and I share many of the same thoughts about IIPR that I do with NLCP. The main difference is the valuation.

Amendment 3 Doesn’t Get Enough Support. What’s Next?

Investors were clearly surprised when only 55.9% of voters supported Amendment 3 for Florida. So, what does this mean for IIPR? I think it’s more negative than positive for now, although it’s not the end of the world. There’s a mix of pros and cons and hope for the future.

Pros: This can help keep competition low for IIPR, as it will delay the expansion of the cannabis market in Florida, keeping more mainstream lenders from feeling a sense of urgency to enter the market. This will allow IIPR to more easily continue charging relatively high rent rates (the portfolio generates twice the yield of typical commercial real estate, according to the Q1 earnings call) and securing long-term leases.

Cons: On the other hand, recreational legalization in Florida could have helped IIPR’s tenants significantly. A recreational market expansion would likely boost the demand for new properties, which would lead to more business for IIPR. It could’ve also helped improve the financials of cannabis firms, reducing tenant-related risk for IIPR.

Looking Forward: Just because recreational cannabis isn’t legalized at the moment doesn’t mean that it won’t be in the future. The trend over the years has been toward legalization, not criminalization, and 55.9% is pretty close to 60%. In the Q3 earnings call, CEO Paul Smithers said, “While I think a lot of us in the industry are disappointed, by no means are we out in Florida. I think it’s a learning lesson, and I expect to see it again in 2 years on the ballot.”

I believe it’s quite possible that the 60% threshold will be passed in two years or at least some time in the next few years. Still, like I said, it’s not the end of the world, as IIPR has done just fine over the years without having recreational cannabis legalized in Florida.

IIPR Misses Earnings Expectations Slightly, But I’m Not Worried

IIPR stock also missed earnings Q3 expectations on Wednesday, November 6, which may have added to the fall. It wasn’t a big miss, though. IIPR’s normalized FFO per share came in at $2.02, missing the $2.03 estimate and down from $2.06 in Q2 2024 and $2.09 in Q3 2023. Further, revenue reached $76.5 million, missing the $77.4M consensus estimate and a bit lower than the $77.8 million achieved in Q3 2023.

This quote from a Seeking Alpha news article explains the situation well:

The year-over-year decrease was due to a $3.0M decline in contractual rent and property management fees in Q3 2024 related to properties that IIPR regained possession of since June 2023; a decline of $1.3M due to rent received but not recognized in rental revenues resulting from the re-classifications of two sales-type leases starting Jan.1, 2024; and $1.3M of contractually due rent and property management fees that were not collected during the current quarter.

That decline was partly offset by a $4.8M increase to contractual rent and property management fees, which was primarily driven by contractual rent escalations, amendments to leases for additional improvement allowances at existing properties that resulted in adjustments to rent, and new leases entered into since June 2023.

The company has re-leased several properties taken back since March 2023, but rent commencement on certain of those properties depends on tenants getting the needed approvals to operate and temporary rent abatements in certain instances. As such, IIPR doesn’t expect to recognize rental revenue from those properties until that has occurred.

These issues don’t worry me for the long term. The falling earnings are likely short-term because they come from temporary delays such as re-leased properties awaiting tenant approvals. Once the approvals occur, IIPR should see its revenues normalize. It’s more of a timing issue rather than a structural one.

IIPR Is Still Expected To Grow

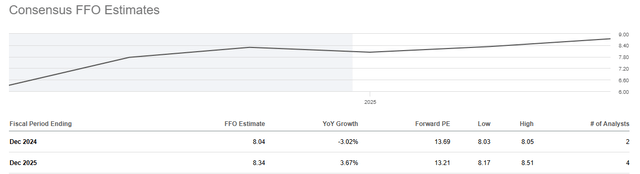

Another reason that I’m not worried about the headwinds the company is facing is that it’s still expected to grow. After the 3% drop expected for 2024 FFO/share, a modest 3.7% growth rate is expected in 2025.

IIPR FFO Estimates (Seeking Alpha)

But honestly, IIPR could surpass this expected growth rate, as the company itself expects the US legal cannabis market to grow at a 9% CAGR from 2023 to 2028. Similarly, NLCP expects a 10.5% growth rate from 2023 to 2027. Additionally, with interest rates falling, cannabis companies may be more willing to expand operations, spurring growth.

SAFER Banking Act Also Presents A Mixed Bag

If you’ve read my NLCP article, then you already know my thoughts on the SAFER Banking Act, but I don’t want to leave out any important information for new readers, so I will reiterate what I said.

The SAFER Banking Act, which has not yet been fully passed, could open up the floodgates for banks and financial institutions to offer financing to cannabis businesses. This would be good for the industry, but it brings both upsides and downsides for IIPR.

As I put it in my previous article on NLCP, “The main negative with this [SAFER Banking Act] is that it can introduce more competition for NewLake as other financial institutions step in to offer financing. This will likely cause NewLake to not be able to charge as much for rent.” The same logic applies to IIPR, which can hurt its pricing power.

However, there’s a flip side. As I also pointed out when discussing NLCP stock, “First, NewLake has expertise in designing and financing specialized cannabis facilities relative to traditional financial companies, giving it a competitive advantage.” IIPR, being the same kind of company, is in a similar position.

Another benefit is that the SAFER Banking Act could lower IIPR’s cost of capital since the company might be able to secure lower interest rates as industry risk falls. Lower capital costs could help IIPR remain competitive, even if yields on rent fall.

Finally, just like NLCP, IIPR’s weighted-average lease term is 14 years. Thus, even if competition increases, IIPR has plenty of time before it would feel the full effects on its rental revenue.

Innovative Industrial Properties Has A Strong Financial Position

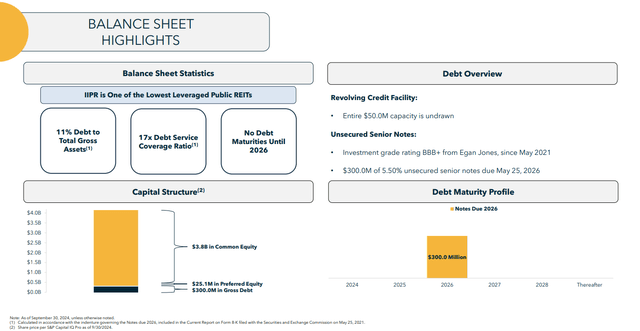

One of the things that I like about IIPR is its financial position. Specifically, it has an 11% debt-to-total-assets ratio, with no debt maturities until 2026. It also has a BBB+ rating from Egan Jones since May 2021 and a 17x debt service coverage ratio.

IIPR’s Balance Sheet Highlights (Q3-2024 Investor Presentation)

Combined with predictable cash flows from rent payments, this is clearly not a company that’s at high risk of default despite being involved in a relatively high-risk industry.

It’s worth noting, however, that IIPR isn’t the only low-debt cannabis REIT. NewLake Capital Partners had just 8 million in debt as of Q2 while having $436 million in assets.

The Valuation Is Attractive, But Still Not As Attractive As NLCP’s Valuation

At a share price of $106.37, IIPR has a dividend yield of about 7.14%. That’s great, especially for a company with growth potential, but I still prefer NewLake Capital Partners’ valuation. NLCP currently sports a dividend yield of about 9.7%, and that’s with an AFFO payout ratio of 82% (per its Q2 investor presentation), which is very similar to IIPR’s five-year average AFFO payout ratio of 85%.

Additionally, IIPR trades at a forward price/FFO of 13.2x based on 2024 estimates, while NLCP trades at 8.9x 2024 estimates. It’s likely that IIPR will continue trading at a premium to NLCP because it’s bigger, has a longer track record, and because NLCP trades on the OTC exchange. That’s fine, but I just prefer the lower valuation and higher yield, as I don’t mind buying on the OTC, and I think both companies have similar growth trajectories.

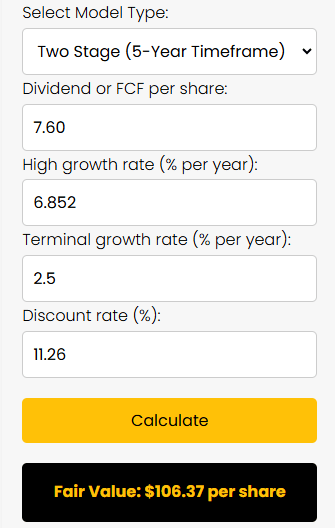

That being said, IIPR’s valuation is still attractive. The current valuation doesn’t price in much dividend growth. Below, I used a dividend discount model calculator that I created to find out how much dividend growth is needed for IIPR to justify its valuation. So, keep in mind that this is not my estimate of fair value.

In essence, for IIPR stock’s fair value to be in line with its current share price, it would need to grow its dividend per share by 6.852% per year for the next five years and then grow it by just 2.5% per year after that (more or less in line with inflation). I calculated the discount rate by using the CAPM model.

IIPR Stock DDM Valuation (Author)

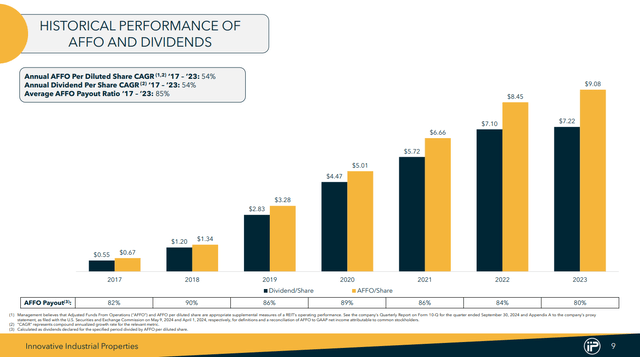

Given the stock’s history of dividend/share and AFFO/share growth, along with the growing cannabis market, I don’t think those figures will be too hard to achieve. I recognize that its AFFO has fallen, and so has its dividend growth, but we need to remember that the past two years saw interest rates rising at a fast pace. Now, that is reversing, which can help IIPR get back on track. On top of that, its AFFO payout ratio of 84% (in Q3) gives it a good amount of room for further dividend increases.

IIPR Dividend History (Q3-2024 Investor Presentation)

The Takeaway

IIPR stock has fallen due to a lack of support for Amendment 3 in Florida and a slight earnings miss. These are negative developments that may weigh on the stock in the short term, but IIPR still looks good for the long term. Despite short-term issues like delayed rent payments and industry-related headwinds, IIPR is able to generate stable, high-yielding revenue from triple-net leases, and its strong financial position is another reason to be optimistic.

Looking ahead, the company is well-positioned to benefit from the expected growth of the cannabis market and possibly improved access to capital through lower interest rates.

In addition, the SAFER Banking Act presents its own pros and cons, but with a weighted-average lease term of 14 years, IIPR won’t have to worry about its current tenants negotiating lower rates for a long time.

While I view NewLake Capital Partners as a bit more attractive due to its lower valuation and higher yield, the market still isn’t pricing in much growth for IIPR, which leads me to believe that it’s undervalued, making me rate it as a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in NLCP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.