Summary:

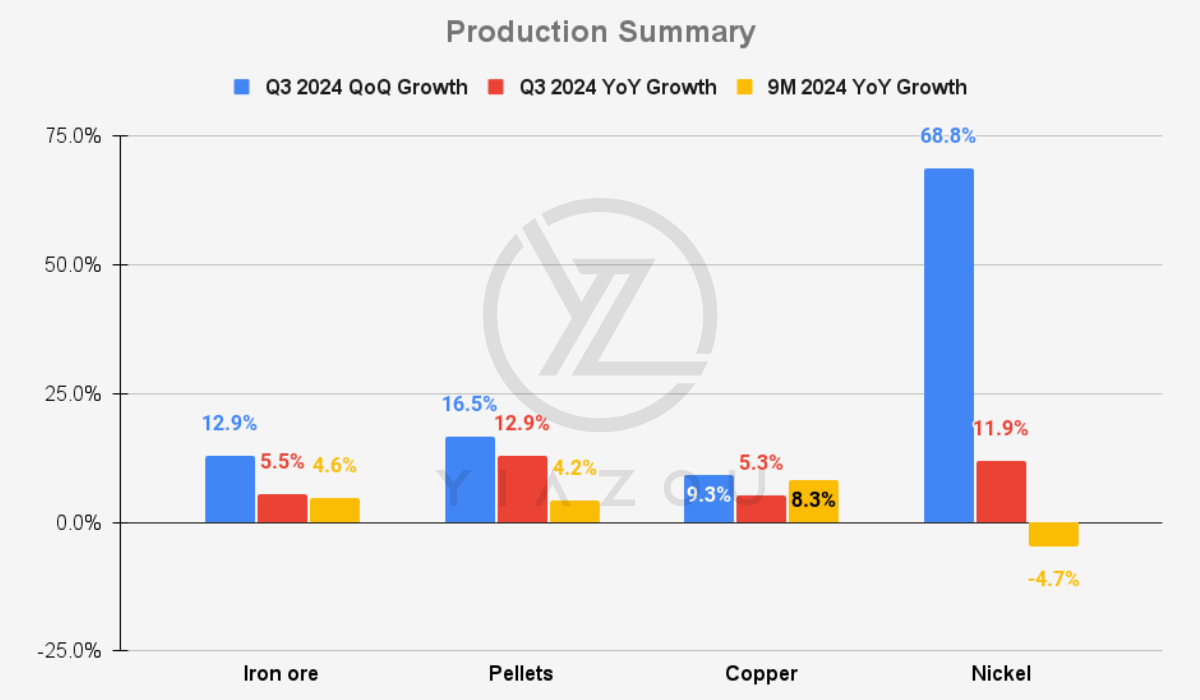

- Vale’s Q3 iron ore production reached 90.97 million metric tons, the highest since 2019, up 12.9% quarter-over-quarter.

- Production gains in copper and nickel rose 9.3% and 68.8% respectively, supported by operational improvements in Sossego and Sudbury.

- Declining iron ore prices, driven by reduced Chinese demand, cut realized prices 7.7% quarter-over-quarter to $90.6 per ton.

- Rising freight and operational costs, alongside a $956 million provision for the 2015 Mariana dam incident, pressured margins.

- Premium adjustments on high-grade iron ore mitigated some losses, helping Vale offset declining market prices amid demand fluctuations.

Monty Rakusen

Investment Thesis

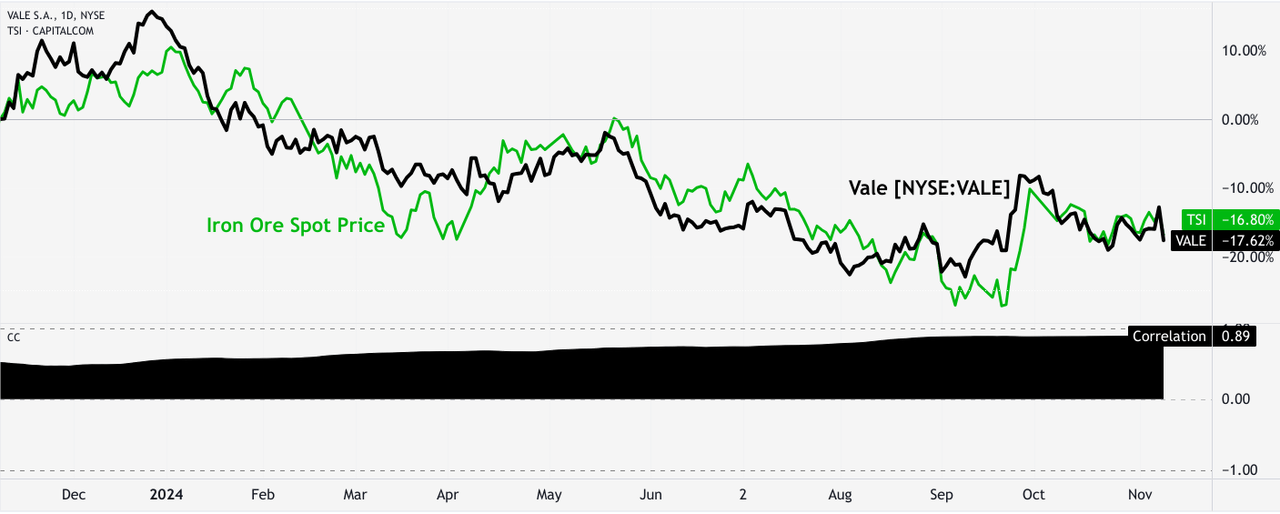

Since our last coverage, Vale’s (NYSE:VALE) stock performance has been impacted by a combination of falling iron ore prices and elevated operational costs. Key factors include a substantial decline in demand from China’s property sector, which has slowed steel production and reduced iron ore consumption. This trend has directly influenced Vale’s realized iron ore prices, a core driver of its revenue. Additionally, freight and other input costs have risen, putting further pressure on margins, compounded by a $956 million provision for the 2015 Mariana dam collapse, weighing on profitability.

Despite these challenges, Vale’s Q3 production metrics were strong, showcasing growth across iron ore, pellets, copper, and nickel. The company’s focus on high-grade iron ore production and premium adjustments have helped mitigate some of the pricing pressure in the volatile commodity market. However, the decline in core commodity prices underscores Vale’s vulnerability to external market conditions and highlights the stock’s high correlation with iron ore price movements.

Iron Ore Production Hits 5-Year High, Boosting Sales Amid Strong Demand

In Q3 2024, Vale held solid progress on the production side. Its iron ore production stood at 90,971,000 metric tons (mt) (highest since 2019). This marked a 12.9% rise quarter-over-quarter (QoQ) and a 5.5% gain year-over-year (YoY) from Q3 2023’s 86,238,000 mt.

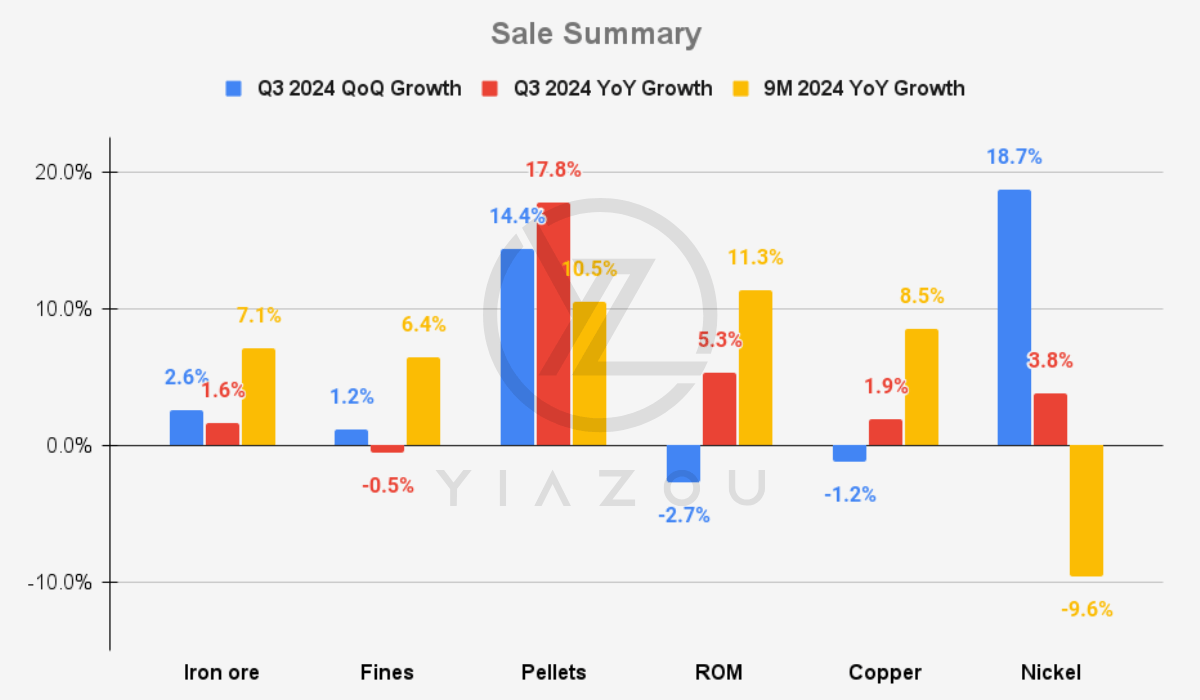

During 9M 2024, Vale’s iron ore production hit 242,395,000 mt, which reflects a 4.6% increase compared to 231,755,000 mt in the same period of 2023. This stable rise aligns with Vale’s 2024 guidance of 323-330 million mt, which indicates continued output growth. Similarly, Vale’s iron ore sales reached 81,838,000 mt in Q3 2024 with a 1.6% rise YoY. The sales side is closely matched with production, reflecting stable demand and sharp inventory management. Year-to-date (9M24), iron ore sales climbed 7.1%, reaching 225,456,000 mt, pointing to improved demand.

Moreover, Vale’s iron ore operational upgrades are evident in the Northern System, where production rose by 1.9 million mt YoY, with S11D contributing significantly at 22.1 million mt. The Southeastern System saw a production increase of 3.6 million mt YoY due to plant improvements and a new wet processing line at Brucutu. These adjustments boosted production and improved product quality, as the Northern System’s high-grade output allows Vale to command a premium.

Vale’s quality-centered approach boosted the all-in premium by $1.8 per ton QoQ to $1.7 per ton in Q3. By prioritizing high-grade production and managing inventory, Vale softened the impact of declining reference prices, attaining a smaller decline in its average realized iron ore fines price ($90.6 per ton) compared to a $12 per ton drop in the market. This pricing flexibility reflects Vale’s capability to leverage premium products and adapt to market changes sharply.

In detail, Vale’s Q3 pellet production stood at 10,363,000 mt with a 16.5% rise QoQ and a 12.9% increase YoY (highest since 2018). For 9M 2024, pellet production hit 27,724,000 mt, which reflects a 4.2% rise YoY. Vale’s yearly guidance of 38-42 million mt of pellet production remains within reach, reflecting market demand strength. Pellet sales rose by 14.4% QoQ and 17.8% YoY, at 10,143,000 mt in Q3 2024. This was supported by robust demand and higher pellet feed availability. Year-to-date sales growth was considerable, with a 10.5% gain to 28,232,000 mt, against 9M in 2023. This steady sales growth aligns with Vale’s strategy of maximizing output from high-quality feed, responding to demand for pellets.

Yiazou

Source: Analyst’s compilation

Vale’s Copper and Nickel Production Soars: Q3 Gains Reflect Operational Upgrades and Resilience Amid Market Shifts

Vale’s copper production hit 85.9 thousand tonnes ((kt)) for transition metals in Q3 2024, up 9.3% QoQ and 5.3% YoY. For 9M 2024, copper production rose 8.3% to 246.3 kt. The growth stemmed from improved operational conditions and plant improvements across multiple copper sites, notably Sossego and Canada. Sossego’s 4.3 kt sequential increase in copper production marks a rise in mining volumes and higher feed grades. Salobo saw a 30% YoY rise in processed ore, reflecting stable recovery after setbacks like a conveyor fire at Salobo 3. Canada’s copper production added 4.7 kt YoY, owing to shorter maintenance times and improved mining output, which helped Vale’s upward trend in copper production.

Although copper sales decreased slightly (75.2 kt in Q3, down 1.2% QoQ from 76.1 kt), Vale’s average realized price was $9,016 per ton, showing resilience amid a 2% dip in London Metal Exchange (LME) prices. Vale’s sales approach includes strategic retention of in-transit volumes, which allows the company to handle demand shifts and support revenue stability.

Vale’s nickel production surged by 68.8% QoQ to 47.1 kt from 27.9 kt in Q2, largely due to improved performance in Sudbury and the restart of smelter and refinery operations after maintenance. This quarterly rise reflected an 11.9% YoY gain from Q3 2023’s 42.1 kt. Despite a 4.7% year-to-date decrease in nickel production (114.4 kt in 9M24 versus 120 kt in 9M23), the 2024 guidance of 153-168 kt indicates optimism in sustaining higher output.

Lastly, Vale gained a 5.6 kt YoY increase in nickel production in Sudbury due to sharp mine-to-refinery processes, while Voisey’s Bay added 2.2 kt, boosted by increased production from underground mines. This expansion supports Vale’s capability to satisfy demand and maintain production despite global market shifts.

Yiazou

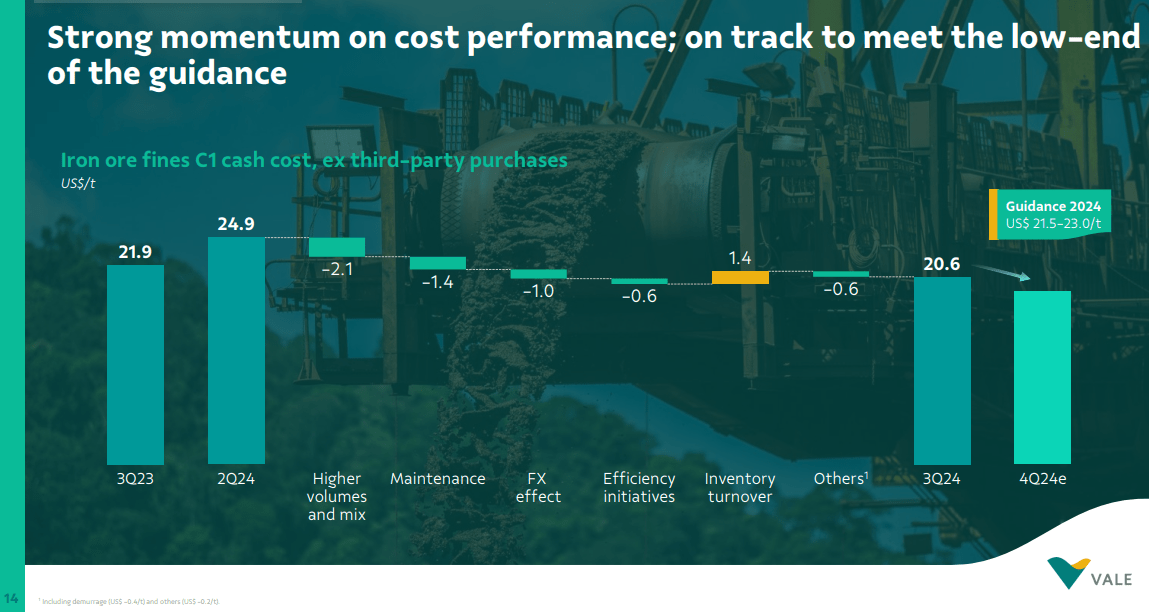

Finally, Nickel sales hit 40.7 kt in Q3, up 18.7% QoQ and 3.8% YoY, reflecting production gains. Aligned with Vale’s sales approach, inventory build-up enables market flexibility and margin optimization. Vale’s inventory strategy sustains a steady balance in nickel supply-demand, particularly with boosted production in strategic areas like Sudbury. Looking forward, based on the cost control advantage, Vale is on track to hit the low-end cost guidance for iron ores and copper. This may provide limited benefits to the 2024 bottom line against the dropping iron prices.

Q3 Presentation

Vale’s Core Commodity Prices Declining And Hitting Stock’s Market Value

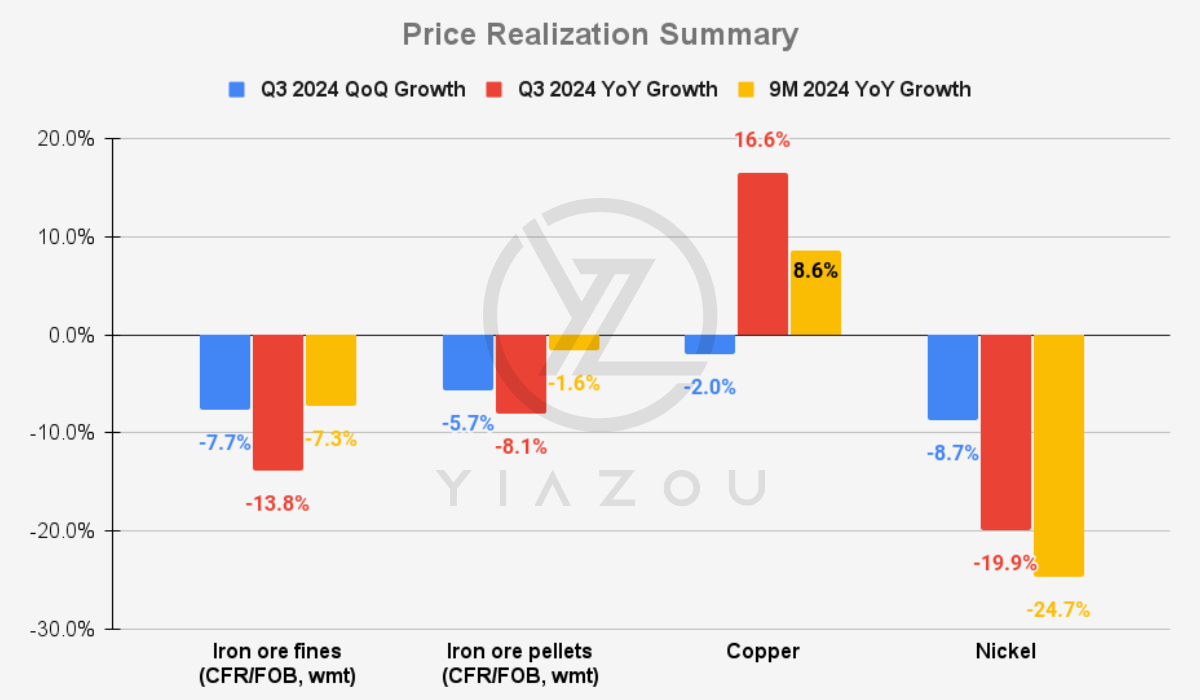

Vale’s iron ore fines prices fell 7.7% QoQ, hitting $90.6/t in Q3 2024. This decline stands despite a drop of only $12.0/t in reference prices for iron ore. Such a considerable decrease in realized prices indicates Vale’s high sensitivity to market shifts. It suggests Vale has limited pricing power against macro pressures. Over the same period, iron ore pellets also saw a price decline of 5.7% QoQ to $148.2/t in Q3 2024.

In a YoY comparison, iron ore fine prices dropped by 13.8% in Q3 2024. This accelerating downward trend suggests Vale may face issues in maintaining pricing leverage. With increased production volumes, revenue growth remains limited under the current pricing. Iron ore pellets also saw an 8.1% YoY decline, reflecting a similar downward trend. On a longer comparison, Vale’s average iron ore fines price for 9M 2024 stood at $96.1/t, with a 7.3% decrease against $103.7/t in 2023. This decrease reflects persistent pricing challenges beyond a single quarter.

Similarly, Nickel has experienced a 19.9% YoY drop in average realized prices, going from $21,237/t in Q3 2023 to $17,012/t in Q3 2024. This decline reflects extreme price sensitivity for nickel in the current market. Such volatility limits the upside of Vale’s financial planning and hinders growth strategies. For 9M 2024, Vale’s nickel price realization declined 24.7%, falling to $17,477/t against $23,203/t in 2023.

Again, this sustained price drop suggests persistent weakness in Vale’s nickel market or its competitive lead. Vale’s nickel prices fell 9% from $18,638/t in Q2 2024. Interestingly, this decline occurred despite premium adjustments, which failed to counteract adverse market trends. Such exposure to price volatility in nickel could limit Vale’s growth if these trends persist.

Yiazou

Finally, Vale’s realized copper price fell 2% QoQ, while smaller than in iron ore and nickel, which points to Vale’s open vulnerability to fluctuations in metal prices. Such fluctuations may affect near-term revenue projection. However, copper prices rose by 16.6% YoY, hitting $9,016/t in Q3 2024 from $7,731/t in Q3 2023. This YoY growth was driven by broader market conditions for energy transition rather than Vale’s pricing strategies. This dependency on external market demand limits Vale’s control over copper price outcomes and reduces Vale’s pricing if demand falls.

In short, Vale’s product enhancements and premium adjustments have shown limited success in maintaining prices, especially as seen in nickel. Despite higher-value product mixes and provisional pricing, these strategies have not prevented QoQ and YoY price declines. This outcome suggests a lack of elasticity in Vale’s product offerings. It points to limitations in adding value within Vale’s current market framework. Vale stock’s high correlation (annual) with iron ore prices indicates that production growth cannot prevent valuation downturns without substantial diversification. Falling realized prices make it harder to maintain profitability and restrict growth forecasts and valuation upsides.

Takeaway

Vale’s robust production growth across iron ore, copper, and nickel was offset by falling commodity prices and rising costs, especially from China’s slowed demand and freight expenses. Despite premium adjustments and efficient inventory strategies, Vale remains vulnerable to market volatility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.