Summary:

- Alibaba’s upcoming earnings will reveal the ability of the company to diversify its revenue base and move away from the core China e-commerce segment.

- Cloud and International commerce will be the key segment to look out for in the next earnings season as we see silver linings in the operations.

- Alibaba’s International segment already contributes 12% of the consolidated revenue, and this should increase to 25% by the end of 2027.

- Regulatory challenges have decreased considerably, and new fiscal support should provide a good tailwind to Alibaba in the near term.

- Alibaba stock is still one of the cheapest options, with a forward PE ratio of less than 10 and a strong moat.

maybefalse/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA) stock has started showing promising signs over the last few weeks. The fiscal support announced by the Chinese government has helped improve the bullish sentiment towards the stock. In the previous earnings, Alibaba reported 1% YoY decline in its core e-commerce revenue. Strong fiscal support could improve the core e-commerce growth of Alibaba. However, the most important segment for Alibaba will be its Cloud and International commerce. In the previous article, it was mentioned that a better macro environment is likely to provide a tailwind to the stock in the next few quarters.

Alibaba’s forward PE ratio is close to 10, which makes it one of the cheapest stocks in this segment. Most of the geopolitical risk has already been priced in. The regulatory challenges for the company have declined considerably, and its revenue diversification should increase the growth runway in the next few quarters, making the stock a Buy at the current price.

An important earnings call

Prior to the last few weeks, Alibaba stock showed sideways movement for a number of quarters. The fiscal support announced by China has improved the sentiment towards most of the Chinese stocks. Without a strong stimulus in the future, it would be difficult for China to reach 5% growth rate. It is highly likely that we could see better growth policies from the government to improve consumer confidence and also support the property market.

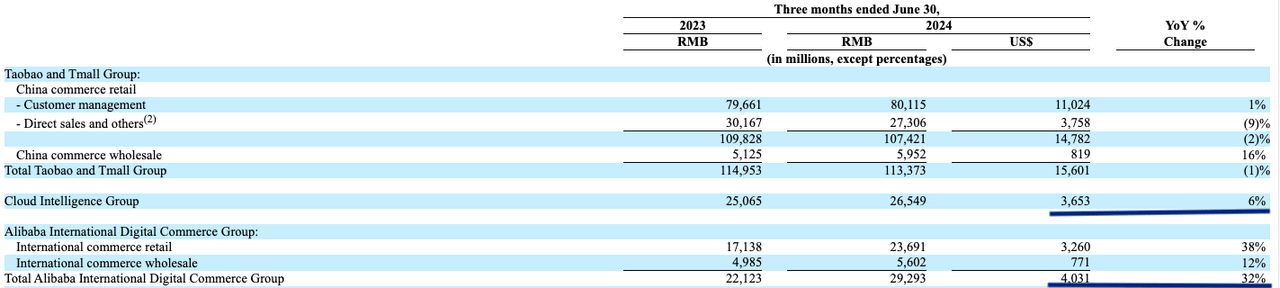

Figure: Alibaba’s revenue growth in the previous earnings. Source: Alibaba Filings

Good fiscal policy should improve the growth rate of Alibaba’s e-commerce segment. However, it would be more important to focus on the cloud and international commerce segment. In the previous quarter, Alibaba reported 6% YoY revenue growth in Cloud business and 32% YoY growth in International commerce. International commerce already contributes 12% to the consolidated revenue. It will be important to closely watch these two growth numbers to gauge the future potential of the stock. Alibaba has been launching new AI services and tools over the last few months, and this should certainly be a tailwind for the cloud segment. If the company is able to hit double-digit YoY growth in Cloud business, we could see a better bullish sentiment towards the stock.

The international arm has recently developed an AI-based translation tool that the company claims can beat Google and ChatGPT. This should improve the experience of merchants on the platform. Building a supply chain for international commerce can take time and lots of resources. However, this will also increase the growth runway for the company over the next few quarters.

Growth in Southeast Asia

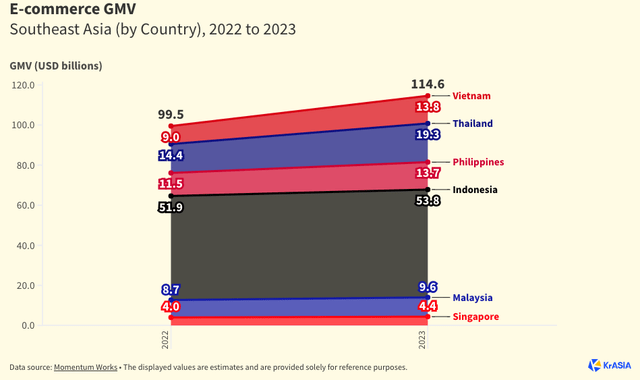

Alibaba is focusing on the Southeast Asia region, where the market is rapidly growing. Alibaba’s Lazada is competing against Shopee and TikTok. Lazada has recently collaborated with Armani and D&G to gain an upper hand in this region. Lazada has set an ambitious target of reaching $100 billion in e-commerce sales by 2030. Lazada has an advantage compared to other players due to Alibaba’s experience in the e-commerce segment and massive resources that Alibaba can invest to support growth.

Figure: Rapid growth of e-commerce in Southeast Asia. Source: KrAsia

Lazada’s competitor Shopee tried to increase market share by using massive cash burn. However, this strategy did not help the company, as its stock crashed by 90% in 2022. Since then, the stock has recovered to some extent, but it is still more than 70% below the earlier peak set in 2021. TikTok is also trying to gain market share by investing heavily in this region.

Alibaba has built a wide set of services and tools that Lazada is using to build a better growth runway. New AI-based tools for advertisers and shoppers should help Lazada in the near term. Southeast Asia has a total GDP of $3.3 trillion, or close to 20% of China’s GDP. A strong market share of Alibaba’s Lazada could improve the growth trajectory of its international business. If Alibaba continues to show YoY growth of 25%-30% in international commerce over the next few years, we could see this segment’s revenue share increase to 25% within Alibaba by the end of 2027. This would give the company good revenue diversification.

Geopolitical risks and revenue diversification

A major bearish argument against Alibaba is the high geopolitical risk associated with the company. Any increase in tensions between China and the U.S. could significantly impact the sentiment towards Alibaba. However, it should be noted that many other companies have a significant revenue base in China. Apple (AAPL) and Tesla (TSLA) receive close to 20% of their revenue from China, and their supply chain is heavily dependent on this region.

Alibaba’s rapid growth in international commerce should reduce the geopolitical risk over the next few years. Many other Chinese companies are rapidly growing their international business. One of the largest Chinese automaker, BYD, will likely increase its international car sales to 400,000 in 2024. This is 60% growth from 2023 and shows the ability of these companies to rapidly gain market share. Tariffs and regulatory hurdles are quite strong in many international markets. European Commission has recently announced additional tariffs on Chinese automakers. However, we have seen negotiations in most of these cases. Over the next few years, Alibaba and other Chinese companies could slowly gain market share in important international regions.

Many analysts have mentioned a bearish argument for Chinese stocks due to the next Trump presidency, where we could see higher rhetoric. However, I believe an ultra-hawkish policy by the U.S. could help Alibaba and other Chinese stocks. It is likely that any uncertainty around Taiwan could be reduced significantly in the next administration. The Chinese government is already providing good fiscal stimulus and easing regulations. Reuters has mentioned that we could see greater stimulus from the Chinese government in the near term as it tries to boost growth.

It is difficult to quantify the impact due to change in geopolitical relationship between U.S. and China. But it should also be noted that during the previous administration, Alibaba stock went from $100 in early 2017 to $300 by the end of 2020. While during the current administration, Alibaba stock went back to $100.

Downside risks for Alibaba

Over the last few years, Alibaba has tested the patience of most of the investors. The stock has declined by over 60% from its peak in 2020 and there have been few signs of a strong tailwind. This is true for many other Chinese stocks as Wall Street got more cautious. However, this also means that the stock is very cheap. It is difficult to see how Alibaba could correct any further.

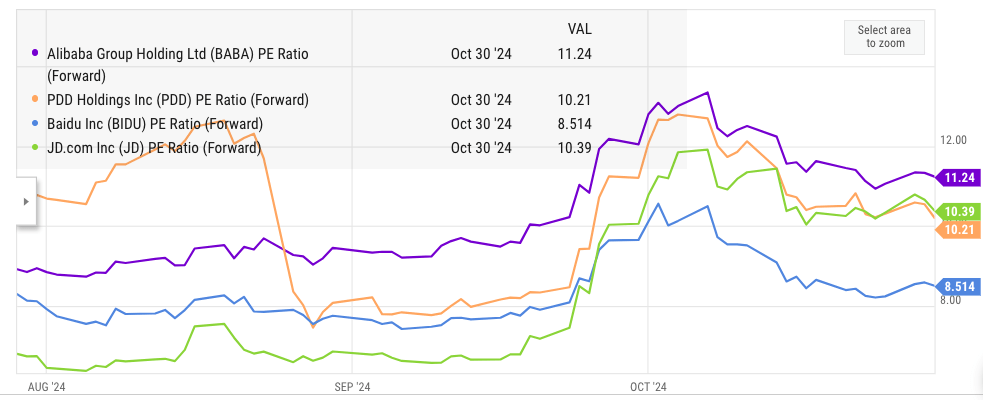

Ycharts

Figure: Forward PE multiple of Alibaba. Source: YCharts

The future regulatory and fiscal policy of the Chinese government will be very important for Alibaba and other companies. It is very difficult to see 5% GDP growth without a supportive regulatory environment. This could force the regulators to reduce the restrictions on Alibaba. As mentioned above, Alibaba is also rapidly diversifying into international regions, which should reduce China-specific risk for the company.

Another risk is Alibaba’s ability to leverage its talent and resources to build a strong AI platform. We have seen Meta Platforms (META) perform very well in the last few quarters due to its ability to build new AI tools for advertisers, which has improved the revenue and margin growth of the company. Alibaba would also need to deliver a similar improvement in AI services to recover some of its bullish momentum. Chip restrictions have hurt Alibaba to some extent, but over the long term, it will depend on the ability of the company to attract AI talent and build requisite hardware and services for customers.

One of the cheapest stocks

Alibaba’s most attractive argument is the cheap price. While most of the tech stocks in the U.S. are trading at a very high multiple, investors can buy Alibaba stock at a forward PE multiple of 10. This is quite a modest price compared to the strong moat of the company. We should also take into account the strong growth potential in Cloud and international commerce segment, which will contribute a higher revenue share in the next few years.

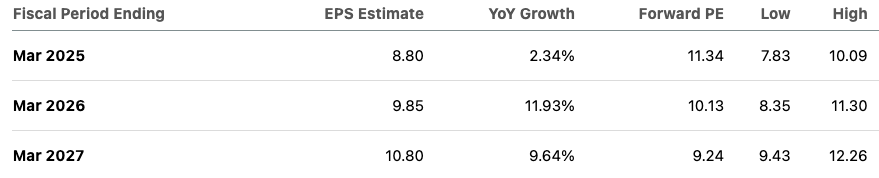

Seeking Alpha

Figure: Forward EPS estimate of Alibaba. Source: Seeking Alpha

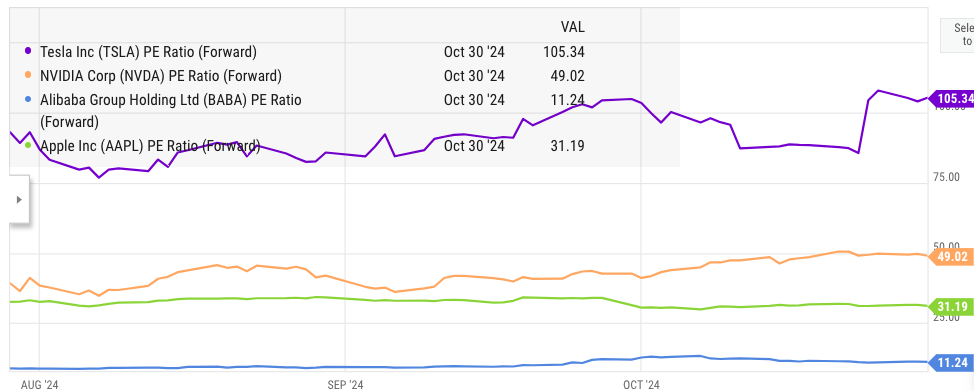

The threat of geopolitical risk is overhyped. We can see many other big tech companies with significant Chinese business trading at a much higher multiple.

Ycharts

Figure: Forward PE multiple of Alibaba and other big tech companies. Source: YCharts

Investors who are looking for a stable company with AI potential and attractive valuation can look at Alibaba closely. As Alibaba launches new AI tools in Cloud and e-commerce business, we could see a better margin and revenue trend.

Investor takeaway

Alibaba has gained better sentiment after Chinese government announced a few fiscal measures supporting the economy. It is highly likely that we will see further fiscal stimulus if the government is keen on reaching its 5% GDP growth target. A boost in consumer confidence should help Alibaba improve its revenue and margin trajectory.

Alibaba is also rapidly growing international commerce, and this segment could contribute as much as 25% of the total revenue base by the end of 2027. This will reduce the geographic risk with the stock and provide it with a better growth runway. The company is also launching new AI tools and services, making it an attractive option at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.