Summary:

- ET continued its strong YTD performance in Q3, delivering record volumes across segments with EBITDA margins rising ~200bps y/y on strong Midstream performance.

- The Permian basin remains a key strategic focus with gathering & processing capacity to rise ~25% through YE25 on several high-scale startups.

- The acquisition of WTG Midstream will expand ET’s Permian footprint to the Midland basin, boosting gathering capacity by a further 40% while being ~2% accretive to EBITDA/unit.

- We reiterate shares at Overweight and a $22/unit YE24 price target, implying ~28% price upside and ~35% TSR potential including dividends.

Huyangshu/iStock via Getty Images

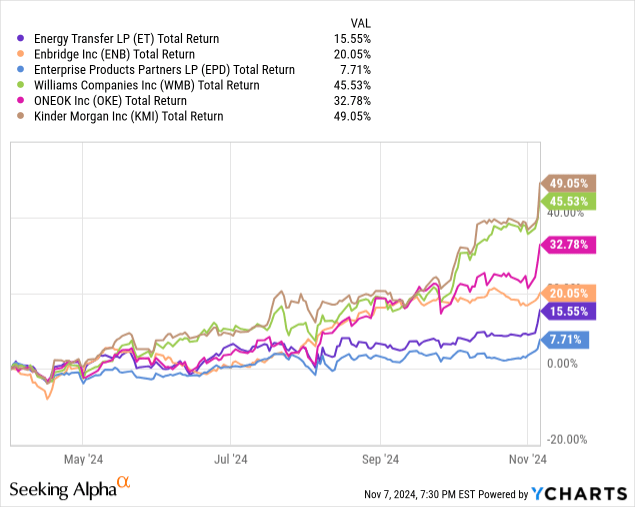

We began our coverage of Energy Transfer (NYSE:ET) in April this year, calling it our top pick in the US midstream space on its attractive combination of 1) solid business fundamentals, 2) a sector-leading dividend yield and 3) a discounted valuation. Since then shares returned ~16% including dividends, putting ET at the low end of peers. We believe this is largely due to ET’s lower perceived traction to AI and datacenters which are expected to fuel strong growth in US natural gas.

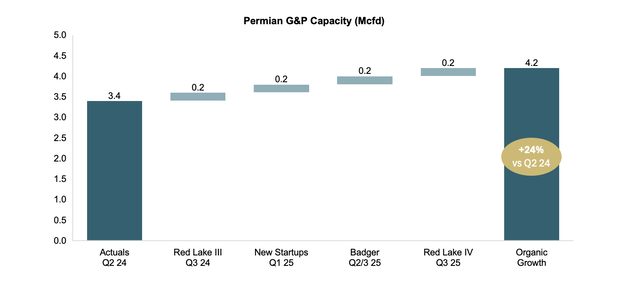

And while we acknowledge the better positioning of some peers, especially gas pure-plays Williams and Kinder Morgan, we believe the strong recent expansion of its Permian gas gathering & processing (G&P) capabilities should provide a strong tailwind for ET in the mid term which we feel is currently underestimated by the market. On a standalone basis, we see ET’s local G&P capacity growing by ~25% through YE25, rising from 3.4Mcfd as of Q2 24 to ~4.2Mcfd.

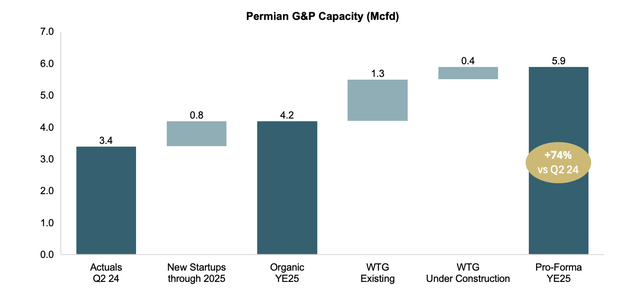

Also including recently acquired WTG, which operates around 1.3Mcfd of Midland basin G&P capacity and has a further 0.4Mcfd under construction, we see ET becoming the second largest G&P player in the Permian, ahead of Enterprise Products and only behind Targa Resources (TRGP). Acquired at a sub-7x multiple on 25E EBITDA, the deal should also be modestly accretive to unit metrics. We estimate a ~2% accretion to EBITDA/unit for the first full year of consolidation. While political impacts tend to even out over time, we also believe the recent elections should provide a tailwind to ET (and the entire midstream sector) as easier permits and additional onshore drilling activity should benefit volumes across segments.

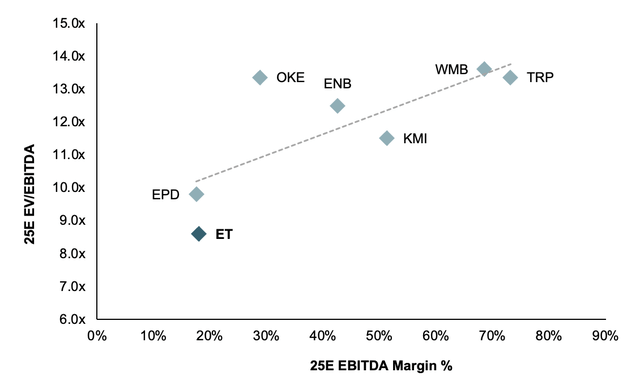

With ET’s dividend yield remaining at a sector-high 7.5% and still around ~16% undervaluation based on our 2025E EBITDA margin vs multiple framework, we reiterate shares at Overweight, being a core midstream holding in our view. We confirm our $22/unit YE24 price target, implying ~28% price upside for around 35% TSR potential. Key risks include a general deterioration of economic conditions which could negatively affect transported, stored and gathered volumes as well as project delays and cost overruns.

[Note: Peers refer to Enbridge (ENB), Enterprise Products Partners (EPD), Williams Companies (WMB), ONEOK (OKE), Kinder Morgan (KMI) and TC Energy (TRP). All financials and company projections taken from the most recent 10-Q and Q3 earnings call.]

Key Discussion Points

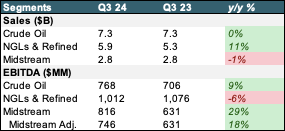

Q3 continued strong YTD performance with record volumes across segments. New projects expected to add ~24% in Permian gathering capacity. Sales for the period from July to September came in at $20.8B, roughly flat vs the year prior while EBITDA jumped 12% to $4.0B for a ~200bps uplift in group margins. With a ~9% higher unit count, however, driven by recent acquisitions of Crestwood and WTG, EBITDA/unit was up just 3% to stand at $1.15. Net income to unitholders of $1.2B for the quarter was up 103% y/y, albeit against easy Q3 23 comps. DCF was flat y/y with DCF/unit down ~9% on a higher unit count.

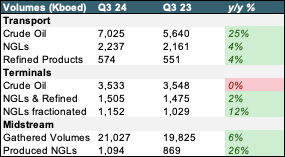

Driven by strong activity and M&A impacts, transported crude volumes grew 25% y/y to a record 7Mboed with management noting a 49% surge in exported crude volumes through the company’s Gulf Coast terminals. Excluding the Crestwood and WTG acquisitions, crude volumes were up 4% y/y, partially driven by the recently formed Permian JV with Sunoco. Both transported NGLs and Refined Products such as gasoline and distillates also marked new quarterly record volumes as each rose 4% y/y with management citing continued good performance in NGL exports. Terminal volumes were roughly flat y/y while NGLs fractionated at the Mont Belvieu complex grew 12% to ~1.2Mboed. Midstream also had a strong quarter with total gathered volumes up 6% y/y while produced NGLs grew 26%.

Company Filings

Broken down by segment, revenues for crude oil transportation and midstream were roughly flat y/y while sales in the NGL & Refined segment grew 11%. While sales in both segments were flat, EBITDA for both crude oil and midstream grew strongly, at 9% and 29% respectively. With management noting a ~$70MM one-time impact in Midstream, adjusted segment EBITDA was up 18%.

Company Filings

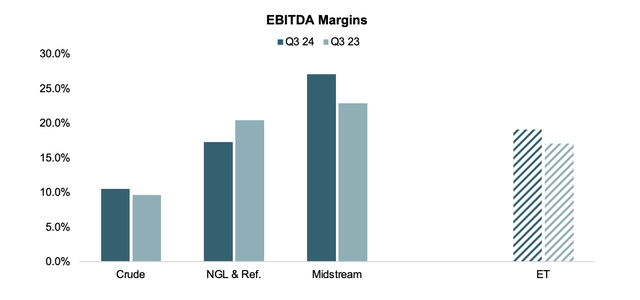

With sales flat and EBITDA up, margins improved significantly across Crude and Midstream with (one-time adjusted) Midstream margins reaching ~27%. Despite a slight decrease in NGL & Refined profitability, this drove a 200bps y/y uplift on group EBITDA margins to ~19.1%.

ET also showed solid operational performance in Q3, particularly in growing its Permian gas gathering capabilities. During the quarter, the company completed the construction of a 50Mcfd expansion to its Orla East processing plant. Alongside the Grey Wolf, Arrowhead II, and Arrowhead III plants, all to be completed by early 2025, this will add around 200Mcfd in local gas gathering and processing (G&P) capacity. Following the close of the WTG acquisition in July, ET also placed the Red Lake III plant in service, adding a further 200Mcfd. With the 200Mcfd Badger plant, currently being relocated to the Permian, also expected to be in service by mid-2025 and recently FID’ed Red Lake IV expected online by Q3, we estimate Permian G&P capacity to reach ~4.2Mcfd, a roughly 25% increase vs mid-2024.

Company Filings, WSR Estimates

WTG acquisition to further grow Permian G&P capacity and drive ~2% EBITDA/unit accretion. In July 2024 ET closed the acquisition of Permian-based WTG Midstream for $2.3B in cash and 50.8 million newly issued units (approx. deal value ~$3.2B). Acquiring WTG at a sub-7x multiple on 2025 estimated EBITDA, we estimate the deal to be a low single-digit addition to group EBITDA while being around 2% accretive to next year’s EBITDA/unit.

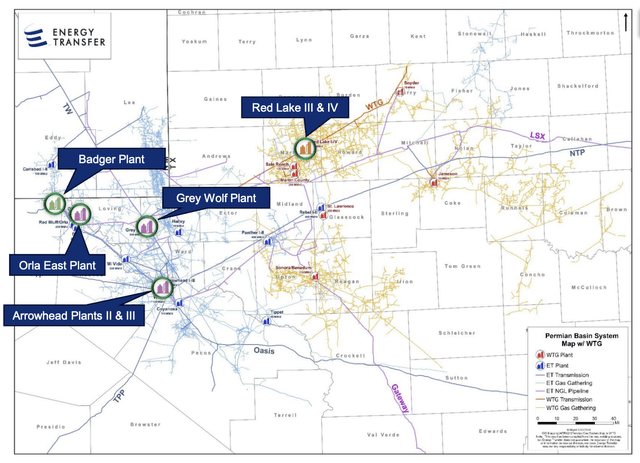

With ET’s previously existing assets being almost exclusively located in the Delaware basin across Texas and New Mexico, we believe the deal presents an effective and quick method to extend the company’s reach into the rest of the basin. Focusing on the Midland basin, the deal adds around 6,000 miles of pipelines to support ET’s local gas gathering capacity. WTG also adds eight processing plants with a headline capacity of 1.3Bcfd as well as two under-construction plants which are expected to boost capacity by a further 0.4Mcfd. This implies a pro-forma YE25 G&P capacity of almost 6Mcfd, up almost 75% vs Q2 24 actuals and an around 40% boost to ET standalone YE25 estimates.

Company Filings, WSR Estimates Pro-Forma Permian G&P Footprint (Energy Transfer IR)

At ~5.9Mcfd in pro forma gas G&P capacity, we estimate that ET could become the second-largest player in the Permian, ahead of EPD (~4.8Mcfd) and behind only Targa Resources which has ~7.6Mcfd of G&P capacity. Overall, we believe ET’s increased scale in the Permian to become a crucial driver of mid term performance and growth, exposing it to 1) a more favorable outlook for Permian gas vs oil production driven by rising LNG and LPG exports and 2) growing gas cuts in the basin leading to higher gas volumes and more G&P demand.

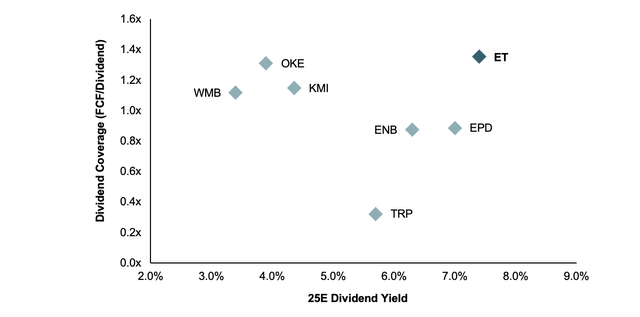

~7.5% dividend yield remains sector-leading and looks well-covered on 2025 estimates. Even despite the strong performance YTD, ET’s distributions remains best-in-class with shares yielding ~7.5% in 2025E dividends. This screens roughly 100bps above the MLP peers and around 300bps above the C-corps. Looking at coverage, calculated as 2025E FCF over dividends, ET’s dividend remains well-covered at ~1.3x, roughly in-line with the C-corps and significantly ahead of its MLP peers which screen below 1x coverage based on current consensus estimates. We also note that ET announced a distribution increase as part of its Q3 earnings call with new quarterly dividends/unit at $0.3225, implying ~3.2% growth vs the prior year. While this is at the lower end of management’s 3-5% long-term distribution/unit growth guidance, we believe the dividend growth outlook remains favorable given the excess coverage and would expect ET to return towards the higher end of the guided range next year.

Company Filings, WSR Estimates

Valuation Update

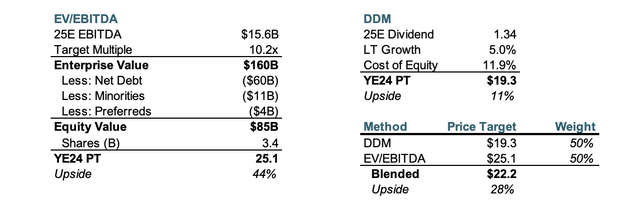

Using our framework of expected EBITDA margins to forward valuation multiples, we believe ET remains undervalued, especially as an increase in G&P capacity and volumes should benefit the higher margin Midstream segment. Roughly in line with peer EPD, we target a 10.2x multiple on 2025E EBITDA.

Company Filings, WSR Estimates

Using consensus estimates of ~$15.6B in EBITDA for next year, this implies an enterprise value of $160B. Deducting net debt, minority interests and preferred shares, this yields ~$85B in equity value or around $25/unit.

Estimating dividends to grow ~5% in the long-term which is the upper end of management guidance yields a fair price of around $19/unit, although we note a significantly higher CAPM-derived cost of equity driven by ET’s sector-high ß of 1.64 (sector average ~1.1).

Weighing both methods equally at 50%, we arrive at a blended YE24 price target of $22/unit, implying ~28% price upside.

ET Valuation (Company Filings, WSR Estimates)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.