Summary:

- Nvidia Corporation’s AI-driven growth continues, but a cyclical decline looms when the first infrastructure build-out peaks.

- Q3 guidance: $32.5B revenue, 75% gross margin. My EPS estimate is $0.78 (above the $0.74 consensus).

- My model estimates $235B in revenue and $152.75B in EBITDA for Fiscal 2028.

- An EV-to-EBITDA multiple of 40 could be valid for January 2028, but forward-looking sentiment factors could reduce this to as low as 30.

- In an optimistic market, Nvidia’s enterprise value will be over $6 trillion in 2028. In a pessimistic market, its enterprise value will be approximately $4.5 trillion amid a valuation collapse.

Antonio Bordunovi

My last publication on NVIDIA Corporation (NASDAQ:NVDA) outlined the impending cyclical decline that the company is likely to experience as a result of the first stage of the AI infrastructure build-out culminating. However, until then, we still have time for the AI-led bull thesis to compound positively. Indeed, since my last analysis, the stock has gained an impressive 7.8% in price, but Nvidia is not an investment to take your eye off.

Following my Nvidia Q3 earnings preview (it reports on Wednesday, November 20th), I provide an extensive three-year valuation model for the company. This model indicates that the company is trading at an enterprise value that is fair for now, though highly subject to an impending medium-term decline.

Q3 Earnings Preview: Data Center Demand Remains Robust for Now

To begin with, let’s look at Nvidia’s Q3 guidance. Its revenue is expected to be $32.5 billion, plus or minus 2%, with a non-GAAP gross margin projected at 75%, plus or minus 50 basis points. Its non-GAAP operating expenses are expected to be around $3 billion. Based on my analysis and management’s style of under-promising and overdelivering, I anticipate we’ll see a normalized EPS estimate of $0.78, which is higher than the consensus of $0.74. My estimate indicates a year-over-year normalized EPS growth of 94% from the Q3 2024 normalized EPS of $0.40.

The main event is Nvidia’s Data Center segment, considering the unprecedented demand for AI infrastructure expansion that is currently underway. In Q3 2024, Data Center revenue grew by a staggering 279% year-over-year, and in Q2 2025, Data Center revenue grew by 16% quarter-over-quarter and 154% year-over-year. While growth rates are slowing related to this segment, demand is still robust for now. The Data Center segment is the key to sustaining Nvidia’s current valuation and driving it higher because, in Q2 2025, the company reported that 88% of its total revenue came from Data Centers.

We should take a longer-term view on this segment, given that consensus is growing that there is an AI semiconductor downcycle likely in the medium to long-term horizon. For the next couple of years at least, revenue growth looks set to be relatively robust for Nvidia. Many of us are wondering whether we’ll see higher demand for longer, even though the consensus estimates suggest that by 2028, we’ll be looking at year-over-year revenue growth rates of below 10% and falling.

The reality is that the initial infrastructure-based surge in data center GPU demand is likely to stabilize and eventually taper. This is especially true for a company like Nvidia, as there are likely to be several major new entrants to the semiconductor market for AI inference in the future, given how lucrative and enduring the AI market is proving to be. Even if infrastructure demand remains higher than expected for longer, there’s no escaping one major fact: Nvidia’s data center revenue growth rates will likely show a general trend of contraction from here on out. A total revenue contraction is impending in the medium to long term, which is just the nature of the semiconductor business; Nvidia is benefiting from an unprecedented revenue upcycle right now.

In contrast to the immense growth in Nvidia’s Data Center segment, in Q2 2025, its Gaming segment reported a 16% year-over-year growth in revenue. Additionally, in Q2 2025, its Professional Visualization segment generated a 20% year-over-year revenue growth rate. In Q3, we should expect similar growth from these two segments, given the majority of the returns are accruing from Nvidia’s Data Center offerings.

Valuation Analysis: Moderately Overvalued With Lots of Growth Yet To Come

In my valuation model, I am using a period from now until January 2028, as it seems, both optimistic and conservative to propose that the company will retain revenue growth from its Data Center segment until this date (which is the end of its Fiscal Year 2028). I think there’s room for further expansion in data centers currently, which is not anticipated in the consensus estimates. So, my estimate is bullish, at $235 billion in annual total company revenue in January 2028.

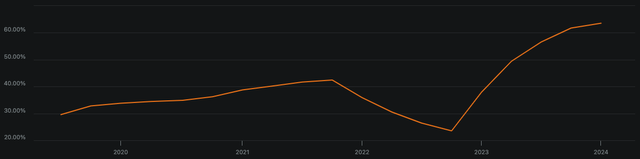

As Nvidia is a cyclical business, its EBITDA margins are also cyclical. Although its EBITDA margin will collapse at the end of this cycle, it will likely stay robust through my model’s terminal date. The EBITDA margin growth is showing signs of plateauing, so I am using 65% as my Fiscal 2028 EBITDA margin. Therefore, my Fiscal 2028 EBITDA estimate for Nvidia is $152.75 billion.

Nvidia’s EBITDA Margin (Author, Using Seeking Alpha)

As the company’s valuation multiples are very likely to have contracted by this point (indeed already have been), it is reasonable to propose an EV-to-EBITDA terminal multiple of 40 for my model. This is significantly under its five-year forward average of 49, but deservedly so given the impending slowdown in growth. Therefore, my enterprise value estimate for Nvidia for Fiscal 2028 is $6.11 trillion. This indicates a Buy, and indeed, Nvidia is a Buy for now, but my Hold rating acts as a caution (there is a large decline coming following this, and because the market can act ahead of this event, it is best to proceed carefully).

Nvidia’s weighted average cost of capital is 18.78%, with an equity weight of 99.7% and a debt weight of 0.3%, with equity costing 18.83% and debt at 2.31% after tax. This is what I will be using for my discount rate. Discounting $6.11 trillion back to present-day value gives an intrinsic enterprise value of $3.54 trillion for Nvidia. The company is currently trading at an enterprise value of $3.6 trillion, meaning the investment has a negative 1.67% margin of safety or is approximately fairly valued.

Risk Analysis: Sentiment Factors May Diminish Returns

The greatest caution here is that my Fiscal 2028 enterprise value estimate depends on the market sustaining relatively high sentiment for the stock. If by 2026, the market is anticipating a revenue contraction for Fiscal 2028, the reality is that the company will not be trading at an EV-to-EBITDA ratio of 40. An EV-to-EBITDA ratio of approximately 30 would be more likely in this case, bringing the January 2028 enterprise value to $4.58 trillion. Indeed, just a few months before, it may have been trading near $6 trillion, as outlined in my model. This major and fast valuation decline would be just the start of the major cyclical sell-off of Nvidia stock.

After careful and ongoing analysis, I see this sell-off as not only highly likely but inevitable. For this not to happen, we will need to live in a hypothetical world where Big Tech AI players continue to expand data centers at a growing pace indefinitely (which is physically impossible, impractical, and unnecessary).

Conclusion: Hold

It’s tempting to buy more of Nvidia right now, but the stock is not particularly stable for a long-term investment. Indeed, there is likely more room for this investment to compound over the next three years. However, given the risk in sentiment factors and the amount of attention the stock is getting from the professional finance community and media, the market is going to anticipate the impending revenue contraction way in advance. It’s not implausible that the company’s valuation will start to collapse cyclically in early 2027 in simple anticipation of a revenue contraction in 2028. Indeed, it could happen even earlier.

Given the considerable element of risk and speculation involved in these outcomes, I believe the prudent rating is a Hold. I will update readers with my Sell rating in due course. However, for now, the going for Nvidia is still good.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.