Summary:

- AMD’s recent earnings result showed strong potential for its Data Center business and, specifically, its AI chips.

- The company projected $5 billion in AI chip revenue for 2024, which is up from $4.5 billion in earlier projections.

- AMD is in a good spot to deliver over $10 billion in AI chip revenue in 2025 and will likely be a main competitor for Nvidia in this segment.

- AMD’s forward P/E ratio for fiscal ending Dec 2026 is close to 20 compared to Nvidia’s P/E ratio of 30, making AMD significantly cheaper and with strong tailwinds.

JHVEPhoto

AMD (NASDAQ:AMD) (NEOE:AMD:CA) delivered good results in the recent earnings call. Wall Street was eagerly looking at the growth trajectory of its Data Center segment. AMD reported YoY 122% jump in Data Center segment revenue and almost 3.5X times the operating income. Most of the growth is attributed to the rapid growth in AI chip sales. The management increased the forecast for AI chip sales to $5 billion, up from the prior forecast of $4.5 billion. It should be noted that AMD had projected only $2 billion of AI chip sales at the end of 2023. The rapid growth in AI chip sales matches the earlier pace shown by NVIDIA (NVDA), although from a lower base. In the previous article, it was mentioned that AMD’s AI growth is showing a better trajectory due to new chips.

On the other hand, AMD stock is much cheaper than Nvidia. The consensus EPS estimate for two fiscal years ahead is $7.3 which gives it a forward P/E ratio of 22.5. Nvidia is trading at a forward P/E ratio of close to 30 for fiscal year ending Jan 2027. AMD has a longer growth runway in this segment as it tries to increase its market share while Nvidia will be trying to defend its market share. This should boost the sentiment for AMD in the next few quarters.

All eyes on AI chip sales

While AMD posted good overall results, Wall Street has been focused on the ability of the company to drive AI chip sales. AMD did not disappoint in this metric by showing another quarter of rapid revenue and operating margin growth in its Data Center segment. The Data Center revenue increased to $3.5 billion, up from $1.6 billion in the year-ago quarter. The operating margin for Data Center segment increased to $1.04 billion, up from $306 million in the year-ago quarter.

AMD filings

Figure: Rapid growth in Data Center segment. Source: AMD filings

The AI chip sales are a key driver of the Data Center growth. The management has announced another increase in the AI chip revenue forecast for 2024 to $5 billion. This is up from an earlier forecast of $4.5 billion. In the year-ago forecast, AMD forecasted only $2 billion in AI chip sales for 2024. This pace of growth means that it is highly likely that AMD will deliver over $10 billion in AI chip sales for 2025. A higher revenue share in AI chip sales should also help in expanding the overall gross margin and improve the EPS estimate in the next few quarters.

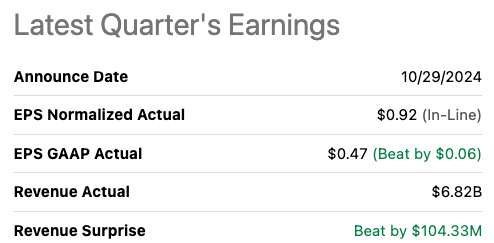

Seeking Alpha

Figure: Recent earnings result of AMD. Source: Seeking Alpha

Market share and stock trajectory

Prior to the AI boom, AMD was focused on the competition with Intel (INTC). Despite having a lower market share than Intel, AMD’s market cap was already higher than Intel’s before 2022. One of the main reasons behind this trend is that Wall Street believed AMD had a higher growth runway as it increased its market share. On the other hand, Intel was trying to defend its market share and margins which did not leave potential for future growth. There have been a lot of changes in the last two years as the AI hype continues to increase. However, investors should take into account the ability of the second-best option in the AI business to increase its market share which can lead to better valuation multiples.

AMD is in a similar battle with Nvidia within the AI segment. Obviously, Nvidia is not Intel. Nvidia also has a strong moat due to its CUDA platform and is developing new chips at a rapid pace. However, it is highly likely that AMD’s AI chip revenue could cross $10 billion in 2025 which will make it close to 9-10% of Nvidia’s projected AI chip sales for 2025.

AMD has a longer growth runway which should improve its forward growth estimates. The management has already announced that they are highly focused on delivering better AI chips at attractive prices.

AMD filings

Figure: Operating margin and revenue of Data Center segment. Source: AMD filings

Increase in the revenue share of Data Center segment should improve the overall margins of AMD in the next few quarters.

AMD is a lot cheaper

In comparison to Nvidia, AMD is a lot cheaper when we look at several key metrics. The P/E ratio of Nvidia for fiscal year ending Jan 2027 is close to 30 while AMD’s forward P/E ratio is only 22. As mentioned above, AMD also has a longer growth runway as it can grab a higher market share from Nvidia over the next few quarters.

Seeking Alpha

Figure: Forward P/E ratio of AMD compared to Nvidia. Source: Seeking Alpha

AMD’s forward earnings estimates are a lot more certain with a smaller gap between the low and high EPS estimates. AMD’s high EPS estimate of $10 for fiscal year ending Dec 2026 is only 60% higher than the low EPS estimate of $6.25. On the other hand, Nvidia’s forward EPS estimates are a lot more uncertain with a high estimate almost 4 times the low estimate. More certainty on future earnings makes it easier to make an investment decision.

Figure: Forward EPS estimate of AMD and Nvidia. Source: YCharts

Another factor to consider is that Nvidia already has a market cap of over $3 trillion, which is 3% of the total worldwide equities. This leaves little room for growth, and we could even see more regulatory headwinds for Nvidia. AMD’s market cap is less than $250 billion, and many hyperscalers could choose AMD in order to gain greater flexibility from where they get AI chips.

AMD stock has not performed well in YTD, but the company is in a good position to increase its market share in the lucrative AI segment and deliver solid EPS growth over the next few quarters.

Investor Takeaway

AMD has increased the AI chip revenue forecast for 2024 to $5 billion, which is significantly above the $2 billion projection made at the end of 2023. It is highly likely that AMD’s AI chip revenue in 2025 crosses the $10 billion level. Starting from a smaller base gives AMD a greater runway for growth, which should boost the overall sentiment towards the stock.

AMD stock is also trading a lot cheaper than Nvidia and many other big tech giants. At 22 times the EPS estimate for the fiscal year ending Dec 2026, the stock is reasonable and any future EPS upgrade should improve the stock momentum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.