Summary:

- Amazon continues to shine operationally, with strong Q3 results where management is proving excellent at driving profit growth.

- My valuation analysis shows that the company is now significantly overvalued, with a -32% margin of safety for investment.

- The company remains a prudent long-term holding, given its exceptional management and governance, where profit growth could evolve into dividend returns.

SonerCdem/iStock via Getty Images

Since my Amazon (NASDAQ:AMZN) Q3 earnings preview, the stock has already gained 12.8% in price at the time of this writing. The company is now overvalued, so I downgrade my rating to a Hold for this analysis, due to the fact that there are better-valued stocks for 15%+ returns over the next few years. As Amazon stock currently stands, it has years of future growth already priced in. I will show this below in my discounted EBITDA model but also provide a longer-term analysis to show that holding Amazon for the long term is a very prudent move.

Q3 Earnings Review: Strong Results With AWS Remaining Crucial

To begin with, the headline data: Amazon beat the normalized EPS consensus estimate by $0.29 and beat the revenue consensus estimate by $1.59 billion. Management provided Q4 guidance of between $181.5 and $188.5 billion in revenue (indicating year-over-year growth of 7% to 11%) and operating income of between $16 billion and $20 billion (indicating year-over-year growth of 21.2% to 51.5%). The mid-point of its Q4 guidance indicates a full-year 2024 revenue of $635.17 billion (10.5% year-over-year growth) and an operating income of $65.39 billion (77.44% year-over-year growth).

AWS consistently generates the highest operating margins among Amazon’s segments. In Q3 2024, AWS’s operating income hit $10.4 billion on $27.5 billion in revenue, achieving a 38% operating margin. Its revenue reflects a substantial 19% year-over-year revenue growth rate in Q3, with a projected annual run rate of $110 billion. Remember, AWS has around a 33% market share of the cloud market (a market most analysts expect to maintain a double-digit CAGR for the foreseeable future).

Understandably, management continues to invest heavily in AWS’s competitive positioning, and Amazon’s capital expenditures increased to $22.6 billion for the quarter. Management expects the company’s capital expenditures to be approximately $75 billion for the full year 2024. Despite such heavy capital expenditures, the company is still generating robust free cash flow per share, at $4.12 as of the last trailing 12 months. This is a testament to the current management’s relentless focus on profit generation, a feat made starkly clear in its year-over-year operating income guidance, indicating a 51.5% growth in the upper limit compared to 11% in the upper limit for revenue. Moreover, these high capital expenditures are building an impenetrable moat for Amazon, alongside its other Big Tech peers. These companies could become the bedrock of the West, as there is going to be a high dependency on proprietary artificial general intelligence owned by companies like Amazon for automation, robotics, and efficiency across all industries. In other words, the long-term return on investment in data centers is very high, even if there is some volatility in the medium term in establishing revenue and cash flow streams from the cash outflows.

Other notable areas of growth included the Advertising segment, which delivered $14.3 billion in revenue, marking an 18.8% year-over-year growth. This has been supported by the introduction of ads on Prime Video, where subscribers can opt to pay an additional fee to avoid commercials, and continued growth in its sponsored products offering. In addition, the International segment is proving strong, with a 12% year-over-year sales growth in Q3, compared to the North American segment delivering a 9% year-over-year sales growth for the quarter.

Interestingly, for Q3, the company observed a trend of consumers opting for lower-priced items, leading to larger basket sizes and increased shopping frequency. The key observation is that consumers are seeking value amid economic uncertainties—it remains to be seen how the current macroeconomic environment develops, but at this time, the cost of living amid high inflation is stultifying for many of Amazon’s customers. The strength of Amazon is that it is not just a marketplace for expensive or premium goods; it has become, as Bezos set out in the beginning, the “everything store”. Such a store with so many varying price points has some element of robustness amid a recession. That said, it is still prone to the effects of lower overall demand, and buying Amazon stock at a fair valuation is even more important given this consideration.

Valuation Analysis: Overvalued for Now

Starting at the beginning of Fiscal 2025 through to the end of Fiscal 2034, it is clear to me that a conservative, though optimistic, revenue CAGR estimate is approximately 9.5%. While the company has delivered a 10-year annualized revenue growth rate of approximately 23%, this is declining, with the five-year annualized rate at 19.5%. This is to be expected, considering the vast scale of Amazon’s retail operations at this time and with established market leaders in burgeoning economies like China and India making international domination unlikely. Of course, AWS is the segment promising outsized growth, but this is only 17.3% of Amazon’s total net sales as of Q3 2024 (that said, I expect this segment to expand significantly over the next 10 years, boosting the company’s total revenue growth above the current consensus estimates). Starting with management’s mid-point revenue guidance of $635.17 billion for Fiscal 2024, this compounds to $1.57 trillion at a 9.5% CAGR over 10 years.

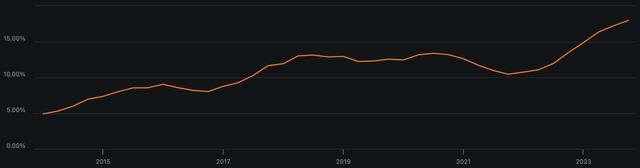

Amazon’s EBITDA margin has been expanding aggressively. Its five-year average is currently 12.84%, but it is now 17.99% as of the last trailing 12 months.

Amazon’s EBITDA Margin (Author, Using Seeking Alpha)

Given management’s current focus on operational efficiency and the advent of AI, allowing the company to invest in automation and robotics, I do not see it as unreasonable to suggest that this EBITDA margin will continue to expand substantially. At an EBITDA margin of 22.5%, the company will have a Fiscal 2034 EBITDA of $353.25 billion, based on my above revenue estimate for the year.

The company’s forward EV-to-EBITDA ratio is currently 15.93, but it has a five-year average of 19.91. In addition, its 10-year median EV-to-EBITDA ratio is 30. Given this long-term trend of contraction, it’s reasonable to forecast that this will continue, although at a slower rate. This is further supported by the company’s focus on margin expansion at the moment over top-line growth. Therefore, an EV-to-EBITDA ratio of approximately 13.5 is what I will be using as my terminal multiple in my valuation model. Therefore, I estimate that the company will have an enterprise value of $4.77 trillion toward the end of Fiscal 2034. This indicates an 8% 10-year CAGR from the present enterprise value of $2.26 trillion.

Amazon’s weighted average cost of capital is 12%, calculated by combining 12.65% for the cost of equity and 1.89% for the cost of debt, weighted by their proportions: equity at 94.15% and debt at 5.85%. The tax rate of 16.68% further adjusts the debt component. If we discount my Fiscal 2034 enterprise value estimate for Amazon of $4.77 trillion back by 10 years using its weighted average cost of capital of 12% as the discount rate, we arrive at a present-day intrinsic enterprise value of approximately $1.54 trillion. As the company is trading at an enterprise value of $2.26 trillion, this indicates that the investment currently has a margin of safety of -31.86%, meaning it is significantly overvalued.

Contrarian Analysis: Still a Prudent Long-Term Holding

Even though my valuation analysis shows that the company is currently significantly overvalued, I still believe Amazon stock is worth holding for the long term. Indeed, many readers would have initiated their positions in Amazon at a much more favorable valuation, and the resultant valuation CAGRs over the next 10 years will be more favorable as a result. However, the stock and the company cannot be expected to deliver very high alpha anymore, given that the business is well past its growth phase for many of its dominant operating segments. Moreover, the efficiency focus can only be stretched so far. Therefore, management may focus on dividends and share buybacks following the profit-focused strategy currently being enacted. This is something for long-term investors to look forward to. Such a well-managed company with continued robust growth ahead of it provides a stock that is likely to be stable in portfolios, meaning it is worth holding.

Moreover, I expect that the current valuation will contract significantly in the near term, given my margin of safety estimate. If the valuation contracts by approximately 20%, this would more than validate a Buy rating, and a collapse of upward of 30% would certainly validate a Strong Buy rating. The stock’s valuation is definitely overextended here, so long-term value investors simply need some patience before buying their next position or initiating their first.

In addition, it’s worth recognizing that my model is quite bullish on the AWS segment continuing to expand and the associated revenue accretion this will provide above the current consensus. Moreover, my EBITDA margin expansion estimate is also bullish, dependent on success with AWS driving automation capabilities. A failure of the AWS division to successfully execute this long-term AI and automation roadmap could lead to a poor return on investment of the company’s very high capital expenditures at the moment, particularly on data centers. This could mean the company is even further overvalued in a relatively pessimistic negative long-term outcome for AWS.

Conclusion: Hold

Given the overvaluation I have outlined, a Hold rating is definitely prudent here. This is a fantastic and enduring company with exceptional management—nothing about that has changed. However, with strong Q3 results, the company’s valuation has become significantly overextended, and initiating a position now is relatively foolish. There will likely be better entry points in the near-term future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.