Summary:

- Disney’s strong IPs and unique park experiences provide long-term resilience despite current challenges.

- Despite market conservatism, Disney’s revenue and margin expansion potential remain possible, supported by its robust IP portfolio and a strong business model.

- A ‘buy’ rating is justified given Disney’s solid fundamentals, potential for margin improvement, and attractive valuation.

ben phillips/E+ via Getty Images

Disney (NYSE:DIS) has long been considered a company of the highest quality and resilience. Its parks are (or at least were) unique experiences desired all over the world and with the capacity to increase prices in line with inflation without causing a decline in the flow of people, its films and IPs in general are well known and are part of global culture, among many other qualities.

On the financial side, the company has also always been able to generate a significant volume of cash and still pay reasonable dividends and buybacks. Even after a bad period, it generated $13.2 bn of operating cash flow in the last 12 months, equivalent to a P/OCF of ~14x.

The main entertainment companies have already reported their Q3 results. Paramount (PARA) reported interesting earnings, with a beat in EPS and Paramount+ subscribers, leading to an increase in DTC subscriptions and profitability. Netflix (NFLX) also experienced another solid quarter, with increases in paid memberships. Even Warner Bros. Discovery (WBD) recorded a quarter that the market liked, although a little more mixed, there was a solid increase in DTC subscribers and an increase in International ARPU.

Although this factor could be one of my justifications for giving Disney stocks a ‘buy’ rating before the Q3 (Q4 Fiscal), it doesn’t necessarily mean that The Walt Disney Company’s DTC results will also be robust, nor that the market will once again credit Disney as a good company with great prospects, as this also depends on a number of other factors. Still, I think that the market’s disbelief opens up a margin of safety for a good company going through a strange time.

Addressing Key Risks for Disney Stock

In 2019 FY, Disney reported an EPS of $5.77. For 2024 FY, the market expects a rebound from 2023 FY, with the company reaching $4.94. For 2025 FY, the consensus has a YoY growth estimate of 4.15% for EPS. This shows us that although the market is already pricing in an upturn in EPS, there is still a high degree of conservatism, at least for the short term.

This conservatism is well-founded, and the risks should not be overlooked. Since 2019, the linear viewership segment has faced headwinds, and the euphoria over streaming has subsided, with the company facing challenges to maintain a fast pace of growth in capturing new subscribers, and the sustainability of DTC profitability is still uncertain.

Another factor that bothers me is the failure of some movies. After Marvel’s great successes, several superhero films that have been released in recent years have been considered unsuccessful and it has become apparent that Disney/Marvel have “lost the knack” of making good films that achieve great box office. “The Marvels” is a good negative example, the film had a budget of over $270 million but grossed around $200 million. It may be unfair to compare it to Avengers: End Game, which grossed over $2.5 billion, but the point is not just the movie’s loss, but also its notoriety. There is a somewhat indirect gain from keeping its main franchises in the hype – such as Marvel’s superheroes, Star Wars, or even animated films. Keeping them relevant with good content not only generates profit from the high box office but also increases the sales of licensed products, a greater desire to visit the parks and also increases the resilience of streaming users. In other words, the company’s business is entertainment, so producing content that is sometimes good (and we have good recent examples, such as Inside Out 2) and sometimes considered bad by the public itself, brings an air of instability to various segments of the company.

As if that weren’t enough to make the scenario cloudy, the parks division (one of the most important for Disney’s thesis) also has volatile prospects and suffers from other problems. There is fear in the market about the opening of the Epic Universe park in Orlando, which increases competition in the region, which, along with other external factors such as macroeconomic aspects, consumer preference, and the like, makes it harder to believe that in the coming quarters attendance and prices will increase and consequently the operating income of this segment will continue to grow rapidly.

But some questions need to be asked, such as: Are these problems structural, i.e. do they hinder the long-term thesis? If we take a longer period, such as a decade, is it likely that the company will be able to maintain a pace of revenue and margin expansion?

Why Disney Still Holds Long-Term Potential

My take is that Disney is still a good company. Yes, there are a number of problems that need to be monitored closely, and many things haven’t gone exactly to plan, but there are still positive points that allow us to look a little more optimistically in the medium and long term.

The power of its IPs is something that should not be underestimated. The name “Disney” alone is very strong and makes its park business virtually unbreakable. It’s something unique, that people look for, will probably always look for, and will pay whatever it takes to achieve that experience or provide that experience for their children. This doesn’t just apply to parks, but I see this force spreading to streaming as well.

Warner’s Max platform has good, timeless series, such as The Sopranos, Succession, and Game of Thrones, among many others. But with a limited quantity, the platform still needs to prove itself in terms of churn and keep renewing its catalog to justify the subscription and possible price hikes. I believe that in the future, Disney streaming should be able to mitigate some of this churn risk and become more resilient, as it has content aimed at children and families, in addition to its already robust portfolio of brands. However, it turns out that this is not something that is being observed now. In a Forbes survey, Disney+ appears in first place, with 44% of respondents saying they would cancel the subscription if there were price increases. This is a factor that limits the prospects for the medium term.

The good thing is that the company already has a very significant number of subscribers, and is adopting strategies, such as plans that start at $10/m for the plan with ads and also with partnerships/bundles with Max, Hulu, and ESPN+. In fiscal Q3 the company reported YoY ARPU growth of a few cents, as well as subscriber growth/stability, which allowed revenue to grow by 14% for this segment and reversed the losses seen in recent quarters into a positive number.

Some releases such as Moana 2, Snow White, and Captain America in the coming quarters will also help to sustain a more stable outlook for the entertainment-related segments.

For the long term, I believe that the robust IP portfolio can sustain a more optimistic outlook for the Entertainment and Experiences segment. I believe it’s more a question of optimizing and getting back on track so that the company can once again exploit its franchises in profitable ways, through films, and series, and thus add more revenue (directly and indirectly) to streaming, parks, and products.

Thinking about things that are a little more “futuristic” and can’t be priced into the thesis, it’s possible that new forms of entertainment eventually emerge (or old forms, but improved), and if they do, Disney will be able to exploit them. As examples a little outside the box, perhaps there will be a growth in augmented reality/metaverse movies (and the like), games with Disney franchises, and the like. Artificial intelligence assisting in better/faster content development could also be a trigger in this more distant future, and one that we can’t price due to its uncertainty, but it’s to be hoped that if any of these trends emerge, Disney, due to its size and portfolio, should be able to benefit.

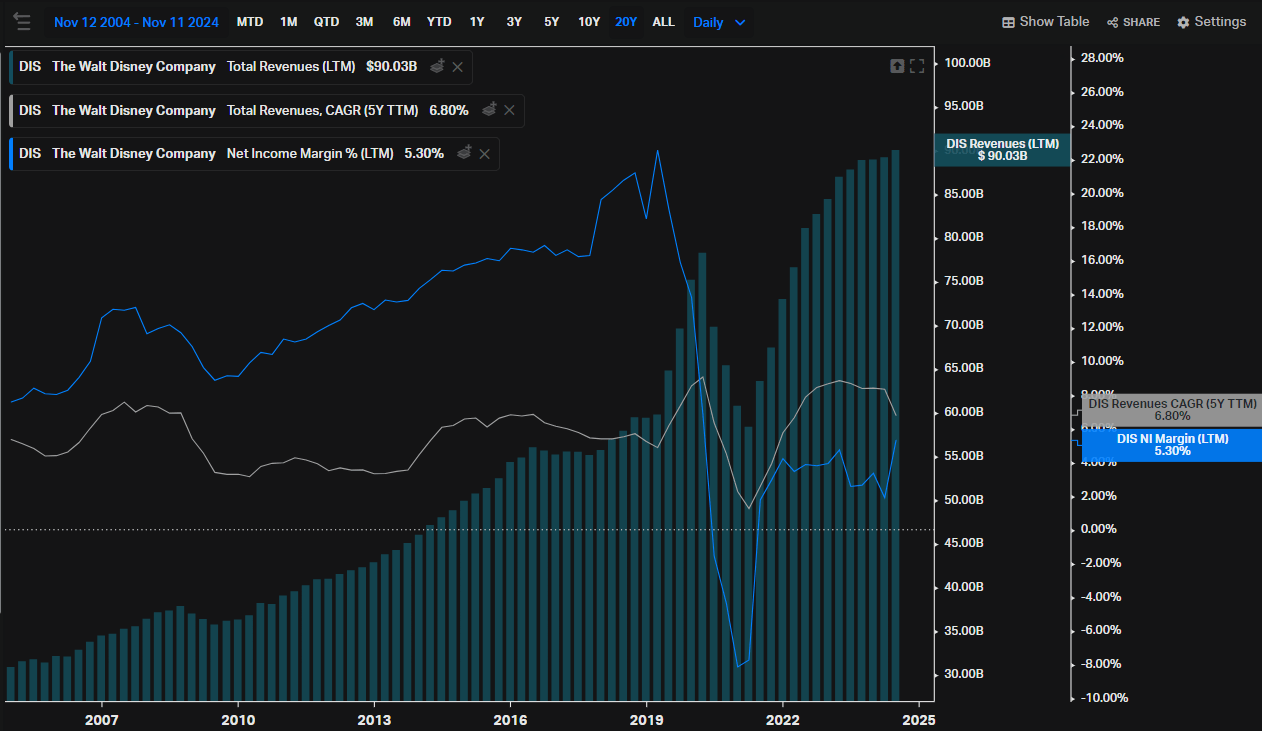

In any case, the best part of the thesis is that it’s not necessary to believe in miraculous futures where the company will have a double-digit revenue CAGR or return to its Net Income Margin above 15%, which was a level observed between 2015 and 2019. Still, in my view, these risks are relevant but do not contaminate the long-term thesis, and it is possible and likely that Disney will deliver a revenue CAGR close to mid-single digit in the coming years.

Disney’s Undervaluation and Growth Prospects

The graph below is complete enough and tells the story of an excellent company that has been able to generate shareholder value. Its revenue has evolved quite consistently, with a mean CAGR of 5.6% for the 5y TTM period, even counting more difficult periods such as the current one, the pandemic, and the fiscal year 2017. Its net income margin has also evolved well over time, but is currently at a worse level, with prospects of soon returning to something more normalized and close to 9%/10%.

Koyfin

The fiscal year of 2017 is something curious to analyze. The stock was underperforming the S&P500 in 1-year and 3-year periods, and the change in operating income exceeded the 10% decline in Media Networks, Consumer Products & Interactive Media, and Studios, with only Parks and Resorts maintaining interesting momentum. What strikes me is that at that time Disney stock was also trading at a price similar to what we see today, just over $100 per share. Of course, this is explained by an EPS that has been stagnant ever since.

However, as mentioned, this disbelief and uncertainty is reflected in the valuation. Disney is currently trading at a forward P/E of 20x, below its historical average of ~24x over the last 20 years and also below the S&P500 (SPY), which currently has a multiple of ~23x.

These 20x earnings are already cheap in themselves, as they mean an earnings yield of 5% for a company that may well be able to grow its earnings at least at the rate of inflation in the long term, but perhaps that wasn’t enough for me to be optimistic about the thesis. There is a relevant upside risk, which could materialize if Disney gets back on track and manages to raise its margin or win back the market if it manages to deliver faster-growing revenues at some point (and this could be in a few years).

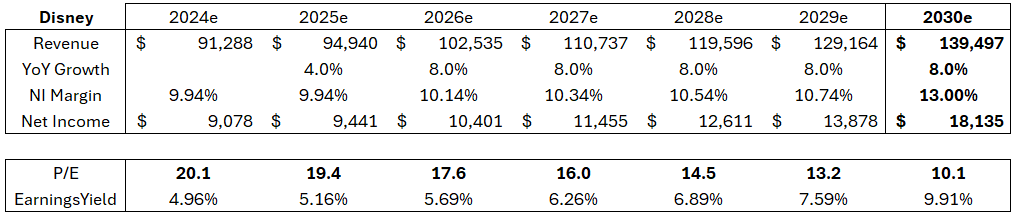

Let me give an example. If we believe that the company will grow its revenues at a slow pace, somewhere between 4% and 6% per year until 2030, and achieve a net income margin of 10.74%, we find a P/E in 2030 of ~13.5x. If, by some chance, the company manages to grow 8% from 2026 to 2030 and achieve a margin of 13%, whether due to solid momentum from DTC and Parks, efficiency gains, or similar, this P/E goes to 10x.

Author (Kênio Fontes)

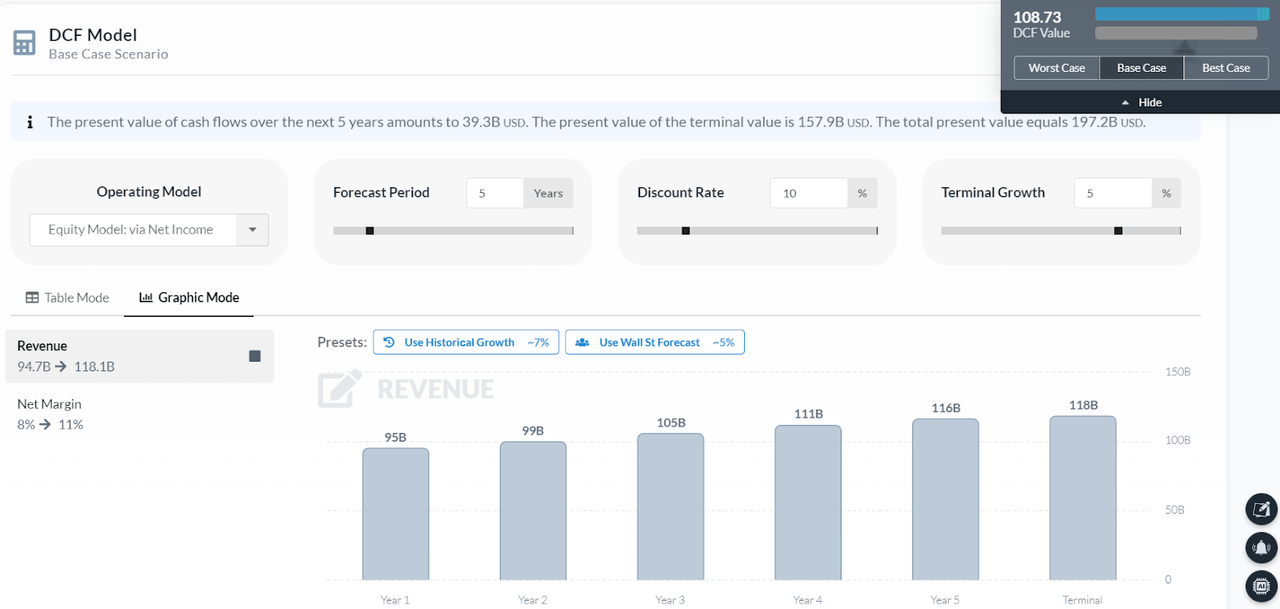

Using net income as a proxy for FCF (historically they are close and have a similar trend) and performing a DCF Model, it is also possible to infer that Disney stocks are undervalued at the current price. Applying revenue growth of 5% over the next few years and a terminal net income margin of 10.77%, terminal growth of 5%, and a discount rate of 10%, we find a fair price of $108.7 for Disney stocks.

Alpha Spread

This means that if this base/conservative scenario plays out, the Disney shareholder will already be paid more than 10% a year. In addition, there is the upside risk mentioned, in case the company surprises positively and manages at some point to show better margins or a better pace of revenue growth.

The Bottom Line

Even if the company disappoints in the fiscal Q4 (whose earnings call will be on November 14) and runs the risk of this margin of safety becoming even better, the rating for Disney deserves to be ‘buy’ ahead of earnings. The company is going through a somewhat delicate time, but it is still a solid, quality thesis with an attractive valuation.

For the more cautious investor, it may be more interesting to wait for the earnings call and see how management will address certain issues. If there are comments about the parks and prospects for DTC, as well as what they expect from upcoming launches and how they can be received and/or unlock value again, this can help build a more optimistic thesis with clearer prospects. The efficiency point is also important to follow, understanding how points such as costs, SG&A, and CapEx may shape up in the coming years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.