Summary:

- Energy Transfer remains a top holding in my portfolio, with a strong buy rating due to its robust cash flow and undervaluation.

- Despite missing Q3 revenue and EPS estimates, the company maintained 2024 guidance, reinforcing its long-term value for investors.

- Impressive EBITDA growth driven by the Midstream segment and Sunoco LP investment, with significant upside potential compared to peers.

- Energy Transfer’s financial stability and reduced leverage make it a stellar prospect, warranting continued investment and a strong buy rating.

spooh

Those who follow my work closely understand that one of my favorite publicly traded companies in the entire world is none other than midstream/pipeline firm Energy Transfer (NYSE:ET). Even as I type this, the company is the 4th largest holding in my larger portfolio, accounting for 14.53% of total assets. In that portfolio, I have six stock holdings and three sets of call options, two of which involve stocks that I currently own in that portfolio. So as you can tell, I like having a very concentrated portfolio. But honestly, that has worked out well for me. At present, I’m currently outperforming the S&P 500 for the year. And considering that it’s up 37.4%, inclusive of dividends, I would say that’s pretty solid.

My rating for the stock has also been quite successful. Since I last reaffirmed it as a ‘strong buy’ back in August of this year, shares are up 12% compared to the 11.8% increase experienced by the S&P 500. And since I first upgraded the company to a ‘strong buy’ in November 2019, shares have generated upside for investors of 125.6%. That’s comfortably higher than the 93.5% increase experienced by the S&P 500 over the same window of time.

Of course, given how important the company is to my financial well-being, it is incumbent upon me to continue to watch over it closely. Just the other day, management announced financial results covering the third quarter of the company’s 2024 fiscal year. Even though the company fell short of analysts’ expectations when it came to revenue and earnings per share, missing these figures by $820 million and by $0.03, respectively, the company maintained guidance for 2024 in its entirety. This improved guidance, combined with how cheap shares remain, only furthers my belief that the company remains a robust opportunity for long term, value-oriented investors. So because of that, I am keeping it rated a ‘strong buy’ for now.

Cash keeps flowing

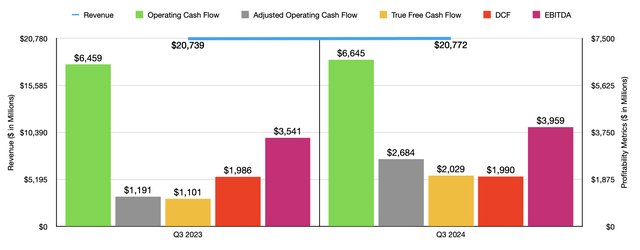

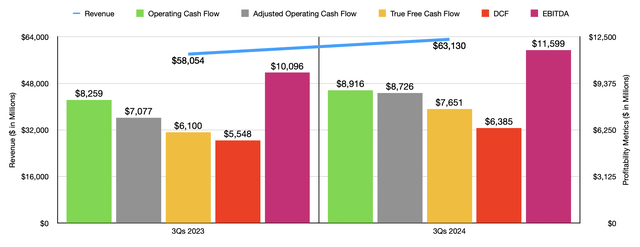

One of the things that I love most about the midstream/pipeline industry is how steady cash flows can be. Revenue rarely matters all that much. What matters, instead, is the spread that the company can capture on the commodities that go through its pipelines and the overall volume that it can transport and otherwise deal with. For instance, from the third quarter of 2023 to the third quarter of 2024, revenue increased modestly from $20.74 billion to $20.77 billion. However, operating cash flow jumped from $6.46 billion to $6.65 billion. Other profitability metrics have also fared well. During the third quarter of the year, adjusted operating cash flow, which strips out changes in working capital, grew from $1.19 billion to $2.68 billion.

Another metric that I like to look at is what I refer to as ‘true free cash flow’. This strips out preferred distributions and maintenance capital expenditures. I understand that preferred distributions are not an operating cash flow item. But since they are a required cash outflow, I like to deduct them. And maintenance capital expenditures, or sustaining capital expenditures as some companies call them, represent the amount of capital expenditures needed in order to keep operations running as-is. Year over year, this metric grew from $1.10 billion to $2.03 billion. DCF, or distributable cash flow, increased by only $4 million. But rounding to the nearest $10 million mark, we still get $1.99 billion each year. And finally, EBITDA for the firm managed to rise from $3.54 billion to $3.96 billion.

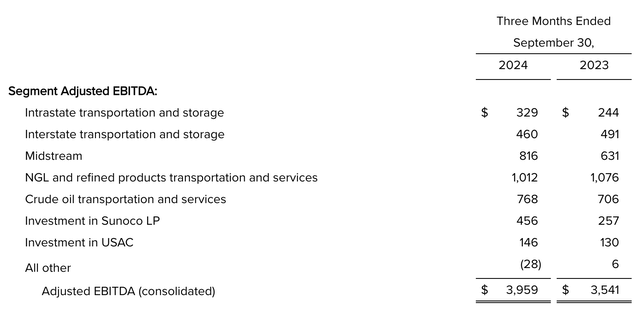

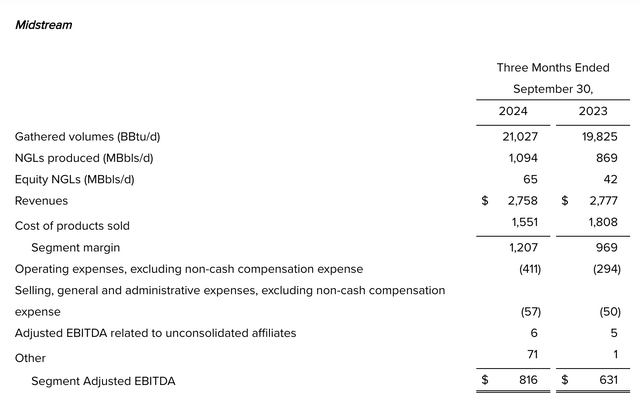

Digging into the company further, we can see what helped it achieve these impressive results. There ended up being two major contributors to its increase in EBITDA, for starters. The first of these was its Midstream segment, which saw an increase in EBITDA from $631 million to $816 million. Revenue barely budged, declining slightly from $2.78 billion to $2.76 billion. However, volumes increased quite a bit. Gathered volumes grew by 6.1% year over year. The amount of NGLs produced on a per-barrel basis expanded by 25.9%. And the company enjoyed an increase in equity NGLs of 54.8%.

Speaking about the segment’s EBITDA specifically, most of the heavy lifting was done from higher margin associated with assets that the company recently acquired and because of higher organic volumes coming from the Permian Basin and surrounding areas. The company also benefited to the tune of $70 million from other income because of an insurance claim. However, there were some other things offsetting these increases. A $108 million increase in costs associated with recent acquisitions and the placement of other assets into service helped to push up operating expenses by $117 million. Lower natural gas prices also hit profitability to the tune of $16 million, while higher insurance costs pushed selling, general, and administrative costs up by $7 million.

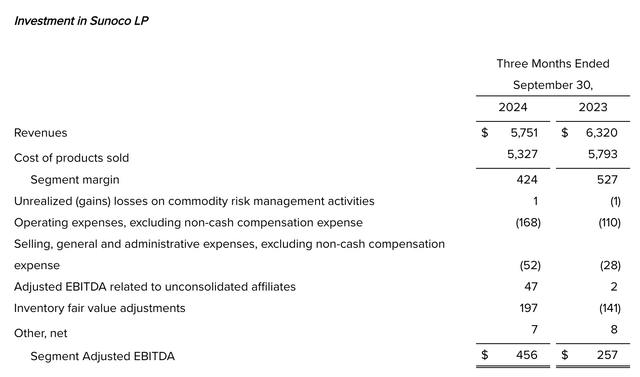

The other big benefit for the company came from its investment in Sunoco LP. Even though revenue dropped from $6.32 billion to $5.75 billion, EBITDA expanded from $257 million to $456 million. However, this had nothing to do with improved margin. In fact, segment margin contracted from $527 million to $424 million. However, this was more than offset by a $338 million swing in inventory fair value adjustments.

Energy Transfer Energy Transfer

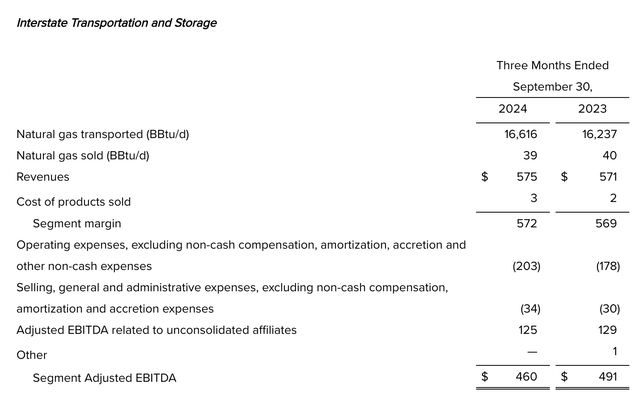

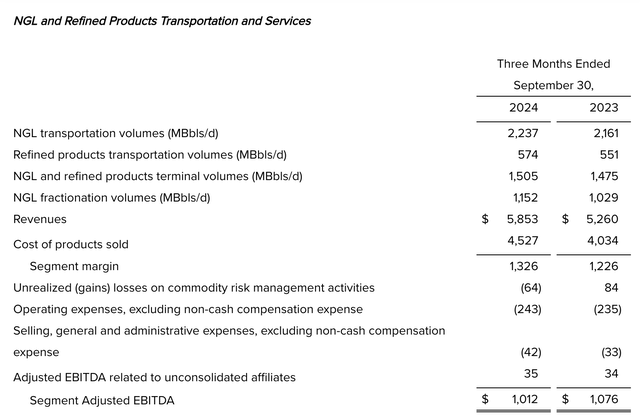

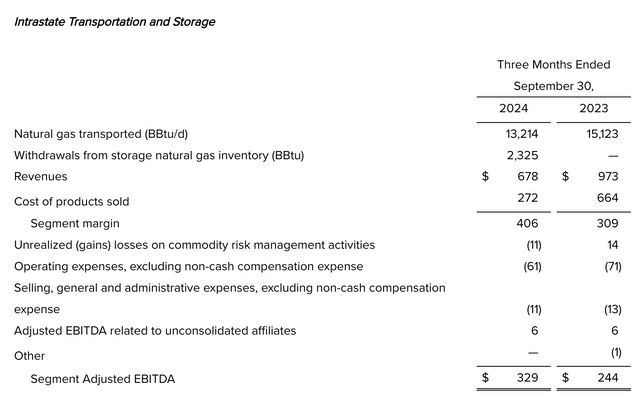

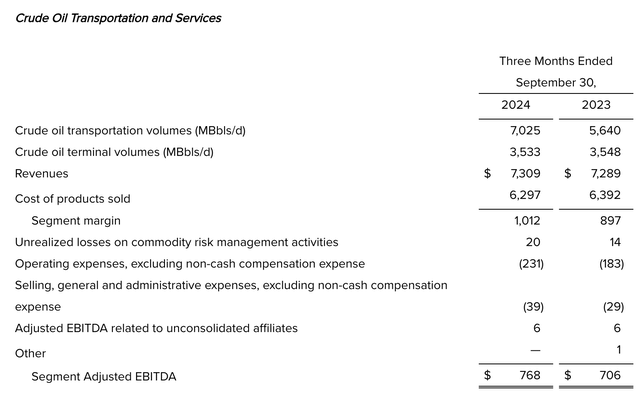

Unfortunately, not everything performed well during the quarter. There were some other increases, such as when it came to the Intrastate Transportation and Storage Segment, with EBITDA climbing from $244 million to $329 million because of increased realized natural gas sales, and a rise in EBITDA coming from the Crude Oil Transportation and Services segment from $706 million to $768 million That management attributed mostly two recently acquired assets and a recently formed joint venture. On the other hand, both the Interstate Transportation and Storage segment and the NGL and Refined Products Transportation and Services segment reported declines in EBITDA.

The Interstate Transportation and Storage unit of the company reported a decline in profitability from $491 million to $460 million. Even volumes of natural gas transported by these assets jumped 2.3% year over year, the firm’s bottom line was negatively impacted by increased operating expenses. Meanwhile, the NGL and Refined Products Transportation and Services segment reported a drop in EBITDA from $1.08 billion to $1.01 billion. Transportation volumes increased here as well. Overall segment margin improved. However, profitability was ultimately impacted by a $148 million swing in gains and losses associated with commodity risk management activities.

In the chart below, you can see financial results for the first nine months of 2024 compared to the same time last year. As was the case in the third quarter on its own, Energy Transfer experienced higher revenue and cash flows. Year over year, cash flows were up across the board. In fact, the picture for the business remains robust enough that, even though the company fell short of analysts’ estimates, the company is still forecasting EBITDA for this year of between $15.3 billion and $15.5 billion.

As I detailed in my prior article about the firm, these results only take into consideration a partial year of ownership regarding WTG Midstream Holdings LLC, a $3.25 billion purchase added roughly 6,000 miles of complementary gas gathering pipelines to the business. In that prior article, I estimated that, had the company purchased that business at the beginning of this year, hitting the midpoint of EBITDA guidance for 2024 would translate to a reading of roughly $15.65 billion. So that is the number I will be using. Based on that, we should expect adjusted operating cash flow to be around $11.43 billion, true free cash flow to be $10.21 billion, and DCF to be $8.66 billion. I see no reason to change these estimates given that management’s own guidance remains unchanged.

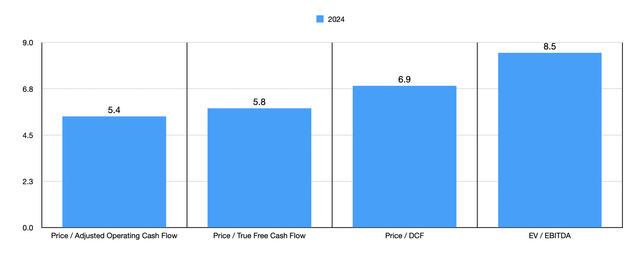

Taking these figures, we can see in the chart above how the company is currently valued for the 2024 fiscal year. I always love seeing a high-quality cash cow trading in the mid to high single digit range. But outside of this space, that is incredibly rare to experience. In addition to shares being cheap on an absolute basis, they are also cheap relative to similar enterprises. In the table below, I took two of these four valuation metrics and compared the company to five similar businesses. And fortunately, our candidate ended up being the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Energy Transfer | 5.4 | 8.5 |

| Kinder Morgan (KMI) | 9.1 | 13.8 |

| The Williams Companies (WMB) | 12.2 | 13.2 |

| Enbridge (ENB) | 9.7 | 12.6 |

| Enterprise Products Partners (EPD) | 8.2 | 10.7 |

| MPLX (MPLX) | 8.3 | 10.2 |

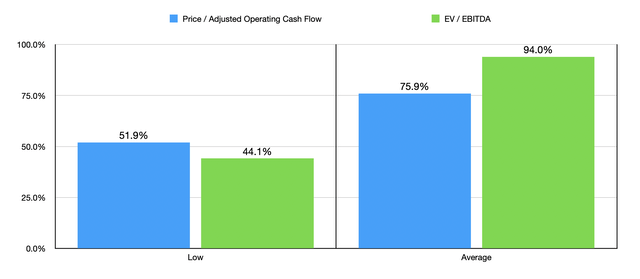

In my opinion, shares of Energy Transfer are not just cheap. They look drastically undervalued. To illustrate how much upside potential they have, I decided to create the next chart below. In it, I looked at a couple of different scenarios. For instance, using the price to operating cash flow scenario, I calculated how much upside shares would have if the company were to trade at the multiple of the lowest of the five companies I compared it to. In this case, upside would be 51.9%. If we instead assume that it should trade at the average of these five firms, then upside would be 75.9%. Next, I did the same thing regarding EBITDA for the EV to EBITDA scenario. In this case, we get upside of between 44.1% and 94%.

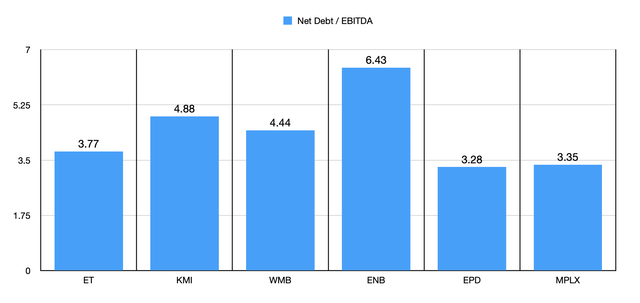

Normally when you see such a huge disparity in price, it is because there is something wrong with the business that’s cheaper. But that does not appear to be the case here. For instance, if we look at overall leverage, as shown in the chart below, Energy Transfer seems to be doing quite well. The net leverage ratio of the company, using projections that I set out for this year, and assuming no further reduction in debt, comes in at 3.77. Only two of the five companies that I compared it to have net leverage ratios lower than this. The others are quite a bit higher. In the near term, we could see even further reduction in leverage. I say this because management is forecasting growth in capital spending this year of between $2.8 billion and $3 billion. This actually marks a downward revision from what they stated in their second quarter release, when they were forecasting spending of between $3 billion and $3.2 billion. In the long run, this might mean reduced upside for the company. However, it could also lead to further debt reduction and, by extension, a reduction in annual interest expense.

Takeaway

Based on all the data provided, I would make the case that Energy Transfer is still a stellar prospect. Even though the company has gone up quite a bit since I became very bullish on it a few years ago, I believe that further significant upside is warranted. Because of this, I have absolutely no problem keeping it rated a ‘strong buy’. And in all likelihood, I will continue to add to my position gradually as time goes on.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!