Summary:

- Energy Transfer stock remains a ‘buy’ due to its 7.5% distribution yield, strategic asset positioning, and attractive valuation metrics compared to peers.

- ET is positioned to benefit from the incoming administration, growing demand for natural gas, and strong operational performance with record-setting crude oil, NGL, and midstream volumes.

- Expansion projects in the Permian Basin and Nederland terminal position ET to meet future energy demand and capitalize on global LNG and LPG export opportunities.

- With a well-covered distribution and favorable EV/EBITDA valuation, ET could deliver strong total returns from here.

spooh

The Trump victory last week has lifted a number of stocks, with the rally being justified for some and maybe not so much for others. For example, some stocks that were already trading at nosebleed valuations have gotten even pricier and ventured into what I would call speculative range. On the other end, there are some stocks that have been undervalued for a long time and are finally getting the respect that they deserve.

This brings me to Energy Transfer (NYSE:ET), which I last covered in September, highlighting its compelling 8% distribution yield, and strategic positioning across its asset base. The stock has performed well since my last piece, producing an 8% total return, outpacing the 6% rise in the S&P 500 (SPY) over the same timeframe, with much of those gains coming after the election last week.

In this article, I revisit ET including recent Q3 performance and discuss why this stock remains a resounding ‘buy’ for income and potentially rewarding total returns, so let’s get started!

Why ET?

Energy Transfer issues a Schedule K-1 and is a leading midstream company with assets that include natural gas and liquids pipelines that transport crude oil, refined products, and NGL. Its EBITDA has just 5-10% commodity price exposure with the remaining 90% being fee-based, resulting in steady cash flows.

ET’s long haul pipelines benefit from significant economies of scale due to the network effect that connects producing regions in North Dakota, Texas and Appalachia to its storage facilities, terminals, processing and export facilities, as shown below.

As one can imagine, the recent election victory of Trump back into the White House is viewed as a positive for U.S. oil and gas companies due to his and Republicans’ long-held support for the industry. In fact, ET’s founder and executive chairman Kelcy Warren was a significant backer of Trump’s campaign and co-CEO Mackie McCrea said last week that the election result will bring a “breath of fresh air” to the oil and gas industry, in one of the first public comments by an energy executive.

Meanwhile, ET continues to demonstrate strong results, with adjusted EBITDA growing by 12% YoY to $3.96 billion during Q3 2024. This was driven by crude oil transport volumes growing by 25% YoY, setting a new record. Moreover, crude oil exports were up 49% YoY, midstream gathered and produced volumes were up 6% and 26%, respectively. Lastly, NGL fractionation and transport volumes both set records at 12% and 4% YoY growth, respectively.

Moreover, ET is benefitting from the AI-wave, as it has received requests for connections to more than 90 power plants and data centers, which could total around 16 billion cf/day of new natural gas demand. According to Goldman Sachs (GS), energy-hungry data centers needed to support AI are expected to account for 8% of power demand in the U.S. by 2030 compared to 3% in 2022.

This fits well with ET’s growth strategy of meeting growing electricity demand with its expansion projects. This includes the construction of eight, 10-MW natural gas-fired electric generation facilities for 80 MW of total capacity, which fits well across ET’s pipeline network, as shown below.

Looking ahead, ET is well positioned with a number of other projects that include natural gas processing facilities in the Permian Basin to increase capacity to meet growing demand and export requirements, as noted below during the recent conference call:

Taking a look at our Permian processing expansions, we recently completed the 50 million cubic foot per day upgrade to our Orla East processing plant and construction continues on upgrades to three other processing facilities, which will add incremental processing capacity in West Texas of approximately 150 million cubic feet per day.

Additionally, construction of the 200 million cubic feet per day Badger processing, plant in the Permian Basin is underway. As a reminder, this plant, which is expected to be in service in mid-2025 will utilize an idle plant that is being relocated to the Delaware Basin.

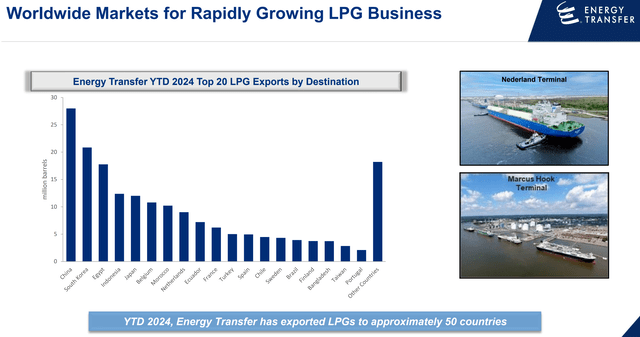

Notably, ET also has the Nederland terminal expansion with initial phase expected to come online in mid-2025 to meet growing global demand for NGLs. Looking further down the line, ET’s co-CEO McCrea believes that the change of administration assures financial go-ahead for its proposed Lake Charles LNG plant in Louisiana to facilitate exports, with potential to process 16.5 metric tons/year of LNG. ET also exports LPG with top markets being China, South Korea, Egypt, Indonesia, and Japan, as shown below.

Importantly, ET carries a strong balance sheet with BBB/Baa2 credit ratings from S&P and Moody’s, which were upgraded last year and this year by the two agencies. This is supported by a net debt to TTM EBITDA ratio of 4.26x, which sits below the 4.5x level generally regarded as being safe for energy midstream companies.

ET continues to raise its distribution, including the most recent 0.8% raise to $0.3225 quarterly rate for Q4, which sits 3.2% higher than the prior year period. Currently, ET yields an appealing 7.5%. In Q3, ET had a robust DCF to Distribution coverage ratio of 1.8x, based on $1.99 billion in DCF and $1.099 billion in distributions paid.

Lastly, I continue to see value in ET at the current price of $17.17 with a price to cash flow of just 5.8x, which compares favorably to the 8.5x and 8.4x of MLP peers Enterprise Products Partners (EPD) and MPLX LP (MPLX), respectively, as shown below.

ET also looks undervalued relative to its peers using an apples-to-apples comparison with EV/EBITDA, since enterprise value includes debt. As shown below, ET’s EV/EBITDA ratio of 9.6x sits below the 10.4x and 11.6x of EPD and MPLX, as shown below. With a 7.5% distribution yield, and potential for robust annual EBITDA growth due to projects and strong demand, ET could produce potential market beating total returns from here.

Risks to the thesis include potential commodity price volatility, which could put pressure on produces that utilize ET’s services. In addition, a slowdown in the global economy, particularly in China, which is a top LPG export market for ET, could put into question the viability of near-term projects to boost exports. ET also carries more balance sheet risk compared to peers due to higher leverage, as noted earlier. As such, higher interest rates could result in pressure to the bottom line.

Investor Takeaway

Energy Transfer remains an attractive investment with its robust distribution yield of 7.5%, attractive valuation metrics, and strategic asset positioning across key U.S. oil and gas regions. It’s also positioned to benefit from a supportive political backdrop and growing demand for natural gas due to the rise in energy-intensive AI applications across data centers.

Meanwhile, ET has demonstrated strong operational performance with record-setting crude oil, NGL, and midstream volumes. The company’s expansion projects, including those in the Permian Basin and the Nederland terminal, position it to meet future energy demand and capitalize on global LNG and LPG export opportunities. Plus, with a well-covered distribution and a favorable EV/EBITDA valuation relative to peers, ET could deliver potential strong total returns from here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.