Summary:

- Towers have resilient secular growth but have often been expensive.

- Multiples dropped considerably in 2022, allowing an opportunistic entry point.

- We dig into CCI and AMT to get a sense for which is better positioned.

D-Keine

In 2CHYP, the Portfolio Income Solutions portfolio, we are constantly re-evaluating existing positions. It is a matter of opportunity cost and if something better comes along, we want to be swapping into whatever offers the best risk adjusted return on a forward basis. Within the tower sector, Crown Castle (NYSE:CCI) has fallen to a valuation that appears to be more attractive than American Tower (NYSE:AMT). This warrants a deeper dive to determine whether to make the swap.

Both companies are well managed, sturdy, mega caps in a secular growth sector but there are significant differences in valuation, strategy and growth rate. In this article, we examine each category to see which has the edge over the competition.

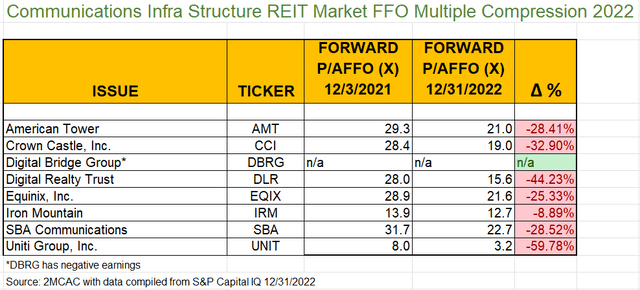

Valuation

Towers, due to their mega-cap nature and long term reliable cashflows are less volatile than most other sectors which resulted in the tower REITs falling less than the rest of REITs. Both AMT and CCI grew AFFO/share but their market prices dropped causing their multiples to decline by 28.4% and 32.9%, respectively.

Portfolio Income Solutions

All that multiple compression was caused by more moderate price declines.

S&P Global Market Intelligence

At the time we bought AMT, we preferred it over its peers because it had a more attractive valuation, but due to the relative price movement, CCI is now the cheapest tower REIT with a 19.12X AFFO multiple.

SBA Communications (SBAC) remains significantly more expensive than its peers.

CCI is also cheaper than AMT on an NAV basis which makes it rather tempting to swap out AMT for CCI. However, there are some substantial differences between the companies, so perhaps different multiples are warranted.

Strategy

Despite both being companies centered around macro communications towers, the strategies have diverged significantly in recent years. The 2 primary points of differentiation are:

- Geographic focus

- Secondary property type

Crown Castle is the domestic U.S. play while AMT is international with plans to become global. There are advantages to each which I will explore further below.

I generally prefer U.S. properties for most real estate sectors because there is a certain reliability that comes with a wealthy, established nation with strong property law. U.S. based cell carriers have a track record of paying rent consistently and risk losing their entire businesses if they fail to pay rent for their towers.

In contrast, AMT has had trouble with Vodafone in India refusing to pay part of its rent. There are perhaps underlying economic reasons that Vodafone can’t or won’t pay, but I suspect a significant portion of the challenge here is that India’s laws and enforcement of laws do not provide the same protections to property owners that U.S. laws do.

As such, the tower business overseas is riskier and especially riskier in emerging markets.

However, there are some aspects unique to the tower business that cause me to prefer AMT’s international focus.

- Cap rates on acquisitions are significantly higher

- Earlier stage of tower buildout provides lengthy growth runway.

The U.S. tower market is fairly mature having reached nearly full saturation of 4G macro towers. This leaves the remaining growth as upgrades to 5G through lease amendments. I suspect the 5G organic tower growth will fuel strong same store NOI for the next decade. After that, it is a big unknown. Will I move to strictly small cell? Will there be a 6G? The smartest tech minds don’t yet know the distant future of communications infrastructure so I certainly am not going to venture a guess.

In contrast, many of the overseas markets are quite immature in comparison. Some are still building 3G and 4G coverage. This provides a much longer runway of growth. All the growth experienced by towers in the U.S. over the past 15 years is still set to play out in the less mature markets. AMT can collect via developing new towers, collocating additional operators on towers, adding more advanced 4G equipment, and eventually amending leases to add 5G equipment.

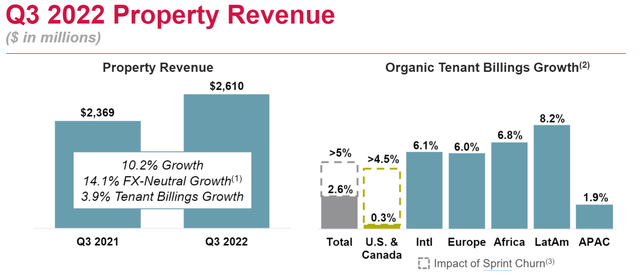

Thus, the way I’m looking at it is whatever duration the runway of growth is in the U.S., the international markets have that duration plus 15 years. Over time, I think the excess growth will significantly outweigh the risks of Vodafone or other similar hiccups. The higher growth can already be seen in the organic growth rates by region.

AMT

Secondary property type

CCI has built out quite an extensive fiber network while AMT has gone the data center/edge computing route through its purchase of CoreSite.

Each secondary property type has the potential for extensive synergy with towers. Every macro tower needs fiber for backhaul while data centers located proximally to towers allow for ultra-low latency processing.

That said, the synergies of each company are still in their very early stages with most of the revenues of the secondary businesses just being those directly associated with fiber and data centers. Synergies are more of a 3-5 years into the future sort of event.

I think there is merit to each strategy and I don’t have a strong preference between the two. However, I do think there are reasons to attribute a higher multiple to data centers as a secondary business.

Essentially, there is no way to acquire data centers cheaply. Digital Realty (DLR) trades at about 16X AFFO and data center acquisitions such as Switch and CoreSite were at multiples well north of that. Equinix trades at 21.5X AFFO and they have similar capabilities to CoreSite. Thus, I think it is reasonable to pay AMT’s multiple of about 21X to get exposure to data center through AMT.

In contrast, CCI’s exposure to fiber should probably lower CCI’s overall multiple because fiber is readily accessible at very cheap prices. I don’t want to pay 19X AFFO to get fiber through CCI when I can get fiber for just over 3X AFFO through Uniti Group (UNIT). It is also quite cheap through Lumen (LUMN). So while I like fiber as an asset, there are simply better value ways to gain exposure.

Growth rate

Towers in general are one of the higher growth sectors. Most of the contracts with carriers come with 3% annual rent bumps and these are supplemented by continual amendments in which the tenant agrees to pay more in exchange for being able to add more equipment on the tower. Another source of growth is adding an additional tenant to an existing tower. At the moment, this is likely to be DISH as it builds its network.

Due to its international exposure, I think AMT has a slightly higher base growth rate than CCI but that higher growth rate is largely balanced out by slightly higher risk.

Based on the topics discussed so far, I would be largely indifferent between AMT and CCI at current valuation. It is the timing of headwinds and tailwinds that I think makes AMT a significantly better opportunity.

Upcoming and recent tailwinds

T-Mobile (TMUS) buying Sprint was one of the worst events for tower REITs in quite some time. When a tower can add an additional tenant to a tower it is pure margin. Almost no capital outlay for a significant increase to revenue.

The opposite happens when carriers consolidate. A tower that used to serve Verizon, T-Mobile, AT&T and Sprint will soon just serve the 3 larger tenants as TMUS will not renew the Sprint equipment on the tower as it would be redundant coverage with their own equipment.

Eventually Sprint will largely get replaced by Dish, but in the interim, there is an awkward churn in which most of the Sprint revenues lapse upon expiry.

AMT had its Sprint leases spread out over time such that it has been taking a churn hit each quarter since the merger completed. This slowed its growth rate from the historical ~10% annual to a rate closer to 5% annually for the next couple years.

S&P Global Market Intelligence

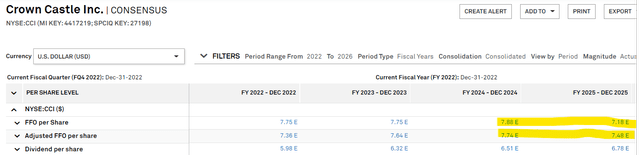

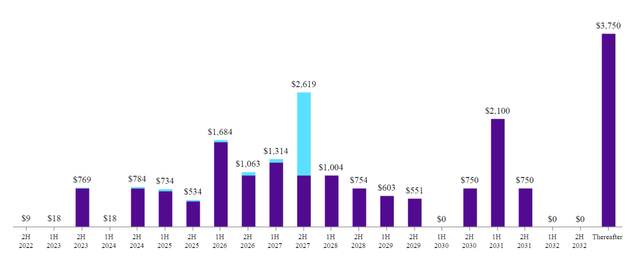

Crown Castle hasn’t really taken the Sprint churn hit yet as almost all of its churn is concentrated into 2025. As you can see below there is anticipated to be a drop in earnings for 2025 as compared to 2024.

S&P Global Market Intelligence

I agree with the analysts in this estimate as the Sprint churn timing is well telegraphed.

What this means from a valuation perspective is that CCI is effectively overearning its true run rate. If you were to factor in the Sprint churn into CCI’s proforma it would no longer be a 19X AFFO stock. In fact I think it is slightly more expensive than AMT.

2 other headwinds/tailwinds related to AMT

CCI’s debt profile is great. Smooth maturities and about 90% fixed rate.

CCI Supplemental

AMT’s is both better and worse.

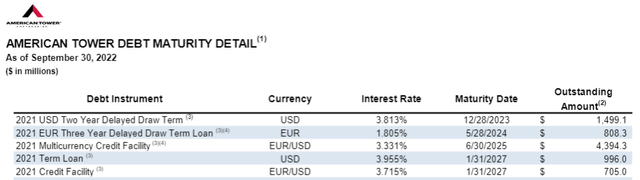

The downside is that it has about $4.4B of floating rate debt.

AMT

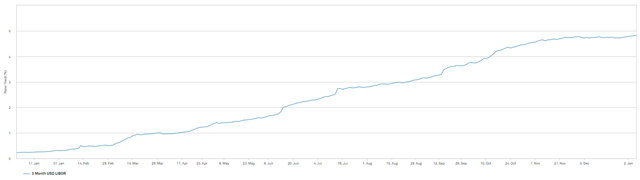

Given recent changes to interest rates, this will hurt a bit.

S&P Global Market Intelligence

Weighted average 3 month LIBOR in 3Q22 was about 3% and it is now sitting at about 4.8% so that is a 180 basis point increase. On $4.4B of variable rate debt this represents a forward annual interest expense increase of about $79.2 million or about $0.17 per share.

The flip side of this is that due to its exposure to Europe, AMT has access to absurdly cheap debt. As of 3Q22, it had a weighted average cost of debt of 2.8%.

AMT

So even with the increased cost of the floating rate debt its overall interest rate is still going to be south of a 10 year Treasury. AMT is also rapidly paying down its floating rate debt with its cashflows.

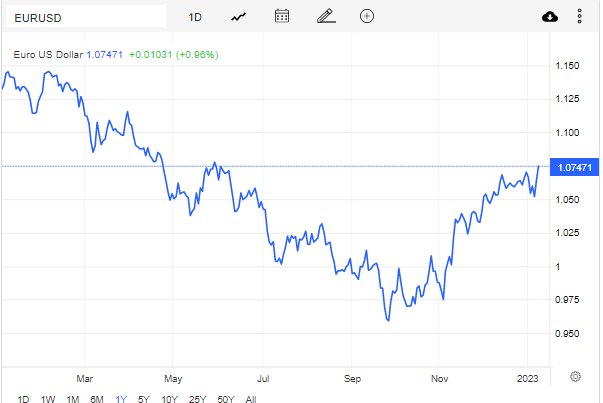

Forex has been a headwind for AMT, costing it multiple percentage points of growth in 2022, but that seems to be flipping to a tailwind.

Tradingeconomics

Since reporting 3Q22 earnings, the US Dollar has weakened materially (Euro strengthening in the chart above). This should largely offset the variable interest expense.

Wrapping it up

Towers are good real estate as long life, low capex infrastructure with secular growth. I view AMT as the best value tower REIT given its superior growth outlook and properly adjusting for timing of Sprint churn.

Disclosure: I/we have a beneficial long position in the shares of AMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Important Notes and Disclosure

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.

Opportunistic Market Sale: 20% off for a limited time!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and chock full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!