Summary:

- Shares of American Tower have had a rough 2022 and are down 25% YTD.

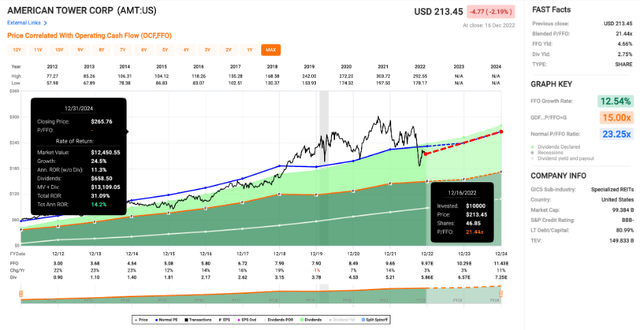

- With shares at a price/FFO of 21.4x, shares currently trade below the average multiple from the last decade.

- The company recently announced a 6.1% dividend hike, the latest in a long string of quarterly increases. The yield currently sits at 2.9%.

- Investors looking at the telecommunications sector should consider American Tower or its smaller sibling, Crown Castle, over large companies like AT&T or Verizon.

imaginima/iStock via Getty Images

Every once in a while I read articles on AT&T (T) and Verizon (VZ), two large telecommunications giants with cheap valuations and large dividends. I certainly prefer dividend paying stocks, and all else being equal, the more income you can get from a stock, the better. However, both of these companies carry large debt loads and have other issues that have kept me away. AT&T yields 6%, with Verizon at 7%, so you can definitely get current income from these stocks, but AT&T recently cut their dividend. Verizon is the better option of the two in my opinion, but I prefer to invest in the telecommunications industry through cell tower REITs like American Tower (NYSE:AMT) and Crown Castle (CCI), which are better businesses with a superior track record of dividend growth.

Investment Thesis

American Tower shares have had a rough 2022 and are down over 25% YTD. We have seen these prices a couple times since 2019, and I think shares are very attractive today. The asset portfolio is impressive and now includes data centers, giving the REIT exposure to another sector crucial to the information infrastructure. Most of their leases don’t renew until 2026 or later, and the lease terms have attractive rent escalators built in.

Shares currently sit at a price/FFO of 21.4x, a couple turns below the average multiple. Estimates are projecting solid FFO/share growth moving forward, a trend I expect to continue for years to come. The yield of 2.9% is close to an all-time high (the yield hit 3% briefly in October) and the company recently announced another dividend hike. The pattern of quarterly raises continued with its most recent 6.1% hike to $1.56 per share, and the dividend hikes look like they will continue as well. For all of these reasons, investors looking at the telecommunications space might want to consider American Tower instead of operators like AT&T or Verizon.

Portfolio Overview

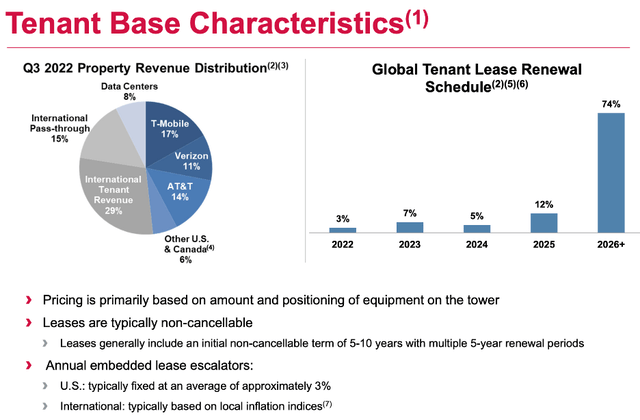

American Tower continues to build out its international footprint through acquisitions and organic growth. They have towers all over the world, and the revenue split is pretty even between North America and the international segment. At the end of Q3, North America accounted for 48% of revenue while the international side accounted for 44%. The data centers, which are a relatively new addition, make up 8%, and I wouldn’t be surprised to see that percentage grow in coming years.

AMT Portfolio (americantower.com)

There are a couple reasons that I think American Tower has been able to generate impressive long-term returns. The first is the ability to rent a single site to multiple tenants. For example, one tower in the US can serve AT&T, Verizon, and T-Mobile (TMUS) at the same time. This creates impressive margins and ROIs on each tower. The other reason is the built-in escalators. In the US, these are typically fixed at 3%, which is a bit higher than most REITs. Outside of the US, they are usually based on inflation, which has no doubt led to solid rent growth in the last couple years. These factors are also why American Tower has typically commanded a premium valuation, but with shares down 25% on the year, now could be an opportune time to be buying shares.

Valuation

Over the last decade, American Tower has traded at an average price/FFO of 23.3x, which certainly looks expensive at first glance compared to other REITs. Since 2019, shares have spent most of the time above that blue average multiple line below. Today shares are a couple turns cheaper than that at 21.4x. If shares see a bit of multiple expansion, investors are likely looking at double digit returns over the next couple years.

While this year has been rough for risk assets in general, it has created pockets of buying opportunities, especially in REITs that have typically been expensive over the last five years. This includes cell towers like American Tower and Crown Castle, but also REITs in the industrial and self-storage sectors. In my opinion, it represents a solid buying opportunity for long term investors looking for dividend growth.

More Dividend Growth

I can’t call the valuation dirt cheap on American Tower, but I do think it represents a high-quality company at an attractive price. The proof is in the pudding with the REIT’s impressive streak of quarterly dividend raises. The most recent hike was a nice 6.1% bump to $1.56, and any company that has maintained double digit dividend growth with quarterly raises for a decade deserves a closer look. The current yield isn’t massive at 2.9%, which might drive investors looking for current income to look at Crown Castle for its larger 4.6% payout.

Conclusion

I have written on American Tower and Crown Castle several times in the last year, and I think both are great buying opportunities today. I prefer both cell tower REITs to companies like AT&T and Verizon, despite the smaller current yield. In my opinion, they have superior business models that translate to robust long term dividend growth which hasn’t shown any signs of slowing down.

American Tower in specific has an irreplaceable portfolio of assets around the world and I think they could continue to expand their data center footprint as a solid complement to the existing tower infrastructure. Their portfolio also has solid lease terms and rent escalators, which will help with continued top line growth. At a price/FFO of 21.4x, shares represent a high-quality company at a good price. The 2.9% yield might not draw investors looking for current income, but the company has dividend growth in spades. Investors looking at the telecommunications sector might want to consider the cell tower REITs today. Buying shares at current prices could turn out to be a good Christmas present for 2023.

Disclosure: I/we have a beneficial long position in the shares of AMT, CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.