Summary:

- Boeing raised more than $20 billion to protect its investment grade rating amid financial pressures from a machinists’ strike and FAA production caps on the 737 MAX.

- Potential asset sales, including the space business and Jeppesen navigation arm, aim to boost cash flow but reduce diversification and attractiveness of company metrics.

- Despite a recent capital raise, Boeing’s profitability remains uncertain with ongoing financial issues and limited production increases in commercial airplanes.

- Positive news includes a $5.2 billion deal with Israel for F-15 jets, but regulatory and market risks continue to challenge Boeing’s recovery.

Monty Rakusen

Introduction to Boeing

The Boeing Company (NYSE:BA) designs, manufactures, and sells airplanes, rockets, satellites, and missiles to military and commercial customers worldwide. The competition operates in a duopoly with European company Airbus to dominate the airliner industry. Both companies grew in dominance since the 1990s, following a series of mergers.

Boeing completes a $22bn capital raise to protect rating

Boeing last week completed a more than $20 billion capital raise from the sale of stock and convertible preferred shares as the company moved to protect its investment grade rating. The top three credit rating agencies – S&P, Moody’s, and Fitch – threatened to cut Boeing’s credit rating to junk as it struggled with negative free cash flow and fears of a prolonged strike.

The airline giant has been under financial pressure from a recent machinists’ strike that halted production of its 737 MAX plane. The company has been burning through cash this year and that led to a $6 billion loss in the recent fourth-quarter earnings release. Boeing has already been suffering from a cap on 737 production implemented by the Federal Aviation Administration (FAA). Following the January Alaska Airlines incident, the regulator imposed a limit of 28 per month as it continues to monitor the company’s quality and safety protocols.

“Boeing’s (BA) safety enhancements and its ability to continue to monitor and track important safety KPIs will be inherent to having the 737 Max production cap removed by the FAA,” Kristine Liwag, an analyst at Morgan Stanley, said. However, Liwag added that an increase to 50 per month “remains steep” and is “underpinning its potential annual FCF generation of $10 billion.”

Asset sales reduce the appeal of the current valuation

In order to shore up the company’s balance sheet further, asset sales are being touted by analysts. A WSJ report in late October said the company was exploring the sale of its space business. That includes the troubled Starliner operation, which was deemed unsafe by NASA and required an intervention by Elon Musk’s SpaceX to bring astronauts back home from the International Space Station.

Another report last week from Bloomberg said that Boeing was now exploring the sale of its Jeppesen navigation arm for $6 billion.

Although these asset sales will boost the company’s cash flow, it is surely a negative to exit space exploration when companies in the sector are ramping up space travel and rocket technology.

Divesting assets will also reduce the attractiveness of company metrics, such as Enterprise Value. Boeing currently trades at a forward EV/Sales ratio of 2.35x, which is 13.07% higher than the company’s five-year average. Price/sales offers a discount over the five-year average at -27.2%, but that has to factor in the 737 cap. Boeing’s current valuations do not look like that of a company in crisis.

Another interesting metric to look at after the recent capital raise is the Return on Capital Assets, which is currently -10.41%, but -4.04% on a five-year average. With the current financial issues, the company is likely to be fighting fires in my opinion, rather than creating a great return on capital.

A deeper look at profitability

Boeing investors can breathe a sigh of relief that the costliest workers’ strike in the U.S. this year is now over. Consulting firm Anderson Economic Group last week estimated that the strike created losses of nearly $10B over six weeks to Boeing workers, suppliers, and shareholders.

Boeing was able to raise around $20 billion from the recent public offering, which Is close to what analysts said was required.

“We estimate it needs approximately $18 billion through early 2026 for cash burn and upcoming maturities,” said Matthew Akers at Wells Fargo.

At the end of the third quarter of 2024, Boeing had only $10 billion in cash and cash equivalents, alongside debt of $57.7 billion.

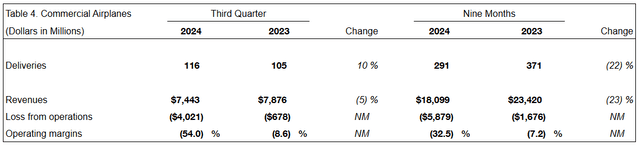

The company’s Defense, Space & Security division saw revenue of $5.53 billion for the same period, but delivered a loss of $2.38 billion. That was higher than a loss of -$924 million a year earlier on similar revenue, so it is clear that more efficiency was needed ahead of the strike.

Boeing now plans to cut 10,000 of its global workforce after agreeing to repay workers furloughed during the strike.

Deliveries in commercial airplanes in Q3 2024 were only 10% higher than a year earlier, so it remains to be seen how much the company can increase its production.

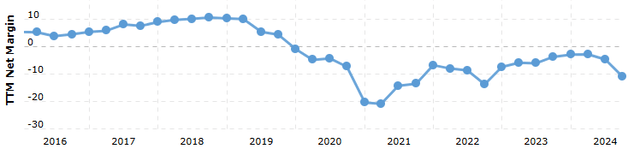

Margins are another issue with the company’s net margins from 2019, before recovering into the 2023 high. The chart below shows another potential downtrend is underway.

Boeing Net Margins (Macrotrends)

Risks to the investment thesis

The risk to the investment thesis would be a significant increase in 737 MAX production sooner than expected. I believe that the FAA will be hesitant to lift the current cap soon as it would look bad on regulators if another safety event occurred. The news last week that a Qantas 737 engine failed on take-off is another negative to the potential reduction of regulatory pressure.

Positive news for the company last week was a $5.2 billion deal with Israel to produce 25 F-15 fighter jets. The company’s fortunes could be improved by further such deals. The incoming President Donald Trump has a pro-America business stand that could see him look to secure Boeing’s future, but he is also looking to de-escalate conflict between Ukraine and Russia, so his anti-war stance could reduce the military deal potential for Boeing. Despite that, Barclays analysts said that Trump’s tariffs plan will not have a significant impact on Boeing. “We see higher tariffs as a potential risk for aero but a relatively small one as compared to broader industrials,” David Strauss wrote, adding that, “China now only constitutes 3% of The Boeing Company’s (BA) backlog as compared to 10% prior to Trump’s first term.”

Conclusion

Boeing stock has come under pressure since the Alaska Airlines incident in January. Safety regulators have capped the company’s 737 MAX production after an initial halt and that has now been followed by a costly workers’ strike. Despite the recent $20 billion capital raise, I believe the company’s stock may come under further pressure. Current valuation metrics do not show a company in crisis and further asset sales will streamline the business, but reduce potential diversification opportunities. Management has said it will return to cash flow positivity in 2025, but the level of profitability remains to be seen.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.