Summary:

- I reiterate a ‘Buy’ rating for Home Depot with a fair value of $450 per share, citing effective cost management and improved sales.

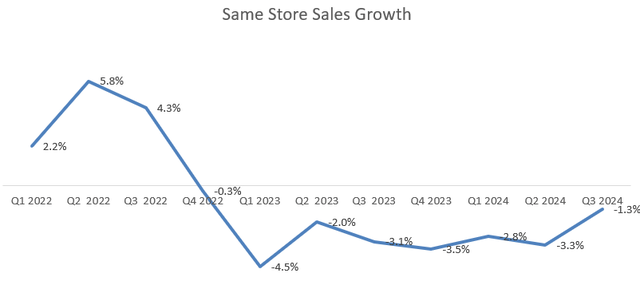

- Home Depot’s Q3 saw a 1.3% decline in same-store sales, but hurricane-related demand contributed positively, adding $200 million in sales.

- The company is guiding for 4% revenue growth in FY24, with a 2.5% decline in same-store sales and 12 new store openings.

- Key risks include potential import tariffs from the Trump administration, which could impact gross margins but may be passed on to consumers.

felixmizioznikov

In my previous ‘Buy’ thesis published in August 2024, I discussed Home Depot’s (NYSE:HD) efforts to navigate a challenging macro environment and a weak home improvement market. Home Depot’s comparable sales growth declined by 1.3% in Q3, beating the market expectations. The hurricane related demand has contributed some additional growth for the quarter. I reiterate a ‘Buy’ rating with a fair value of $450 per share.

Additional Hurricane Related Demand

Home Depot released its Q3 result on November 12th before the market open, reporting a 1.3% decline in same store sales growth (SSS) with a 1.2% decline in the US. On the positive side, Home Depot’s SSS has shown some moderate recovery as homeowners have resumed some renovation projects.

Home Depot Quarterly Results

In Q3, Home Depot generated around $200 million in hurricane related sales, contributing 55bps to Q3 growth and 120bps for October, as noted over the earnings call. The management anticipates additional hurricane-related sales in Q4.

While the current high-interest rate environment has created some challenges in the home renovation market, I think Home Depot’s management has effectively managed costs and improved sales. More specifically, the company continues to improve its interconnected retail experience, offering fast delivery and personalized search powered by AI. In addition, Home Depot has fully leveraged its digital channel to better engage with both PROs and DIY customers. Notably, nearly half of their online orders were fulfilled through their physical stores.

Outlook and Valuation

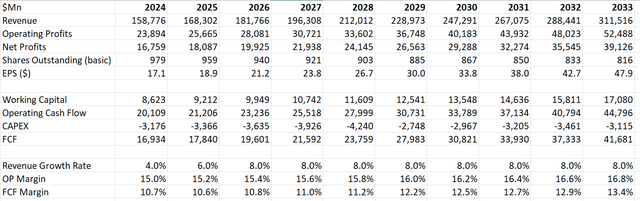

Home Depot is guiding for 4% revenue growth for FY24, comprising a 2.5% decline in same store sales and 12 new store openings. Due to their ongoing shares repurchase, the management anticipates the total number of shares outstanding will decline by 2% in FY24. For the near-term growth, I am considering the following factors:

- As the Fed has started to reduce the interest rate, I anticipate the housing market will gradually normalize. As noted during the earnings call, the housing turnover is just about 3%, a record low level over the past 40 years. I think Home Depot’s business is currently at the bottom of the end-market cycle.

- The management indicated that the pace of recovery in large remodeling projects remains uncertain at this moment. Considering these macro factors, I anticipate Home Depot will grow its SSS by 4% in FY25, followed by an acceleration to the historical average of 6% from FY26 comprising 2% pricing growth and 4% volume growth.

- I continue to project new store openings could contribute an additional 2% to the topline growth.

- I forecast 20bps annual margin expansion, driven by 10bps from mix shift towards digital channel and 10bps from reduction in SG&A due to operation efficiencies.

- The WACC is calculated to be 10.7% assuming: risk-free rate 3.8%; beta 1.11; equity risk premium 7%; equity $405 billion; debt $51 billion; tax rate 24%.

The DCF can be summarized as follows:

Home Depot DCF

Discounting all the future FCF, the fair value is calculated to be $450 per share, as per my estimates.

Key Risk

If the Trump administration imposes additional import tariffs, it could negatively impact Home Depot’s gross margin in the near term, as Home Depot imports almost half of their goods outside North America. I acknowledge that the potential financial impact could be short-term in nature, as any additional costs may ultimately be passed on to end consumers.

Conclusion

I think Home Depot has done a great job navigating the challenging macro environment by improving customer engagement and promoting digital channel. I reiterate a ‘Buy’ rating with a fair value of $450 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.