Summary:

- Meta’s substantial AI investments are supported by strong business momentum, with significant growth in capital expenditures expected to continue into 2025.

- AI-driven engagement on Meta’s Family of Apps boosts ad revenue, demonstrating successful monetization of AI investments.

- Generative AI tools for advertisers and the rapid adoption of Meta AI highlight new monetizable opportunities and expansion of Meta’s addressable market.

- Despite increased capital expenditures, Meta’s focus on productivity and efficiency improvements supports earnings while it invests in its future opportunities.

The Good Brigade

Meta Platforms (NASDAQ:META), like all other big tech companies and hyperscalers, are investing heavily in capital expenditures to invest in the AI opportunity.

The biggest question on investors’ minds continues to be whether these massive investments will reap sufficient returns on investment.

Meta showed investors early evidence not only that it is gaining traction with its AI products and solutions, but that it is capable of monetizing them.

Its Family of Apps business continues to see strong momentum as engagement continues to grow as a result of its AI recommendation engine.

The company also has been focusing on improving productivity and efficiency across the organization, with likely more room for operating margin expansion to come.

I expect this strong momentum in its business to continue into 2025.

I have written about Meta on Seeking Alpha, which can be found here. In my previous article, I argued that Meta’s AI spending is fully supported by its strong business momentum, which is also what I continue to see today in this article.

AI Spending Fully Supported By Strong Business Momentum

Significantly growing capital expenditures bill

How fast are Meta’s capital expenditures growing?

Meta’s capital expenditures in 2023 were $28 billion.

While Meta gave an earlier capital expenditures range for 2024 of $37 billion to $40 billion range, in 3Q24, the range was tightened to the new range of $38 billion to $40 billion.

The midpoint for capital expenditures was raised from $38.5 billion to $39 billion, a marginal 1% increase, while the top end of the capital expenditures was maintained at $40 billion.

How much did capital expenditures grow in 2024?

It grew by 39%, largely due to AI infrastructure spending.

The messaging for 2025 is that after significantly increasing capital expenditures in 2024, it will once again be significantly increasing capital expenditures in 2025.

As such, I do expect capital expenditures to grow at least 30% again in 2025 as Meta continues to invest in the AI infrastructure required for the opportunities it sees ahead.

Returns on Investment on AI investment

While capital expenditures are growing at a rapid rate, that can be justified if we see tangible returns on investment on Meta’s AI investments.

In my view, Meta is one of the few companies that has shown that the investments they are making into AI are bringing about products that are gaining traction amongst users and that these are monetizable opportunities.

Firstly, the investments in AI have helped to drive engagement in its core Family of Apps. Through the roll out of its AI recommendation engine on Facebook and Instagram, Meta saw an 8% and 6% increase in the time spent respectively in 2024.

Improved engagement on its Family of Apps like Facebook and Instagram should allow Meta to serve more ads to users and thereby, support longer-term ad revenue trajectory.

This clearly demonstrates the monetization of AI investments.

In 3Q24, Meta further demonstrated this as Family of Apps revenue increased 19% in the quarter. This was driven by 7% growth in ad impressions and 11% growth in average price per ad.

The strong growth in average price per ad is indicative of the strong advertiser demand on Meta’s Family of Apps and the solid ads performance on its platforms.

Secondly, Meta is also seeing strong traction in its generative AI tools that are meant to help advertisers automate their tasks. Management mentioned in its earnings call that as of today, more than 1 million advertisers use its generative AI tools to generate more than 15 million advertisements in the last month alone.

These generative AI tools for advertisers likely help set up Meta for expansion in its total addressable market over time due to the value add these tools bring. For example, Meta noted that advertisers using image generation tools saw conversions improve 7%.

Image generation tools are just the start, and there will be new video expansion and image animation tools coming in 2025.

As more advertisers and businesses use these generative AI tools for their day-to-day tasks, these tools should become more mainstream and stickier, and that will help with the long-term monetization of these generative AI tools.

Lastly, I am positively surprised by the rapid adoption of Meta AI, the company’s own AI assistant. This AI assistant currently has reached 500 million monthly active users, which is an extraordinary achievement for a relatively new product.

This speaks volumes about the benefits Meta enjoys due to the large scale of its Family of Apps and again, this will allow Meta to expand its total addressable market as it starts to monetize this new surface in the long-term.

In my view, there is a big opportunity for Meta AI because despite being at 500 million monthly active users today, it has the potential to scale into Meta’s three to four billion users across its multiple applications, tapping on the scale of Meta’s Family of Apps.

Meta AI is said to be building its own AI search engine to incorporate into Meta AI. The company currently uses content from its search engine parts Bing and Google, but this new initiative will help to reduce reliance on Microsoft and Alphabet. At the same time, this helps expand Meta’s addressable market further by adding optionality into the search market.

To me, it remains early days for Meta’s AI investments, whether we look at its AI recommendation engine, Meta AI, or generative AI tools for advertisers.

Focus on productivity

While Meta’s capital expenditure bills are increasing significantly this year and next year, the company continues to embody its Year of Efficiency mindset as it continues to focus on improvements in productivity and cost savings.

In the 3Q24 quarter, Meta’s Family of Apps operating income margins grew 250 basis points to 54% due to improved productivity and organizational efficiency.

Whether it is headcount plans or engineering efficiency, Meta continues to be focused on areas where it can improve its cost structure such that it operates more efficiently and leanly.

Also, the investments in AI can also help improve the productivity of its employees, which should also help drive margin improvements going forward. Management highlighted that it has seen strong internal adoption of Meta AI, which should help make workflows and coding easier and more efficient.

More opportunities to look out for

There are plenty of other opportunities to look out for.

Threads is a relatively new product that was only launched in July 2023, and you would think that as an application that is largely similar to X (formerly known as Twitter), the response would be lukewarm.

That said, this Threads is so popular that it was the fastest application in history to reach 100 million users in only five days, even beating ChatGPT’s phenomenal record.

Threads is reported now to have 275 million monthly active users.

This is very solid evidence that Meta’s billions of users across its applications can create strong scale effects for future new application launches to benefit from its user scale.

Another opportunity to look out for is Meta’s Llama.

Meta’s Llama models reached close to 350 million downloads this year, an amazing feat considering downloads last year was close to 30 million.

That does tell me that Llama is seeing growing adoption and becoming a leading open-source model globally.

More importantly, I think Meta knows that it has a massive opportunity with Llama and thus, the company continues to invest in Llama, so it will only get better from here.

As such, some of the significant growth in capital expenditures are likely contributing to research and innovation of Llama, as CEO Mark Zuckerberg told investors that “We’re training the Llama 4 models on a cluster that is bigger than 100,000 H100s, or bigger than anything that I’ve seen reported for what others are doing,”

As such, Meta expects Llama 4, the successor to the highly successful Llama 3, to launch sometime in early 2025.

Valuation

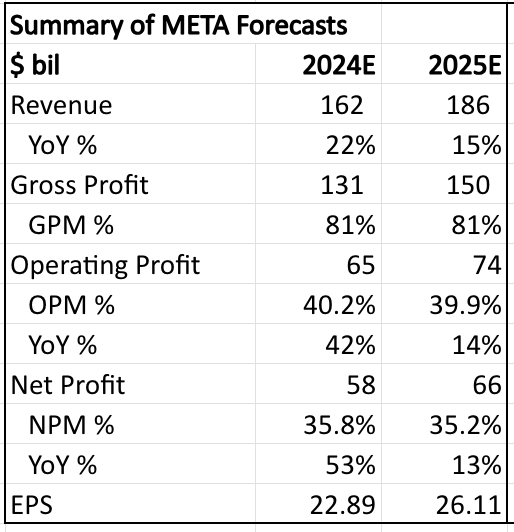

For 2024, I am forecasting Meta’s revenue to grow 22%

Why am I forecasting 22% revenue growth in 2024?

For the first 3 quarters of 2024, Meta’s revenue grew 22% and for 4Q24, I am forecasting revenue to grow in-line with the first three quarters as the business trends continue to be similar with strong engagement on its Family of Apps.

In 2025, I expect revenue growth to come down to 15%.

Why am I forecasting 15% revenue growth in 2025?

I continue to see that Meta’s investments should continue to see improving monetization, so growth in revenues should continue to come in the form of ramping of monetization of Reels and growing engagement on its Family of Apps as it continues to invest in its AI recommendation engine. This higher engagement on its Family of Apps drives higher advertising revenues for Meta.

This revenue growth is offset by a strong year of revenue growth in 2024, which results in a tougher compare for 2025 due to the higher base.

How do I derive this 15% revenue growth?

This 15% revenue growth for 2025 assumes a similar 7% growth in ad impression, similar to what we saw in 3Q24, and 8% growth in average price per ad, as strong engagement on its Family of Apps helps to continue to drive ad impresssions and average price per ad growth.

In turn, I expect a slight operating margin compression from 40.2% in 2024 to 39.9% in 2025.

Why am I forecasting margin compression from 2024 to 2025?

I refer to management’s comments in the 3Q24 earnings call about the acceleration in expense growth in 2025 due to the capital expenditure growth we see in 2024 and 2025:

We continue to expect significant capital expenditure growth in 2025. Given this, along with the back-end weighted nature of our 2024 CapEx, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet.

As such, the 30 basis point decrease in operating margin is largely due to the significant investments made in 2024 and 2025 mentioned above, partially offset by continued efficiency improvements made, bringing the operating margin from 40.2% in 2024 to 39.9% in 2025

This results in EPS growth decelerating to 13% in 2025, partly contributed by the deceleration of growth in revenue from 22% in 2024 to 15% in 2025 and the operating margin compression from 40.2% in 2024 to 39.9% in 2025, thus, my EPS forecast for 2025 is $26.11 per share.

My financial forecast for Meta (Author generated)

My 1-year price target is derived based on taking my forecasted 2025 EPS multiplied by the 2025 P/E multiple, which gives me my price target for Meta for 2025.

My 1-year price target for Meta is $652. I applied a 25x 2025 P/E multiple, which is in-line with its 5-year average P/E multiple.

I think 25x P/E is reasonable for Meta given that I expect Meta’s competitive position in the last five years to be maintained in the next few years and supporting its growth profile as its Family of Apps business continues to see strong engagement across apps due to its AI recommendation engine, while the company continues to show promising and early signs that its AI investments are bearing fruit.

Risks

Macro environment

Meta’s advertising business is dependent on the macro environment and if the macro environment weakens, or if consumer spending trends worsen, we could see reductions in advertising spend.

Reductions in advertising spend will hurt Meta’s near-term growth prospects, as there are less advertising dollars going to players like Meta.

Competition

Time and time again, we have seen how competitive and cut-throat the social media landscape can be.

While Meta’s Family of Apps like Instagram and Facebook continue to be used by billions globally, if competition ramps up more than expected, this could mean competitors gain market share and will deteriorate the market environment for Meta.

Competitors here include TikTok and Snapchat (SNAP), both of which has been growing rapidly in the past few years.

This will not only lead to lower growth rates in revenue, given the higher competition likely leads to less time spent on Meta’s own social media apps, but it will also lead to lower operating margins due to poorer operating leverage.

Increased competitive pressures could also result in investors applying a lower valuation multiple for Meta as investors contemplate the lower growth rates, durability of the competitive moat and future risks.

Return on investment of AI spending

Furthermore, another risk here are the returns on investment of its AI spending, which I have discussed at length in this article.

Investors are increasingly scrutinizing Meta’s AI bills, given the many billions it is spending on AI each year.

There is the risk that the billions that it is spending on AI each year may not reap sufficient return on investment.

Low or negative return on investment of its AI capital expenditures will be detrimental for investors, as this will be negative for shareholder value.

Meta needs to demonstrate returns on investments on its AI spending through improving monetization or growing usage of its products to ensure that investors are assured about this risk.

Conclusion

While I am fully aware that the long-term AI opportunity will require significant capital expenditure investments in the form of AI infrastructure spending, I am confident in Meta’s ability to drive monetization and revenue and earnings growth during this period of investment to support it.

We also saw in this article how Meta has shown investors that AI has resulted in some benefits in its current ads business and brings new opportunities and new products for future monetization that is gaining traction today.

I would also note that Meta has had a strong track record of generating returns on investment for investors when they decide to invest in a business. For example, Reels was a relatively new product a few years ago that many investors were skeptical about.

Today, it’s one of the drivers of growth and engagement across Meta’s platforms.

All in all, Meta’s businesses continue to do well in the current environment, with strong engagement supporting the ads business, which in turn generates strong cash flows for its capital expenditures.

This significant AI spending will drive some margin downside in 2025, but I expect this can be supported by solid growth in its core Family of Apps business where the momentum continues to be strong.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.