Summary:

- I am upgrading Norwegian Cruise Line stock from a sell to a hold due to recent earnings beat and positive changes in quarterly fundamentals.

- Despite high debt and potential share dilution, NCLH shows strong revenue growth and high returns on equity, indicating potential near-term stock price appreciation.

- Key risks include inconsistent free cash flow, economic uncertainties, and potential inflationary pressures that may affect discretionary spending.

- NCLH should be watched for further improvements and is suitable for riskier portfolio allocations in the current “risk-on” investing environment.

KenWiedemann/iStock Unreleased via Getty Images

Investment Thesis

Previously, I had written an article covering Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) title “Norwegian Cruise Line Holdings Struggling In A Growing Industry.” Initially, I wrote this article with a sell rating on the company but highlighted key fundamentals to watch that may indicate the company was turning things around from the pandemic lows and performing well in the industry, such as higher-than-expected returns on equity (ROE). Since I wrote the article, the investing environment has remained relatively “risk on” and the company has reported additional earnings describing updated projections moving forward. Given the updates, recent earnings beat, and positive change in the underlying fundamentals on a quarterly basis, I’m upgrading this company from a sell rating to a hold at this time. I still believe that this company has risks because not every fundamental metric has significantly improved. However, this industry has continued to grow at a rapid rate over the last year, which has driven both growth and investor returns in these stocks.

My Previous Coverage Of Norwegian Cruise Line

In my last article on NCLH, my main conclusion was that I believed NCLH to be a speculative and risky investment based on what I believed to be short-term headwinds and poor fundamentals. I highlighted key fundamentals that I focused on in my analysis, such as lower returns on invested capital to weighted cost of capital, lower earnings per share than in 2019, and high debt levels. Since writing this article, I’ve continued to learn and develop my key metrics as a value investor and have started to realize that when companies display high returns on equity (ROE), it is usually a good indicator that they are doing something right and may see some near term stock price appreciation to better reflect high ROE. I highlighted in my last article that ROE at the time was very high and similar to one of their successful industry peers, which I hold in my portfolio, Royal Caribbean Cruises Ltd. (RCL) and this company has been on a tear this year. At the time of my last writing, there was an opportunity to sell the company as recession fears loomed, but also a time to get in at lower prices by about 18%. Given the positive changes I’ve outlined below, and the recent earnings call, I believe this company deserves an upgraded rating.

NCLH Q3 Earnings Report

NCLH recently reported earnings where they beat analysts’ estimates for both earnings per share and revenue for the quarter. Quarter over quarter, the company is mostly on an upward trajectory, continuing to do better on a fundamental basis which is driven by historic levels of bookings, which they indicated are similar to their pre-covid booking levels. During the earnings call, they also provided details on current debt payment plans and restructuring. One short-term headwind for the stock that I see (over the next 12-24 months) is that there will be a significant amount of share dilution to current investors, which will have an impact on aggregate fundamental metrics and per share earnings. They mentioned during the earnings call that for some of their exchangeable notes payable in 2025, they expect to pay them in shares, thus diluting current shareholders. However, not all notes will be paid back with shares as they are also evaluating later notes due for restructuring as the current rate environments continue to become more favorable. It’s good to see the efforts they are making to address the outstanding debt levels, but I expect they will pay off a good portion with stock while positive free cash flow remains inconsistent and negative. Finally, on debt levels, I think it’s important to point out that they are currently leveraged by 5.58x according to their statements made during the call. Some investors may find this type of leverage riskier than other investments, given the unknown economic environment moving forward.

During the earnings call, the company also provided some details on expected forward growth of low to mid-single digits and described being on the upper end of their estimates looking forward. They also described improvements they continue to make to their brand, such as adding Starlink internet to almost all of their ships at this point and efforts to reduce their carbon footprint. Overall, it was a well-received quarter as they highlighted key areas of 9% top line growth and higher than expected EBITDA. They also provided higher EBITDA estimates for the next quarter and for the year in total due to favorable cost reduction initiatives and consumer spending. As they’ve mentioned, they are growing at a rapid rate and exceeding their already optimistic estimates at this point. Now, let’s focus on the quarterly fundamentals over the last couple of years to see the positive changes they’ve mentioned and highlight areas of focus moving forward.

NCLH Stock Fundamentals

Currently, NCLH trades at a trailing twelve-month (TTM) GAAP P/E ratio of 22.25, a forward GAAP P/E ratio of 19.51, a TTM price to sales ratio of 1.28, and a forward price to sales ratio of 1.29. Compared to sector medians, the P/E ratios are in-line, but the price to sales are both slightly elevated. NCLH’s TTM EV/EBITDA ratio is 11.13, which is given a B- grade on Seeking Alpha’s valuation metrics, and their forward EV/EBITDA ratio is 10.68. Most evaluated metrics are currently more favorable than peers RCL, which trades at a forward GAAP P/E ratio of 23.42, and Viking Holdings Ltd (VIK), which trades at a forward GAAP P/E ratio of 117.7, and both stocks have seen great price appreciation this year. In addition to these fundamentals, NCLH has also grown revenue by an average of 12% over the last 12 months and has continued to grow revenue since the pandemic lows, as you can see in the chart below.

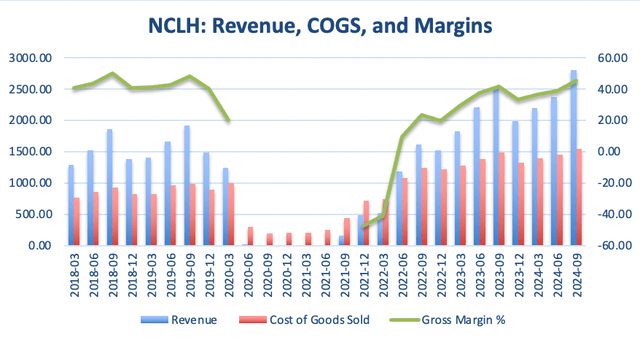

Quarterly Revenue Growth

In the chart below, I have NCLH’s quarterly revenue from March 2018 until now, along with gross margins and costs of goods sold. As you can see, after being affected by the pandemic, it took a few quarters for revenue and margins to recover. At current levels, quarterly revenue and gross margins have fully recovered and exceed pre-pandemic levels when compared to the data from December 2019. However, costs of goods are also higher by about 42% than they were five years ago. Compared to the same quarter, five years ago, revenue is 31% higher while costs of goods sold is 36% higher and gross margins are 6.7% lower. I believe as demand for cruises remains strong with consumers, these metrics will continue to significantly improve, and we will see gross margins maintained between 40-48%. This is a metric to pay attention to though as they are competing with other cruise lines.

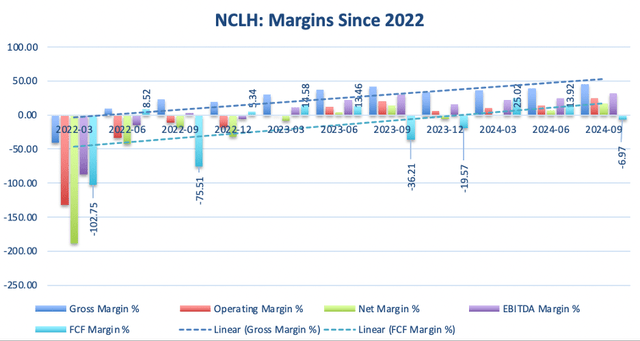

Quarterly Margins

In the chart below, I have gross, operating, net, EBITDA, and free cash flow margins over the last few quarters since March 2023. I removed the quarters prior to then due to the large negative values from the pandemic, which affected the chart depiction/visibility. However, what I’ve highlighted below is the positive change we’ve seen in NCLH’s margins as they’ve recovered from the pandemic, following the linear trend line. Currently, free cash flow remains negative, but I believe as we remain in a high-demand environment with large consumer spending, NCLH may start to produce free cash flow based on the quarter over quarter improvement seen in this metric. Additionally, as you can see in the other fundamentals here, EBITDA and operating margins have remained positive since March 2023. However, EBITDA margins remain lower than they were in September 2019 by about 11%, and this is a metric I would focus on as the company continues to move through a favorable economic environment. If we do not continue to see improvement, this may be one indication that they are becoming less efficient as they are becoming a larger company (with more cruise ships).

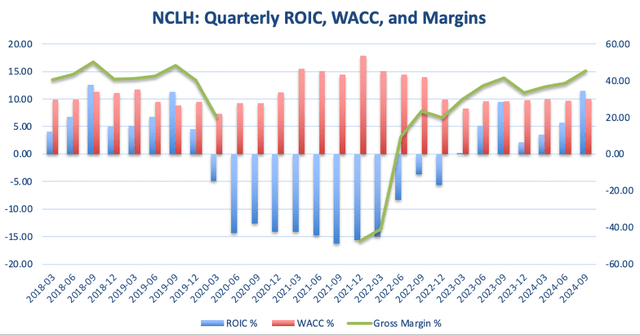

Returns on Investment

One factor that I’ve focused on with fundamental value investing is the comparison of return on invested capital (ROIC) and the weighted cost of capital (WACC) with the ratio ROIC-WACC. Good companies typically have much higher ROIC than WACC, and if ROIC is negative, this would be one indication that management is not making good decisions to provide value for investors. In my first article, I highlighted how this metric was negative for NCLH, however, as you can see with the most recent quarter, this changed. Currently, ROIC-WACC produces a positive 1.5 difference. Over the next few quarters, I would like NCLH to remain consistent by providing a higher ROIC than WACC, and I believe they can get there if they continue to hit their targets and beat earnings. As you will see with the next two charts, my concern is consistency.

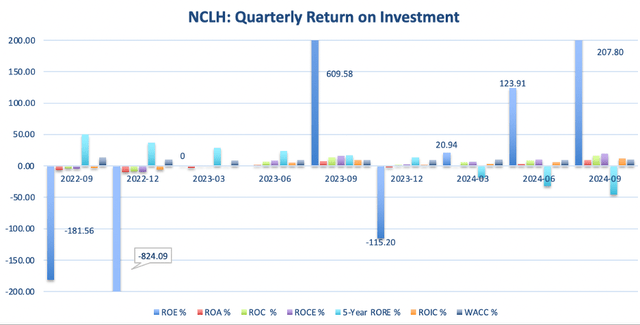

High ROE

In my first article on NCLH, I highlighted one of the biggest positives I saw, even though in aggregate I believed the stock was a sell, was that they were starting to produce a high return on equity (ROE). This is a metric I’ve noticed with high growth companies that as it exceeds around 20%, it starts to indicate that the company is doing very well and should be under consideration for investment. In recent quarters, NCLH’s ROE has exceeded 100% and 200%, but this has been somewhat inconsistent, as you can see in the chart below. The inconsistency is a concern that I have with the company as this is not something that I look to invest in based on the fundamental framework outlined by Warren Buffett in investment books/articles I’ve read, where he also looks for a company that produces consistent returns.

In the graph below, I wanted to remove ROE from the previous graph to better depict the movement of other key fundamentals on a quarterly basis, such as returns on assets (ROA) and returns on retained earnings (RORE). As you can see in the chart, the average RORE continues to decline each quarter and has been consistently negative for the last three. This is usually one indicator that highlights operational problems that may start to materialize in lower earnings per share over the next few quarters. However, on a positive note, other metrics have been consistently positive since June 2023, with current levels of ROIC exceeding WACC and ROA over 9%. Returns on capital (ROC) and returns on capital employed (ROCE) were also both very positive this quarter and in the double digits.

Fundamental metrics with ROE removed, please note the change in bar graph color from the previous chart above. (Author’s Calculations)

Per Share Value

As you can see in the chart below, NCLH continues to have a very high debt level compared to the other values on a per share basis. Prior to issues from the pandemic, NCLH’s book value was almost consistently in line with debt levels, however, since then, book value has declined to 2.58 per share in the most recent quarter while debt remains at 30.49 per share. Positively, we have seen earnings growth per share and EBITDA growth per share, which reached 1.74. Cash per share remains low, and free cash flow per share remains negative. Higher book value than debt is not a rule for investing in a company that I follow, but personally, I would like to see further growth in EBITDA, earnings, and cash per share. Finally, although debt levels are high, they are relatively close to pre-pandemic levels at this point, which is a positive for this company given that this industry functions with higher debt than others.

Risks to Thesis

The primary risk to my thesis as a hold is that the company significantly outperforms or significantly underperforms over the next few quarters, which may cause a large move in either direction for the stock price. As we recently saw with the election results, the market has shifted to highly favor risky assets, which has driven up some stock prices. This will likely continue over the next few months, and thus drive shares up further. Downward pressure on the stock will come from when they service their debt in 2025. They explained in their earnings call that they plan to service debt with shares, which, I believe, will mean share dilution for current shareholders, and thus profit dilution over the next 12-18 months. Moreover, if we run into inflationary pressures again in the near future, companies that rely on discretionary spending may suffer, such as cruise lines. However, I do believe NCLH is continuing to improve their underlying fundamentals overall, and this is a company that should at least be on your watch list.

Conclusion

In conclusion, based on the fundamental analysis above, recent earnings beats, and the current investing environment favoring risk, I am upgrading NCLH from a sell to a hold. Although there is some positive change in fundamentals, there are still some inconsistencies in the quarterly data that suggests management can still make further improvements to give investors more consistent returns, particularly with consistent free cash flow generation. Additionally, even though the company has continued to make headwind on refinancing their debt, they still carry a large amount, with over a 5x leverage, that may cause issues if foot traffic slows for any reason, such as a recession or weaker consumer. With NCLH’s recent beat on earnings, improvements in some fundamentals, and consistent increases in their earnings and revenue, this is a company that should be watched and considered for riskier portions of a portfolio while the investing environment is favoring higher risks. Personally, I will stay away from this company for now, even though the ROE has continued to increase significantly, because of my exposure to this sector already and my current portfolio allocation. However, this is one stock that I will be watching to see continued improvements as I believe there will be more opportunities to buy into this company, likely when shares are diluted to pay off debt. I wrote this article solely based on my research and opinions about the company and the industry. Investors should conduct their own research before making financial decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.