Summary:

- Investment thesis highlights RKLB’s strong revenue growth rates and potential for sustained expansion in the aerospace sector.

- Rapid recap emphasizes recent performance metrics and strategic initiatives driving RKLB’s market position.

- Revenue growth rates demonstrate consistent upward trends, showcasing the company’s robust financial health and growth trajectory.

- Closing paragraphs reinforce the positive outlook, citing continued innovation and market opportunities as key factors for maintaining a favorable rating.

ZargonDesign

Investment Thesis

Rocket Lab (NASDAQ:RKLB) delivered impressive guidance for Q4 2024. The business has now, I believe, reached an inflection quarter. More specifically, its non-GAAP gross margins are starting to move higher, which will in time translate into its EBITDA profile starting to stabilize, before cutting a path back to breakeven, possibly reaching breakeven in late 2025.

The stock is not cheap at an estimated 14x forward sales. But its growth rates are simply impressive and need to be considered here too.

Altogether, I now declare this stock a buy.

Rapid Recap

Back in September, I said in my analysis,

Will investors still be as keen to pay 8x forward sales when in 2025 its revenue growth rates significantly decelerate relative to 2024?

On the other hand, the business has a strong balance sheet that will allow it to continue to invest in its future prospects.

Altogether, this is a tepid buy.

Clearly, being tepidly bullish was the wrong call. There’s no denying the fact that my caution here was not rewarded. I hope that Intuitive Machines (LUNR) performs even slightly as strongly as this on Thursday (disclosure: Deep Value Returns is long LUNR).

Why Rocket Lab? Why Now?

Rocket Lab is a comprehensive space technology company that provides end-to-end solutions for getting payloads into space. It builds rockets, such as the Electron and Neutron, to launch satellites and other payloads into orbit. Besides launching, it also develops spacecraft to operate in space and support complex missions like Earth observation and satellite constellations. Rocket Lab’s goal is to make space more accessible by creating and launching satellites.

As you’d imagine, Rocket Lab is a story stock, that is well-positioned for near-term growth.

It has recently secured multiple new contracts, including a significant multi-launch deal for its Neutron rocket with a commercial constellation operator. That being said, its backlog was unchanged from Q2 2024 at approximately $1 billion.

In addition, its role in innovative missions, such as a study for NASA’s Mars Sample Return, highlights its expanding capabilities in the space sector. As Neutron’s development advances, Rocket Lab is well-situated to compete for national security contracts and meet growing demand in the commercial space sector, especially for small-satellite launches.

What’s more, note that the space sector is increasingly competitive, with companies like SpaceX and Blue Origin leading in launch cadence, and potentially competition for market share against Rocket Lab.

On top of this, as we’ll soon discuss, despite strong revenue growth, Rocket Lab has yet to achieve profitability, partly due to the high costs of developing new technologies and rockets like Neutron.

Given this balanced background, let’s now discuss its fundamentals.

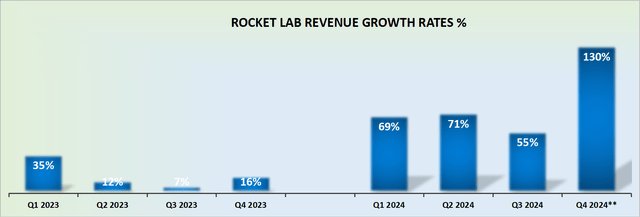

Revenue Growth Rates Impress; 50% Y/Y in 2025

Before we go further, consider what I previously said about RKLB:

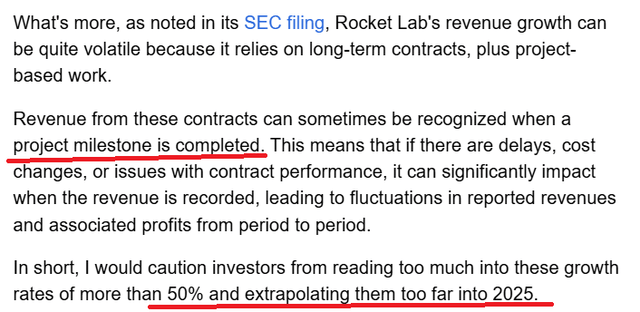

Previously, I cautioned readers not to extrapolate 50% y/y revenue growth rates into 2025.

However, given that Rocket Lab’s backlog is approximately $1 billion, I’m now inclined to believe that Rocket Lab could in 2025 grow by at least 50% y/y to approximately $660 million.

RKLB Stock Valuation — 14x Next Year’s Sales

As an Inflection investor, you need to have a view of your business’s balance sheet. Is the balance sheet in a position of strength or weakness? For its part, Rocket Lab carries approximately $90 million of net cash (after adjusting for its debt).

This isn’t a very strong balance sheet. That being said, it doesn’t detract from the bull case either. Although, in time, Rocket Lab may need to raise some cash, overall, I’m satisfied with its financial footing.

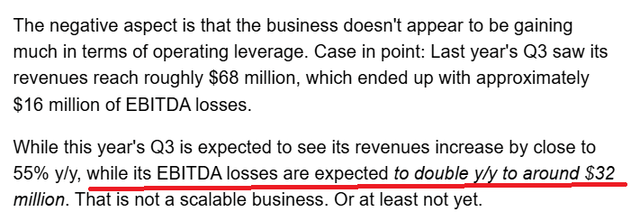

Now, let’s turn our discussion to its operating leverage. Here’s what I previously said:

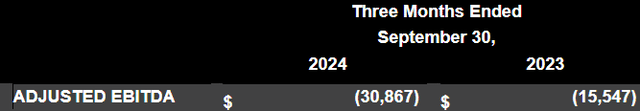

In the text above, you can see my dilemma. Rocket Lab was expected to grow by 55% y/y, but the issue here is that its bottom line significantly increased its losses. More specifically, its EBITDA losses come in around $31 million.

This is an increase of 100% y/y in EBITDA losses, while the topline grows by 55% y/y. That’s not a good situation to be in. That would be twice the EBITDA losses compared with Q3 of the previous year.

Now, I’ll note the one reason why I believe this stock is a buy:

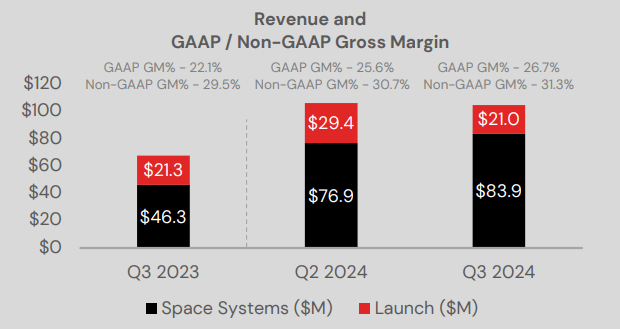

RKLB Q3 2024

What you see above is a steady progression in RKLB’s non-GAAP gross margins. But what is particularly interesting is that looking out to Q4 2024, its non-GAAP gross margins point to 33% at the mid-point. This is roughly a 100 basis point expansion relative to the same period a year ago.

Consequently, I now believe that this business has reached an Inflection quarter.

In sum, being asked to pay about 14x next year’s estimated sales for RKLB is towards the high end of what I feel recommending. But still reasonable.

Top Investment Risks

The main investment risk in my opinion is that Rocket Lab is going to need to raise cash at some point. I don’t know when, and I don’t expect this to be soon. However, if the share prices get too extended, I believe that management will prudently use investors’ confidence to dilute shareholders.

After all, Rocket Lab is likely to end up burning about $115 million of free cash flow this year, and at least a further $100 million of free cash flow in 2025.

The other consideration, which has kept me on the sidelines here, is the cyclical nature of the rocket launch services and contracting cycles. The business is being priced very richly on the assumption that Rocket Lab can continue to grow very rapidly from a recurring revenue growth rates. But this is, in fact, false.

Any delays in winning awards could see its revenue growth rates significantly decelerate and with it the multiple that investors are willing to pay for RKLB.

And yet, I’m inclined to believe that close to 50% of its backlog may be current, meaning that 50% of its $1 billion of backlog may be recognized as revenues in 2025, with room for more awards along the way too (page 11 of SEC filing, 10-Q).

The Bottom Line

At around 14x forward sales, Rocket Lab’s valuation isn’t cheap, but I believe it’s justified by the company’s impressive growth and expanding gross margins as it moves closer to breakeven, possibly by late 2025.

While Rocket Lab’s cash burn—projected at roughly $100 million next year—may lead to a capital raise down the line, its current balance sheet should support near-term initiatives.

Additionally, the revenue stream is somewhat cyclical, which could impact growth if contract awards slow.

Yet with a solid backlog and room for more contracts, Rocket Lab presents a promising, if cautious, buy for those willing to invest in its trajectory within the growing space sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUNR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

DVR is long LUNR. DVR recommends LUNR.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.