Summary:

- Despite Tesla’s strong financials and growth, I maintain a “Sell” rating due to overvaluation driven by speculative factors like Trump’s presidency and market FOMO.

- Tesla’s recent stock surge is attributed to potential benefits from Trump’s policies, but these are uncertain and long term, not justifying the current price.

- Tesla’s financial health is solid, with increased revenues and cash flow, but decreasing average selling prices and high capital expenditures pose risks.

- TSLA stock’s current valuation exceeds even the most optimistic forecasts, making it an unattractive investment compared to other fast-growing companies.

Victor Golmer

Intro & Thesis

My first article about Tesla, Inc. (NASDAQ:TSLA) was published in October 2021 with a “Buy” rating, which I changed to “Hold” in October 2022 and eventually to “Sell” in April 2023. Since then, I have maintained my bearish rating on TSLA, which was aging well until recently – Trump’s win led to a massive expansion in TSLA stock, which has been up over 60% over the past few years, according to Seeking Alpha’s momentum data.

Seeking Alpha, my coverage of TSLA

While my bearish stance turned out to be wrong, I think the rally in Tesla stock itself is hard to explain fundamentally – it simply seems to be a reaction to a Trump-related catalyst that is unlikely to dramatically improve Tesla’s business going forward. Given the valuation premium expansion and widespread FOMO I see on the market right now, I’m reiterating my previous “Sell” rating, being a contrarian to what’s going on around.

Why Do I Think So?

First off, let’s address what’s driving the TSLA stock’s expansion in November this year. I believe that most who are buying Tesla stock these days – aside from just trend followers – are betting on the election of Donald Trump as President of the United States as a potential tailwind for Tesla, especially in light of the electric vehicle subsidies created by the Inflation Reduction Act. Additionally, a Trump administration could still levy tariffs prohibiting lower-cost Chinese EVs from entering the US market, which will allow Tesla to maintain market dominance. Further, Elon Musk’s potential advisory role to Trump may impact federal autonomous driving laws in the United States and speed up the regulatory approval process for Tesla’s self-driving technologies.

While these are all important developments for Tesla shareholders, I think the overall impact is too uncertain and too long-term to drive the stock’s price up that much. I think we should look at Tesla’s recent financials firsthand to really see and assess the company’s medium-term prospects.

Tesla’s Q3 2024 report (published in late October 2024) showed an adjusted net profit of $2.505 billion, or $0.72 per diluted share (+9% YoY), beating analyst and management expectations. The earnings beat was driven by “improved vehicle deliveries, better gross margins, and efficient cost-reduction efforts”, according to the management’s commentary. Tesla’s auto revenue grew by 2% to $20.016 billion and its Energy Generation and Storage revenue increased by 52% YoY to $2.379 billion, driven by “high-demand Powerwall and Megapack products”, which achieved the highest deployments and a gross margin of 30.5%.

Tesla’s balance sheet remained healthy in general, as cash and cash equivalents were $33.65 billion at the close of Q3 2024. The firm’s financial strength stems from its strong operating cash flows which reached $6.255 billion in Q3 – that’s 89% more than last year. As a result, the FCF has gone up by about 3.2 times YoY. Though Tesla may consider share buybacks in the future, the current business environment doesn’t support any buybacks until 2025-2026, I suppose.

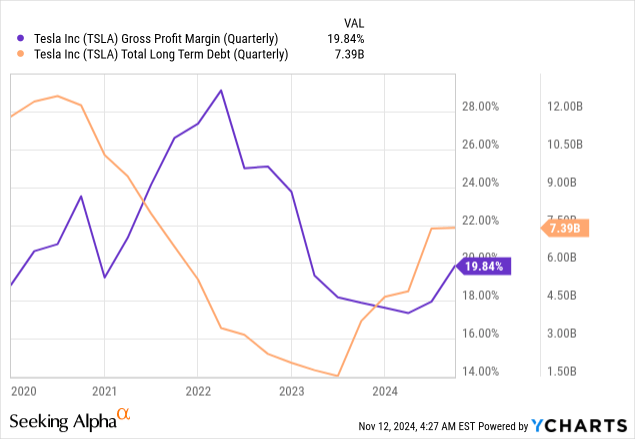

On the liability side, Tesla’s debt rose due to R&D, AI training, and production capacity investment. However, Tesla’s debt/cap ratio is still lower than the industry norm, according to Argus Research data (proprietary source, November 2024), which is a testament to its sound financial control.

Tesla delivered 462,890 vehicles during Q3, which was up 6% from the previous year driven primarily by the Model 3 and Model Y. The Shanghai facility, an integral part of Tesla’s global production plans, ran at full capacity and provided substantial volumes to the firm. The plant’s bounce back from scheduled downtime in Q3 2023 speaks volumes about Tesla’s reliability and performance, bullish-minded analysts at Argus Research noted.

In spite of these seemingly solid results, Tesla is plagued by issues that have hurt its financial metrics. Their average selling prices (ASP) keep decreasing due to product mix changes and increased competition within the EV space. As of note, Tesla Y is “one of the quickest-depreciating cars over the past year or so: the average price of a Tesla Model 3 is now about $26,000, $8,500 less than it was a year before”, according to Patrick George from Inside EVs.

This kind of ASP dynamics has challenged Tesla’s automotive gross margins which, while improving over last year, remain a topic of attention for investors. Additionally, Tesla’s expansion into new markets and lines of business (including Cybertruck and its upcoming low-priced EV) takes significant capital outlay, increasing the company’s debt position (although it’s not that scary amid Tesla’s debt-to-equity of just 0.18, according to Seeking Alpha data).

Tesla’s market leadership in the EV market (51% market share of the US EV market, according to Argus) is a “testament to their brand and technological strength”. Also, Tesla’s energy businesses – Powerwall and Megapack – are expanding quickly and seem to have great long-term growth prospects. According to InsightAce Analytic, the global stationary energy storage market is estimated to reach $215.10 billion by 2031, growing at a CAGR of 22.25% during the forecast period of 2024-2031 with Tesla being one of the key market players there:

On the other hand, Tesla is not immune to flaws and threats: This company’s dependency on a handful of major markets, including the United States and China, places it at geopolitical and regulatory risk. Tesla is under strong pressure from domestic EV makers and could encounter regulatory obstacles in China, as it generates roughly a third of its consolidated sales there. In addition, Tesla’s high growth goals, including 20-30% growth in vehicle deliveries by 2025, are contingent on successful new product introductions and production capacity expansion. I think these projections are too optimistic when you see the market the company has to compete in today.

From Q4 2024 through FY2025, Tesla management set lofty expectations for both its EVs to be more accessible and its business to be autonomous. As new models roll out and production ramps up, Elon Musk expects Tesla’s vehicle deliveries to jump 20-30% by 2025. He also believes that the energy industry is likely to stay afloat with the Megapack and Powerwall markets continuing to grow.

Looking at the dynamics of analysts’ forecasts over the past month, we can see that the forecast EPS figures are gradually recovering from the sharp decline that has persisted since 2021. However, the extent of the recovery in EPS forecasts seems too weak to me to justify the stock reaction we have seen in recent days.

That is to say, sure, the recent stock rise is likely to have been warranted, but not in the way it has been. My perception is that the stock has become too distant from the present.

Despite some obvious bullish hints, Tesla’s aggressive pricing – to retain market share – may continue to stress margins. Add Tesla’s heavy capital spending agenda – necessary for the company’s ambitious growth strategy – and you have a nightmare scenario that threatens even current broadly positive consensus estimates of earnings.

The presence of Tesla in China is a blessing and a curse: It’s one of Tesla’s key markets, but the company is now also up against regional EV makers, who are quickly taking over the market. Since Trump is now president, regulatory and geopolitical concerns also threaten Tesla’s presence in China. Whether the firm will continue to succeed in the market depends on how it is able to get past these obstacles and maintain an edge over the others. For the most part, I don’t see this risk represented clearly by market expectations today.

Additionally, as any skeptic, I’m baffled as to how the company is being valued today. Not only does the stock look overbought on traditional technical measures such as the Relative Strength Index, but it’s also now trading far beyond the expectations of even the most loyal bulls. Look at the Morgan Stanley CFA Adam Jonas’ report (proprietary source, October 2024) – he expected Tesla to be $310/share in a year. But the stock is already trading above $340, 10% higher than what one of the most bullish analysts on the market was predicting.

Morgan Stanley (private source), October 2024, notes added

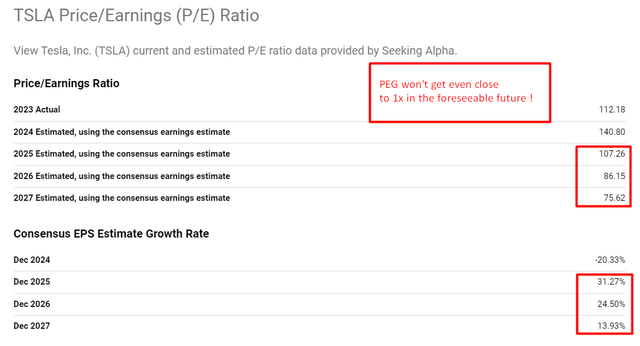

A lot of people would argue that EPS growth is the reason for the company’s valuation to be as strong as it is right now. But let’s face it, if you’re looking at a rapidly growing business, your best bet would be the PEG ratio, which calculates the combination of the price-to-earnings multiple and the rate of earnings growth. For Tesla in particular, this ratio doesn’t even approach 1x, which is typically the benchmark for fast-growing companies. This seems to be the case at least until the end of 2027, and I suspect it may continue to be so for some time.

Seeking Alpha, TSLA, notes added

In other words, recent events have led to what, I believe, is an unreasonably high premium in Tesla’s stock price. This premium is so significant that it seems unlikely that prudent long-term investors, following the principles of Peter Lynch or any other renowned investor in fast-growing companies, can justify holding TSLA at these levels.

Where Can I Be Wrong?

I might be off base in the analysis of what the market believes is an acceleration for Tesla’s stock price: Perhaps I am overlooking something or an impact on Tesla’s stock price that isn’t yet reflected in its price, which could mean Tesla stock would swell dramatically.

Additionally, the high demand in current energy markets, which is driving multiples higher with Tesla dominating the market with its Powerwall and Megapack solutions, could drive higher multiples as the market looks forward to a higher growth rate.

When or if the Tesla stock premium eventually will drop back down to more manageable levels, I don’t know for sure, I can only guess that it will at some point. If it does, it could be devastating for existing shareholders, but then again, the company may simply outgrow its current large multiples, eliminating such threats.

The Bottom Line

I generally agree with the bulls that Tesla’s high-growth plans for Q4 2024 and FY2025, resulting from new models and growth in the energy segment, present significant opportunities for value creation. However, the business will have to judiciously control risks related to the market environment, regulatory developments, and geopolitical uncertainty to meet its long-term targets. In addition, while Trump’s presidency might offer some advantages to Elon Musk’s business ecosystem, it also introduces risks for Tesla in particular. Increased U.S. pressure on Chinese manufacturers could provoke retaliatory actions, and Tesla, given the critical importance of the Chinese market to its operations, could be one of the first to feel the impact. I believe these risks are being overlooked by today’s Tesla buyers, who have driven the company’s market cap to unprecedented heights given the fundamental setup we’re looking at. Currently, Tesla is trading even higher than the most optimistic bulls predicted at the end of last month; the growth potential that very optimistic market players anticipated for the next 12 months has already been realized and even exceeded – in just a couple of weeks.

If we assess the situation without excessive optimism and try to be as objective as possible, it becomes clear that the company is overvalued, with a premium that defies reasonable logic, in my opinion. This is why I have decided to maintain my “Sell” rating, despite its lack of success in the recent past (as it remained relevant for many months). I believe there are many other fast-growing companies in the market that deserve investors’ attention, and unfortunately, Tesla isn’t one of them today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!