Summary:

- Luminar Technologies, Inc. is making progress with new deals, but financials remain weak, requiring patience for long-term gains.

- Volvo’s EX90 production ramp and a second model with Iris LiDAR promise future revenue growth, despite current low sales.

- Luminar’s insurance program could offer significant savings, potentially making LiDAR cost-effective for consumers.

- Despite frustrating financials, Luminar’s strategic cost savings and production ramp-up suggest better financials by 2026.

JHVEPhoto

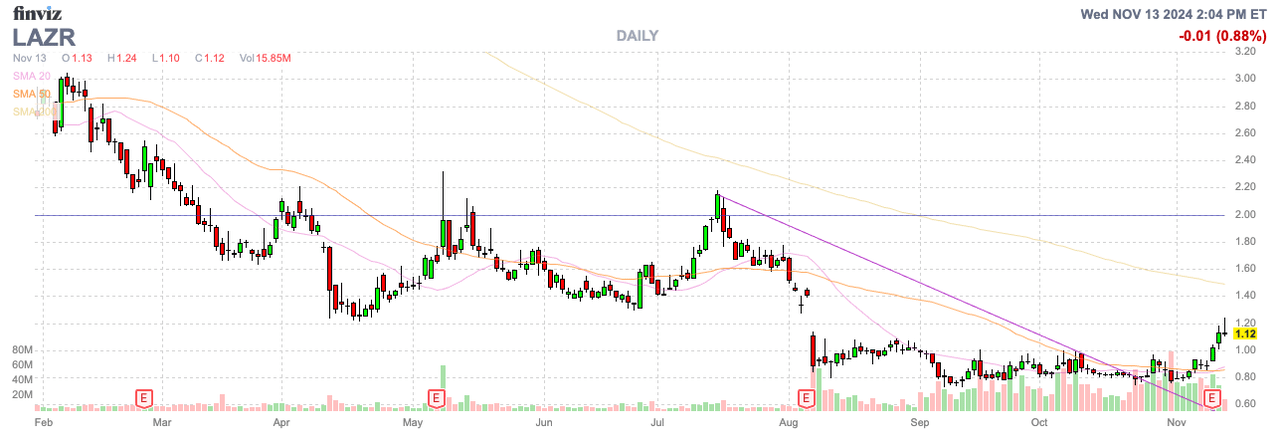

The autonomous driving sector continues to heat up, but Luminar Technologies, Inc. (NASDAQ:LAZR) continues to take steps backwards. The LiDAR sensor company has a ton of potential, but the stock appears stuck until the promises start showing up in the financials. My investment thesis remains ultra-Bullish on the stock over the long term, but patience could be required.

New Deals

The big focus of the business are the automotive deals. Luminar announced two new deals today with Volvo (OTCPK:VOLAF) and likely Nissan Motor Co. (OTCPK:NSANY) in Japan, but neither offers immediate sales.

Volvo is just now finally ramping up EX90 production with the Iris LiDAR included. Luminar shipped 3x the LiDAR sensors in Q3 ’24 as the last 3 quarters combined, and management suggested the EX90 has topped a four-figure number of vehicles produced and reaching to five figures.

For a business hoping to be approaching millions of LiDAR units being sold annually, Luminar is discussing a vehicle that should reach 10,000 units soon. The goal is to deliver 10x to 100x more LiDAR sensors in the years ahead.

More importantly, Volvo is moving forward with a second model, including the Iris LiDAR as standard equipment. On the Q3 ’24 earnings call, CEO Austin Russell made this statement regarding the 2nd vehicle model from Volvo (emphasis added):

It’s going to be smaller than the EX90 and we’re hoping that it is going to launch here over the next several quarters.

Understandably, Luminar didn’t provide many details. The key here is that the model will cost significantly less than the $80K+ premium SUV already in production, and the vehicle is set to launch in a couple of quarters.

Absent any setback, Luminar would likely see LiDAR sensor shipment volumes grow exponentially in 2025. The company has already promised quarterly revenues would reach ~$35 million once the EX90 ramps up, and additional models should only grow revenues.

Luminar continues to work an interesting angle on car insurance. The large increase in insurance rates since COVID-19 could lead to an interesting benefit from LiDAR to pay for itself.

On the Q3 ’24 earnings call, CFO Tom Fennimore had this to say about the initial savings via the insurance program:

…on the insurance side, We’re planning to register in the Top 10 states in the US, which comprise about half the vehicle sales in the US. We’re targeting, I would say, annual insurance savings for the EX90 and other vehicles with our ladder of about 20%. Given the safety improvements, we believe that that’s a meaningful discount to give to the consumer to hopefully attract adoption, while at the same time, making sure that we still get decent profitability on the insurance side.

The CFO suggests annual savings of a couple of hundred dollars on insurance premiums, but a 20% savings on a new premium EV could be a lot more than $200 a year. Either way, annual savings of $200 on an EV would hit $1,000 in 5 years of operation and pay for the LiDAR itself, not to mention the additional safety on the vehicle.

Frustrating Numbers

Luminar continued a path of announcing promising deals and contracts while reporting dismal quarterly numbers. The company only reported Q3 ’24 revenue of $15.5 million, far below the consensus estimates at $19.0 million.

As with the prior quarter, Luminar had a viable excuse for the miss related to a non-series production deal re-negotiation. In reality, the LiDAR sensor company would be better off breaking out the different metrics, so investors can focus solely on the revenues related to sensor sales.

The company guided to Q4 revenues of only $16.5 million, a meager revenue target. The Volvo EX90 deal is going from thousands to tens of thousands of units, but Luminar isn’t showing any financial benefits.

The company last provided an estimate for quarterly revenues reaching $30+ million in 2025. The Volvo ramp with a second model should lead to an even higher quarterly sales estimate, and the LiDAR integration into the second model should go far smoother the second time around.

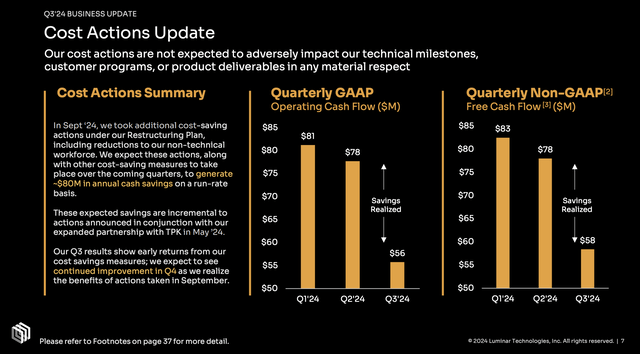

Meanwhile, management made the wise move to target up to $145 million in annual run rate cost savings once fully implemented by the end of next year. Luminar has already seen a $20 million reduction in the free cash flow loss on a quarterly basis.

Source: Luminar Q3’24 presentation

The company is still burning over $50 million of cash a quarter, but Luminar has the liquidity options to survive until late 2026. With Volvo having 2 models in production next year plus the Polestar Automotive Holding UK PLC (PSNY) vehicle and up to 20 additional models under contracts, Luminar will probably have far better financials by 2026 to secure more capital if needed.

Either way, Luminar is now full speed ahead with series production and the stock still trades near the all-time lows. The actual reported financials are frustrating, but the company continues making progress towards the ultimate goal of selling millions of LiDAR units on an annual basis.

Takeaway

The key investor takeaway is that Luminar Technologies, Inc. still has a very long and difficult path towards a profitable business. The company has already solved the difficult part of proving the LiDAR sensors work and ramping up manufacturing units in volumes, now Luminar just has to manage the business to ensure the company can thrive when demand ultimately soars.

Investors should use the recent rally as a signal Luminar has possibly turned the corner. If the stock doesn’t hold the recent support around $0.75, an investor should probably cash out due to the signal that Luminar isn’t making the expected progress and capital risks are arising.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAZR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start November, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.