Summary:

- Apple had a strong Q4 and FY24 with improved profitability and expanding revenues thanks primarily to new product launches.

- Their Services business, with a 74% gross margin, is crucial for profitability, but hardware sales remain essential for ecosystem growth.

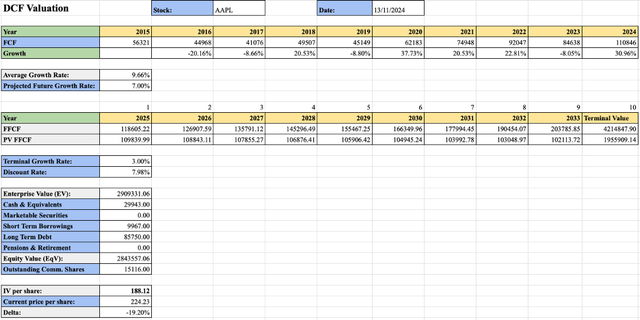

- Despite the robust earnings, Apple’s stock valuation is historically expensive, with my DCF suggesting a 19% overvaluation.

- Competitive pressures in China, governance risks, and massive competitive forces pose significant challenges for Apple.

- Sell rating maintained.

ozgurdonmaz

Investment Thesis

Apple (NASDAQ:AAPL) had a robust Q4 and fiscal year 2024. Improved profitability, operational efficiency and new product launches helped the firm to grow their bottom line results and revenues in what proved to be a mostly positive period for the firm.

Despite the strong earnings, Apple’s stock has still managed to outpace the underlying fiscal data resulting in a historically expensive valuation which places shares at a real premium relative to the firm’s intrinsic value.

According to my DCF, AAPL stock currently trades at a 19% overvaluation.

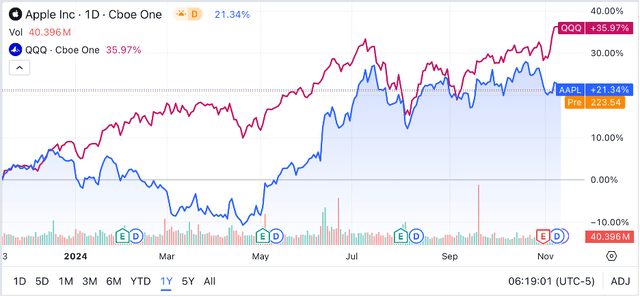

As a result, I maintain my Sell rating for the stock and remind investors that over the past year, the Nasdaq-100 tracking QQQ (QQQ) ETF outperformed Apple stock by 14%.

Business Overview & Economic Moat

Apple needs little introduction. The Cupertino giant is known for their iPhone, iPad and Mac consumer-grade technology products and has become one of the most valuable companies in the world.

The key to Apple’s success has been a tight integration of hardware and software to produce devices which are user intuitive and highly reliable. This strategy has led to the creation of a plethora of Apple services such as Music, Health and TV+ which only aim to further expand the ecosystem within which users may benefit from their seamless hardware and software integrations.

Apple now derives approximately 25% of their revenues from service sales and 75% from hardware product sales.

Products produced by Apple also target the upper-end of the market with even their cheapest devices and services often costing significantly more for consumers than comparable ones from competitors.

This phenomenon illustrates the massive pricing power held by Apple which the firm has achieved thanks to both their superb products and through the curation of an attractive and luxurious brand image.

Another key to their success as a business has been the protection of their core products and services from third-party competition through the creation of switching costs for consumers. By making their devices harder to use with non-Apple products, and by offering a more seamless Apple-derived solution, the firm has been able to increase cross-selling within their user base.

This business practice of creating a “walled-garden” has come under fire by regulators in the U.S., EU and some Asian markets. Nevertheless, I suspect that even if the firm were forced to offer a greater level of compatibility with auxiliary services and products, Apple’s influence among its users would remain due to the ease-of-use advantages offered by their own offerings.

Fundamentally, it is the firm’s high-quality products tightly integrated with advanced software services and complemented by a luxurious and aspirational brand image that creates massive moatiness for Apple.

In my opinion, Apple is one of the only firms in existence to harbour a true mega-moat which I believe is evidenced by their massive returns on invested capital and operating profitability.

Fiscal Analysis – Q4 FY24 Update

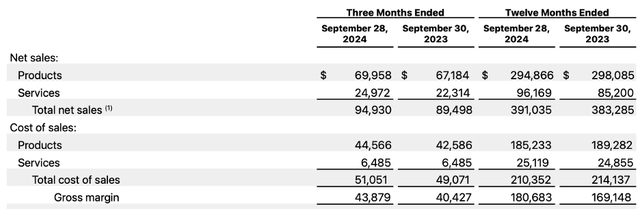

Apple’s latest Q4 and FY24 earnings release and call presented robust sales figures with revenue increasing 6% YoY totalling $94.9 billion. Services sales (software products such as Apple Music or TV+) accounted for 24% of the total revenue figure while product sales (mainly hardware) accounted for the remaining 76%.

This split between revenue sources is essentially unchanged from the prior year suggesting that penetration among consumers of Apple’s services is reaching maturity.

My hypothesis is that solid sales of the latest iPhone 16 models particularly in European, U.S. and Asia Pacific markets along with a packed update cycle for the Mac and iPad lineups has helped bolster hardware sales in Q4 and FY24 as a whole.

While services growth was 0% YoY for Q4 figures, FY24 figures as a whole showed a 12.9% increase compared to FY23. While this rate has slowed from recent years, I suspect Apple will be able to continue growing their services revenues at approximately 2-4% per annum as a result of an increased user base and the release of new solutions to customers.

The services business generated $18.5 billion in gross income for the company in Q4 compared to the $25 billion earned from product sales. To emphasize this point, Apple’s services business has a gross margin of 74% compared to just 36% seen in their hardware business.

Therefore, while the revenue spilt between services and hardware is about one to four, the split becomes closer to three to five in terms of gross income.

I wanted to emphasize this point to highlight how reliant Apple is on their services business in order to generate revenues. While the hardware products are by no means lacking in profitability, Apple’s core strategy at present time is to attract users into their ecosystem by selling a phone, laptop or tablet and then cross-sell their subscription-based services to these customers.

This order of events means that robust hardware sales are critical for Apple. Any slowdown in adoption rates of new devices or switching by consumers away from their products will result in a real decrease in services sales.

While such a scenario is of no real concern at present time, the localized struggles in China could escalate in the future. Variables such as China’s response to the tariffs proposed by president-elect Trump as well as the continued curation of domestically developed competitors could potentially place Apple at a disadvantage in the region.

Considering that most of Apple’s geographic regions have grown between 2-6% on a YoY basis in terms of revenues, the 0.5% decline in sales in the Greater China region are slightly concerning. I suspect that the decline in sales has come as a result of the aforementioned hardware-to-services sales channel being disrupted by consumers purchasing rivalling Huawei and Xiaomi devices instead.

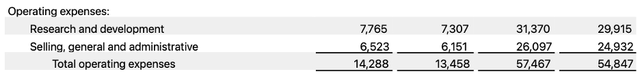

Turning back to Apple’s financial results, the firm remains committed to research and development with Q4 seeing the firm invest an additional 6.4% in their innovation drive. Projects such as a folding iPhone, the next Vision Pro and other unannounced devices are of paramount importance for Apple especially given the massive innovation being pursued by rivals.

I don’t believe R&D costs will increase much beyond the current level of about 2% of revenues especially considering that Apple has essentially chosen to outsource the mass of their AI work to OpenAI.

While I suspect this strategy will allow the firm to provide users access to AI features quickly and – importantly for the company – cost effectively, I worry whether or not this strategy could lead to an erosion of some of the firm’s own technological advantage.

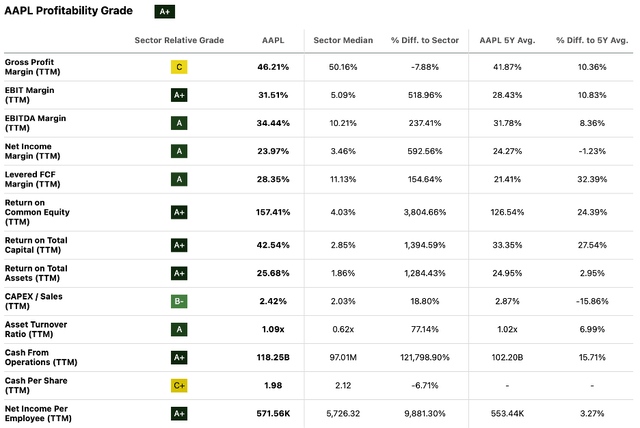

Seeking Alpha | AAPL | Profitability

Seeking Alpha’s Quant calculates an “A+” profitability grade for Apple which, I believe, is absolutely warranted. Considering that Apple’s WACC is estimated to be just 11.3%, the superb 42.5% ROTC is perhaps my favourite metric to quickly illustrate how well the company is out-earning their cost of capital and thus generating value from their operations.

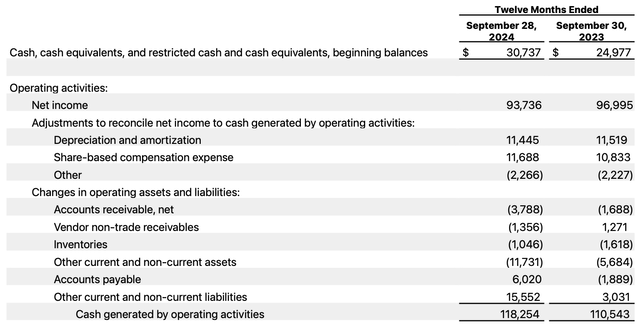

Apple’s balance sheet continues to be in excellent condition with the firm holding both a massive $30 billion in cash and equivalents in their coffers all the while having long-term debentures of just $85.8 billion.

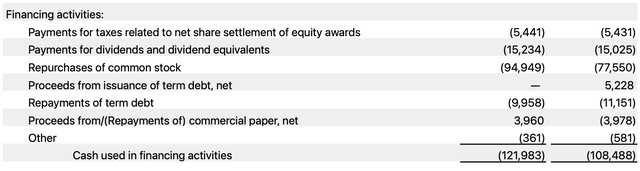

Thanks to the firm’s massive $118 billion in cash generated by operating activities in FY24, Apple has been paying down maturities of debt as they arise with little trouble which is aiding the firm to move towards a net-cash position by reducing the burden of long-term debt due in the upcoming twelve months.

Apple has also been aggressively buying back shares with the firm delivering over $29 billion in share buybacks in Q4. The firm has delivered $94 billion in stock repurchases throughout 2024 even despite what some analysts have deemed to be an elevated share price.

I personally believe the buybacks are a solid way to reward shareholders and a particularly tax-efficient method compared to dividends. Nevertheless, it goes without saying that Apple has been repurchasing a significant amount of their stock at premium prices compared at least to historic valuations.

Overall, Apple has had a very robust FY24 and Q4 with surprising levels of growth and profitability even despite a competitive and weakening macroeconomic environment. Moving forward, Apple must continue focusing on creating hardware devices that consumers want to use so that they may cross-sell their more profitable subscription-based services.

As has been witnessed in China, I believe any reduction in the popularity of their hardware devices can have an outsized impact on regional profitability as a result of the significant contributions made by services sales.

Valuation

Considering my overall satisfaction with Apple’s FY24 earnings report, I understand that my overall “Sell” rating for the stock may come as a surprise. However, I want to emphasize that I view companies and the relative valuations of their stock separately to one another because the two factors can often have little correlation between one another.

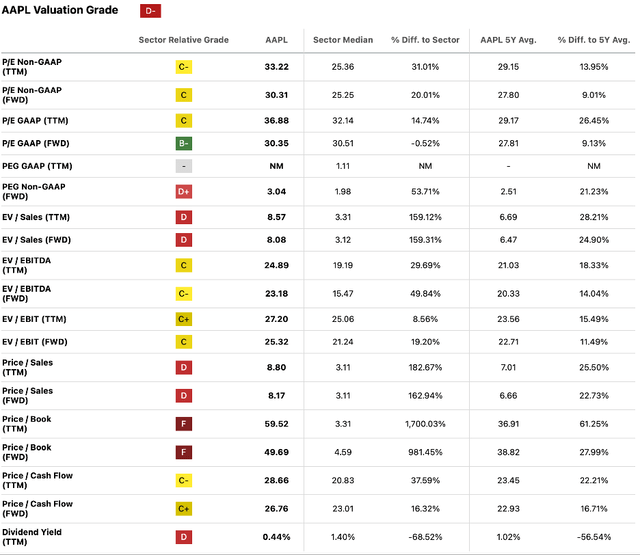

Seeking Alpha | AAPL | Valuation

Seeking Alpha’s Quant appears to agree with my methodology with the algorithm providing a “D-“ valuation rating for AAPL stock.

Since my last update, Apple’s TTM GAAP P/E ratio has increased to 36.88x along with their P/S TTM ratio which has hiked-up to 8.80x. These appreciations in valuation metrics have come despite the solid earnings improvements and revenue growth at the firm.

The P/S TTM ratio in particular suggests the firm’s overall ability to generate sales has fallen relative to the share price (a proxy for market cap) dictated by investors.

Seeking Alpha | AAPL | 1Y Advanced Chart

A quick look at Seeking Alpha’s 1Y Advanced Chart function for AAPL stock against the ever-popular Nasdaq 100 tracking QQQ ETF illustrates that over the past TTM, Apple has been unable to outperform the wider technology sector.

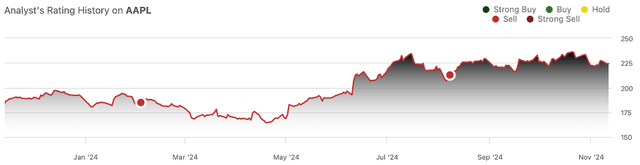

Seeking Alpha | The Value Corner | AAPL Coverage Chart

I also present the above chart in the name of transparency and to illustrate how my coverage has fared over the last year.

Indeed, the stock has only outperformed the S&P 500 (SPY) by 0.8% since my update in February and underperformed by 7.2% since my latest article in August.

While long-term investors may have been able to generate outsized returns from holding AAPL stock, particularly thanks to the 2019-2022 boost in earnings and the coinciding share appreciation, the last year has been less impressive with Apple largely underperforming the greater technology sector.

I completed a DCF calculation for Apple in order to obtain a quantitatively sourced and more objective understanding of what may constitute a fair valuation for AAPL stock at least based-off the present value of all future cash flows from today till judgement day.

I sourced all financial input data from Seeking Alpha’s wonderful Financials tab for AAPL. I slightly adjusted Apple’s projected future growth rate from the firm’s 10Y average of 9.66% to 7% in order to align my estimates with currently conceivable expectations.

I used a 3% terminal growth rate to account for how Apple might fair in what is increasingly becoming a mature consumer electronics industry and applied a discount rate of 7.98% which is the 92-year historic S&P500 average return.

Using these data inputs, I obtained a $188.12 intrinsic value figure for AAPL stock. This is approximately 19% below the current share price, suggesting an overvaluation is present.

In the short-term (1-12 months), I am concerned about the implications this overvaluation may have. While Apple is a profitable, robust and still growing business, it appears that the recent rally in particular has placed their stock in an overbought condition which statistically increases the odds of a downward correction being applied in the future.

Furthermore, the reality that Warren Buffett has sold a significant stake in the company suggests that he does not foresee Apple generating the outsized returns required to support the current valuation for the stock.

While this is just one (albeit massive) shareholder selling stock, Buffett’s overall penchant for valuing assets suggests that market-beating gains may not be found in Apple stock, at least for now.

In the long-run (1-10 years), I suspect Apple will continue generating massive profitability and cash from their operations. Their core products remain popular and a lucrative avenue for income generation, while new ventures into wearables and virtual reality products could lead to renewed growth at the firm.

My only issue with Apple at present time rests with their valuation which, as supported by my analysis, appears to be overvalued at present time.

Apple Risk Profile

Apple faces risk primarily from market cyclicality, competitive pressures and governance concerns.

The reality for consumer discretionary companies is that the overall ability for consumers to purchase their goods will to some extent dictate their ability to grow and increase revenues. Apple is no different and could potentially be exposed to falling consumers demand should a recessionary environment manifest itself in the U.S. economy.

Nevertheless, this threat would impact essentially every single business operating in the U.S. and globally. I therefore do not believe Apple faces any outsized risk from such an unavoidable macroeconomic reality.

A much more acute risk for Apple lies in the massive competitive pressures the company is facing. Industry rivals such as Samsung (OTCPK:SSNLF), Xiaomi (OTCPK:XIACY) and Google (GOOG)(GOOGL) are constantly vying to attract consumers away from Apple’s products and into their own ecosystems. While none of Apple’s competitors currently have an equally extensively integrated user experience, unique selling points such as folding screens have proven particularly popular among consumers.

In order to mitigate the risk of losing market share to competitors, Apple needs to increase the rate at which they innovate within their core businesses. Consumers and critics alike have criticised the recent iPhone, iPad and Mac releases for being relatively tame and showing little real innovation apart from minor iterative improvements.

While it may be difficult for Apple to grow their user base further, the firm must aim to keep the customers they already have.

The weakness in the Chinese market is a complicated issue and one with undoubted socio-political influences. However, the massively competitive smartphone market in China may serve as an early warning for Apple, highlighting the impacts lackluster innovation may have on sales.

Finally, Apple also faces some real governance risks, particularly as a result of multiple antitrust cases against the firm.

The 2024 DOJ lawsuit, recent €1.8 billion EU fines and blocking of iPhone 16 sales in Indonesia are but a few of the significant judicial challenges Apple faces moving into 2025. While Apple’s tight product integrations are responsible for generating much of the firm’s moatiness, some have criticized the firm for engaging in monopolistic activities and anticompetitive behavior.

Apple’s strategy of management over mitigation in relation to these threats is the correct one in my opinion, as the complexity and political motives behind these governance issues are essentially impossible to predict. Nevertheless, it is important as an investor to consider that Apple may be forced to open their ecosystem to third-party solutions and applications while also potentially facing some real financial penalties.

Overall, I rate Apple as having a high-risk profile due to the multitude of factors that affect the firm acutely, as well as their general exposure to what is a cyclical consumer spending environment.

Summary

Apple produced a robust set of 2024 results, with great profitability and reasonable single digit growth characterizing both their Q4 and fiscal year as a whole. I still really like the company, their products and their approach to business and believe that the firm will continue generating real returns from their operations.

However, the valuation for the stock has only gotten dearer since my last update, with the stock now trading at what I calculate to be a 19% overvaluation.

While I am absolutely a proponent of purchasing a great business at a reasonable price rather than a reasonable business at a great price, Apple’s current valuation is expensive and unfortunately unwarranted.

Therefore, I maintain my Sell rating for the stock.

As a closing remark, I want to reiterate that the goal behind my ratings and analysis is to reliably generate maximum returns from invested capital.

With that in mind, investors could have achieved 14% greater gains (36% TTM total) by investing in the QQQ ETF instead of in AAPL stock twelve months ago.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.