Summary:

- CleanSpark, Inc. demonstrates strong growth in Bitcoin mining, with significant hashrate expansion, energy efficiency, and strategic geographic diversification.

- CLSK’s Bitcoin accumulation strategy and institutional backing, including increased stakes from BlackRock and Vanguard, highlight its financial stability and long-term growth potential.

- Recent acquisitions, infrastructure development, and a merger with GRIID position CLSK to achieve a 50 EH/s target by 2025, enhancing operational capacity.

- Despite recent share dilution, CLSK’s undervaluation and correlation with Bitcoin’s price suggest substantial upside potential, with analysts projecting a price target above $20.

da-kuk

CleanSpark Inc. (NASDAQ:CLSK) is positioned as one of the leading players among Bitcoin miners, demonstrating consistent growth in financial capacity, energy efficiency, aggressive expansion efforts, ongoing acquisitions, and a strong operational footprint.

Though CLSK’s road to long-term success has been supported by an increased focus on dilution, this company has increased institutional backing, and now a clear path to capitalizing on the upward rise of Bitcoin’s price.

At current price levels, CLSK still presents an opportunity for investors looking to tap into Bitcoin and the larger digital asset ecosystem. Let’s dive in with the CLSK’s operational updates, their plans going forward, and why this stock presents significant upside potential.

Is CLSK Continuing to Sustain a Strong Bitcoin Accumulation Strategy?

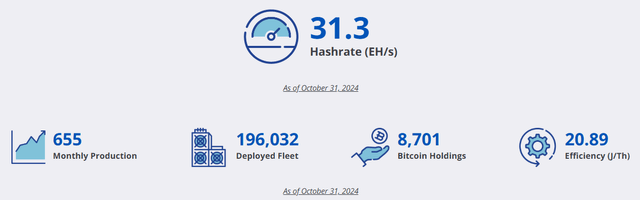

Key to its value proposition is their Bitcoin production and BTC accumulation strategy of CLSK. During the month of October CLSK was able to mine 655, increasing its total holding 8,701 BTC. Unlike most mining companies that immediately sell mined Bitcoin to cover operational expenses, CLSK’s approach signals confidence in Bitcoin’s long-term appreciation and presents a strong balance sheet to investors with strong expansion strategies with current BTC new highs.

October Mining Update (www.cleanspark.com)

As BTC continues to soar higher, CLSK will finally be able to apply the current reserves of almost 9,000 BTC to use for future investments to scale its operations.

Operational Resilience & Upside Sentiment:

Operational growth for CLSK in 2024 has been particularly marked by very strong hashrate expansion. It’s hashrate expanded from 9.6 EH/s at the end of 2023 to as high as 31.3 EH/s by October 2024, up 226.04%. In September alone, CLSK added 5 EH/s, underlining its robust infrastructure development and scaling.

Moreover, CLSK showed that it is operationally capable of rebounding very fast from external disturbances, such as hurricanes and other natural disasters. Recent updates, show that the company’s hashrate has surged further to 31.3 EH/s, underlining its resilience and growth in operations. This operational recovery, together with strategic infrastructure investments, may provide a good case for long-term growth potential.

In addition to expanding capacity, CLSK has pursued energy efficiency-reducing consumption from 22.7 joules per terahash to 20.89 J/TH from August to end of October 2024. Less consumed energy improves profitability and brings the company in line with Environmental, Social, and Governance priorities out in the market, securing its position as a greener mining company.

Geographical Expansion: Improvement of Operational Stability

One of the most vital strategic steps CLSK made in 2024 dealt with expanding into new geographic territories. The company added Wyoming, Mississippi, and Tennessee as its operational sites. By so doing, it materially expanded its geographic diversification. Geographic diversification is critical for miners like CLSK because dependence on single regions is minimized, hence more stability and flexibility against regional challenges, changes in regulations, and natural disasters.1. Acquisitions in Tennessee The addition of seven sites in Tennessee increased the overall mining capacity for CLLSK, adding up to 5 EH/s to its growing hashrate. Of the seven sites added, five were operational and had added 65 MW; the remaining two sites will be fully functional in the near term and are set to add an additional 20 MW. With power restoration from Hurricane Helene completed in September, CLSK’s total hashrate is on pace to increase to 33 EH/s, further cementing the company’s position regarding efficiency in the sector.2. Wyoming Expansion WY – at CLSK, the company closed its second facility and prepared to build out the data center, developing its capability for further scale. The regulation in Wyoming is very friendly and the energy cost is cheap, which makes this area a good destination for Bitcoin mining. 3. Clinton Mississippi Operations Thus, it is anticipated that these two turnkey locations in Clinton, Mississippi, would have all infrastructure up and running by December 1, 2024, with S21 Pro miners available to turn on. Together, these two sites will add 1 EH/s of mining capacity to CLSK’s total, which will bring the company even closer to its long-term goal of 50 EH/s by 2025.

Infrastructure Development and Forward Guidance

CLSK’s expansion plans are not over with its geographic diversification. The infrastructure development strategy of the company has been pursued in addition to the drive of scaling its operations to new heights. In mid-October 2024, CLSK was able to reach a hash rate of 31.3 EH/s. That is only a milestone on the company’s road to reach a target of 50 EH/s by 2025, which CLSK’s management has hinted may be revised upward in the next few months.

Monthly KPI’s (www.cleanspark.com)

CleanSpark | America’s Bitcoin Miner – Monthly KPI’s 31.3 EH/s.

Merger with GRIID: Another leg of the forward-looking growth strategy has also been recently extended by CLSK through a merger agreement with GRIID Infrastructure Inc., another bitcoin mining company. This all-stock deal, valued at $155 million, is an acquisition of all assets held by GRIID, inclusive of their debt obligations, by CLSK. Under this agreement, CLSK provided a $5 million working capital loan to GRIID and a $50.9 million bridge loan to cover certain financial commitments. This positions CLSK to potentially amplify bitcoin mining operations, increase over 100 megawatts of power in Tennessee by the end of 2024, and reach up to 400 megawatts by 2026. This is a major growth driver in CLSK’s strategy, as the company will utilize GRIID’s infrastructure and environmentally responsible power sources. Financial Strategy: Funding Growth and Managing Bitcoin Volatility.

The financial strategy of CLSK is as bold as its operational expansion. Recent dilution approval of 600 million shares to fund aggressive growth strategies from the company could raise concerns in the short term, but one needs to recognize that previous rounds the capital raised has been utilized gainfully – in the past it has been used efficiently for infrastructure expansion, site acquisition, and mining equipment upgrade initiatives. These will eventually result in higher revenues and profitability over the long term and, therefore, should temper the impact of a temporary short-term dilution. That said, having 8,701 Bitcoin reserves acts as a cushion as BTC appreciates this cycle. As highlighted before, most mining companies need to sell a portion of their mined Bitcoins in order to finance operations, while CLSK’s actions are proof that it retains a great portion of its mined BTC, showing great financial discipline and conviction on the price in years to come. This will continue to serve as a strategic reserve for CLSK, affording liquidity to underpin future expansions and growth initiatives with the continued appreciation in BTC’s price.

Institutional Support and Strong Buy Ratings: Recently, BlackRock increased its stake in CleanSpark to 19,473,511 shares, or approximately 7.7% ownership from 6.5% earlier this year. This puts BlackRock’s aggregate investment in CLSK at approximately $230 million. Other institutional investors such as Vanguard and State Street have also demonstrated confidence in the company, with Vanguard owning approximately 7% of the company. These institutions believe that the high growth in hashrate at CLSK and operational efficiency will continue to drive profit in the future.

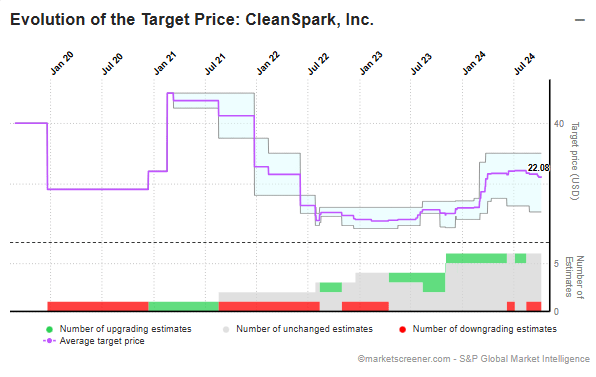

This optimism also reverberates on Wall Street, where the majority of analysts rank the stock as a Strong Buy. The growth in CLSK’s hashrate, along with further expansion, has seen analyst price targets range from $20 to $33, representing potential two or three-digit-percentage gains above its recent trading price today. This institutional support brings more than just much-needed capital to CLSK for further growth; it reinforces confidence in the company’s long game.

Target Price Variations Chart:

www.marketscreener.com

This graph illustrates the evolution of CLSK’s (CLSK) target price over time, as estimated by various analysts. Key elements include:

Average Target Price: The consensus target price for CLSK has, in fact, been in line with fluctuations, moving its peak to as high as around $40 in January 2021 all the way down in 2022. It has since stabilized and is gradually on the rise. Estimates Activity: Analysts’ estimates have remained stable, although there have been some prominent downgrades, especially in early 2022. Green bars represent upgrades, and red bars represent downgrades, while grey bars indicate unchanged estimates. Target Price Range: Analyst target price settings have varied, and the dispersion in the set of high and low estimates creates a wide spread around the average, shown by the blue-shaded area behind the price line.

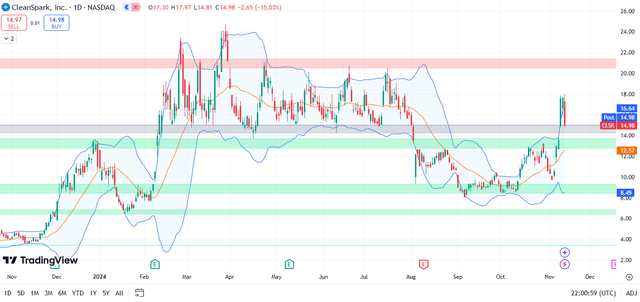

Correlation with Bitcoin Price: Significant Upside Potential

Current Situation:

– Bitcoin’s high in March 2024: $73,794, with CLSK at $15.80.

– Current Bitcoin price: $89,400, representing an increase of approximately 21.14% from its March high.

– Current CLSK price: $15, showing a slight decrease of about 5.06% from its March level of $15.80.

Interpretation Using a 3x Volatility Multiple:

Given CLSK’s historical 3x volatility multiple in relation to Bitcoin, this relationship can be used to project future performance.

Future Scenario Using a 3x Volatility Multiple.

– Scenario – Long-Term Potential:

If Bitcoin reaches $120,000 by late 2024 or early 2025:

– This would represent a 34.26% increase from $89,400.

– With a 3x volatility multiplier, CLSK’s stock price could increase by approximately 102.78% (34.26% * 3).

– Projected CLSK share price: $30.41 from the current $15.

These projections, based on CLSK’s high volatility relative to Bitcoin, indicate significant upside potential aligned with Bitcoin’s anticipated gains. This level of correlation could mean substantial returns for investors, particularly given CLSK’s current undervaluation compared to its 2024 highs.

BTC turns resistance into support and breaks out.

Technical Indicators Favoring Upside:

Recent price action indicates that CLSK has established solid support following earlier sell-offs, with the gap at $13.28 now filled and surpassed, signaling a breakout beyond short-term resistance.

Price Target: $20 and Beyond.

At the current trading price, CLSK is undervalued with respect to its mining capacity, Bitcoin reserves, and institutional backing. Analysts and market sentiment would suggest that a price target of above $20 is very realistic, driven by several catalysts:

• Increasing Price of Bitcoin: As Bitcoin continues to enjoy broader acceptance and increases in demand, the price of BTC is set to rise, and miners such as CLSK will obviously benefit as a result. As analyzed above, if the price of the underlier increases, the direct influence would be seen on profitability and the strength of balance sheets for CLSK.

• Operational Efficiency: CLSK has been focusing on continually optimizing mining infrastructure and has maintained some of the highest hashrates in the industry, thus giving it a competitive advantage.

• Institutional Momentum: Major financial institutions are significant shareholders in CLSK, and one can expect heavy institutional buying with this stock rebounding off current oversold levels. Such inflows could quickly drive the stock to its $20+ target.

Conclusion: Summary of CLSK’s Growth and Investment Potential

CleanSpark remains one of the ambitious miners, targeting a hashrate of 50 EH/s. This is further reinforced by the recent shareholder approval to increase share issuance from 300 million to 600 million, thus providing extra capital that may accelerate the growth trajectory of CLSK.

In recent price action, CLSK successfully filled the $13.27 gap and is now trading above it, indicating strong upward momentum that surpasses previous resistance levels. This breakout suggests that short-term barriers are unlikely to limit CLSK’s long-term growth, given the continued strength in both the stock and the Bitcoin sector. Despite CLSK’s recent rally, its share price remains undervalued compared to levels seen during Bitcoin’s prior all-time high, especially now as Bitcoin approaches new potential highs and CLSK’s mining capacity has expanded substantially.

Given CleanSpark’s historic trading range of $15 to $21 during Bitcoin’s last peak, the stock’s current valuation does appear low due to the current operational level CLSK has achieved in BTC mining. Now, with an expanded operational capacity and a robust hashrate compared to previous highs, CleanSpark is better positioned to capture gains as Bitcoin advances. While recent share dilution has raised the total shares, this additional capital strengthens CLSK’s resources to fund its 50 EH/s target. This combination of increased capitalization and operational growth potential reinforces CleanSpark’s ability to outperform, presenting a strong case for undervaluation and long-term growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in CLSK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.