Summary:

- Higher interest rates increase the likelihood of BAC.PL price increases.

- Price is emerging from a solid support level in BAC and BAC.PL.

- The appearance of a solid bottom in BAC.PL increases the probability of a breakout from $1,255.

Davis Turner

Bank of America Corporation (NYSE:BAC), one of the largest banks in the United States, issues the Bank of America Corporation 7.25% CNV PFD L (NYSE:BAC.PL). BAC.PL is a convertible preferred stock that is capable of converting into a specified number of the bank’s common shares. The stock has a fixed dividend yield of 5.86%, and BAC.PL’s performance is influenced by BAC’s performance, interest rates, economic conditions, regulatory environment, and market sentiment. This article discusses the factors that could affect the price of BAC.PL in the near term. The formation of an inverted head-and-shoulders pattern and a double bottom in BAC and BAC.PL indicates future price increases.

Why BAC.PL is a Secured Investment

BAC.PL is considered a good investment due to the nature of hybrid security, as it has characteristics of both stocks and bonds. Since BAC.PL represents ownership in the bank, it has the potential to appreciate in value. Moreover, the fixed dividend rate provides a steady income stream, comparable to that of a bond. Due to its relatively high fixed return rate, the stock is a good investment in 2023. The investors are also authorized to convert BAC.PL to common stock at a specified price and date, which provides an opportunity for capital appreciation if the price of the common stock rises. Additionally, the preferred stock generally has a greater claim on a company’s assets and earnings than common stock, making it a safer investment. In the event of liquidation, preferred stockholders are entitled to payment before common stockholders. The dividends on preferred stock are generally regarded as more secure than dividends on the common stock due to higher priority in the event that a company lacks sufficient profits to pay dividends.

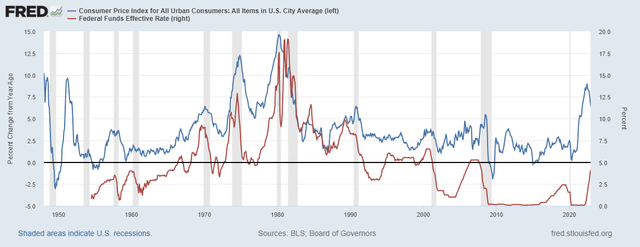

Impact of Interest Rates on Bank of America

BAC.PL’s performance is influenced by BAC’s financial performance, interest rates, economic conditions, the regulatory environment, and market sentiment. To combat inflation, the Federal Reserve has raised the interest rate above 4%; however, inflation remains out of control. In 2023, the Federal Reserve is expected to raise interest rates further. The higher interest rates have a positive effect on BAC.PL’s performance. During periods of high interest, banks earn more on lending operations and raise the value of stocks. The increase in the interest margin has an effect on the profitability of the bank, thereby increasing the value of BAC.PL. The expectation of future rate hikes increases the likelihood of lower inflation. The economy catches the impact of rate increases after a few months of rate hikes. The chart below illustrates the relationship between interest rates and the Consumer Price Index (CPI). The rate hikes above 4% have caused the CPI to decline to a 6.4%. The increase in interest rates is favorable for BAC.PL and increases the likelihood of higher prices in BAC.PL.

CPI vs Interest rates (stockcharts.com)

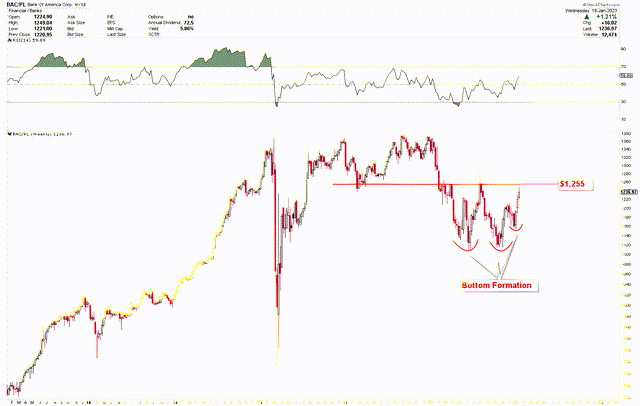

Bottom Development Process

BAC.PL’s chart demonstrates a process of bottom formation in the form of a double bottom and an inverted head and shoulder pattern. The neckline of this pattern is located at $1,255, and a breakout from the neckline would indicate a quick and strong move to new highs. The development of this pattern encourages investors to buy the stock at a lower price.

Bank of America Corporation 7.25%CNV PFD L (stockcharts.com)

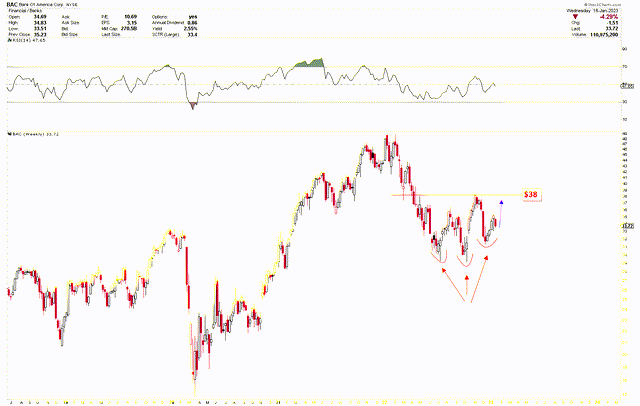

The formation of an inverted head and shoulder pattern indicates that the price of BAC stock is also exhibiting strong positive development. If BAC breaches $38, the stock has the potential to rise. The correlation between BAC stock and BAC.PL is positive. The breakout of one stock increases the likelihood that the other stock will also break out.

Bank of America Corporation (stockcharts.com)

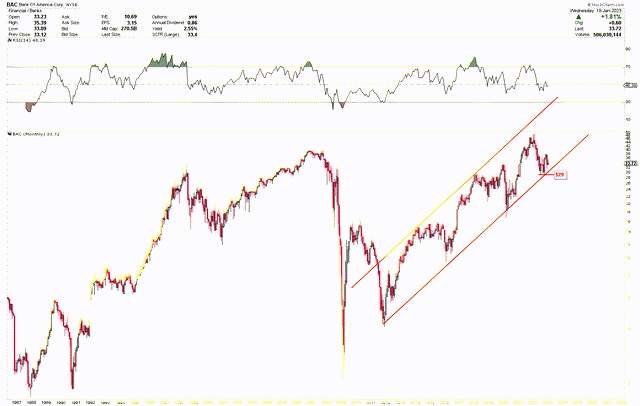

According to BAC’s monthly chart, the stock has been pulling away from its long-term resistance area and trading in a red channel. The consolidation at the red channel’s boundary is indicative of an upward trend. The bullish scenario is negated only if the price falls below $29.

Bank of America Corporation (stockcharts.com)

Conclusion

BAC.PL is trading at lower levels, and the price decline in 2022 presents investors with a buying opportunity. The environment of rising interest rates is ideal for BAC.PL investments. The price is also exhibiting strong support in the form of inverted head-and-shoulders and double bottom, which increases the likelihood of higher prices. The stock will continue to rise until the $29 price level in BAC is breached. Any break above $1,255 in BAC.PL will be the initial evidence that BAC.PL is going to hit new all-time highs. As the stock is currently inexpensive, investors may prefer to buy BAC.PL at current levels in anticipation of a price increase.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.