Summary:

- Alphabet remains a great business but faces regulatory risks and a potential recession, warranting a “Hold” rating despite solid quarterly results.

- The ongoing U.S. antitrust lawsuit against Google could significantly impact its market dominance, similar to Microsoft’s past legal challenges.

- Alphabet’s Q3/24 results show strong revenue and operating income growth, but declining free cash flow raises concerns about valuation.

- Competition is heating up, with Meta and OpenAI developing AI-based search engines, challenging Google’s core business.

pengpeng/iStock Unreleased via Getty Images

Similar to many other tech giants, Alphabet Inc. (NASDAQ:GOOG) reported third quarter results in the last week of October. In previous articles, I always rated Alphabet as a “Hold” – the rating was usually the results of acknowledging the great business, but also considering the stock price as rather high and certainly not cheap. And at least my last two “Hold” ratings can be seen as accurate, as the stock didn’t really move much – in one case, it almost remained the same, in the other it gained a few percent. Previous “Hold” ratings must be seen as too cautious in retrospect, as the stock gained in the last few quarters.

In my last article, the conclusion was rather brief:

Alphabet remains a great business, but the stock is not cheap, and the regulatory risk combined with the looming recession should make us cautious. I remain on the sidelines.

And in the following article, I will look at the two mentioned risks again, talk about the last quarterly results, and we will also look at Google’s (emerging) competitors once again. This time, we start by looking at the risk, and one risk that is hanging like the Sword of Damocles over Alphabet is one lawsuit in particular.

United States vs. Google LLC

It is certainly not newsworthy that Google is involved in legal matters (most companies are from time to time) and Google also had to pay high fines in the past. Especially, the European Commission has fined Google several times. Google had to pay €4.34 billion in 2018 due to illegal practices regarding Android mobile devices to strengthen the dominance of Google’s search or €1.5 billion for abusing its dominant position regarding AdSense. However, the last fine was annulled by the General Court of the European Union recently.

But one lawsuit that is getting quite some attention and could have a huge impact on Google is the ongoing trial of the United States and plaintiff states versus Google. In a 277-page opinion, Judge Mehta found that Google monopolized is search services as well as text advertising markets. This was – according to the judge – done through exclusive dealing agreements Google made, and these agreements made Google the default search engine on many devices. In the following article, the reasoning is explained:

Based on the evidence presented, Judge Mehta concluded that general search services and general search text advertising constituted markets. He applied the factors from Brown Shoe Co. v. United States, finding that general search engines (“GSEs”) and general search text ads (“text ads”) each had unique uses and characteristics, and market participants recognized them as distinct products with no adequate substitutes.

Having established the relevant markets, Judge Mehta found that Google held market power in both. In the general search services market, Google held approximately a 90% share, protected by several barriers to entry, including high capital costs, Google’s control of key distribution channels, brand recognition, and scale. In the text ads market, Google held an 88% market share with the same barriers to entry.

And as we are talking about the first major antitrust ruling against a Big Tech company since the ruling against Microsoft (MSFT) over 20 years, comparisons to Microsoft see reasonable. We are especially interested in the performance of Microsoft in the years following the court ruling and how it did impact the business of Microsoft.

When looking at the stock price performance in the years following November 01, 2001 (the day, the DOJ reached a settlement with Microsoft after a court ordered the break-up of Microsoft in June 2000) we clearly see a struggling company in the following years. But first, we can argue that this struggle was in line with the overall market (which was also struggling in the 2000s). Second, Microsoft was trading for extremely high valuation multiples during the Dotcom bubble peak, and therefore a correction seemed reasonable.

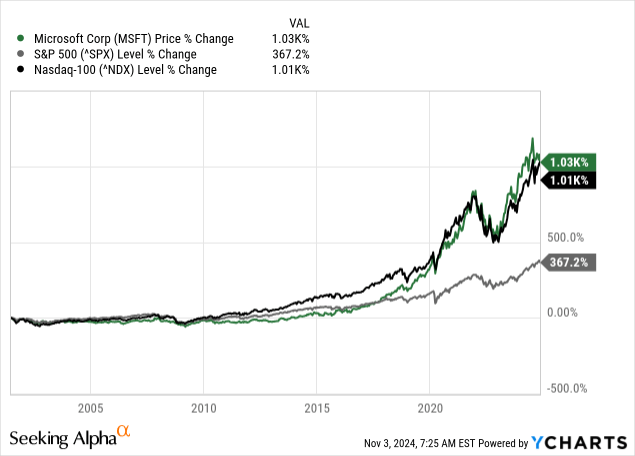

In the long run, Microsoft gained about 1,000% in value since 2001 and 2024 and clearly outperformed the S&P 500, which gained “only” about 370%. And Microsoft performed in line with the Nasdaq-100. Here, we should not forget that Microsoft is contributing about 8% to the Nasdaq-100, making it rather difficult to outperform an index to which a stock is contributing quite a lot.

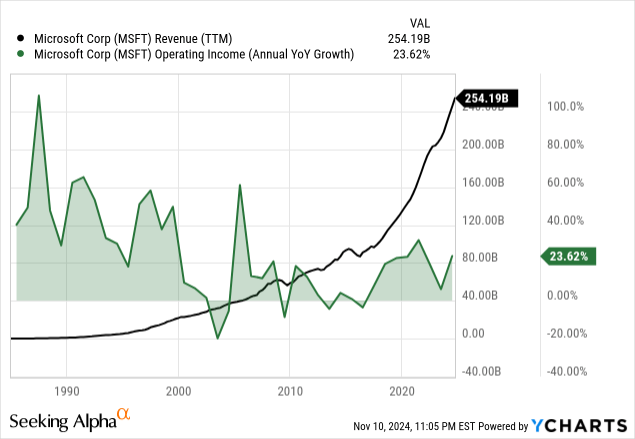

And when looking at revenue and operating income growth in the last few decades, we see the company struggling in the years following 2000 – but we should not forget the Dotcom bubble and the following recession (even it was rather mild). Without knowing and by solely looking at the chart, I would not be able to identify at which point legal troubles for Microsoft arose (or were settled).

Of course, history doesn’t repeat itself but only rhymes and an Alphabet case against the United States could be completely different from Microsoft. Although it seems unlikely, Alphabet could be broken up – a faith that Microsoft could avoid. However, I think that a wide economic moat is protecting companies and will lead to a similar and solid performance in the coming decades. And Alphabet (especially Google) clearly has a wide economic moat, which can be challenged by court and might sometimes get weaker. But, in the end, an economic moat is usually leading to high levels of stability and consistency.

Recession On the Horizon?

A second risk I mentioned in my last article is the looming recession. And once again, it is only two to three months later, and usually this is not long enough to see real changed in economic data. In my opinion, the picture remains the same, as the metrics are also more or less similar to three months ago.

I don’t want to repeat all the metrics and economic indicators I mentioned several times in the past. Instead, I want to provide a different perspective. To make it clear once again, I still think we are headed for trouble and challenging years are in front of us. Nevertheless, we can make the argument for an economy performing well and a recession in the near-term future being rather unrealistic. And a strong argument for a recession on the horizon is the inverted yield curve (or to be more concrete: the 10-year vs. 2-year treasury yield and the 10-year vs. 3-month treasury yield), which is about to re-invert again. But while the yield curve is a great early warning indicator for a recession, it is based on expectations of market participants and not on “hard” economic data and could therefore be wrong.

And other indicators – like the Sahm Rule, for example, – are improving again. This indicator is based on the unemployment rate and declined again to below 0.5 (and therefore not signaling a recession anymore). Additionally, the weekly initial claims for unemployment insurance are rising over the last few quarters but at a very slow pace. Housing permits are also not improving and reaching previous levels again, but the number is also not getting worse.

Like I said, I still think the risk (and probability) for a recession in the near-term future is extremely high, but I must admit that we can interpret the data in different ways. And especially the stock market, which is also a forward-looking indicator, seems not to be expecting a recession as the indices climb from all-time high to all-time high. Of course, this is very simplified, and the situation is more difficult – but like I said, we can see it from different perspectives at this point.

Quarterly Results

And there is another argument speaking against a recession – the quarterly results Alphabet reported on October 29, 2024. Of course, Alphabet is not the entire economy, but together with several other companies, the tech company is showing little signs of trouble at this point.

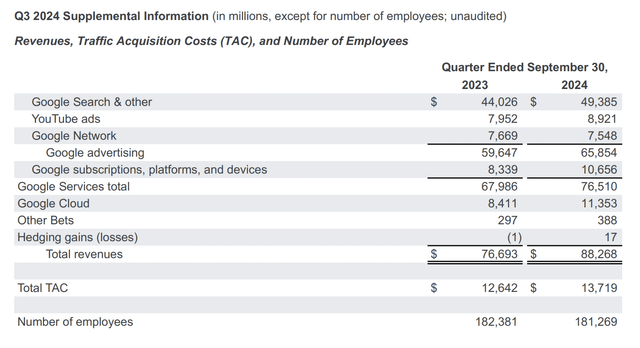

Revenue increased from $76,693 million in Q3/23 to $88,268 million in Q3/24 resulting in 15.1% year-over-year growth. And not only the top line increased in the double digits – operating income increased 33.6% year-over-year from $21,343 million in the same quarter last year to $28,521 million this quarter. And finally, diluted earnings per share increased from $1.55 in Q3/23 to $2.12 in Q3/24 – resulting in 36.8% year-over-year bottom line growth.

Alphabet Q3/24 Earnings Release

And finally, free cash flow in Q3/24 was $17,637 million and compared to $22,601 million in Q3/23 this is a decline of 28.1% year-over-year. Management explained the lower free cash flow during the last earnings call:

We delivered free cash flow of $17.6 billion for the third quarter and $55.8 billion for the trailing 12 months. Year-on-year free cash flow was negatively impacted by the following items. In 2023, we deferred cash tax payments from the second and third quarter to the fourth quarter. And in Q3 2024, we made a $3 billion cash payment related to the 2017 EC shopping fine.

And especially capital expenditures increased from $8,055 million in Q3/23 to $13,061 million in Q3/24. But as management explained during the earnings call, these seem useful investments in the future:

With respect to CapEx, our reported CapEx in the third quarter was $13 billion, reflecting investment in our technical infrastructure with the largest component being investment in servers, followed by data centers and networking equipment.

When looking at the different segments, all contributed to growth. Google Services is still generating the biggest part of revenue, and the segment grew 12.5% year-over-year to $76,510 million in Q3/24. Operating income also increased 28.9% year-over-year to $30,856 million. Aside from Google Services, the second major segment is Google Cloud, which grew the top line 35.0% year-over-year to $11,353 million in quarterly revenue. And profitability improved further, driving an increase in operating income from $266 million in Q3/23 to $1,947 million in Q3/24.

Alphabet Q3/24 Earnings Release

Additionally, we can look at Google Services in more detail. The segment is splitting up on “Google subscriptions, platforms and devices” on the one side, which grew 27.8% year-over-year to $10,656 million. The biggest part of revenue is still stemmed from “Google advertising”, which generated $65,854 million in revenue, but grew “only” 10.4% year-over-year. And while Google Search (12.1% YoY growth) and YouTube (12.1% YoY growth) drove advertising revenue, Google Network had to report declining revenue year-over-year.

Waymo Is Making Good Progress

When talking about Google and the quarterly results, we usually focus on Google (and the advertising and cloud business). But Alphabet also has its “Other Bets” segment, which is generating only a fraction of overall revenue and still not profitable.

Nevertheless, it seems like Waymo is constantly making progress and recently the company announced that its Waymo One service is now providing over 150,000 paid trips a week (as well as over one million fully autonomous miles). Underlining the impressive growth is the fact that Waymo has surpassed 100,000 trips per week only in August – about three months ago.

Competition Heating Up

And while Alphabet is making good progress in new potential markets – autonomous driving – the competition in its core business seems to heat up. About two weeks ago, it was reported that Meta Platforms, Inc. (META) is working on its own AI-based search engine to reduce their reliance on Google or Bing. So far, only limited information is available, but it seems like Meta Platforms is already working on it for eight months and Meta Platforms is also working on building up location data, enabling Meta Platforms to offer a service that is able to compete with Google Search.

The company did not comment on these issues during its last earnings call in the prepared statements, but when asking by analyst Brian Nowak about building an in-house search offering, management commented only briefly:

The second part of your question Meta AI draws from content across the web to address timely questions from users and it provides sources for those results from our search engine partners. We’ve integrated with Bing and Google, both of whom offer great search experiences. Like other companies, we also train our Gen AI models on content that is publicly available online and we crawl the web for a variety of purposes.

Three days later, OpenAI also announced the introduction of ChatGPT search, which is able to search the web in a much better way. The competition between Microsoft/OpenAI and Google was already discussed in previous articles and I still think that ChatGPT won’t compete with Google search in the foreseeable future as the two services are too different and Google’s position is really strong (due to the wide economic moat).

Nevertheless, we should keep a close eye on Meta Platforms as well as OpenAI. We don’t know what Zuckerberg and Altman are planning, and especially in the case of Meta Platforms, the company will launch its own search site in direct competition to Google. The dominance (and moat) of Google is too strong in my opinion. Nevertheless, Meta Platforms could embed search features into its app – like Facebook and Instagram – and therefore reducing the necessity of Facebook and Instagram users to switch to Google to search something as long as they are already on Facebook or Instagram.

Intrinsic Value Calculation

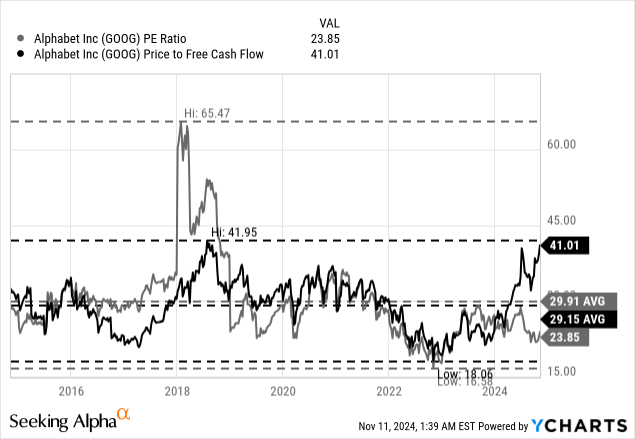

When looking at the two major simple valuation metrics in the last few months, we see a huge discrepancy. While the price-earnings ratio rather got lower and is now 23.85 (which is certainly a reasonable valuation multiple for a business growing like Alphabet), the price-free-cash-flow ratio constantly increased in the last few months and is now 41.01.

While the P/E ratio is indicating a reasonable valued company, that might even be a “Buy” at this point, the price-free-cash-flow ratio is rather indicating a slightly overvalued stock that is maybe not the best investment at this point. The reason for the increasing P/FCF ratio is simple – the declining free cash flow, which was over $75 billion (TTM numbers) a few quarters ago and has now declined to about $55 billion.

A declining free cash flow must be seen as rather problematic, but in this case, the reason is a much higher capital expenditures in the last few quarters and the high spending on AI infrastructure are seen as a great long-term investment by most.

When taking the free cash flow of the last four quarters as basis, Alphabet must grow 17% annually for the next ten years followed by 4% growth till perpetuity to be fairly valued. And 17% growth annually is certainly an optimistic assumption for Alphabet. Of course, we can argue that the free cash flow of the last 12 months is not the basis we should take in our calculation, as it is too low to describe the business in an adequate way. Nevertheless, even with a high free cash flow as basis, Alphabet is certainly not a bargain at this point.

Conclusion

I will still rate Alphabet as a “Hold” at this point. I still think the stock price is a bit too stretched. Or to provide a more nuanced outlook here: In the near- to mid-term future (the next few years) and investment in Alphabet might not pay off as the stock might decline again and correct sideways for some time. But as a long-term investment, Alphabet is probably solid – even at this price – although we could wait for a better entry price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.