Summary:

- Trump’s protectionist policies, such as tariffs of up to 60% on Chinese products, could hit Alibaba hard.

- According to sources, Taiwan Semiconductors itself has indicated to Chinese customers that it will no longer supply high-end AI chips, which could impact Alibaba’s cloud business.

- In this new scenario, the company’s valuation does not appear to show any potential for gains, which is corroborated by Seeking Alpha’s grades.

maybefalse

Investment Thesis

I recommend selling Alibaba (NYSE:BABA) shares. Trump’s election poses major risks to this thesis, as the future US president has already mentioned that he will tariff Chinese products by up to 60%.

In this sense, sources indicate that TSMC (TSM) itself would be ceasing to manufacture chips for Chinese clients, such as Alibaba, which has made massive investments in semiconductor design for its AI clouds.

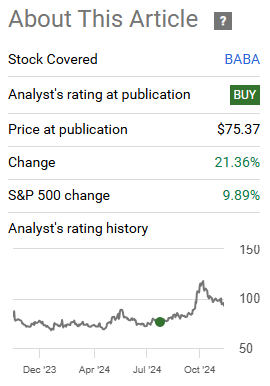

Finally, this article is an update of a recent article with a buy recommendation for Alibaba, with gains close to 20%. Therefore, the investor who followed the recommendation will be putting profit in his pocket.

Introduction

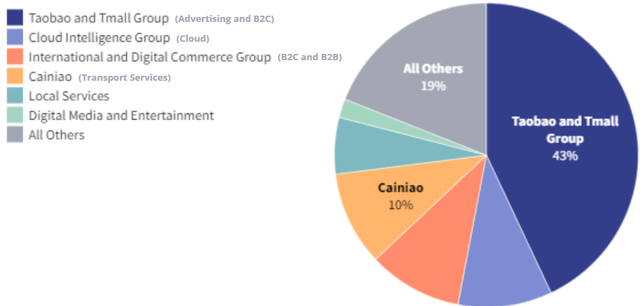

Before starting the thesis, it is important to contextualize that Alibaba is the great pioneer of E-commerce in China. The company operates in a very diversified business model, offering B2B and B2C E-commerce services, in addition to having a cloud service.

Revenue Breakdown (The Author and Investopedia)

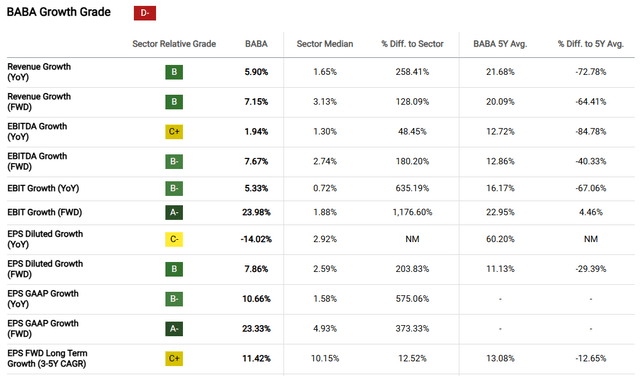

Despite a history of pioneering, a robust business model, and a great lesson in entrepreneurship from the founder, the company has been facing lethargy in its results for some time.

Financial Health (Seeking Alpha)

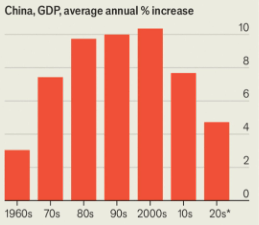

These mediocre results match the economic scenario seen in China, represented by the iShares MSCI China ETF (MCHI), which is becoming increasingly isolated and has a downward trend in GDP growth, as we will see below.

GDP Growth (LSEG)

A New Trade War Could Affect Alibaba (Even More)

Donald Trump was the big winner of the American presidential election and will lead the United States in 2025. We can expect greater protectionism and new chapters in the Trade War initiated by Trump.

In his first term, Trump tariffed Chinese products by 3% to 12%, but his speeches during the presidential race were more emphatic. The future American president stated that he could tariff Chinese products by up to 60%.

Studies by the Consumer Technology Association estimate that this tariff would cause the prices of notebooks to double, game consoles to rise by 40%, and smartphones to rise by 26%.

Both products listed above are distributed by Alibaba, and an impact of this level would undermine one of the company’s competitive advantages, its low price, which corroborates my skeptical view.

Difficulty In Obtaining AI Chips?

Reports indicate that TSMC has already notified Chinese customers that it would suspend production of more advanced 7-nanometer AI chips, citing the fact that supplies would be subject to a US approval process.

USA and TSMC (Bobs guide)

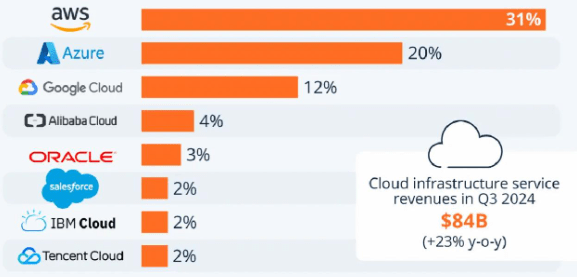

TSMC clearly wants to build good relations with the new US administration. However, this could pose major challenges for Alibaba, given its massive investments in AI chips for its cloud business. Another development from the new government that corroborates a skeptical view of Alibaba, who had been seeking greater prominence.

Global cloud market share (Statista)

Valuation

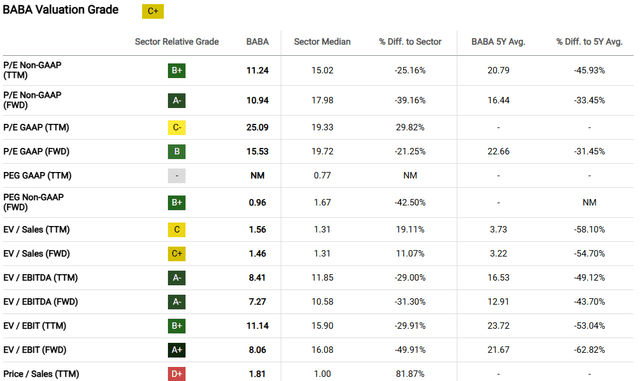

For the valuation, I will use Seeking Alpha’s own metrics, and although the company has an attractive valuation for the PEG and P/E indicators, the other indicators are not very interesting.

Valuation Grade (Seeking Alpha)

In my view, the new risks to the thesis do not justify a 15.5x P/E valuation, as we can see above. Additionally, this is the opportunity for the investor who followed my recent recommendation to pocket the profits, and based on this analysis, I recommend selling Alibaba shares.

Recommendation (The Author)

Potential Threats To The Thesis

The thesis presents several risks, but I would say that the main one is that it is supported by Trump’s statements, such as the strong declaration that he will tariff Chinese products by up to 60%.

It is important to remember that in his first term, Trump did not fulfill all of his promises, such as the expansion of the wall with Mexico and the repeal of Obamacare. So there is no guarantee that he will keep his word this time.

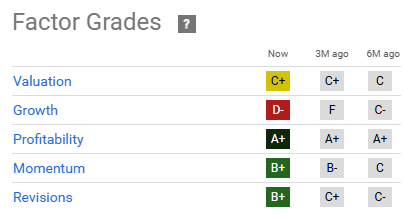

Additionally, the thesis was built based on macroeconomic factors, not company-specific ones. It is worth noting that Alibaba has good profitability and review grades. The thesis is complex and investors should be pragmatic.

Factor Grades (Seeking Alpha)

The Bottom Line

Alibaba may be one of the companies that will suffer most from the protectionist measures of Donald Trump, the future American president, who intends to tariff Chinese products by up to 60%.

The American influence has already had implications even for the business of TSMC, which, according to sources, has notified Chinese customers that it will no longer produce next-generation AI chips. This is a major setback for Alibaba’s strong investment in its cloud business.

Based on this analysis, I recommend selling Alibaba shares. In my view, the scenario has completely changed for the company, and the risks have increased drastically, which demands caution.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.