Summary:

- The Walt Disney Company’s strong DTC growth and margin expansion drive a “Strong Buy” rating with a fair value of $130 per share.

- The company reported 21.3% growth in adjusted operating profits for FY24, fueled by robust Disney+ subscriber growth and improved free cash flow margins.

- Disney anticipates double-digit adjusted EPS growth for FY26 and FY27, with significant investments in parks and cruise lines to sustain market leadership.

- I forecast Disney’s revenue to grow by 6% annually, supported by DTC, sports, and experiences segments, with a calculated fair value of $130 per share.

JHVEPhoto

I discussed The Walt Disney Company’s (NYSE:DIS) strong DTC (Direct-To-Consumer) growth and margin expansion in my “Strong Buy” thesis in August 2024. Disney just reported a strong fiscal Q4 result and announced targets to achieve double-digit adjusted EPS growth for FY26 and FY27. Notably, their DTC business continues its double-digit revenue growth with margin improvement. I reiterate a “Strong Buy” rating with a fair value of $130 per share.

Strong Margin Improvement And Subscriber Growth

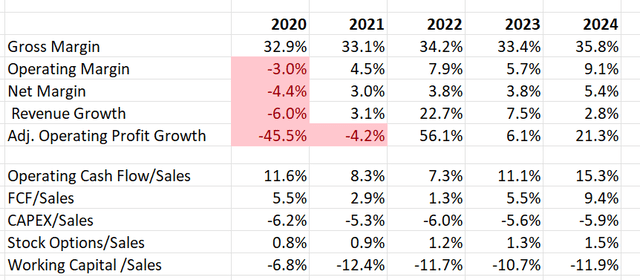

As illustrated in the table below, Disney exited its FY24 with 21.3% growth in adjusted operating profits, driven by their strong margin expansion in their DTC business. Notably, Disney has been improving its free cash flow margin from 5.5% in FY20 to 9.4% in FY24.

Disney reported its Q4 result on November 14th before the market open, delivering 6.3% revenue growth and 23% adj. operating profit growth. Their DTC business generated $5.7 billion in revenue, growing by 14.8% year-over-year. Additionally, their DTC continues to improve its margin to 4.4% in Q4. As discussed in my previous article, Disney’s massive content investment phase is over and the company is now reaping returns from its streaming business.

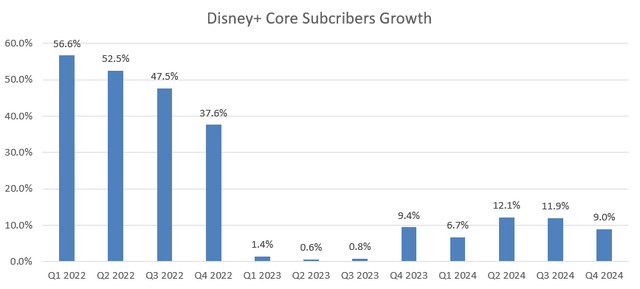

The strong growth is driven by robust Disney+ core subscriber growth, increasing by 9% year-over-year, as depicted in the chart below.

During the earnings call, the management expressed strong confidence in their future subscriber growth, as they are going to bundle ESPN and Hulu with Disney+.

Outlook and Valuation

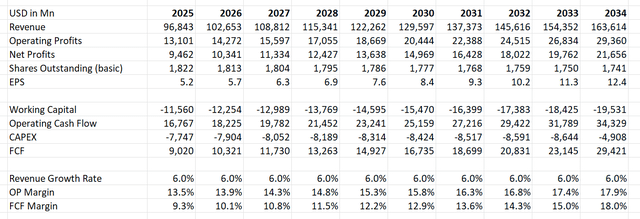

Disney is guiding for high-single-digit adjusted EPS growth for FY25, with double-digit growth for FY26 and FY27. In addition, Disney expects to generate $7 billion in free cash flow in FY25 and targets to repurchase $3 billion of own shares.

For the near-term growth, I am considering the following factors:

- Entertainment: I anticipate the linear network business will continue to decline, and the DTC segment will drive their Entertainment business growth. The DTC business represents more than half of the segment revenue, and grew by 15% currently. I anticipate the Entertainment segment will grow by 6% assuming DTC grows by 15% and legacy business declines by 5% year-over-year.

- Sports: I anticipate the segment will grow by 3%, aligned with their growth in FY24. Disney plans to launch ESPN direct-to-consumer in early 2025, which could potentially drive its business growth by leveraging Disney+ existing subscriber base.

- Experiences: The segment growth is driven by both pricing and attendance increases. With the economy beginning to normalize, I anticipate Disney will generate 6% growth in its Experiences segment, assuming 2% pricing growth and 4% attendance growth. In addition, Disney plans to invest heavily in both domestic and international parks and cruise line capacity over the coming years, which could potentially fuel the Experiences growth.

- Putting together, I anticipate Disney will grow its revenue by 6% annually.

- I forecast Disney can generate 40-50bps operating margin expansion annually, comprising 20bps from ongoing DTC margin expansion, 20bps from reduction in SG&A expenses and 10bps-20bps from declining amortization and depreciation costs.

The discounted cash flow, or DCF, can be summarized as follows:

The WACC is calculated to be 9.6% assuming: risk-free rate 3.8%; equity risk premium 7%; cost of debt 5%; debt balance $46 billion; equity $120 billion; tax rate 25%; beta 1.15.

The fair value is calculated to be $130 per share after discounting all the future free cash flow, according to my DCF model.

Key Risk

Disney is targeting to spend $8 billion in capital expenditure for FY25, a significant increase from $5.4 billion in FY24. As communicated in September 2023, Disney plans to accelerate capital spending in its Parks, Experiences and Products segment over the next 10 years to roughly $60 billion. I think it makes sense for the company to invest in their theme parks and cruise lines’ capacity to sustain their market leadership in the Experience market.

Conclusion

I am encouraged by The Walt Disney Company’s strong earnings growth and margin expansion, and the company is on the right track to further expand its DTC business. I reiterate a “Strong Buy” rating with a fair value of $130 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.